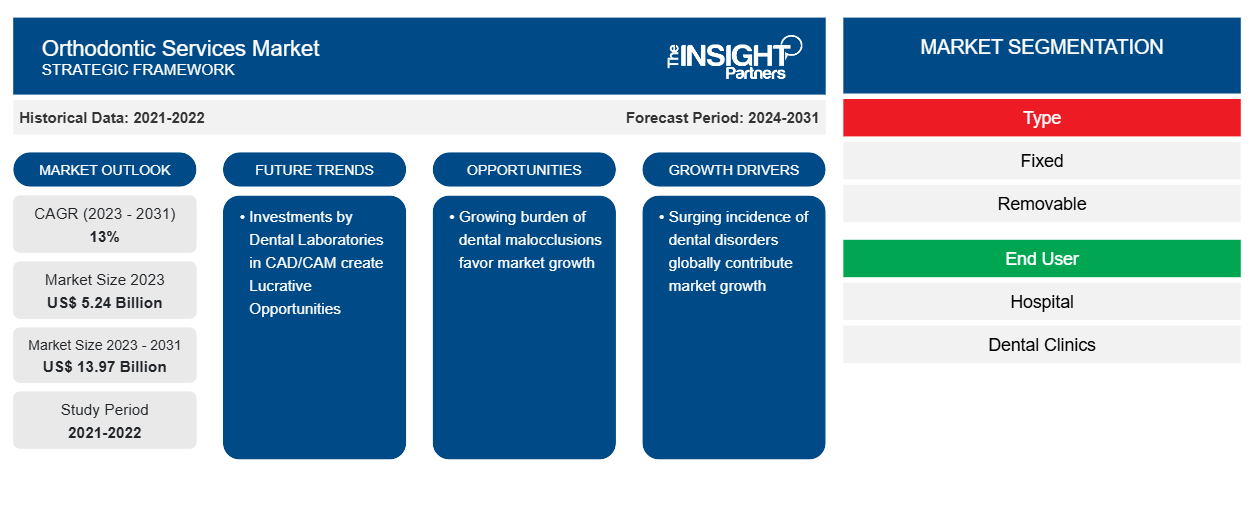

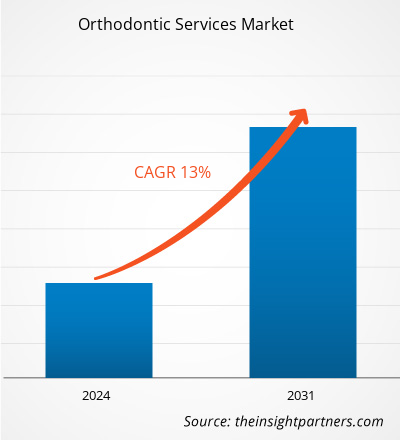

The Orthodontic services market size is projected to reach US$ 13.97 billion by 2031 from US$ 5.24 billion in 2023. The market is expected to register a CAGR of 13.0% during 2023–2031. Advancements in orthodontic technology and treatments are likely to remain key trends in the market.

Orthodontic Services Market Analysis

The surging incidence of dental disorders globally followed by the growing burden of malocclusion are the driving factors of orthodontic services market. Additionally, increasing awareness and demand for cosmetic dentistry, expansion of dental insurance, new product launches and development, and increasing focus on preventive care is further expected to contribute the market growth. Moreover, investments by dental laboratories in technology upgrade and investments is expected to create lucrative opportunities in the market.

