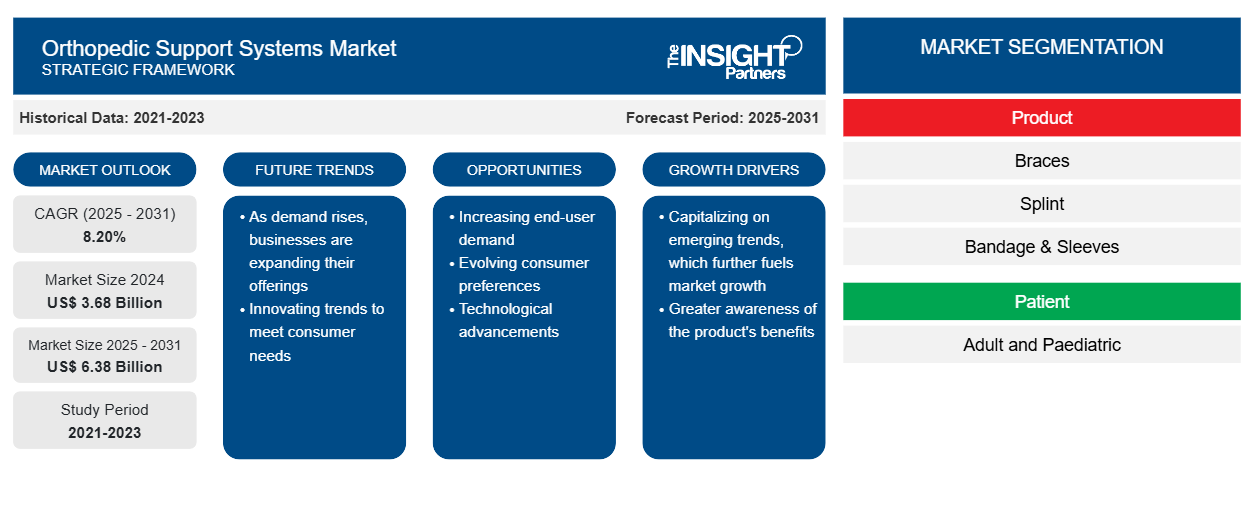

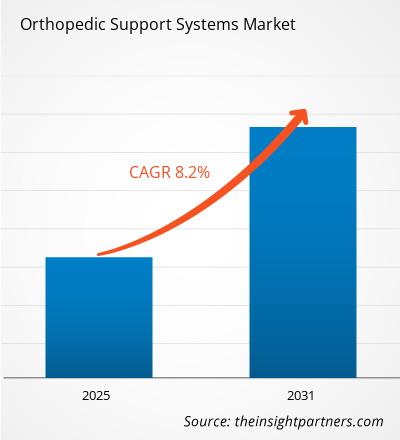

[Research Report] Orthopedic support systems market size is projected to grow from US$ 3,139.96 million in 2022 to US$ 5,915.90 million by 2031; it is estimated to record a CAGR of 8.2% during 2022–2031.

Market Insights and Analyst View:

Orthopedic support systems can help with pain and immobility in the hands, elbows, back, knees, or ankles. In orthopedics, they are used to promote, restore, or support movement within the body and are used in the treatment and prevention of injuries, medical conditions, and damage to the body's motor system. The braces and supports are available in knee braces, ankle braces, leg braces, elbow braces, tennis elbow braces, wrist braces, thumb and hand splints, back and shoulder braces, and many more. The orthopedic support systems market is majorly driven by factors such as growing incidences of orthopedic disorders and diseases, the rise in sports and accident-related injuries cases, rise in the geriatric population, and technological advancement in orthopedic braces and supports. Increasing technological advancements that enable the launch of innovative braces and supports for patients are expected to drive the orthopedic supports systems market due to the comfort and ease of mobility offered to patients. Companies are constantly involved in selling their innovative products through off-the-shelf and e-commerce platforms, which have paved the way for significant growth opportunities for the players operating in the orthopedic braces and support systems field.

