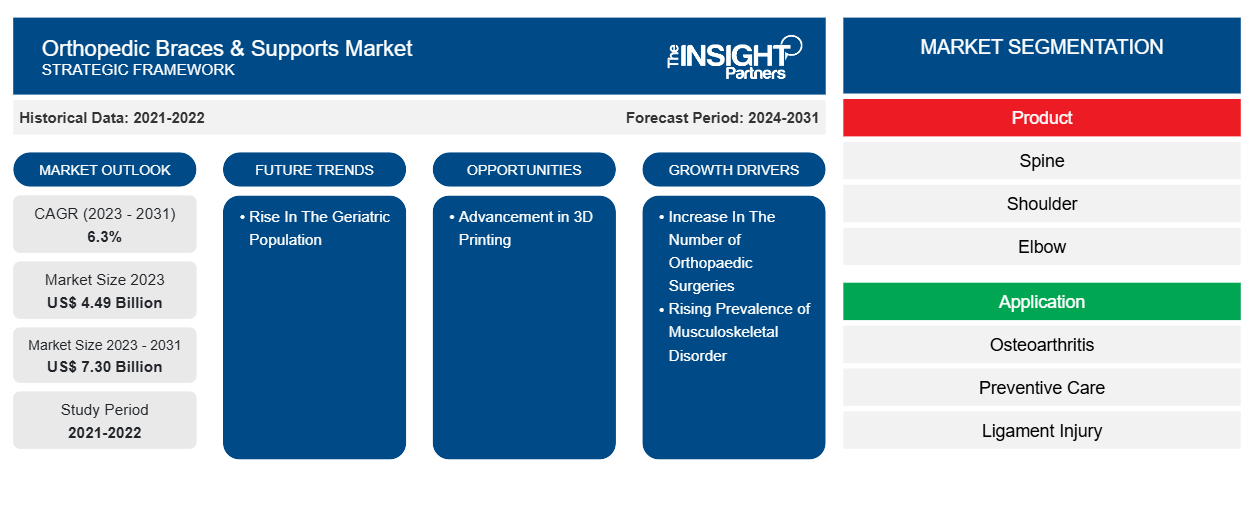

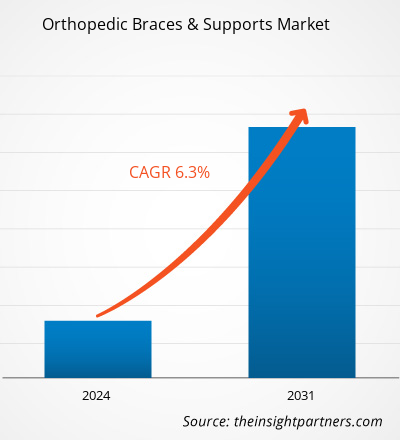

The orthopedic braces & supports market size is projected to reach US$ 7.30 billion by 2031 from US$ 4.49 billion in 2023. The market is expected to register a CAGR of 6.3% during 2023–2031. Technological development such as adoption of anatomical modelling software and hypoallergenic materials for improved product design accuracy and efficiency are likely to remain key trends in the market.

Orthopedic Braces & Supports Analysis

The orthopaedic braces and supports market is being driven by technological improvements, an increase in the number of sports and accident-related injuries, a rise in the geriatric population, and a growing public awareness of preventive treatment. These variables help to produce creative goods and solutions that improve patient outcomes. For example, according to the, Population Reference Bureau, the number of people aged 65 and over in the US would increase from 58 million in 2022 to 82 million by 2050. The incorporation of orthopaedic consultations and device recommendations into telehealth platforms and demand for personalized orthopaedic braces and supports represents an expanding opportunity.

Orthopedic Braces & Supports Overview

The orthopedic brases and support products are used for the injury rehabilitation, injury prevention, osteoarthritic care, post-operative care and more. The braces and supports are available in the form of knee braces, ankle braces, leg braces, elbow braces, tennis elbow braces, wrist braces, thumb, hand splints, neck, back and shoulder braces and more. Moreover, Athletes people regularly utilize orthopaedic braces to prevent injuries and aid in the recovery process. Patients' increased preference for non-invasive treatment options over surgery is driving up product demand and providing a non-surgical solution for a wide range of musculoskeletal disorders. According to CDC, osteoarthritis affects over 32.5 million US adults. Braces for osteoarthritis may help improve symptoms, mobility, function, and quality of life.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Orthopedic Braces & Supports Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Orthopedic Braces & Supports Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Orthopedic Braces & Supports Drivers and Opportunities

Rising Prevalence of Musculoskeletal Disorder to Favor Market

The increasing prevalence of musculoskeletal disorder, as well as the growing geriatric population, drive up the demand for orthopaedic procedures. For example, according to a September 2021 article in the Journal of Orthopaedic Science, approximately 4052 knee arthroplasties will be performed on males aged 40 to 64, 6942 on men aged 65 to 74, and 14,986 on men aged 75 and older in Japan by 2030. Moreover, according to the National Safety Council, in the US ~440,000 exercise and exercise equipment injuries were reported in 2022. Thus, the predicted increase in hip and knee operations in the population raises demand for braces and supports that help patients walk, propelling the market forward.

Advancement in 3D Printing

Advances in 3D printing and digital scanning technologies have made it possible to design custom-fit orthopaedic devices based on an individual's anatomy and needs. Healthcare practitioners use digital scans of a patient's spine to produce detailed 3D models that will guide the printing process. Personalization improves patient comfort and treatment outcomes, making it a huge commercial opportunity.

