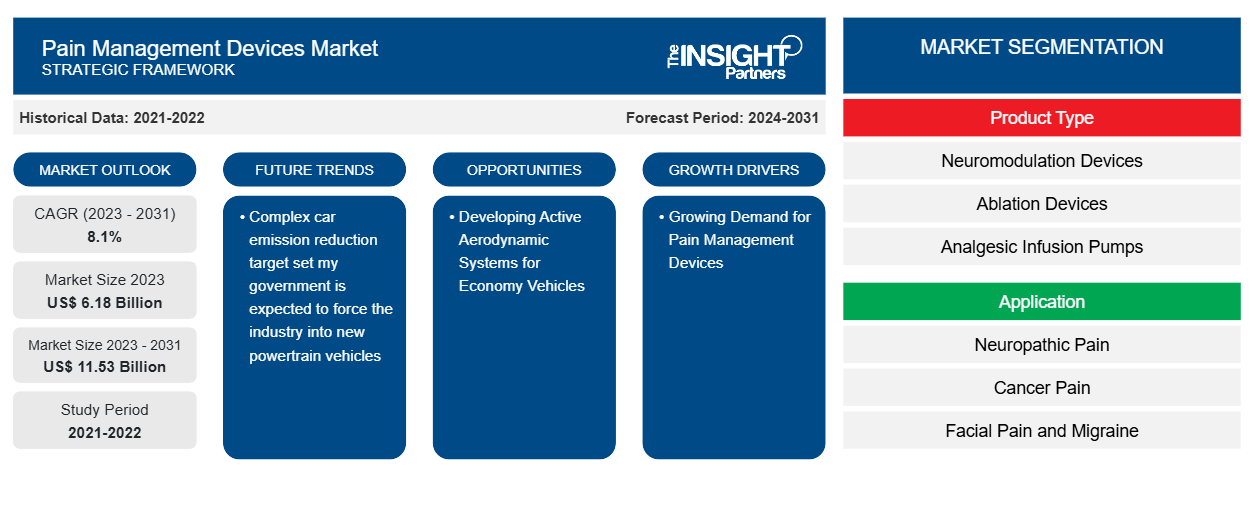

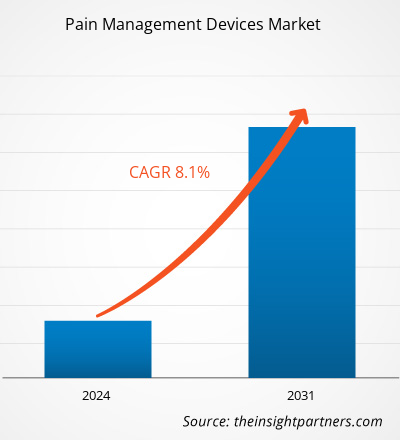

The pain management devices market was valued at US$ 6.18 billion in 2023 and is expected to reach US$ 11.53 billion by 2031. The market is expected to register a CAGR of 8.1% in 2023–2031. Technological advancement will likely remain key to pain management devices market trends.

Pain Management Devices Market Analysis

Pain management devices are used to control or manage pain resulting from cancer treatments, arthritis, and old injuries. In hospitals, devices that can be purchased over-the-counter or used during pain management therapy are used based on the patient's level of difficulty with the pain. Devices for managing pain are used during the implantation, replacement, or other surgical procedures involving a device needed to treat pain. Treatment for nerve pain and chest pain resulting from coronary heart disease involves the use of infusion pumps or neurostimulators. The aging population, rising rates of new product launches, and rising incidence of chronic pain all contribute to the ongoing demand for pain management devices.

