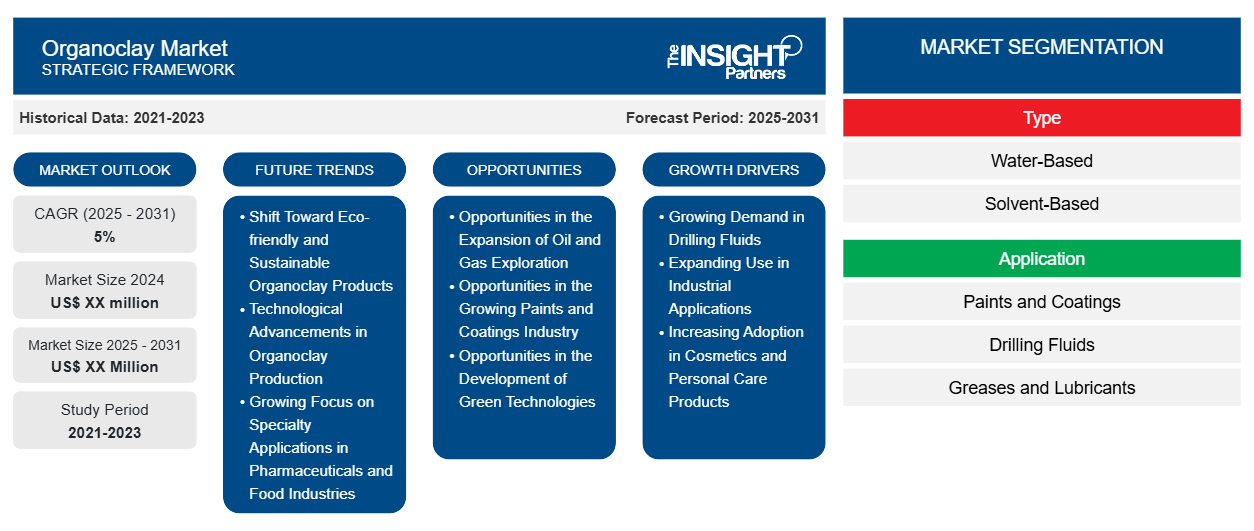

The Organoclay Market is expected to register a CAGR of 5% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Type (Water-Based and Solvent-Based). The report is also segmented based on Application (Paints and Coatings,Drilling Fluids, Greases and Lubricants, Adhesives and Sealants, and Others). The report scope covers 5 regions: North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America and key countries under each region. The global analysis is further broken-down at regional level and major countries. The Report Offers the Value in USD for the above analysis and segments.

Purpose of the Report

The report Organoclay Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Organoclay Market Segmentation

Type

- Water-Based

- Solvent-Based

Application

- Paints and Coatings

- Drilling Fluids

- Greases and Lubricants

- Adhesives and Sealants

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Organoclay Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Organoclay Market Growth Drivers

- Growing Demand in Drilling Fluids: Organoclay is widely used in the oil and gas industry, particularly in drilling fluids, where it helps improve the viscosity and stability of drilling mud. As global oil exploration activities continue to rise, the demand for drilling fluids with enhanced properties is driving the growth of the organoclay market. The increase in offshore drilling and deepwater exploration is also contributing to the demand for these high-performance additives.

- Expanding Use in Industrial Applications: Organoclay is increasingly used as a thickening agent, stabilizer, and rheological modifier in various industrial applications such as paints, coatings, adhesives, and sealants. Its excellent dispersion, viscosity control, and compatibility with organic solvents are fueling its demand across different manufacturing sectors. The growth of industries such as construction, automotive, and consumer goods is a significant driver for the organoclay market.

- Increasing Adoption in Cosmetics and Personal Care Products: Organoclay is being adopted in the cosmetics and personal care industry due to its ability to enhance the texture, stability, and performance of formulations. It is widely used in products like creams, lotions, and deodorants, as well as in hair care and skincare products. The growing demand for premium, long-lasting, and effective cosmetic products is propelling the market growth for organoclay in this sector.

Organoclay Market Future Trends

- Shift Toward Eco-friendly and Sustainable Organoclay Products: There is a growing trend towards the use of eco-friendly and sustainable organoclay products as industries shift towards more environmentally conscious practices. Manufacturers are developing organoclays derived from natural, renewable resources that meet sustainability criteria while offering high performance in various applications. This trend is expected to shape the future growth of the organoclay market as industries embrace greener alternatives.

