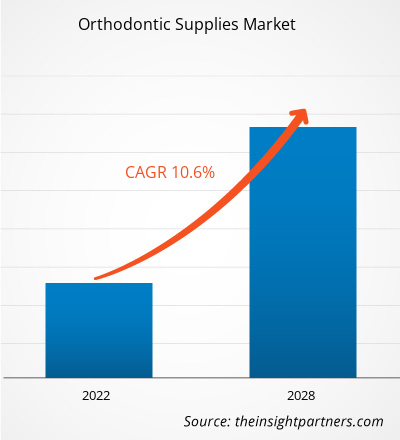

[Research Report] The orthodontic supplies market is projected to reach US$ 11,038.07 million by 2028 from US$ 5,448.86 million in 2021. It is expected to grow at a CAGR of 10.6% during 2021–2028.

Market Insights and Analyst View:

The orthodontic supplies are appliances or materials used during the orthodontic treatment of various dental irregularities such as malocclusion, crooked teeth, excessive spacing and others. The orthodontic supplies include various products such as fixed braces, removable braces, adhesives, accessories and others. The growing prevalence of dental problems and rising incidence of malocclusion in children are the factors driving the orthodontic supplies market growth. However, high cost of orthodontic treatments and stringent regulatory polices is restraining the orthodontic supplies market growth.

Growth Drivers and Challenges:

Growing Prevalence of Dental Problems Drives the Orthodontic Supplies Market

There are large number of populations in the world suffers from various dental problems such as crocked teeth malocclusions, gum disease, periodontal diseases and others. This population includes both children and adult with the high prevalence rate of various dental problems on a global level. According to Global Burden of Diseases Study, oral disease affected approximately 3.5 billion people on a global scale and dental caries and periodontal disease are the 11th most prevalent disease on a global level in 2019. The increasing prevalence rate of dental problems such as crooked teeth, spaces between teeth, overbites, teeth overcrowding and other has created the demand for orthodontic supplies for the treatment of such conditions. For instance, as per Centers for Disease Control and Prevention, in US approximately 47.2% of the adults over 30 years of age have some kind of periodontal disease and its increases with the age approximately 70.1% adults over the age of 65 years have periodontal disease during 2020.

Moreover, the increasing awareness among people about oral health and dental problems has further created the demand for orthodontic supplies which helps the healthcare professional to maintain the good oral health among patients. According to the Centers for Disease Control and Prevention data, 63% of the adult population took dental treatment in the US in 2020, and 85.9% of the children and the teenage population took dental treatment in the US in 2018. Also, as per the Centers for Disease Control and Prevention (CDC) data, ~25.9% of the adult population had untreated dental caries during 2015‒2018 in the US.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Orthodontic Supplies Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Orthodontic Supplies Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

In a study published in the National Center for Biotechnology Information (NCBI) 2019, Africa had the highest prevalence of Class I malocclusion (90%). However, the prevalence of Class II malocclusions (7.5%) was the lowest. The maximum incidence of Class II, Class III, and open bite malocclusions were reported in Europe (31.95%), Asia (5.76%), and Africa (8.3%), and the worldwide prevalence of malocclusion was 56% in 2020. According to European Journal of Pediatric Dentistry, Africa accounts for the highest malocclusion prevalence rate of, 81%, followed by Europe at 72%, America at 53%, and Asia at 48% in 2020.

Furthermore, the increasing prevalence rate of dental problems among large population especially among children, the governments have taken initiatives to increase awareness and also provide dental services under various government schemes for treatment. For instance, in UK all the child dental care is carries under National Health services and funded by government similarly Australia have National Oral Health Plan 2014-2024 to ensure health teeth and mouth for Australian population. Thus, the rising prevalence of dental problems, rising awareness and government initiatives are likely to create demand for the orthodontic supplies which in turn driving the growth of the orthodontic supplies market.