Orthodontic Services Market Overview

The orthodontic services market is primarily driven by the surging incidence of dental disorders globally along with growing burden of malocclusion, recent developments in the market. Additionally, expansion of dental insurance, increasing demand for cosmetic dentistry and surging focus on preventive care is expected to support the market growth. North America holds the major market share owing to the technological advancements in dentistry due to rising prevalence of dental problems and increase in product approvals for the treatment of orthodontics are likely to boost the North American orthodontic services market during the forecast period. Asia Pacific is anticipated to register the highest growth rate due to the surging prevalence of oral diseases and increasing awareness among large population. In addition, increasing number of market players focusing on countries in Asia Pacific for geographical expansion and other strategies. Therefore, the region holds huge potential for the orthodontic services market players to grow during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Orthodontic Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Orthodontic Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Orthodontic Services Market Drivers and Opportunities

Increasing Cases of Dental Disorders to Favor Market

The need for orthodontic services is increasing with the growing prevalence of dental issues, such as crowded teeth, abnormalities, chipped teeth, and uneven spacing between teeth. Orthodontic services are provided in various settings, including hospitals and dental clinics. Fixed orthodontic appliances provide a better control over tooth movements. Moreover, fixed braces require specific maintenance and basic oral hygiene to keep them in good shape. According to the World Health Organization (WHO), oral diseases affected ~3.5 billion people worldwide in 2022. A 2022 survey by the International Society of Aesthetic Plastic Surgery (ISAPS) states that the US, Brazil, Mexico, Germany, and India are the top 5 countries that perform the most cosmetic surgeries. The US and Brazil accounted for 28.4% of all cosmetic procedures—surgical and nonsurgical—in the world in 2022. Further, various offers and discounts offered by dentists may favor the orthodontic services market growth.

Investments by Dental Laboratories in CAD/CAM create Lucrative Opportunities

Computer-aided design (CAD) and computer-aided manufacturing (CAM) have become an increasingly popular part of dentistry over the past 25 years. These technologies can be used to manufacture transparent aligners, custom-made brackets, implant abutments, and full-mouth reconstruction products in dental laboratories and dental offices. The CAD and CAM technologies were developed to solve three challenges. The first challenge was to ensure adequate restoration of strength, especially for posterior teeth. The second challenge was to retain a natural appearance along with functional restorations. The third challenge was to make tooth restoration easier, faster, and more accurate. In several cases, the involvement of CAD and CAM technologies provides patients with same-day restorations. The high-strength structural materials, such as alumina and zirconia-based ceramics, used in restoration cores and frameworks can be shaped only by CAD/CAM systems, as these systems increase the lifetime of restorations. As a result, the number of CAD/CAM systems available for the dental community has increased substantially in the last few years, with the elevated demand for safe and aesthetically pleasing dental materials. Further, new high-strength ceramic materials have been introduced for the manufacturing of dental devices. Due to the limited compatibility of these materials with conventional dental processing technologies, CAD and CAM have gained significant traction in dentistry.

Orthodontic Services Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Orthodontic services market analysis are type and end user.

- Based on type, the Orthodontic services market is bifurcated into fixed and removable. The removable segment held a larger market share in 2023.

- In terms of end user, the market is bifurcated into hospitals and dental clinics. The dental clinics segment held a significant share of the market in 2023.

