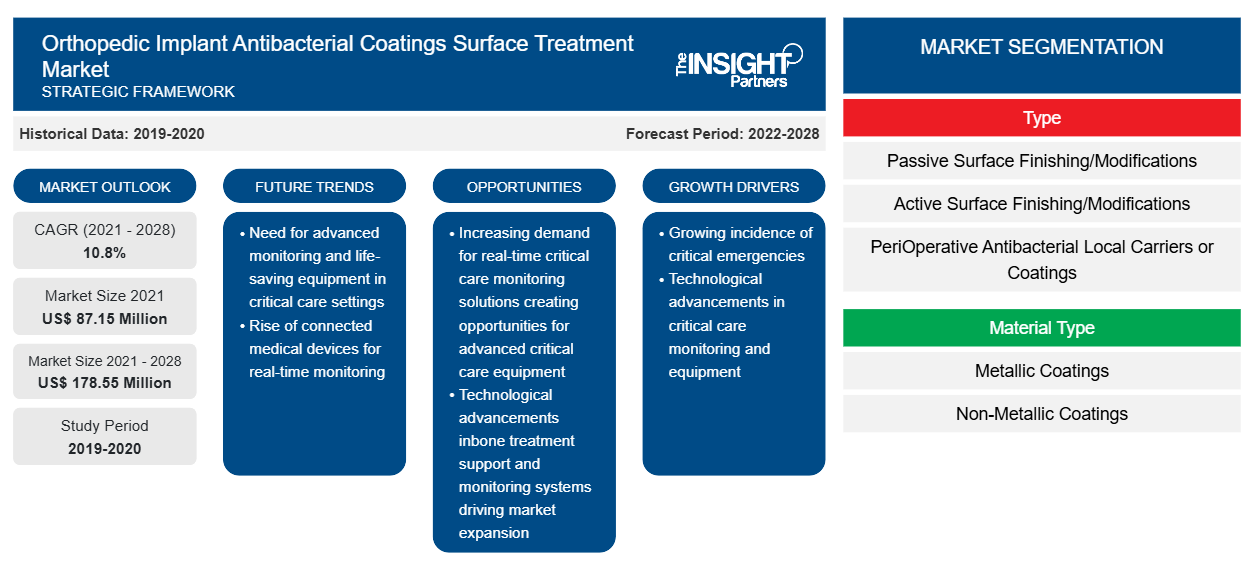

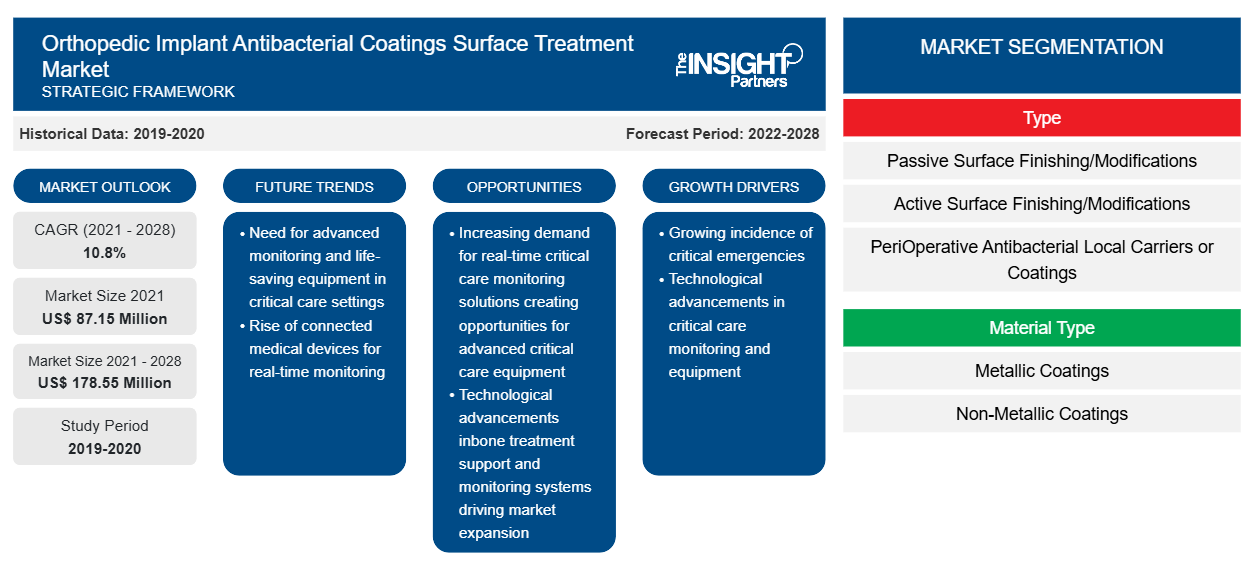

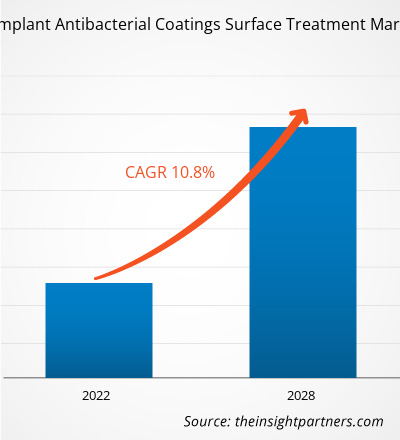

The orthopedic implant antibacterial coatings surface treatment market is projected to reach US$ 178.55 Million by 2028 from US$ 87.15 Million in 2021; it is estimated to register a CAGR of 10.8% from 2021 to 2028.

Bacterial infection and infection-induced immune responses have become a life-threatening concern Among patients undergoing orthopedic implant surgery. Biocontamination of conventional biomaterials causes bacterial invasion in injured areas, resulting in postoperative illness. As a result, anti-infection and immune-evasive coatings for orthopedic implants are desperately needed. There is an increase in demand for orthopedic implants such as screws, plates, nails, and artificial joints from hospitals for orthopedic surgery. Moreover, there is a rise in demand for coating the implants with an anti-biofouling polymer, which prevents bio substances and bacteria from adhering onto the surface.