High Cost of Orthodontic Treatments and Stringent Regulatory Policies

Orthodontic supplies help diagnose, treat, and prevent various dental problems, including periodontal disease, crooked teeth, malocclusion, jaw diseases, and others. The increasing incidences of dental problems have created the demand for advanced orthodontic supplies. Advanced orthodontic supplies are costly as compared to conventional supplies. For instance, the metal braces cost ranges between US$ 3000 and US$ 10,000, and it may vary more or less based on the place and position of the teeth. Lingual braces cost range between US$ 5000 and US$ 13,000, and ceramic braces cost between US$ 2000 and US$ 8,500. Thus, the high cost of orthodontic treatments and supplies is expected to hamper the market growth.

Moreover, dental treatment is considered under the cosmetic treatment category, so it is not covered by various insurance companies. The high cost of orthodontic treatments and unfavourable reimbursement scenarios, especially in emerging countries with low disposable income, negatively affect the growth of the orthodontic supplies market.

Report Segmentation and Scope:

The “Global Orthodontic Supplies Market” is segmented based on product, disease type, patient, distribution channel, end user, and geography. Based on product type, the orthodontic supplies market is segmented into fixed braces, removable braces, adhesives, and accessories. Based on disease type, the orthodontic supplies market is segmented into malocclusion, crowding, excessive spacing, and others. Based on patient, the orthodontic supplies market is segmented into adults, children, and teenagers. Based on distribution channel, the orthodontic supplies market is segmented into online stores, direct to customer/offline stores. Based on end user, the orthodontic supplies market is segmented into hospitals, dental clinics, orthodontics clinics, dental service organizations, orthodontic service organizations, and others. The orthodontic supplies market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

Based on product type, the orthodontic supplies market is bifurcated into hash brown and tater shots. The tater shots segment held a larger share of the market in 2022; the hash brown segment is likely to grow at a higher rate during the forecast period. Tater shots, also known as tater puffs, tater gems, shots, or chunks, are small cylindrical grated sweet potatoes seasoned with salt, pepper, and other spices. They are widely consumed due to their crispy texture and taste. Tater shots are becoming increasingly popular as snacking items and appetizers, especially among the younger population and children, as they are bite-sized, making them excellent finger food. They are flavorful, easy to consume on the go, and perfect for mid-day or evening snacks. Tater shots are available in various shapes and forms, making them versatile snacking items. Thus, the rising demand for sweet potato tater shots is driving the orthodontic supplies market growth.

Based on end user, the orthodontic supplies market has been segmented into hospitals, dental clinics, dental service organization, and others. The dental clinics segment held the largest share of the market in 2021, and orthodontic clinics and dental service organizations segment is estimated to register the highest CAGR in the market during the forecast period. Orthodontics is a branch of dentistry deal with the diagnosis and treatment of dental irregularities such as crocked teeth, crowded teeth, protruded teeth and others. As per National Library of Medicine journal, the prevalence rate of malocclusion is 56% on global level without any difference in gender. The highest prevalence is observed in Africa 81% followed by Europe 72%, America 53% and Asia 54% respectively in 2020. Orthodontic clinics are the settings where all the treatment procedures are performed for the dental irregularities. The attractive smile is an asset as it adds aesthetics and confidence to the individual’s personality. The rising prevalence of dental irregularities and increasing awareness among people about dental problems along with surge in cosmetic dental procedures around the globe has further increased the orthodontic clinics. The increase in orthodontic clinics along with the development in the branch orthodontics has fueled the demand for orthodontic supplies market. For instance, The American Dental Association (ADA) estimates there are 10,658 orthodontists practicing in the United States as of 2017. This translates to about 3.27 orthodontists per every 100,000 population. Thus, constant increase inn orthodontics along with the increase in orthodontic clinics are likely to promote the growth of orthodontics supplies market. Dental Service organization are also known as Dental Support organization (DSOs) which are independent business support centers that contracts with the dental practices in the country. The main purpose of the organization to provide support to dental practitioners including non-clinical operations. The changing reimbursement scenario and technological advancement in the field of orthodontics led to the transition towards advanced dental treatment. Dental Service organization helps to provide affordable dental treatment to large population base by the use of advanced and innovative technology, it also helps in the reducing the professional burden, increases skill training and collaborations, and incentives for joining and eliminating the dental education debt. According to American Dental Association Health Policy Institute, there are 7.4% of all practicing US dentist are affiliated with the DSOs. Thus, increasing advantages of working in contract with DSOs is expected to further increase the DSOs on global level and fuel the demand for orthodontics supplies and support the market growth.

