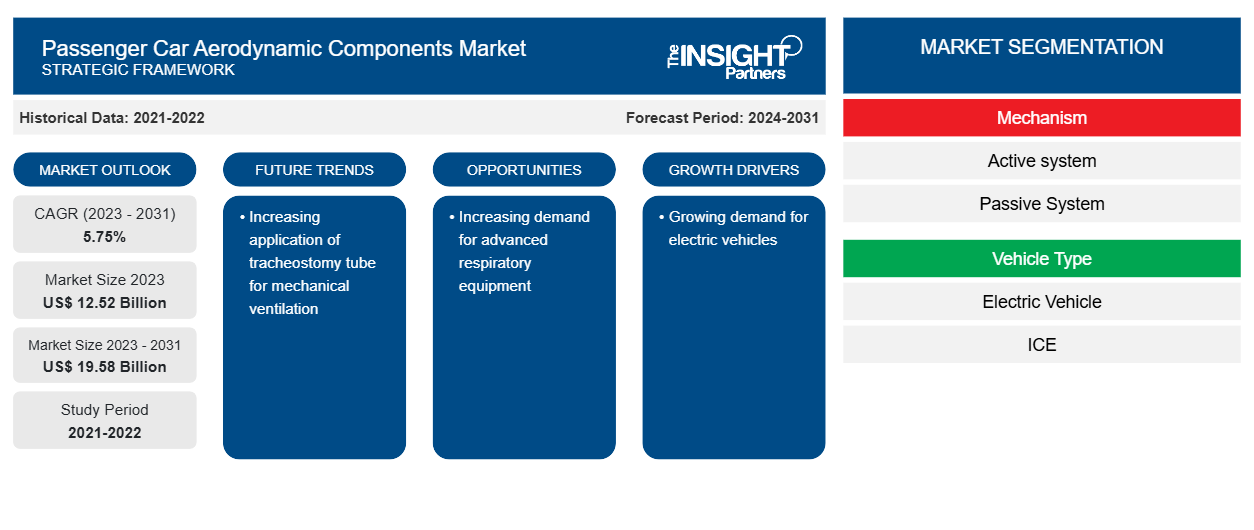

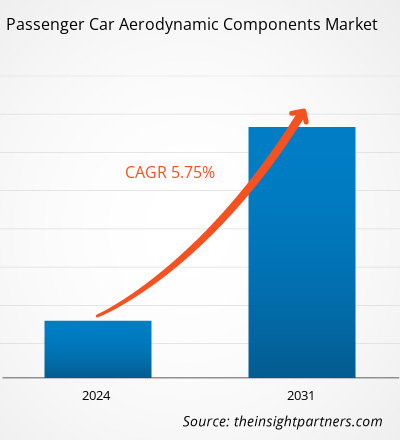

The passenger car aerodynamic components market size is projected to reach US$ 19.58 billion by 2031 from US$ 12.52 billion in 2023. The market is expected to register a CAGR of 5.75% in 2023–2031. The aerodynamic performance of an electric car has a substantial influence on the economy, power performance, handling stability, and ride comfort of the vehicle. As a result, the automakers are focusing on aerodynamic measures of the electric vehicle which in turn driving the passenger car aerodynamic components market.

Passenger Car Aerodynamic Components Market Analysis

Europe has set an aggressive target to vehicle manufacturers for carbon dioxide emission mitigation. In 2021, Europe's vehicle fleet will have to arrive at an average of 95 grams per kilometer (g/km) per vehicle. After achieving to firmly pass the 2015 130g/km target by most of the OEMs, the new 95g/km aim by 2021 is expected to be much more laborious to reach, mainly if vehicle manufacturers keep advancing at the same pace as they did during the 2008-2014 period. If Nissan, Volvo, Toyota, and Groupe PSA are heading by the example, favorable powertrain mix with either hybrid or diesel by the likes of Hyundai, General Motors, Fiat, and Honda will have to adapt fast to comply with the CO2 emission reduction to meet the target before 2025. With the necessity to reach the emission regulation set by the government, automakers are expected to rely heavily on more efficient aerodynamic designs to minimize drag and reduce carbon emission.