Growth Drivers:

Playing sports benefits adolescents physiologically, psychologically, and socially. It helps improve health conditions, self-esteem, and social interactions. However, as the number of sports increases, so does the number of sports-related injuries. Sports injuries are a main issue for athletes, coaches, and sports clubs, which negatively affect the health of the injured athlete. More than 30 million children and teens in the US participated in organized sports in 2021, out of which one-third were reported with sports-related injuries, according to Stanford Medicine Children's Health. In addition, ~3.5 million injuries occur in children each year in the country while playing sports or participating in recreational activities, and ~75,000 children aged 14 and below are treated for these injuries. In the US alone, 3.5 million youth under 15 receive medical care every year for injuries caused during sports practice.

In addition, these injuries burden the healthcare system as the management of such injuries is usually expensive and time-consuming. Handball is a pivoting team sport in which players are mostly affected by injuries and can lead to musculoskeletal injuries. As per a study titled "Prevalence and Determinants of Sports Injuries among the Egyptian National Handball Players," published in August 2022, knee injuries represent the greatest share of extensive injuries in these players. As per a cross-sectional study carried out on all the Egyptian National handball players, ~83% of the total national handball players suffered from one or more sports injuries, 81% of them were injured once, and 40% of total injuries were overuse injuries. The most frequent injured sites were the knee (47.5%), followed by the ankle (19%) and shoulder (13%).

Moreover, the lower extremity accounts for the majority of sports injuries around the world. According to the Federation Internationale de Football Association (FIFA), an ankle sprain is the most common injury sustained by football players globally. Such injuries are expected to generate substantial demand for ankle braces. Ankle braces are recommended after an acute ankle sprain to aid in recovery and help prevent ankle injuries such as sprains, fractures, and tendonitis.

Thus, a high participation rate in sports (both children and adults), coupled with an increase in sports injuries, is creating the demand for orthopedic support systems globally. Athletes also use orthopedic braces to safeguard themselves from further injury during sports activities. It helps them limit unwanted movement during competitions, thereby facilitating convenient play. Therefore, increasing sports injuries drives the growth of the orthopedic support systems market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Orthopedic Support Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Orthopedic Support Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global Orthopedic Support Systems Market” is segmented based on product, patient, application, and geography. Based on product, the orthopedic support systems market is segmented into braces, splint, bandage & sleeves, and strap. Based on patient, the orthopedic support systems market is categorized into adult and paediatric. Based on application, the orthopedic support systems market is segmented into upper body extremities and lower body extremities. The orthopedic support systems market, based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Spain, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (Saudi Arabia, UAE, South Africa, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

The orthopedic support systems market, by product, is segmented into braces, splint, bandage & sleeves, and strap. The braces segment held the largest share of the market in 2022. Braces segment is growing due to the rising usage of knee braces and their high demand due to the growing number of knee surgeries related to knee injuries such as anterior cruciate ligament (ACL), runner’s knee, patella tendonitis, and torn knee cartilage. Knee brace demand is growing because it is used as a follow-up treatment after knee surgery associated with injuries. Growing number of the target population affected by knee joint-related ailments benefit from knee braces as it helps in pressure relief from knee joints affected by arthritis. Orthopedic doctors also recommend ankle braces to patients for the treatment of acute ankle sprain. Athletes wear an orthopedic brace to prevent further injury during sports activities, prevent unwanted movement during matches, and make play easier.

Based on patient, the orthopedic support systems market is segmented into adult and paediatric. The paediatric segment held the largest market share in 2022. The growth of the segment is due to the rising number of child injuries. Child injuries are a growing global health problem and require immediate attention. Unintentional injuries make up for 90% of child injuries. These injuries are a significant healthcare problem that needs immediate attention. Moreover, the number of children born with musculoskeletal and bone disorders such as spinal and limb deformities is rapidly growing, which is elevating the need for orthopedic support systems worldwide to treat the pediatric patient population. In addition, the growing enthusiasm among the pediatric population to participate in sports activities is associated with sports-related injuries. These factors potentially boost the demand for orthopedic support systems across the globe for these patients.