Regional Analysis:

Based on geography, the orthodontic supplies market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. North America region includes countries such as US, Canada, and Mexico. The region is expected to experience a steady growth rate of xx from 2019 to 2028. US held the largest market share in 2021 followed by Canada. US is also estimated to be the fastest growing country in the region. The healthcare sector in North America region has been witnessing rapid transformation in the field of oral care. In recent years, various startups and reimbursement scenario have been established in the region that have transformed the dynamics of oral care in the region. Owing to the technological developments made by the countries in the region, the market of orthodontics supplies is anticipated to witness a major market share during the forecast period. Oral health disparities are profound in the United States. Despite major improvements in oral health for the population as a whole, dental health disparities exist for many racial and ethnic groups, by socioeconomic status, gender, age and geographic location. Dental diseases is one of the most preventable public health challenge among chronic health conditions in the US. Oral care becoming more advanced and smarter in the country. According to the CDC, adults aged 35–44 years with less than a high school education experience untreated tooth decay nearly three times that of adults with at least some college education. Moreover, 47.2% of U.S. adults have some form of periodontal disease. In adults aged 65 and older, 70.1% have periodontal disease. The significant prevalence of dental diseases is expected to propel the growth of orthodontics supplies market in the US.

Moreover, many private and government organizations provide reimbursement policies, in order to provide awareness for oral and dental care in the country. For instance, in 2017, the American Academy of Pediatric Dentistry (AAPD), an authority on children’s oral health provide policy on third-party reimbursement to improve medical care and manage patients with special health care needs. Additionally, the Centers for Disease Control and Prevention provides a Dental Public Health Residency Program to produce skilled specialists in dental public health. This residency program provides more opportunities, dental stakeholders to achieve improved oral health and guided practice in collaborating with public health.

Market players are adopting organic and inorganic strategies for the market development owing to the factors mentioned above in the country is expected to witness fast growth during the forecast period.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global orthodontic supplies market are listed below:

- In October 2021, Candid Care Co. ("Candid") and Vivos Therapeutics, Inc., a medical technology company focused on developing and commercializing innovative diagnostic and treatment modalities for patients suffering from mild to moderate obstructive sleep apnea (OSA) and snoring, announced a new collaboration that will seek to provide patients with a comprehensive, whole-mouth solution to diagnose and treat OSA in adult patients and provide orthodontic treatment from the same provider network.

- In September 2021, Dentsply Sirona partnered with Smile Train, the world’s largest cleft-focused organization. For over 21 years, Smile Train has supported safe and quality cleft care for more than 1.5 million children in over 90 countries worldwide. Dentsply Sirona’s commitment aims to advance the future of and access to cleft care.

- In March 2022, SureSmile Aligners by Dentsply Sirona continues to go from strength to strength, and becoming a leading name in high-performance, clear aligner orthodontic treatment. This intuitive orthodontic planning software, the SureSmile Aligners System offers a modern and in-built digital clear aligner treatment pathway which provides safe and predictable results, with the comfort and aesthetics that patients love. The company announced its partnership with Wrights in the UK-Dentsply Sirona with Irish Distributors, Dental Medical Ireland (DMI) to promote SureSmile as their Clear Aligner of choice.

