Orthotic Aids Market Key Companies and SWOT Analysis by 2030

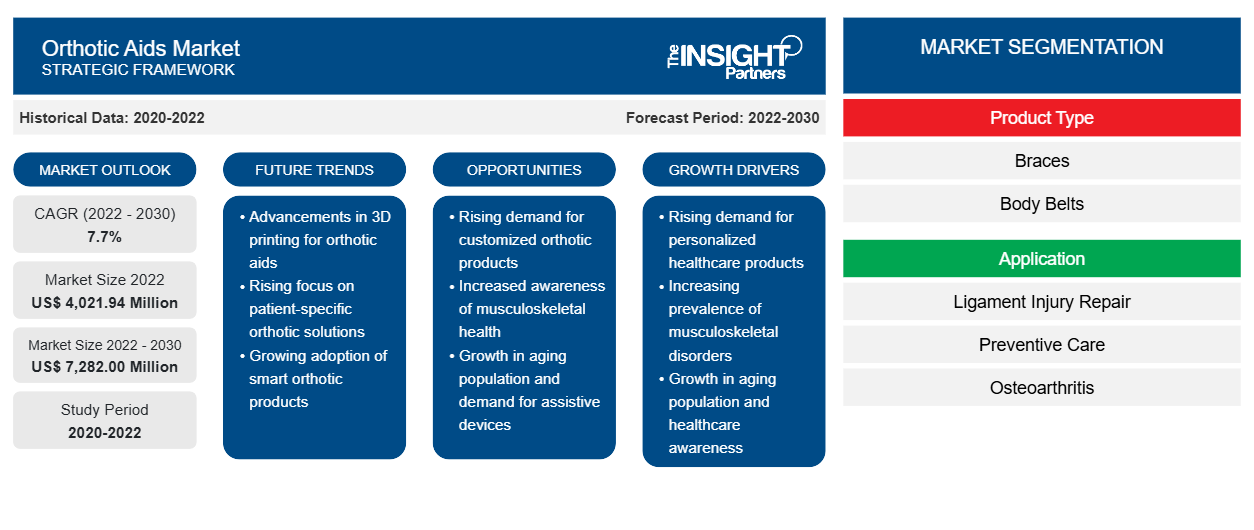

Historic Data: 2020-2022 | Base Year: 2022 | Forecast Period: 2022-2030Orthotic Aids Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type [Braces (Knee Braces, Foot Support & Braces, Elbow Support & Braces, Neck & Cervical Braces, and Others), Body Belts, and Others (Cast Covers, Pouch Arm Sling, and Cast Shoes)], Application (Ligament Injury Repair, Preventive Care, Osteoarthritis, Compression Therapy, and Others), Distribution Channel (Online and Offline), Supplier Type (Branded and Unbranded), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

- Report Date : Feb 2026

- Report Code : TIPRE00030114

- Category : Life Sciences

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

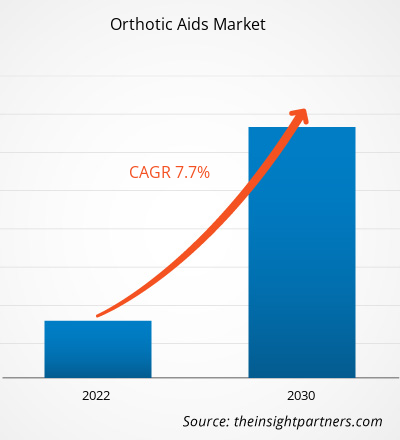

[Research Report] The orthotic aids market size is projected to grow from US$ 4,021.94 million in 2022 and is projected to reach US$ 7,282.00 million by 2030; the market is estimated to register a CAGR of 7.7% during 2022–2030.

Market Insights and Analyst View:

Orthotic aids are devices that are used to provide support and stability to the musculoskeletal system; prevent, correct, or align deformities; and improve the function of body parts. A few of the commonly used orthotic aids include foot orthotics, knee braces, back braces, wrist braces, and ankle braces. An upsurge in orthopedic conditions among large populations on the global level increases the demand for orthotic aids. Moreover, increasing product launches, technological advancements, and strategic collaborations by the orthotic market players are likely to amplify the orthotic aids market growth in the coming years.

Growth Drivers:

Orthopedic aids such as body belts and braces facilitate patients affected by cerebral palsy, brain injury, spinal cord injury, and other neurological/orthopedic conditions with mobility and support. According to the Centers for Disease Control and Prevention, the US reported approximately 214,110 traumatic brain injury (TBI)-related hospitalizations and 69,473 TBI-related deaths in 2020. Thus, the use of orthotic aids is increasing with the rising number of patients suffering from various orthopedic and neurological conditions.

The modernization of healthcare facilities and improvements in healthcare services, which eventually boost people's life expectancy, lead to an increase in the global geriatric population. Elderlies are at a greater risk of falls, and minor accidents can also cause fractures or bone breakage due to the tendency of muscles and bones to wear off with age. Osteoporosis and other conditions that may affect older people may further raise the risk of bone breakage. Thus, an upsurge in the elderly population is correlated with the soaring number of orthopedic injuries and disorders, which creates the demand for orthotic aids. According to the Osteoarthritis (OA) Action Alliance, 88% of people with OA are at least 45 years old, and 43% are 65 or older in the US.