Based on application, the orthopedic support systems market is segmented into upper body extremities and lower body extremities. The lower body extremities segment held the largest market share in 2022. The growth of the segment is associated with a growing geriatric population suffering from lower body problems, including knee-related disorders such as osteoarthritis and the rise of lower body disabilities. The causes of osteoarthritis are dislocation of joints, ligament injuries, and torn cartilage; in addition to obesity and poor posture, joint malformation can also result in osteoarthritis. The severe osteoarthritis shows symptoms such as severe & increased pain, increased swelling & inflammation, joint instability, and decreased range of movements. The growing need to support the weak ligament contributes to the rising global demand for orthopedic braces and support systems. To treat the condition, braces are prescribed by the doctors. The braces enhance stability, reduce swelling & pain, reduce pressure, and increase confidence in the patients to move independently. The braces used to treat osteoarthritis conditions are prophylactic, unloader, rehabilitative, functional, or supportive. These braces are custom-made, which provides better comfort and better movement.

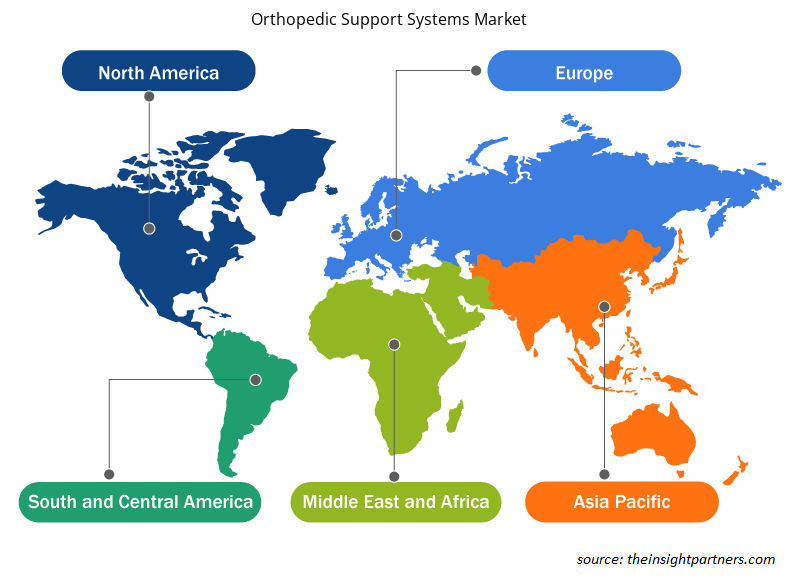

Regional Analysis:

Based on geography, the orthopedic support systems market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. North America is likely to acquire a significant share of the global market in 2022. The market growth in the region is attributed to the increasing geriatric population, growing developments by the market players for orthopedic braces and supports, growing awareness about product availability, and rising adoption of orthopedic braces to offer mobility and prevent further injury in the ligament. According to the facts provided by the National Safety Council, a US-based non-profit organization, exercise-related injuries accounted for ~468,000 injuries in 2021. In addition, the US government offers various funds and support for the usage of orthopedic braces & support and various programs for the betterment of the population. For instance, the Orthopedic Research Program (US) supports clinical, epidemiological, and outcomes research in orthopedics and musculoskeletal rehabilitation. Such initiatives are expected to drive the demand for orthopedic braces and supports.

The increasing geriatric population is one factor propelling the market's growth. According to the National Institutes of Health (NIH) report, America’s 65-and-over population is projected to nearly double over the next three decades, from 48 million to 88 million by 2050. As per SingleCare article data, ~350 million people have arthritis worldwide. Per the same source, a quarter of American adults have arthritis. 1 in 4 adults in the US have arthritis in 2021, and the number of US adults suffering from arthritis is estimated to reach 78 million by 2040. Therefore, the high rate of age-related problems, increasing government support for funding, and awareness of orthopedic braces and supports indicate the potential growth for wider adoption of the orthopedic support system products in the region.