- Technological Advancements in Organoclay Production: Innovations in the production of organoclays are improving their efficiency, versatility, and performance in different applications. New formulations and modifications are allowing organoclays to perform better in extreme conditions, such as high temperatures or aggressive chemical environments. These advancements are enhancing the value proposition of organoclays, particularly in challenging industrial and oilfield applications.

- Growing Focus on Specialty Applications in Pharmaceuticals and Food Industries: Organoclay is finding increasing applications in pharmaceuticals and food products as an anti-caking agent, stabilizer, and emulsifier. Its growing role in these industries, especially in drug formulations and food packaging, is driving its market expansion. With rising consumer demand for clean-label products and natural additives, the use of organoclays in specialty formulations is expected to rise.

Organoclay Market Opportunities

- Opportunities in the Expansion of Oil and Gas Exploration: The global oil and gas industry continues to expand, particularly in offshore and deepwater drilling operations, where high-performance drilling fluids are in high demand. Organoclay plays a vital role in these applications, providing enhanced performance in extreme conditions. This expansion presents significant growth opportunities for the organoclay market, particularly in regions with new oil and gas exploration initiatives.

- Opportunities in the Growing Paints and Coatings Industry: The paints and coatings industry presents a substantial opportunity for organoclay, particularly as demand increases for high-quality, durable coatings. Organoclay is used as a rheological modifier to improve the texture, stability, and spreadability of coatings. The growing construction, automotive, and industrial sectors are fueling the demand for organoclays in this market, creating growth prospects.

- Opportunities in the Development of Green Technologies: As industries continue to adopt more sustainable and environmentally friendly technologies, the development of green organoclay products is a significant opportunity. These organoclays, which are made using renewable or natural resources, offer a more sustainable alternative to traditional chemical additives. The shift toward cleaner, safer products in industries like cosmetics, pharmaceuticals, and food will drive demand for eco-friendly organoclays.

Organoclay Market Regional Insights

The regional trends and factors influencing the Organoclay Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Organoclay Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Organoclay Market

Organoclay Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

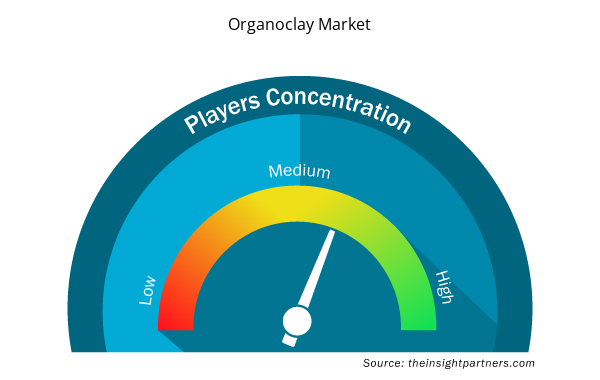

Organoclay Market Players Density: Understanding Its Impact on Business Dynamics

The Organoclay Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Organoclay Market are:

- Minerals Technologies Inc

- Azelis Americas LLC

- Unitech Chemicals Zibo Co Ltd

- Zhejiang Camp-Shining New Material Co Ltd

- Weifang Huawei Bentonite Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Organoclay Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Organoclay Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Organoclay Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Military Rubber Tracks Market

- Microplate Reader Market

- Pressure Vessel Composite Materials Market

- Health Economics and Outcome Research (HEOR) Services Market

- Helicopters Market

- Procedure Trays Market

- Non-Emergency Medical Transportation Market

- Airline Ancillary Services Market

- UV Curing System Market

- Constipation Treatment Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Based on geography, Asia Pacific is expected to register the fastest CAGR from 2023 to 2031.

Development of innovative and eco-friendly formulations is one of the key opportunities for the market growth.

Minerals Technologies Inc, Azelis Americas LLC, Unitech Chemicals Zibo Co Ltd, Zhejiang Camp-Shinning New Material Co Ltd, Weifang Huawei Bentonite Group, Camp-Shinning, Cutch Oil and Allied Industries Pvt Ltd, and Schlumberger Limited are among the leading players operating in the organoclay market.

The report can be delivered in PDF/Word format, we can also share excel data sheet based on request.

Increasing demand for environmentally friendly products is driving the market growth

The Organoclay Market is estimated to witness a CAGR of 5% from 2023 to 2031

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies

1. Amrfeo Private Limited

2. BYK

3. Camp-Shinning

4. CETCO (MTI)

5. Elementis

6. Laviosa

7. MI-SWACO

8. Tolsa

9. Unitech Chemicals (Zibo)

10. Zhejiang Huate Industry Group

Get Free Sample For

Get Free Sample For