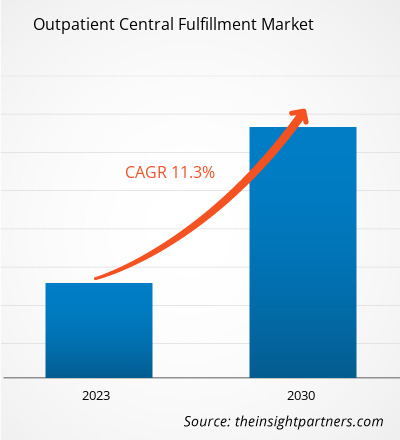

[Research Report] The outpatient central fulfillment market size is projected to surge from US$ 309.32 million in 2022 to US$ 725.79 million by 2030; the market is estimated to grow at a CAGR of 11.3% during 2022–2030.

Analyst Perspective:

Automating the mechanical procedures of any pharmacy process typically entails tracking and updating customer information in databases (e.g., medical history and drug interaction risk detection), counting small objects (e.g., pills and capsules), and measuring and combining powders and fluids for compilation and other such activities. As a result, automated pharmacies are preferred by many hospitals and pharmacies. Hospitals use pharmacy automation to improve patient care and achieve long-term financial savings. For example, hospital pharmacies automate the task of measuring liquids or powders for mixing to streamline and automate healthcare drug processing. Integrating automated services in pharmacies worldwide has significantly improved the effectiveness and safety of storing, dispensing, filling, packaging, and labeling prescription drugs. Moreover, filling and labeling prescriptions can generate medication waste; this waste is minimized through pharmacy automation. Therefore, traditional pharmacies have also begun to transition to automated systems. Thus, such factors are anticipated to impact the growth of the global outpatient central fulfillment market

Market Overview:

The pharmacy automation industry is growing due to increased consumer demand for pharmaceutical products, tougher competition among pharmaceutical companies, technological advancements, and precise robotic equipment availability. The increasing demand for error-free medicines is expected to drive the outpatient central fulfillment market. Governments in many countries are promoting automated medication technology in pharmacies and hospitals to reduce prescribing and dispensing errors. As a result, outpatient centralized fulfillment is gaining significant popularity. However, reluctance among healthcare organizations to support outpatient centralized processing may hamper the growth of the overall market to some extent. Strict regulatory control and large initial investment requirements also limit the growth of the outpatient central fulfillment market.

Technological advancements by key players favor the growth of the outpatient central fulfillment market. In September 2021, Deenova reported winning its first-ever contract in Germany and parallelly established Deenova operations in Europe’s largest GDP healthcare market. Under this contract, the company would deliver and install 3 all-in-1 packaging robots, 34 all-in-1 station medication dispensing robots, and 72 all-in-1 trolleys with secure bedside verification at Marien Hospital Gelsenkirchen. It would also extend full-service support for these solutions. Marien Hospital Gelsenkirchen is an operating company in the service network of St. Augustinus Gelsenkirchen GmbH.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Outpatient Central Fulfillment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Outpatient Central Fulfillment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver and Restraint:

Pharmacy automation has become one of the most flourishing segments of the healthcare sector. The automation technology can improve patient care and increase efficiency by automating pharmacy tasks and processes. According to a study by Visionary Insights, automation in pharmacies was predicted to increase by 22% through 2021. This rise can be due to the growing need for precise and efficient dispensing, and the increasing number of specialty medication dispensing operations. Pharmacists also adopt technologies to automate certain other tasks than dispensing, e.g., inventory management. Automated inventory systems can help pharmacies track and manage their inventory more accurately, which is expected to boost the outpatient central fulfillment market growth.

In February 2021, Omnicell Inc. announced the launch of its Medimat, a next-generation, automated dispensing system for retail pharmacies. It has been built for improved patient safety, efficient time utilization, and financial savings. Similarly, innovativeAspirations (iA), a commercial provider of software-enabled pharmacy fulfillment and automation solutions, launched 3 solutions integrated with Medimat’s NEXiA technology in August 2021 to manage the fulfillment of prescribed medicines centrally. iA has also introduced SmartPod, a next-generation robot with a modular autofill unit. Such strategies by the market players are projected to drive the outpatient central fulfillment market.