Orthodontic Supplies Market Regional Insights

The regional trends and factors influencing the Orthodontic Supplies Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Orthodontic Supplies Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Orthodontic Supplies Market

Orthodontic Supplies Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 5.45 Billion |

| Market Size by 2028 | US$ 11.04 Billion |

| Global CAGR (2021 - 2028) | 10.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product, Application, Disease Type, Distribution Channel, End User |

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

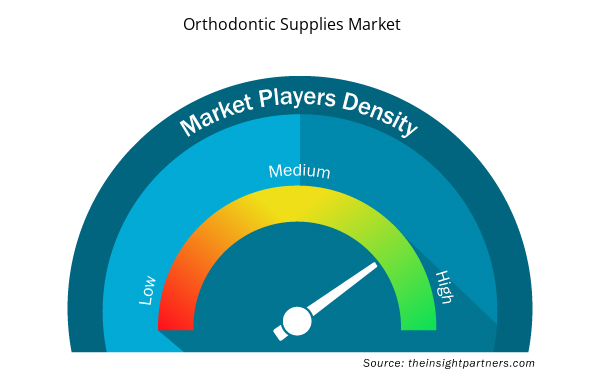

Orthodontic Supplies Market Players Density: Understanding Its Impact on Business Dynamics

The Orthodontic Supplies Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Orthodontic Supplies Market are:

- 3M

- Dentsply Sirona

- Align Technologies Inc.

- Henry Schein, Inc.

- Ultradent Products Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Orthodontic Supplies Market top key players overview

Covid-19 Impact:

North America is witnessing the growing number of COVID-19 cases; for instance, in the United States, the number of cases has been increased to about 6.83 million with 199 thousand deaths reported as per the worldometer. Additionally, Mexico and Canada cases are also growing. Due to the spread of coronavirus, many cities are shutting down, causing treatments and doctors/dentist appointment cancellation. The patients suffering from critical dental issues need physical attention and need to perform procedures in the clinics. The procedure includes root canal obturation, root repair, tooth decay, root canal treatment, tooth cavity treatments, and others. Among chronic health conditions, dental diseases are one of the most preventable public health challenges in the US. Due to the rising intensity of the pandemic, the patients are not able to visit the dental clinics, the limited/uneven availability of dental staffs and such other factors have an impact on the market.

As per the CDC Guidance for dental settings, the US has prioritized the most critical dental services and provided care to minimize harm to patients from delaying care and damage to personnel and patients from potential exposure to SARS-CoV-2 infection. The interim guidance has been renewed based on currently available information about coronavirus disease 2019 (COVID-19) and the United States' current circumstances. As dental healthcare departments begin to restart elective procedures by the administration from local and state officials, some anticipations should remain in place as a part of the ongoing response to the COVID-19 pandemic. Precaution such as wearing eye protection in addition to a facemask to ensure the eyes, nose, and mouth are all protected and usage of an N95 respirator.

As the oral treatment, procedures are directly contacted with patients’ oral fluid that has a possible risk of infections, for the preventing the spread of COVID-19 it is requested to maintain social distancing as there is a greater risk of being infected with coronavirus due to direct exposure to oral fluids of the patients. Therefore, it is likely to affect the orthodontics supplies market owing to the abovementioned points.

Competitive Landscape and Key Companies:

Some of the prominent players operating in the global orthodontic supplies market include 3M; Dentsply Sirona; Align Technologies Inc.; Henry Schein, Inc.; Ultradent Products Inc.; Orthodontics, Inc.; SmileDirectClub, Inc.; American Orthodontics; G&H Orthodontics; DB Orthodontics; Candid Care Co.; and Envista Holdings Corporation among others. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, which provides them to serve a large set of customers and subsequently increases their market share.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application, Disease Type, Distribution Channel, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Algeria, Argentina, Australia, Austria, Belgium, Brazil, Canada, China, Croatia, Czech Republic, Denmark, Finland, France, Germany, Hong Kong, Hungary, India, Indonesia, Ireland, Italy, Japan, Luxembourg, Mexico, Morocco, Netherlands, New Zealand, Norway, Poland, Portugal, Russian Federation, Saudi Arabia, Singapore, South Africa, South Korea, Spain, Sweden, Switzerland, Thailand, Tunisia, Turkey, United Arab Emirates, United Kingdom, United States, Vietnam