A child's musculoskeletal system may develop in ways that make movement and posture difficult due to orthopedic and neuromuscular conditions such as cerebral palsy, spina bifida, muscular dystrophy, and clubfoot. According to the Centers for Disease Control and Prevalence (CDC), clubfoot is one of the most common congenital disabilities in the US, and it affected ~6,643 babies in the country in 2022. Pediatric bracing involves the use of specialized orthotic devices or braces to support and align joints in children’s bodies, particularly those in the spine, hips, knees, ankles, and feet. These devices are prescribed following diagnosis and are typically manufactured to meet patients’ needs.

Thus, increasing the use of orthotic aids among people from various age groups drives the orthotic aids market growth.

Inconsistent insurance coverage or limited product coverage results in an increased cost burden on patients. The high cost of orthotic treatments and aids, along with unfavorable reimbursement policies, impedes the growth of the orthotic aids market. Elderly people suffering from chronic pain or injuries can benefit significantly from back braces. Durable arm, leg, neck, and back braces are covered by Medicare Part B, with some restrictions. The Medicare Braces Benefit covers knee orthoses. The orthosis must be a semi-rigid or rigid device that is used to support a weak or deformed body part or to limit or completely rule out motion in a diseased or injured part of the body to qualify for coverage under this benefit. The statutory definition of the Braces Benefit does not apply to items that are not sufficiently rigid to be able to immobilize or support the body part for which they are intended. Items that don't fit the description of a brace aren’t covered and don't qualify for benefits under this Medicare benefit.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Orthotic Aids Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Orthotic Aids Market" is segmented on the basis of product type, application, distribution channel, supplier type, and geography. Based on product type, the orthotic aids market has been segmented into braces, body belts, and others. In terms of application, the orthotic aids market has been segmented into ligament injury repair, preventive care, osteoarthritis, compression therapy, and others. Based on distribution channel, the market is bifurcated into online and offline. The orthotic aids market, by supplier type, is bifurcated into branded and unbranded. Based on geography, the orthotic aids market is categorized into North America (US, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, Rest of Asia Pacific), Middle East & Africa (Saudi Arabia, South Africa, UAE, and Rest of MEA), and South & Central America (Brazil, Argentina, Rest of South & Central America).

Segmental Analysis:

The orthotic aids market, by product type, is categorized into braces, body belts, and others. The braces segment held the largest market share in 2022. The same segment is anticipated to register the highest CAGR during 2022–2030. Body belts such as back traction belts, elastic back braces, copper belts, back pain belts, and back braces are commonly used to treat joint sprain, muscle strain, and injuries. Most people are likely to experience back pain at some point in their lives. While injuries and illnesses are among several causes of back pain, a vast percentage of cases result from improper lifting of heavy objects and poor posture. Wearing a back brace is a common method of preventing back pain and improving posture. According to Cross River Therapy, 8 out of 10 Americans report having back issues at least once or more frequently in a year. As per the same source, 80 million workers, or 50% of all employed Americans, report back pain annually.

Based on application, the orthotic aids market is segmented into ligament injury repair, preventive care, osteoarthritis, compression therapy, and others. The ligament injury repair segment held the largest market share in 2022 and is anticipated to register the highest CAGR 2022-2030. The medial collateral ligament (MCL), posterior cruciate ligament (PCL), anterior cruciate ligament (ACL), and lateral collateral ligament (LCL) are the four major ligaments in the knee. Ligaments are instrumental to keeping a person's knee moving, and moderately minor injuries can also cause much discomfort to persons. Knee braces can decrease the load on the knee. In case of a partial tear, a doctor may recommend repairing the ACL tear non-surgically by using an ACL brace and physical therapy for muscle strengthening. However, for patients undergoing surgery, doctors recommend wearing post-operative knee braces and crutches until they are adequately healed. The rehab procedure for an ACL tear is relatively lengthy, as it can take 6 months to 1 year for completion. After recovery, the patient may be advised to wear an ACL knee brace while playing sports.

PCL tears are classified into four groups: Grade 1 tear, Grade 2 tear, Grade 3 tear, and Healthy PCL. If the tear is severe enough, the patient may have to have PCL surgery. After surgery, they are recommended to wear a PCL knee brace for post-surgical recovery. Brace Ability offers many braces and supports for preventing and treating PCL tears. The majority of MCL injuries can be treated at home with ice application, anti-inflammatory medication, and rest. A doctor may suggest a brace that helps protect the patient's knee and enables some movement. If the tear is significantly severe, patients may need surgery.

Based on the distribution channel, the orthotic aids market is bifurcated into online and offline. The offline segment held a larger market share in 2022. However, the online segment is anticipated to register a higher CAGR during 2022-2030. Online pharmacies allow customers to buy prescription medications, medical equipment, and electronic services without the need to visit actual stores, enabling them to receive their medications or services quickly and comfortably at home. Internet penetration, digitalization, government support, booming economy, etc., are the prominent factors contributing to the growth of the orthotic aids market through the online distribution channel. For instance, Walmart and Medical Department Store, Inc. are a few of the online distributors that offer braces, body belts, arm slings, etc.