Pain Management Devices Market Overview

The market for pain management devices has grown significantly in recent years due to a rise in the frequency of chronic pain conditions and technological advancements. The market comprises many devices, such as analgesic infusion pumps, neurostimulators, and electrical stimulation devices. North America and Europe dominate the market for pain management devices, but emerging markets in Latin America and Asia-Pacific are also expanding quickly. Abbott Laboratories, Boston Scientific Corporation, Medtronic, and other major players are in the market. The market is defined by constant innovation, as businesses engage in R&D to bring more potent and minimally invasive pain management solutions to the market. Other important factors influencing market dynamics are patient preferences, reimbursement policies, and regulatory approvals.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pain Management Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pain Management Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Pain Management Devices Market Drivers and Opportunities

Growing Demand for Pain Management Devices to Favor Market

Many technologies and techniques are used in pain management devices to reduce or control pain. Transcutaneous electrical nerve stimulation (TENS) units, pulsed electromagnetic field (PEMF) devices, ultrasound therapy, and infrared therapy devices are a few common varieties. Every gadget functions according to distinct principles and could be helpful for a range of pain situations, from acute injuries to long-term illnesses. For many adults in the United States, chronic pain is a paralyzing condition that interferes with daily activities such as work and life. The Centers for Disease Control and Prevention estimate that in 2021, 5.1% (17.1 million people) and 20.9% (51.6 million adults) of American adults suffer from chronic pain and high-impact chronic pain, respectively. Thus, an increase in the number of patients with chronic pain and awareness regarding the portability, safety, effectiveness, and ease of use of pain management devices will likely drive the demand. This leads to drives the growth of the market.

Introduction of Novel Products – An Opportunity in Pain Management Devices Market

Neurostimulation devices for the treatment of chronic pain have been made possible by advancements in the medical field. Numerous businesses, including Abbott, Medtronic, and Omron Healthcare, Inc., have introduced neurostimulation technology. Key players have also turned their attention to neurostimulation therapy. Over the past few decades, neurostimulation has advanced from a low-resolution technique to a highly sophisticated methodology utilizing cutting-edge technologies. Numerous neurological applications of neurostimulation have been tested; the results show great promise, and the field is beginning to pay more attention to this emerging field. Numerous medical technologies use neurostimulation, and some of these devices have already received approval for clinical use. The development of neurostimulation followed developments in other fields. The field's rapid development was aided by adopting emerging technologies, including flexible electronics, application-specific integrated circuit (ASIC) technology, wireless energy transfer, and silicon microfabrication, among many others. Neurostimulation therapy is a cutting-edge technology that should see greater growth prospects in the future. In January 2024, positive long-term results from the COMFORT randomized controlled trial (RCT) of California-based Nalu Medical's peripheral nerve stimulation (PNS) device for treating chronic pain have been released. The Nalu neurostimulation system is being tested in the COMFORT randomized controlled trial (RCT) to treat foot, ankle, shoulder, and lower back pain. A non-invasive multi-channel brain neuromodulation system was approved in March 2021 to treat acute migraines.

Pain Management Devices Market Report Segmentation Analysis

Key segments contributing to the pain management devices market analysis derivation are product type, and application.

- Based on therapy type, the pain management devices market is segmented into neuromodulation devices, ablation devices, analgesic infusion pumps. The neuromodulation devices segment held a larger market share in 2023.

- By application, the market is segmented into neuropathic pain, cancer pain, facial pain and migraine, musculoskeletal pain, others. The neuropathic pain segment held the largest share of the market in 2023.