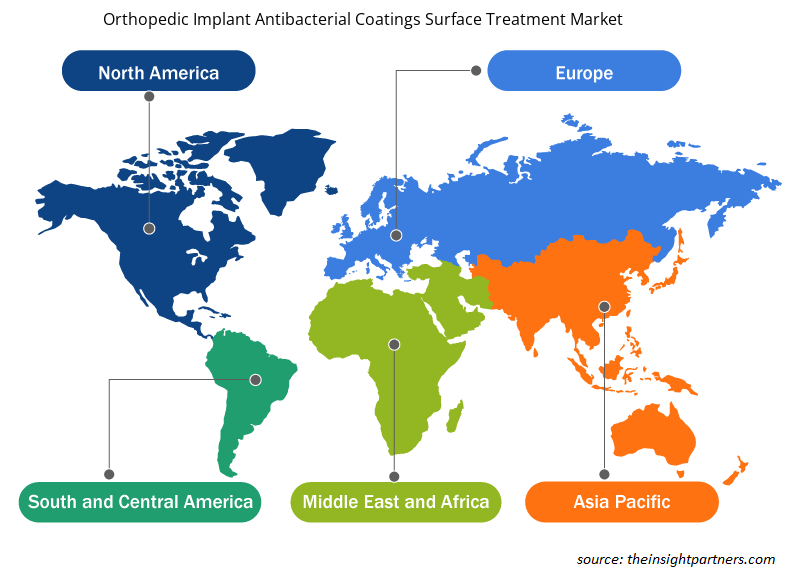

The orthopedic implant antibacterial coatings surface treatment market is segmented into type, material type, and geography. By geography, the market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South and Central America. The report offers insights and in-depth analysis of the market, emphasizing parameters such as market trends, technological advancements, and market dynamics, along with the analysis of the competitive landscape of the globally leading market players.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Orthopedic Implant Antibacterial Coatings Surface Treatment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Orthopedic Implant Antibacterial Coatings Surface Treatment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rise in prevalence of implant-associated infections to drive orthopedic implant antibacterial coatings surface treatment market growth