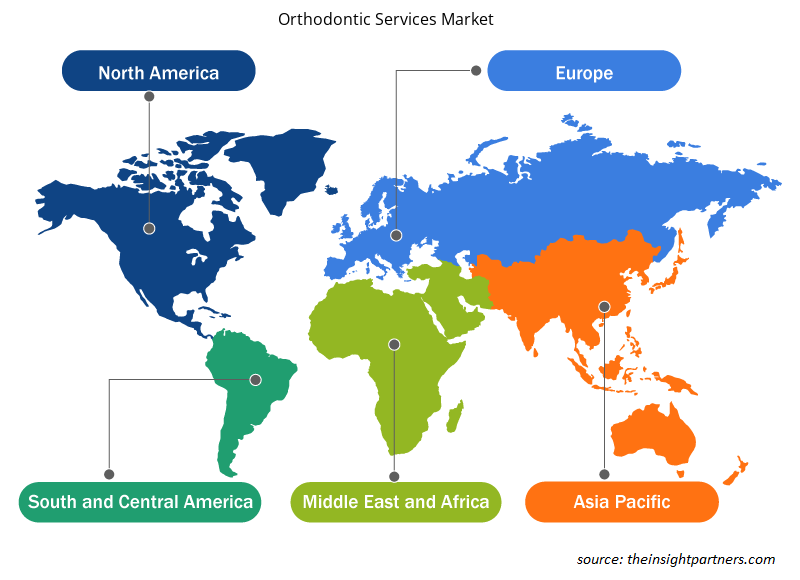

Orthodontic Services Market Share Analysis by Geography

The geographic scope of the Orthodontic services market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the market owing to the rapid technological advancements in the field of dentistry due to rising prevalence of dental problems and increase in product approvals for the treatment of orthodontics are likely to boost the North American orthodontic services market during the forecast period. Asia Pacific is anticipated to grow with the highest CAGR in the coming years due to the increasing prevalence of oral diseases and increasing product launches. In addition, growing number of market players focusing on countries in Asia Pacific for geographical expansion and other strategies. Therefore, the region holds huge potential for the orthodontic services market players to grow during the forecast period.

Orthodontic Services Market Regional Insights

The regional trends and factors influencing the Orthodontic Services Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Orthodontic Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Orthodontic Services Market

Orthodontic Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.24 Billion |

| Market Size by 2031 | US$ 13.97 Billion |

| Global CAGR (2023 - 2031) | 13% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Orthodontic Services Market Players Density: Understanding Its Impact on Business Dynamics

The Orthodontic Services Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Orthodontic Services Market are:

- DENTSPLY SIRONA Inc

- 3M

- Institute Straumann AG

- Q and M Dental Group

- Wuhan Dazhong Dental Medical Co. Ltd.

- Dalian Meier Dental

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Orthodontic Services Market top key players overview

Orthodontic Services Market News and Recent Developments

The Orthodontic services market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Orthodontic services market are listed below:

- Ormco Corp launched its Spark On-Demand program, which enables doctors to order any number of Spark Aligners and Prezurv Plus Retainers with, a simple, economical, no-subscription pricing structure. (Source: MEDQOR LLC., Newsletter, May 2024)

- Candid launched Orthodontic Platform CandidPro an enhanced set of clinical features to provide more flexibility and control to the doctors over their clear aligner cases. (Source: Candid, Newsletter, February 2023)

- Align Technology, Inc. integrating new Cone Beam Computed Tomography (CBCT) feature for ClinCheck digital treatment planning software, a user-friendly tool that combines roots, bone, and crowns into a single three-dimensional model that enables doctors to visualize a patient’s roots as part of the digital treatment planning process. (Source: Align Technology, Inc., Company Website, March 2022)

Orthodontic Services Market Report Coverage and Deliverables

The “Orthodontic Services Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Orthodontic services market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Orthodontic services market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Orthodontic services market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Orthodontic services market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Authentication and Brand Protection Market

- Battery Testing Equipment Market

- Extracellular Matrix Market

- Hydrogen Compressors Market

- Hydrogen Storage Alloys Market

- Artificial Intelligence in Defense Market

- Genetic Testing Services Market

- Artificial Turf Market

- Legal Case Management Software Market

- Playout Solutions Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type; End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America region dominated the Orthodontic services market in 2023

The surging incidence of dental disorders globally along with growing burden of malocclusion are the driving factors impacting the Orthodontic services market

are the future trends of the Orthodontic services market are the future trends of the Orthodontic services market

The leading players operating in the Orthodontic services market includes DENTSPLY SIRONA Inc, 3M, Institute Straumann AG, Q and M Dental Group, Wuhan Dazhong Dental Medical Co., Ltd., Dalian Meier Dental, Crescent Dental Care, Align Orthodontics, Coast Dental, and ABANO HEALTHCARE GROUP LIMITED among others

The estimated value of the Orthodontic services market by 2031 is US$ 13.97 Bn

The expected CAGR of the Orthodontic services market is 13.0%

Get Free Sample For

Get Free Sample For