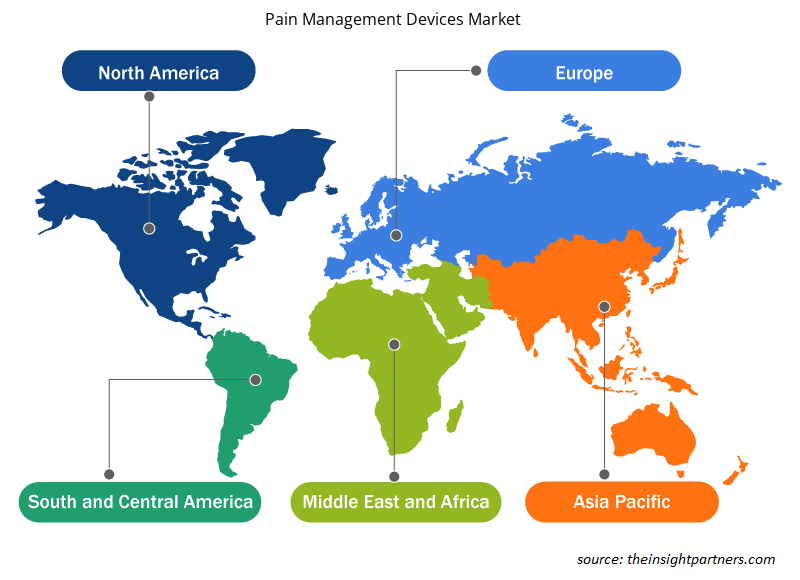

Pain Management Devices Market Share Analysis by Geography

The pain management devices market report's geographic scope is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

North America has dominated the pain management devices market. In North America, the U.S. is the largest market for pain management devices in 2023. Well-established healthcare infrastructure, the presence of key players and healthcare facilities, and early adoption of technologically advanced products are the factors that likely contribute to the region's market growth. For instance, in November 2021, the FDA granted de novo approval for AppliedVRx, its flagship immersive therapeutic, to treat chronic low back pain. EaseVRx was previously designated as a breakthrough device in 2020. AppliedVR is a pioneer in advancing the next generation of immersive therapeutics. With preloaded software content on a proprietary hardware platform, EaseVRx is a prescription-only medical device that offers pain management training based on cognitive behavioral skills and other behavioral methods.

Pain Management Devices Market Regional Insights

The regional trends and factors influencing the Pain Management Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Pain Management Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Pain Management Devices Market

Pain Management Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.18 Billion |

| Market Size by 2031 | US$ 11.53 Billion |

| Global CAGR (2023 - 2031) | 8.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

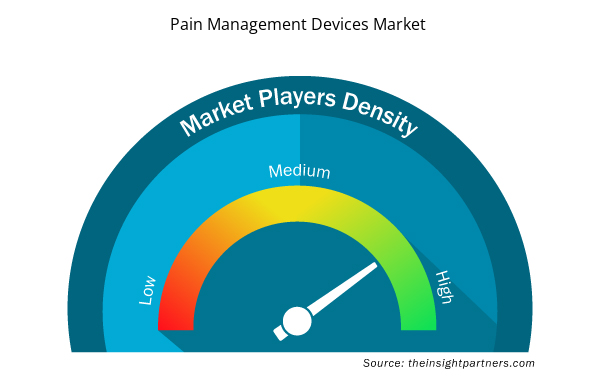

Pain Management Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Pain Management Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Pain Management Devices Market are:

- Medtronic plc

- ST. Jude Medical, Inc

- Boston Scientific Corporation

- Hospira, Inc

- Halyard Health Inc

- Smiths Medical

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Pain Management Devices Market top key players overview

Pain Management Devices Market News and Recent Developments

The Pain Management Devices market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for pain management devices and strategies:

- Boston Scientific Corporation announced the close of its acquisition of Relievant Medsystems Inc., a company that offers the only U.S. Food and Drug Administration-cleared IntraceptIntraosseous Nerve Ablation System, a therapy to treat vertebrogenic pain that is a form of chronic low back pain (Source: Boston Scientific Corporation Company Name, Newsletter, 2023)

- Nevro Corp., a global medical device company that is delivering comprehensive, life-changing solutions for the treatment of chronic pain, announced that it has acquired Vyrsa Technologies, a privately held medical technology company focused on a minimally invasive treatment option for patients suffering from chronic sacroiliac joint pain. (Source: NEVRO CORP Company Name, Press Release, 2023)

Pain Management Devices Market Report Coverage and Deliverables

The “Pain Management Devices Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type ; Application ; and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For