Common medication errors that have the potential to harm patients include dispensing a wrong drug, an incorrect quantity of a drug, and a wrong drug strength. Moreover, omitting items unintentionally may result in medication errors. These errors are alarming and are considered the third leading cause of death worldwide. The World Health Organization (WHO) also stated that a medication error causes 1 death in 1 million population globally. Unsafe practices in medicine have been causing unavoidable risks in the healthcare sector. According to the US Food and Drug Administration (FDA), over 100,000 reports associated with medication errors are received every year. Distractions are the leading cause of medication errors. Distractions occur because healthcare professionals are engaged in multiple tasks throughout the day, including examining the patient, interacting with consultants, speaking to patients’ family members, and conversing with insurance professionals. Sometimes a lapse of judgment develops in a hurry to complete their duties, which may lead to a medication error. Another major cause of medication error is distortion. Poor writing, abbreviations, misunderstood symbols, or improper translation cause distortions. Thus, the undeniable possibility of medication errors fuels the growth of the outpatient central fulfillment market.

Despite the evident benefits of automation in pharmacy operations, there is resistance to its adoption among physicians and healthcare providers. This reluctance is particularly due to cultural barriers, especially in emerging markets. Automated pharmacies are primarily popular among high-capacity pharmacists and medical facilities that can rationalize the return on investment (ROI) achieved through implementing such automated systems. According to Rangewell, pharmacy automation cost ranges from US$ 54,710.50 to US$ 547,105 and above; moreover, this value is only based on the physical price of the systems. Further, maintenance and servicing costs add to the overall costs of pharmacy automation systems. Automated dispensing systems require regular software updates to function properly, which is an expensive process. Pharmacy owners are often concerned about the safety and accuracy of medication dispensing owing to the risk of cross-contamination. As machines are programmed to administer different medications, tiny traces of the medications may remain in the robot. For this reason, thorough cleaning is necessary at regular intervals to avoid cross-contamination. Healthcare professionals need to program these systems, and any mistakes in drug inputs may lead to a medication error, affecting the overall health of patients. Moreover, these systems cannot refill drugs themselves; an operator must be available to check the sufficiency of stocks. Thus, high capital requirements and operational limitations associated with automated dispensing systems hinder the growth of the outpatient central fulfillment market.

Segmental Analysis:

The outpatient central fulfillment market, based on product type, is divided into automated medication dispensing systems, automated packaging and labeling systems, automated tabletop counters, automated storage and retrieval systems, and other types. The automated medication dispensing systems segment held the largest outpatient central fulfillment market share in 2022, and the same is expected to register the highest CAGR of 12.0% during 2022–2030. An automated medication dispensing system, or automated drug cabinet, is an electronic device primarily used for drug storage and dispensing in healthcare settings. Secured with authenticated passwords and biometrics for drug inventory control and security, these systems aid in tracking and controlling drug distribution. These systems are now widely used in many hospitals, clinics, and nursing homes. The Pyxis MedStation system offered by BD is one of the most used automated dispensing systems in the world. It supports decentralized medication management, and its barcode scanning ensures accurate medication dispensing.

Based on end user, the outpatient central fulfillment market is segmented into hospital pharmacies, retail pharmacies, and mail-order pharmacies. The hospital pharmacies segment held the largest outpatient central fulfillment market share in 2022. The market for this segment is anticipated to grow at the highest CAGR during 2022–2030. Many hospitals adopt pharmacy automation systems to ensure accuracy, reproducibility, and patient safety. Some studies have observed up to 10% manual error rates in hospital pharmacies. Many studies have proved that using ADM confers more benefits than liability. In March 2020, Swisslog Healthcare partnered with PipelineRx and Savioke to launch the Meds-to-Beds program, an initiative to provide hospital outpatient pharmacy services at discharge. The program includes automatic robotic delivery of prescribed medication and consulting to expand pharmacy capacities. As hospital pharmacies acknowledge the need to provide a high standard of care to patients, the demand for automation equipment is likely to increase significantly during the forecast period.