Based on supplier type, the orthotic aids market is bifurcated into branded and unbranded. The branded segment held a larger share of the market in 2022; however, the unbranded segment is anticipated to register a higher CAGR during 2022-2030. Branded orthotic aids include products that are manufactured by well-known manufacturers with significant global presence; these products are made available through online and offline distribution channels. The US is the second-largest importer of knee braces in the world, sourcing the majority of its knee braces from China, Vietnam, and Belgium. The limited number of manufacturers in developing economies and increasing the purchasing power of consumers encourage manufacturers of branded goods to offer products meeting evolving consumer needs.

Regional Analysis:

The global orthotic aids market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America is expected to hold a major market share owing to the increasing prevalence of orthopedic conditions among a large population, along with an upsurge in the geriatric population prone to such conditions. Moreover, product launches, geographic expansions, and technological advancements are expected to boost the orthotic aids market growth in the region in the future. The North American orthotic aids market is segmented into the US, Canada, and Mexico. The US accounts for a major market share. The Osteoarthritis Action Alliance (OAAA), states arthritis is a severe health crisis in the US. As per the Centers for Disease Control and Prevention (CDC) estimates, 53.2 million adults (i.e., ~25% or 1 in 4 persons) in the country were suffering from a form of arthritis during 2019–2021, and the number is anticipated to reach 78 million by 2040. There are more than 100 forms of arthritis and related diseases. Individuals with osteoarthritis (OA) experience more significant pain, disability, fatigue, and activity limitations than other people of their age. Chronic and episodic pain can result in functional disabilities and work limitations. Arthritis is characterized by the tenderness and swelling of one or more joints. Primary symptoms of arthritis include stiffness and joint pain, which generally worsen with age. Orthotic aids, such as knee braces, can help relieve pain and provide protection and support for joints or parts of the body without using drugs. The back braces strengthen the musculature and upper body, thereby reducing the risk of osteoporotic fractures.

The burgeoning incidence of spinal cord injuries in the US is fueling the orthotic aids market. According to the American Association of Neurological Surgeons, nearly 17,000 new spinal cord injuries occur in the US every year. The National Multiple Sclerosis Society states that ~1 million people were affected by multiple sclerosis in the US in 2020. Thus, disabilities caused by spinal cord injuries and multiple sclerosis consequently result in the need for orthotic aids to assist these patients in attaining mobility. The use of a brace is recommended by doctors among patients suffering from spinal cord injuries (SCIs). A brace externally appropriates the spine position, stabilizes the spine when soft issues (such as ligaments) cannot, applies corrective forces, and restricts movements.

Asia Pacific is expected to register a significant CAGR in the orthotic aids market during 2022–2030. The projected market growth is ascribed to the increasing geriatric population, which is prone to various orthopedic conditions. China has one of the largest geriatric populations. According to the Population Reference Bureau 2023, the Chinese geriatric population is expected to reach 366 million by 2050, i.e., substantially larger than the US. Moreover, collaborations among market players, technological advancements, and product launches would further drive the orthotic aids market growth in Asia Pacific. In January 2023, Breg, Inc. partnered with Coreal International, a medical device supplier, to bring its broad portfolio of bracing and cold therapy products to Chinese physicians and their patients.

Orthotic Aids Market Regional InsightsThe regional trends and factors influencing the Orthotic Aids Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Orthotic Aids Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Orthotic Aids Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4,021.94 Million |

| Market Size by 2030 | US$ 7,282.00 Million |

| Global CAGR (2022 - 2030) | 7.7% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Orthotic Aids Market Players Density: Understanding Its Impact on Business Dynamics

The Orthotic Aids Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Orthotic Aids Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the orthotic aids market are listed below:

- In October 2023, OrthoPediatrics Corp. launched DF2 Brace as part of its expansion in the non-surgical business. The product is indicated for the treatment of kids with musculoskeletal injuries. The brace is intended to replace a spica cast in femur fracture fixation in pediatric patients of age ranging from 6 months to 5 years, enabling the immobilization of the femur, knee, and hip.

- In February 2021, Breg, Inc. launched two new lines of spinal orthoses: Pinnacle and Ascend. These two lines consist of 15 products in total, designed to elevate care for patients with spinal injuries.

Competitive Landscape and Key Companies:

Ossur hf, Ottobock SE & Co KGaA, Thuasne SAS, Fillauer LLC, Lohmann & Rauscher GmbH & Co KG, DeRoyal Industries Inc, Hanger Inc, Steeper Group Holdings Ltd, Breg Inc, and DJO LLC are among the prominent orthotic aids companies. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide.

Frequently Asked Questions

What are orthotic aids?

Which segment is dominating the global orthotic aids market?

What are the driving factors for the global orthotic aids market worldwide?

Which region is dominating the global orthotic aids market?

Who are the major players in the global orthotic aids market worldwide?

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For