Orthopedic Braces & Supports Report Segmentation Analysis

Key segments that contributed to the derivation of the orthopedic braces & supports analysis are product and application.

- Based on product, the orthopedic braces & supports is segmented into knee, back & hip, shoulder, elbow, foot, and ankle and spine. The knee segment held a largest market share in 2023.

- By application, the market is segmented into ligament injury, osteoarthritis, preventive care, cold bracing and others. The ligament injury segment held the largest share of the market in 2023.

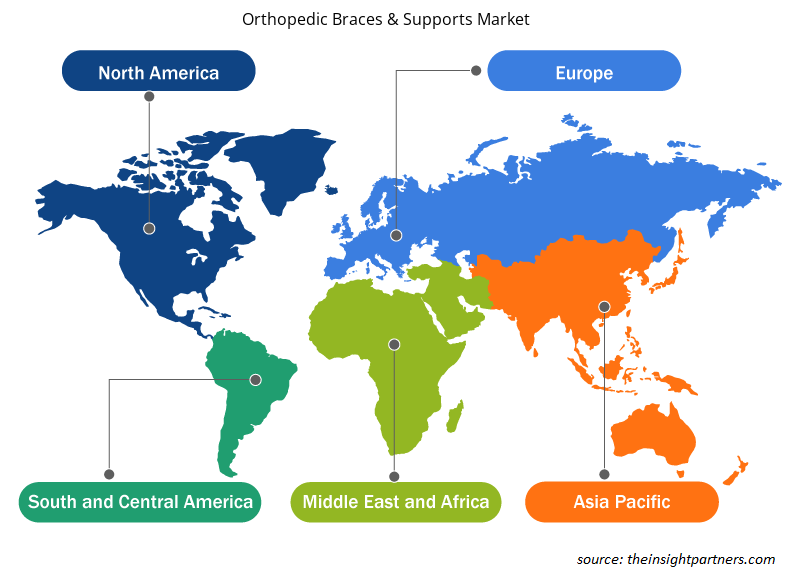

Orthopedic Braces & Supports Share Analysis by Geography

The geographic scope of the orthopedic braces & supports report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the market. The market growth in the region is attributed to the increasing geriatric population, growing developments by the market players for orthopedic braces and supports, growing awareness about product availability, and rising adoption of orthopedic braces to offer mobility and prevent further injury in the ligament.

Orthopedic Braces & Supports Report ScopeOrthopedic Braces & Supports Market Regional Insights

The regional trends and factors influencing the Orthopedic Braces & Supports Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Orthopedic Braces & Supports Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Orthopedic Braces & Supports Market

Orthopedic Braces & Supports Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.49 Billion |

| Market Size by 2031 | US$ 7.30 Billion |

| Global CAGR (2023 - 2031) | 6.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

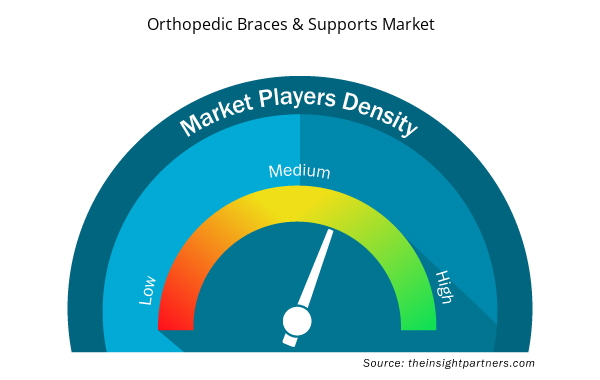

Orthopedic Braces & Supports Market Players Density: Understanding Its Impact on Business Dynamics

The Orthopedic Braces & Supports Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Orthopedic Braces & Supports Market are:

- DJO Global

- Zimmer Biomet

- Ossur Corporate

- 3M

- Breg Inc.

- Bauerfeind

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Orthopedic Braces & Supports Market top key players overview

Orthopedic Braces & Supports News and Recent Developments

The orthopedic braces & supports is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the orthopedic braces & supports are listed below:

- OrthoPediatrics Corp. acquired Boston Orthotics & Prosthetics. This acquisition enables OrthoPediatrics Corp to serve more patients as an extension of our growth strategy to surround the pediatric orthopedic surgeon customers with the most comprehensive portfolio of pediatric orthopedic treatment devices (Source: OrthoPediatrics Corp, Press Release, Jan 2024)

- dj Orthopedics, Inc., released a new, multifunctional back bracing system, the BOA (Back Orthotic Appliance). The BOA is designed to address a variety of clinical spinal indications, including post-operative support after spinal fusion and spinal laminectomy, acute and

- chronic low back pain and disc herniation or degeneration. (Source: dj Orthopedics Inc, Press Release, September 2022)

Orthopedic Braces & Supports Report Coverage and Deliverables

The “Orthopedic Braces & Supports Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Orthopedic braces & supports market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Orthopedic braces & supports market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- orthopedic braces & supports analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the orthopedic braces & supports

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market is estimated to grow at a CAGR of 6.3% during 2023–2031.

The estimated value of the market by 2031 will be US$ 7.30 billion.

DJO Global and Zimmer Biomet are the leading players operating in the intermittent catheters market.

Adoption of anatomical modelling software and hypoallergenic materials is likely to act as trends in the market in the future.

The rising prevalence of musculoskeletal disorder, increase in the number of sports and accident-related injuries, and a rise in the geriatric population are the factors bolstering the market.

North America dominated the market in 2023.

Get Free Sample For

Get Free Sample For