Regional Analysis:

North America is the dominating region in the outpatient central fulfillment market. The North America outpatient central fulfillment market forecast was valued at US$ 152.56 million in 2022 and is projected to reach US$ 350.50 million by 2030; it is expected to register a CAGR of 11.0% during 2022–2030. The North America outpatient central fulfillment market is segmented into the US, Canada, and Mexico. The outpatient central fulfillment market growth in this region is attributed to the increasing adoption of pharmacy automation in the US, rising public health awareness, surge in strategic initiatives by governments, and the presence of leading pharmacy automation vendors. The US is the largest contributor to the outpatient central fulfillment market in North America. With the growing burden on pharmacies, the frequency of medication errors also increases in the country. The outpatient central fulfillment market share in the US is mainly attributed to rising concerns among medical professionals with an upsurge in medication errors and an increasing demand for pharmaceutical products. Capsa Healthcare, headquartered in Portland (US), focuses on developing medication carts, computer carts, medical carts, wall-mounted workstations, and prescription tablet counters. In July 2023, the company acquired MASS Medical Storage. The acquisition of MASS Medical Storage provided Capsa with expertise in making medical storage and endoscope cabinet drying systems. In 2021, Rx Billing Genie, LP launched the Rx Billing Genie app. The company’s collaboration with the Canadian Pharmacists Association drives the adoption of the Rx Billing Genie app nationwide. In Mexico, the growing medical tourism, leading to a surge in medicine prescriptions, provides vital growth opportunities to the outpatient central fulfillment market.

Europe holds the second-largest outpatient central fulfillment market share. The region holds a substantial share of the global outpatient central fulfillment market. The presence of numerous domestic market players and the increasing incidences of chronic diseases are among the prominent factors that benefit the market in this region. Germany is one of the major contributors to the global outpatient central fulfillment market. The country has many players that work on the development and manufacturing of medical devices as well as the accessories required in the healthcare sector. Also, the healthcare sector is developing at a faster pace in France, Spain, Italy, Ireland, and the Netherlands, exhibiting a progressive use of innovative medical prescription and dispensing technologies.

The Asia Pacific outpatient central fulfillment market is expected to grow at the highest CAGR of 12.1% during 2022–2030. The factors contributing to the market progress in this region include the entry of international players in healthcare markets and the increasing geriatric population. In addition, the surging cases of infectious and chronic diseases, and initiatives by government and non-government organizations fuel the growth of the outpatient central fulfillment market in Asia Pacific. Medical tourism is further contributing to the proliferation of the hospital industries in Asia Pacific, which, in turn, triggers the rate of medication errors. According to a survey published by LEK Consulting, ~65% of hospitals in Asian countries have increased their spending on digitalization to reduce medication errors.

Key Player Analysis:

Capsa Healthcare, Cardinal Health, Surescripts, McKesson Corporation, Tension Packaging and Automation, ScriptPro LLC, Omnicell, BD, RxSafe LLC, and Custom Health Inc. are the key outpatient central fulfillment players analyzed during the market study. Due to their diversified product portfolio, Capsa Healthcare and Omnicell are the top two outpatient central fulfillment market players.

Outpatient Central Fulfillment Market Regional Insights

Outpatient Central Fulfillment Market Regional Insights

The regional trends and factors influencing the Outpatient Central Fulfillment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Outpatient Central Fulfillment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Outpatient Central Fulfillment Market

Outpatient Central Fulfillment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 309.32 Million |

| Market Size by 2030 | US$ 725.79 Million |

| Global CAGR (2022 - 2030) | 11.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

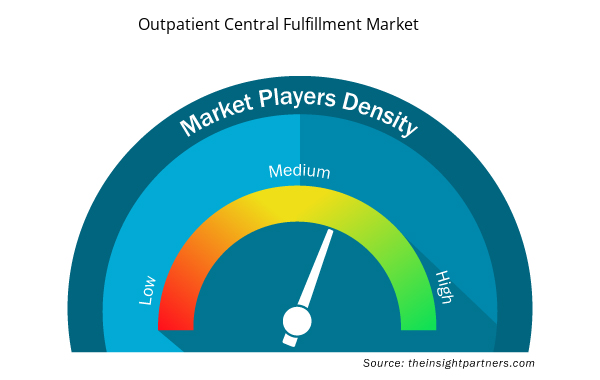

Outpatient Central Fulfillment Market Players Density: Understanding Its Impact on Business Dynamics

The Outpatient Central Fulfillment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Outpatient Central Fulfillment Market are:

- Capsa Healthcare

- Cardinal Health

- Surescripts

- McKesson Corporation

- Tension Packaging and Automation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Outpatient Central Fulfillment Market top key players overview

Recent Developments:

Companies in the outpatient central fulfillment market focus on adopting both inorganic and organic strategies. A few recent key market developments are listed below:

- In June 2023, Cardinal Health Inc. announced its plans to expand a new distribution center in Greenville, South Carolina. The new center would support its at-Home Solutions business, which provides home healthcare medical supplies as well as addresses the needs of people suffering from chronic and serious health conditions in the US. This new facility center would be the company’s second distribution center to feature AutoStore empowered by Swisslog, which is the fastest order fulfillment system per square foot in the market.