Implant-associated infections result from various factors, including antibacterial prophylaxis, bacterial load, microorganism and host's type, surgical procedure and technique, and type of implant. The increasing prevalence of implant-associated infections is one of the prominent factors driving the orthopedic implant antibacterial coatings surface treatment market.

For instance, as per the study reported by the Journal of Orthopaedic Surgery and Research in 2018, the prevalence of implant-associated infections in orthopedic trauma patients was found to be in the range of 5 to 10%. Each year, 750,000–1,000,000 implant-associated infections cases are found in the US, and the government needs to spend more than US$ 1.6 billion to cover the expense of the excess hospital charges due to implant-associated infections. Especially with the widespread use of orthopedic implants, the number of infected implants was continued to increase. Even if the infected implants can be successfully removed by secondary surgery, the functionality of the limb and the fracture healing may be limited, which may eventually lead to fatal surgical operations such as amputation, joint arthroplasty, or arthrodesis. Therefore, the high epidemiology of implant-associated infections generates the demand for appropriate implant antibacterial coating treatment, which will support the market's growth.

The demand for the orthopedic implant antibacterial coatings surface treatment has been rising because of the heavy incidence of prosthetic joint infection (PJI). PJI is the most serious complication following total joint arthroplasty. According to an article published in Annals of Joint 2021, the estimated cost of treating PJI in the US alone is US$ 1.62 billion. The incidence of PJI varies with the joint involved. According to the study, total knee arthroplasty, total hip arthroplasty, and total shoulder arthroplasty have reported incidences of 0.25% to 2%, 0.5% to 1%, and less than 1%, respectively. Around 23 to 25% of revision total knee arthroplasty procedures and 12 to 15% of total hip arthroplasty procedures are performed for PJI.

Moreover, according to the investor's presentation published by aap Implantate AG, in 2020, in orthopedic trauma, it has been estimated that up to 30% of cases may result in infection. Similarly, fracture-related infection (FRI) is a severe complication after bone injury and can pose a serious diagnostic challenge. According to the Federal Statistical Office of Germany (Destatis), the prevalence of FRI increased by 0.28 from 8.4 cases per 100,000 inhabitants to 10.7 cases per 100,000 inhabitants between 2008 and 2018. Hence, the increasing prevalence of orthopedic implant-associated infections will increase the demand for orthopedic implant antibacterial coatings surface treatment.

Technological Advancements in Antibacterial Coatings Contribute Significantly to Orthopedic Implant Antibacterial Coatings Surface Treatment Market Growth

Microbial colonization, infection, and biofilm formation are significant complications in the use of implants and are the predominant risk factors in implant failure. To reduce implant-related infections, antimicrobial materials are increasingly being investigated and applied to implant surfaces. Antimicrobial coating technology seems to be the most effective way to improve infection control in a hospital setting without compromising patient care. The scope of applications of antibacterial coating is quite high, owing to its functional properties to prevent the growth of microorganisms. Many surface-coating technologies are under investigation, ranging from pharmaceutical excipients and antimicrobial agents for medical devices and surgical implants to coatings that ensure disinfection of implant surfaces. Silver is well known for its antimicrobial and antibacterial properties, so it is widely used in the antimicrobial coating. Nanostructured silver is the most prevalent antimicrobial agent that can be used in the form of nanoparticles, nanowires, and nanolayers for orthopedic implants. Titanium dioxide is also well known for its antimicrobial properties, and the compound has been shown to kill 99.9% of E. coli colonies. Hydrophilic coatings and biofilm-inhibiting surface technology are some of the recent technologies in implantable devices.