Passenger Car Aerodynamic Components Market Overview

Aerodynamics play a important role in defining the range of vehicle from an fuel-powered vehicle to electric vehicle. Since it directly affects the energy utilized by a vehicle to overcome air resistance. GFEI (Global Fuel Economy Initiative ) has launched a various polocies from which countries can work towards enhancing the fuel economy. Engines, powertrains and aerodynamics, acts as an vital factor in fuel economy enhancement. Besides, switching to alternate fuel sources such as promoting zero-emission and electric vehicles are initiatives taken towards fuel economy enhancement. thus, growing concern of fuel economy may drive the aerodynamic components market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Passenger Car Aerodynamic Components Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Passenger Car Aerodynamic Components Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Passenger Car Aerodynamic Components Market Drivers and Opportunities

Growing demand for electric vehicles

Aerodynamic drag or wind resistance is considered to be of prime concern in vehicle design. The other vital issues are vehicle weight & fuel efficiency. The 21st century, in particular, has observed refinement in vehicle design in terms of the problems relating to aerodynamics. It is worth remarking that a reduction of one count of drag, i.e., ACD = 0.1, explicates an improvement of the mileage of 2.60 km/liter.

It is also worth noting from the statistics given by the Department of Energy (DOE) that 16% of the energy produced in the USA is consumed to overcome the drag of road vehicles. The Global scenario is similar. Therefore, there is an enormous scope for improving the aerodynamics of cars to conserve depleting oil reserves. The aerodynamic design of cars is critical as it undeviatingly affects the stability and fuel economy in motion. Therefore, it is necessary to have a clear understanding of the external aerodynamics of passenger cars, which are nearer to bluff bodies, and the flow over them is complex owing to their nonlinear and stochastic nature. Also, the Auto industry has seen a perpetual increase in the level of global competition. The increase in the complexity of vehicle design and content has led to time-consuming and expensive development processes. The high cost and long gestation period imply a notable risk for the automaker. On the contrary, it is clear that technology will play an ever-increasing role as the basis of this global competition, requiring high-quality products that are safe to use and economical to design and manufacture.

Developing Active Aerodynamic Systems for Economy Vehicles

Active aerodynamic systems for economy cars ranging from Class A/B, C, and D are expected to propose a massive opportunity for the market's growth. Active aerodynamic systems are significantly costlier to implement than passive systems. However, the advantages of active systems negate the usefulness of a passive system in economy cars. A passive system in an economy car can provide better handling with the loss of fuel economy as well as provide better fuel economy with the loss of better driving dynamics. For instance, a rear spoiler in a Class C vehicle would provide better handling and driving dynamics but with a cost of fuel economy owing to the downforce created by the spoiler. However, with an active rear spoiler, the vehicle can offer better fuel economy as well as better handling as per the driving conditions. Thus, developing cost-effective active aerodynamic systems is expected to provide a wide array of opportunities for the aerodynamic components market.

Passenger Car Aerodynamic Components Market Report Segmentation Analysis

Key segments that contributed to the derivation of the passenger car aerodynamic components market analysis are mechanism, vehicle type and application.

- Based on mechanism, the passenger car aerodynamic components market has been divided into active system, passive system. The passive system segment held a larger market share in 2023.

- Based on vehicle type, the passenger car aerodynamic components market is segmented into Electric Vehicle and ICE. The ICE segment held the largest share of the market in 2023.

- Based on application, the passenger car aerodynamic components market has been divided into air dam, diffuser, gap fairing, grille shutter, side skirts, spoiler, front splitter. The spoiler segment held a larger market share in 2023.