Frequently Asked Questions

Key factors that are driving the growing prevalence of dental problems and rising incidences of malocclusions in children are expected to boost the market growth for orthodontic supplies market over the years.

The CAGR value of the orthodontic supplies market during the forecasted period of 2021–2028 is 10.6%.

The removable braces segment dominated the global orthodontic supplies market and accounted for the largest market share of 10.09% in 2021.

The children and teenagers segment dominated the global orthodontic supplies market and accounted for the largest market share of 10.06% in 2021

The online stores segment dominated the global orthodontic supplies market and accounted for the largest market share of 10.9% in 2021.

Orthodontic supplies are appliances or materials used during the orthodontic treatment of various dental irregularities such as malocclusion, crooked teeth, excessive spacing and others. The orthodontic supplies include various products such as fixed braces, removable braces, adhesives, accessories and others.

The orthodontic supplies market majorly consists of players such as 3M; Dentsply Sirona; Align Technologies Inc.; Henry Schein, Inc.; Ultradent Products Inc.; Orthodontics, Inc.; SmileDirectClub, Inc.; American Orthodontics; G&H Orthodontics; DB Orthodontics; Candid Care Co.; and Envista Holdings Corporation amongst others.

Align Technology and Dentsply Sirona are the top two companies that hold huge market shares in the orthodontic supplies market.

COVID-19 has placed a tremendous strain on healthcare systems globally. According to World Health Organization (WHO), the demand for diagnostic and therapeutic devices increased dramatically in hospitals with the chaotic situation erupted in the healthcare sector. Many health authorities shifted their focus on pandemic-related care in 2020. They postponed elective surgeries, suspended outpatient clinics, and triaged employees involved in urgent care to lower the disease transmission rate at hospitals. However, patients suffering from critical dental issues need physical attention and need to perform procedures in the clinics. The procedure includes root canal obturation, root repair, tooth decay, root canal treatment, tooth cavity treatments, and others. Among chronic health conditions, dental diseases are one of the most preventable public health challenges. Due to the rising intensity of the pandemic, the patients are not able to visit the dental clinics, the limited/uneven availability of dental staffs and such other factors have an impact on the market. As the oral treatment, procedures are directly contacted with patients’ oral fluid that has a possible risk of infections, for the preventing the spread of COVID-19 it is requested to maintain social distancing as there is a greater risk of being infected with coronavirus due to direct exposure to oral fluids of the patients. Therefore, it is likely to affect the orthodontics supplies market owing to the abovementioned points.

North America dominated the orthodontic supplies market. The US holds the largest share of the market in this region. The market growth in the US is attributed to the increasing incidence and prevalence of orthodontics, the strong foothold of major key players in the region, higher awareness of orthodontic treatment, and significant adoption of orthodontic supplies.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Orthodontic Supplies Market

- 3M

- Dentsply Sirona

- Align Technologies Inc.

- Henry Schein, Inc.

- Ultradent Products Inc.

- Orthodontics, Inc.

- SmileDirectClub, Inc.

- American Orthodontics

- G&H Orthodontics

- DB Orthodontics

- Candid Care Co.

- Envista Holdings Corporation

- Danaher Corporation

- Dental Morelli

- Great Lakes Orthodontics Ltd.

- TP Orthodontics

- DENTAURUM GmbH & Co.

- Straumann Group

- DynaFlex

- Ormco Corporation

- Rocky Mountain Orthodontics

- Shofu Dental

Get Free Sample For

Get Free Sample For