The increasing focus of market players in offering technologically advanced medical products and orthopedic implants with antibacterial coating will contribute to market growth during the forecast period. For instance, Specialty Coating Systems Inc. offers new SCS microRESIST Antimicrobial Parylene Technology, which can effectively eliminate harmful microorganisms on coated medical devices. It can coat the medical implant with biocompatible Parylene coatings with effective antimicrobial properties.

Similarly, Germany-based company DOT GmbH offers orthopedic implantable devices physical vapor deposition (PVD) coatings technology. The PVD coating technique involves applying ceramic hard material layers to the implants using a special arc evaporation technique with nitrogen. The implants with this kind of ceramic coating can largely prevent foreign body reactions and significantly improve the biocompatibility of the implant surfaces. In addition to this, DOT has also developed an innovative technology called BONIT, which includes an electrochemical process of applying a thin, resorbable calcium phosphate layer to orthopedic implants. Calcium phosphates are used in medical coating technology because they ensure the rapid growth of bone tissue and promote a connection with high strength between the implant and the surrounding tissue, thereby shortening the healing phase. Hence, such technological advancement in the antimicrobial coating will drive the orthopedic implant antimicrobial coating surface treatment market.

Type Insights

Based on type, the global orthopedic implant antibacterial coatings surface treatment market is segmented into passive surface finishing/modifications (PSM), active surface finishing/modifications (ASM), and peri-operative antibacterial local carriers or coatings (LCC). In 2020, the active surface finishing/modifications (ASM) segment held the largest share of the market. Furthermore, the same segment is expected to register the highest CAGR in the market during 2021–2028. ASM involves the application of pharmacologically active antibacterial agents or compounds like antibiotics, antiseptics, metal ions, or organic molecules on the surface of orthopedic implants. Such pharmacologically activated coatings on implant surfaces may change the implant from a passive or pharmacologically inert medical device to a drug-loaded medical device. Companies such as DOT GmbH and Harland Medical Systems, Inc. provide antibacterial coatings surface treatment, which is expected to drive the market during the forecast period.

Material Type Insights

Based on material type, the orthopedic implant antibacterial coatings surface treatment market is segmented into metallic coatings and non-metallic coatings. The metallic coatings segment would hold a larger market share in 2021. Moreover, the same segment is expected to hold a significant market share in the orthopedic implant antibacterial coatings surface treatment market due to the high efficacy at low dosage levels without the development of antimicrobial resistance. Metal-based antimicrobials coating can provide sustainable solutions toward orthopedic implant-associated infections, which is expected to drive the segment.

Product launches and mergers and acquisitions are highly adopted strategies by the global orthopedic implant antibacterial coatings surface treatment market players. A few of the recent key market developments are listed below:

In September 2021, aap Implantate AG announced that three implants coated with the company's innovative antibacterial silver technology were implanted in patients to check the healing process. aap addressed one of the greatest and inadequately solved challenges in traumatology, i.e., surgical site infections (SSI), as all three surgeries had excellent healing processes, and no indications of infections were recorded. The overall results are a positive indication for the planned human clinical study that aap intended to launch in Germany in the fourth quarter of 2021 to obtain CE approval.

In March 2020, Covalon Technologies Ltd. launched its breakthrough antimicrobial technology called CovaGuard, formulated to kill the COVID-19 virus (or "SARS-CoV-2") and other viruses, bacteria, and pathogens and provide continuous protection by trapping and deactivating microbes over an extended period. CovaGuard can be safely applied on the skin and protective medical equipment.

Health care systems are overburdened due to the COVID-19 pandemic, and the delivery of medical care to all patients has become a challenge worldwide. As the COVID-19 pandemic continues to unfold, medical device companies are finding difficulties in managing their operations. Many companies offering products for orthopedic implant antibacterial coatings surface treatment have their business operations in the US, and their business is adversely being negatively affected by the COVID-19 pandemic. This pandemic has disrupted the product distribution, as well as resulted in temporary closures of company facilities. For instance, as per the British Journal of Surgery published in May 2020, orthopedic procedures were affected the most, with 6.3 million operations canceled worldwide due to the pandemic. Moreover, cancellations of elective surgeries to reduce exposure to COVID-19 in the hospital and operating rooms into intensive care units have hampered the growth of the orthopedic implant antibacterial coatings surface treatment market. However, in 2021 as the new COVID-19 cases are going down the as the situation is recovering thus, the market is expected to grow in upcoming days.