Moreover, Europe is the second leading region in the global orthopedic support systems market. The Europe orthopedic braces and supports market is in a growth phase due to the rising aging population, increasing focus of market players in Germany and France, grants & funds by the government, and rising number of conferences in the UK. These factors upsurge the orthopedic support systems adoption in the region. In addition, the rising prevalence of osteoarthritis also promotes the growth of the market in Europe.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global orthopedic support systems market are listed below:

- In April 2023, DJO Global Inc. (now known as Envois) expanded its ankle and foot portfolio with a knotless syndesmotic repair system by launching Enofix with Constrictor technology. This technology is a repair system demonstrating superior fixation under cyclic loading and is useful in stabilizing syndesmosis, thus making an effective contribution to the field of orthopedic braces and supports.

- In September 2021, Ossur, a global orthotics and prosthetics industry leader, launched the Rebound ACL brace, designed to help patients recovering from anterior cruciate ligament (ACL) injury. The brace’s proprietary Dynamic Tension System (DTS) allows for custom, adjustable settings based on individual anatomy and rehabilitation needs, whether the patient is undergoing non-surgical conservative treatment approaches or recovering from post-operative reconstruction.

- In February 2021, Breg, Inc. launched two new lines of spinal orthoses (braces) products under the brand names Pinnacle and Ascenda. Breg is the leading orthopedic bracing and billing services company, which has developed 15 products to elevate care for patients with spinal injuries.

- In June 2021, DJO launched the DonJoy X-ROM Post-Op Knee Brace into the market. The knee brace features the most advanced range of motion protection, and its design is improved for ease of user and easier application and adjustment. The X-ROM brace technology allows patients to recover faster from ACL repair and other knee surgeries. In addition, it improves patients’ confidence, comfort, and stability.

Competitive Landscape and Key Companies:

Breg, Inc; DeRoyal Industries, Inc; Enovis Corporation; Bauerfeind AG; Otto Bock Healthcare GmbH; Ossur Corporate; medi GmbH & Co. KG; Boston Orthotics & Prosthetics; Essity Health & Medical (BSN medical, Inc); and ALCARE Co., Ltd are the major orthopedic braces and support systems companies. These companies focus on various growth strategies such as new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide.

Report ScopeOrthopedic Support Systems Market Regional Insights

The regional trends and factors influencing the Orthopedic Support Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Orthopedic Support Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Orthopedic Support Systems Market

Orthopedic Support Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 3.68 Billion |

| Market Size by 2031 | US$ 6.38 Billion |

| Global CAGR (2025 - 2031) | 8.20% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

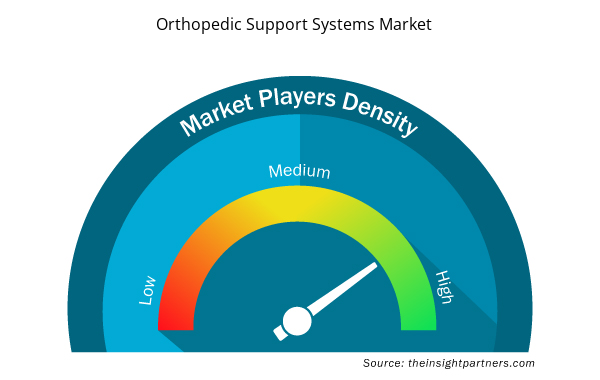

Orthopedic Support Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Orthopedic Support Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Orthopedic Support Systems Market are:

- Breg, Inc

- DeRoyal Industries, Inc

- Enovis Corporation

- Bauerfeind AG

- Otto Bock HealthcareGmbH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Orthopedic Support Systems Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Breg, Inc

- DeRoyal Industries, Inc

- Enovis Corporation

- Bauerfeind AG

- Otto Bock Healthcare GmbH

- Ossur Corporate

- medi GmbH & Co. KG

- Boston Orthotics & Prosthetics

- Essity Health & Medical (BSN medical, Inc)

- ALCARE Co., Ltd

Get Free Sample For

Get Free Sample For