- In November 2023, Omnicell Inc announced that Baptist Health, Kentucky, opted for Omnicell's Central Pharmacy Dispensing Service to tackle labor issues, and enhance clinical and economic results. Baptist Health is among the most recent health systems to implement this service offered by Omnicell Inc. To offer this service, the company uses advanced robotics, dispensing optimization tools, and remote and onsite experts for streamlining workflows, improving safety, and enhancing dispensing accuracy. The all-inclusive system enabled under this service can reduce pharmacists' dispensing time by 75% on average by automating and streamlining pharmacy labor and workflows.

- In October 2022, Omnicell Inc announced the launch of Specialty Pharmacy Services. The services are dedicated to setting up, operating, and optimizing a specialty pharmacy program. Specialty Pharmacy Services is a complete program created to assist health institutions with establishing and maintaining a hospital-owned, fully managed specialty pharmacy.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Pressure Vessel Composite Materials Market

- Power Bank Market

- Retinal Imaging Devices Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Toothpaste Market

- Foot Orthotic Insoles Market

- Vision Guided Robotics Software Market

- Portable Power Station Market

- Railway Braking System Market

- Medical Enzyme Technology Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Global outpatient central fulfillment market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. The North America regional market is expected to grow with a CAGR of 11.0% during 2022–2030. Market growth in this region is attributed to the increasing adoption of pharmacy automation in the US, rising public health awareness, surge in strategic initiatives by governments, and the presence of leading pharmacy automation vendors. The US is the largest contributor to the outpatient central fulfillment market in North America. With the growing burden on pharmacies, the frequency of medication errors also increases in the country. Thus, the outpatient central fulfillment market growth in the US is mainly attributed to rising concerns among medical professionals with an upsurge in medication errors and an increasing demand for pharmaceutical products. The Asia Pacific outpatient central fulfillment market is expected to grow at the highest CAGR of 12.1% during 2022–2030. The factors contributing to the market progress in this region include the entry of international players in healthcare markets and the increasing geriatric population.

Capsa Healthcare and Omnicell are the top two companies that hold huge market shares in the outpatient central fulfillment market.

The outpatient central fulfillment market majorly consists of the players such Capsa Healthcare, Cardinal Health, Surescripts, McKesson Corporation, Tension Packaging and Automation, ScriptPro LLC, Omnicell, BD, RxSafe LLC, and Custom Health Inc.

The hospital pharmacies segment dominated the global outpatient central fulfillment market and held the largest market share of 54.4% in 2022.

The automated medication dispensing systems segment held the largest share of the market in the global outpatient central fulfillment market and held the largest market share of 32.8% in 2022.

Automating the mechanical procedures of any pharmacy process typically entails tracking and updating customer information in databases (e.g., medical history and drug interaction risk detection), counting small objects (e.g., pills and capsules), and measuring and combining powders and fluids for compilation and other such activities. As a result, automated pharmacies are preferred by many hospitals and pharmacies. The pharmacy automation industry is growing due to increased consumer demand for pharmaceutical products, intensified competition among pharmaceutical companies, technological advancements, and precise robotic equipment availability. The increasing demand for error-free medicines is expected to drive the outpatient central fulfillment market. However, stringent regulatory control, high capital requirements, and problems associated with automation system operations limit the growth of the outpatient central fulfillment market.

Key factors that are driving the growth of this market are automation in pharmacies and risk of medication errors.

The CAGR value of the outpatient central fulfillment market during the forecasted period of 2022-2030 is 11.3%.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Outpatient Central Fulfillment Market

- Capsa Healthcare

- Cardinal Health

- Surescripts

- McKesson Corporation

- Tension Packaging and Automation

- ScriptPro LLC

- Omnicell

- BD

- RxSafe LLC

- Custom Health Inc.

Get Free Sample For

Get Free Sample For