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Regional Insights

The regional trends and factors influencing the Orthopedic Implant Antibacterial Coatings Surface Treatment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Orthopedic Implant Antibacterial Coatings Surface Treatment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Orthopedic Implant Antibacterial Coatings Surface Treatment Market

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 87.15 Million |

| Market Size by 2028 | US$ 178.55 Million |

| Global CAGR (2021 - 2028) | 10.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Players Density: Understanding Its Impact on Business Dynamics

The Orthopedic Implant Antibacterial Coatings Surface Treatment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Orthopedic Implant Antibacterial Coatings Surface Treatment Market are:

- DOT GmbH

- Covalon Technologies Ltd.

- Sciessent LLC

- Harland Medical Systems, Inc.

- Isoflux, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Orthopedic Implant Antibacterial Coatings Surface Treatment Market top key players overview

Orthopedic Implant Antibacterial Coatings Surface Treatment – Market Segmentation

The global orthopedic implant antibacterial coatings surface treatment market is segmented into type, material type, and geography. In terms of product, the market is segmented into passive surface finishing/modifications (PSM), active surface finishing/modifications (ASM), and peri-operative antibacterial local carriers or coatings (LCC). Based on material type, the orthopedic implant antibacterial coatings surface treatment market is segmented into metallic coatings and non-metallic coatings. In terms of geography, the market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South and Central America.

Company Profiles

- DOT GmbH

- Covalon Technologies Ltd.

- Sciessent LLC

- Harland Medical Systems, Inc.

- Isoflux, Inc.

- Allvivo Vascular, Inc.

- aap Implantate AG

- BASF SE

- Agienic Inc.

- ARAN BIOMEDICAL

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Material Type, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Active Surface Finishing/Modifications (ASM) segment growing in the orthopedic implant antibacterial coatings surface treatment market.

High market potential in developing economies is likely to fuel the market growth in the comping years.

Asia-Pacific is the lucrative for the orthopedic implant antibacterial coatings surface treatment market.

Increasing number of product launches and strategic initiatives taken by market players is likely to act as trend the market growth in the comping years.

Key players in the market are DOT GmbH, Covalon Technologies Ltd., Sciessent LLC, Harland Medical Systems, Inc., Isoflux, Inc., Allvivo Vascular, Inc., aap Implantate AG, BASF SE, Agienic Inc., ARAN BIOMEDICAL among others.

Key factors driving the growth of the market are rise in prevalence of implant-associated infections and rise in prevalence of implant-associated infections drive the market growth. However, high cost of implants with antimicrobial coating hampers the market growth.

Among patients undergoing orthopedic implant surgery, bacterial infection and infection-induced immune responses have become a life-threatening concern. Biocontamination of conventional biomaterials causes bacterial invasion in injured areas, resulting in postoperative illness. As a result, anti-infection and immune-evasive coatings for orthopedic implants are desperately needed. Orthopedic implants such as screws, plates, nails, and artificial joints have grown in great demand by hospitals for orthopedic surgery. Coating the implants with an anti-biofouling polymer, which prevents bio substances and bacteria from adhering onto the surface, is in demand.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Orthopedic Implant Antibacterial Coatings Surface Treatment Market

- DOT GmbH

- Covalon Technologies Ltd.

- Sciessent LLC

- Harland Medical Systems, Inc.

- Isoflux, Inc.

- Allvivo Vascular, Inc.

- aap Implantate AG

- BASF SE

- Agienic Inc.

- ARAN BIOMEDICAL

Get Free Sample For

Get Free Sample For