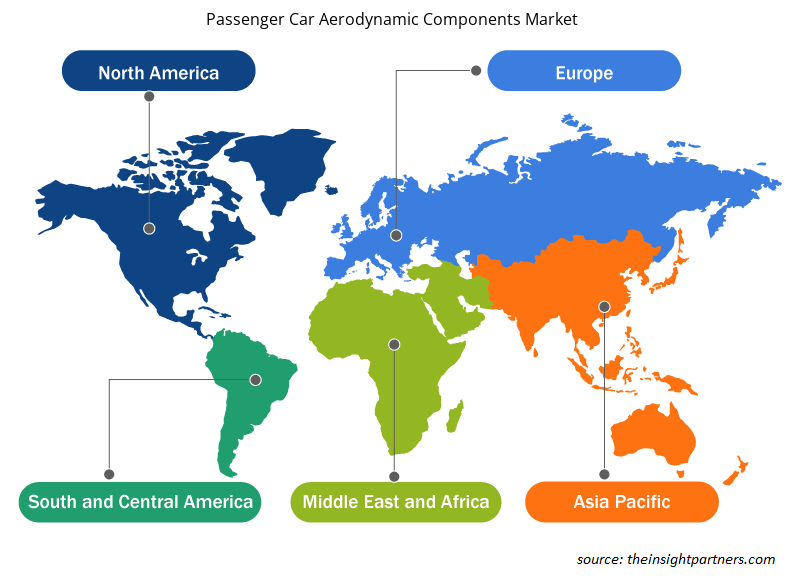

Passenger Car Aerodynamic Components Market Analysis by Geography

The geographic scope of the passenger car aerodynamic components market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The passenger car aerodynamic components market is broadly segmented into five major regions—North America, Europe, APAC, MEA, and SAM. The European automotive industry is densely populated by the well-renowned automakers namely, Volkswagen Group, BMW AG, ŠKODA AUTO, Audi AG and Porsche AG among others. The economic growth in different countries in the European region, is propelling the demand for passenger cars, sports cars, and commercial vehicles, thereby compelling the car manufacturers to increase their production over the timeline. The well established market of Europe is anticipated to offer lucrative growth opportunities over the forecast period.

Passenger Car Aerodynamic Components Market Regional Insights

The regional trends and factors influencing the Passenger Car Aerodynamic Components Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Passenger Car Aerodynamic Components Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Passenger Car Aerodynamic Components Market

Passenger Car Aerodynamic Components Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 12.52 Billion |

| Market Size by 2031 | US$ 19.58 Billion |

| Global CAGR (2023 - 2031) | 5.75% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Mechanism

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

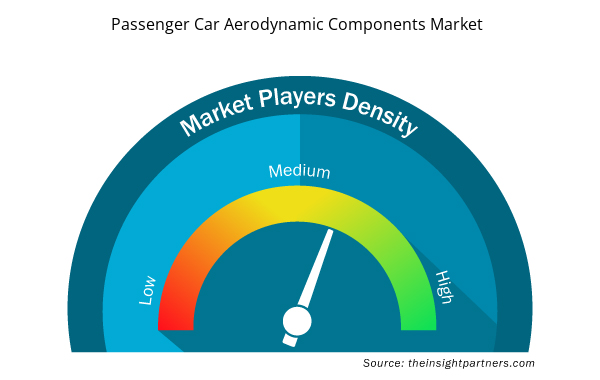

Passenger Car Aerodynamic Components Market Players Density: Understanding Its Impact on Business Dynamics

The Passenger Car Aerodynamic Components Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Passenger Car Aerodynamic Components Market are:

- Plasman Group

- Valeo

- Magna International Inc.

- HBPO GmbH

- Röchling Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Passenger Car Aerodynamic Components Market top key players overview

Passenger Car Aerodynamic Components Market News and Recent Developments

The passenger car aerodynamic components market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for passenger car aerodynamic components market and strategies:

- On January 2024, Hyundai Motor Company and Kia Corporation unveiled the ‘Active Air Skirt’ (AAS) technology that minimizes the aerodynamic resistance generated during high-speed driving, effectively improving the driving range and driving stability of electric vehicles (EVs). (Source: Hyundai Motor, Press Release/Company Website/Newsletter)

Passenger Car Aerodynamic Components Market Report Coverage and Deliverables

The “passenger car aerodynamic components market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter’s Five Forces analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Intradermal Injection Market

- Webbing Market

- Microplate Reader Market

- Social Employee Recognition System Market

- Trade Promotion Management Software Market

- Digital Language Learning Market

- Battery Testing Equipment Market

- Virtual Pipeline Systems Market

- Asset Integrity Management Market

- Enzymatic DNA Synthesis Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Mechanism ; by Vehicle Type , by and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Get Free Sample For

Get Free Sample For