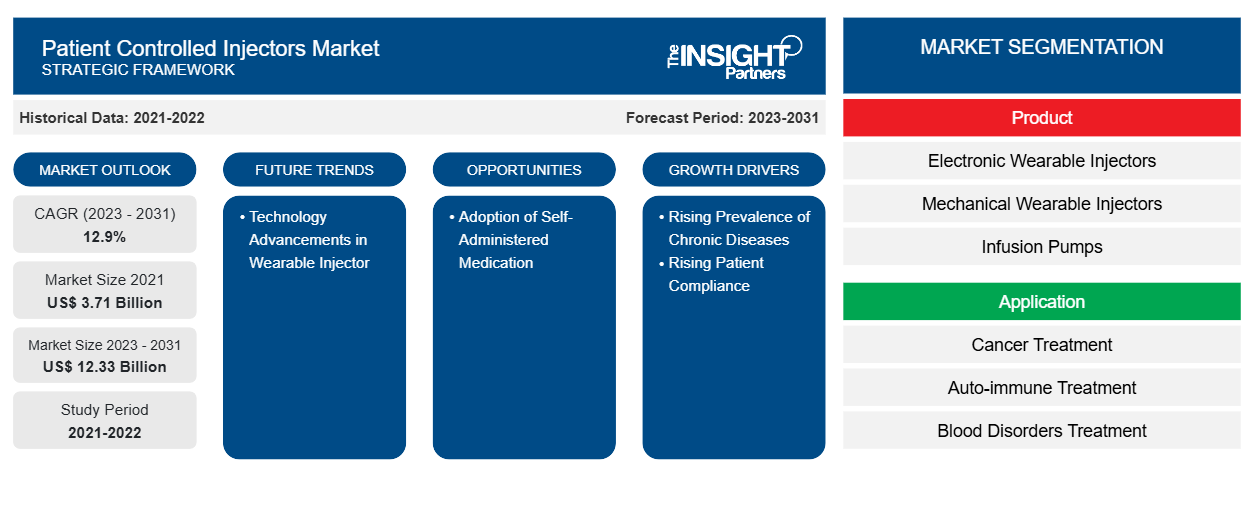

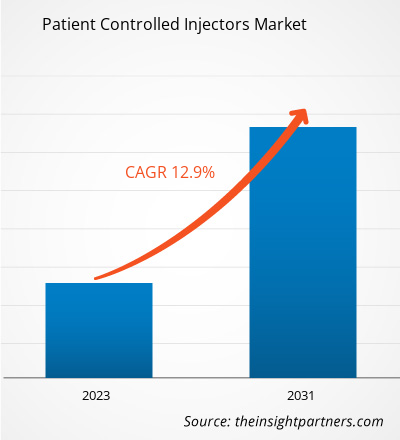

The Patient controlled injectors market size in 2021 stood at US$ 3.71 billion and is projected to reach US$ 12.33 billion by 2031 from US$ XX billion in 2023. The market is expected to register a CAGR of 12.9% in 2023–2031. Technology advancements in wearable injectors, such as bluetooth integrated wearable injectors, enable the transmission of signals to patients, such as injection reminders, and provide patients with access to therapy data are likely to remain key Patient Controlled Injectors Market trends.

Patient Controlled Injectors Market Analysis

The rising prevalence of chronic ailments such as diabetes, rheumatoid arthritis, and autoimmune diseases contributes to the demand for patient-controlled injectors. These devices offer comfort and ease of use to patients who require frequent disease control injections. Patient Controlled Injectors Market enable patients to self-administer medication at home, decreasing the need for frequent hospital visits and increasing patient convenience.

Patient Controlled Injectors Market Overview

The demand for patient-controlled injectors went up during the pandemic. Factors such as expanding patient population, a shortage of healthcare resources, and ease of increased the adoption of injectors had positive impact on the market by certain extent. However, the introduction of physical distance policies and firm closures to prevent viral infection disrupted supply chain processes, negatively impacting market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Patient Controlled Injectors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Patient Controlled Injectors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Patient Controlled Injectors Market Drivers and Opportunities

Rising Patient Compliance to Favor the Market Growth

Patient-controlled injectors are expected to rise concurrently in the market owing to greater ease, safety, and comfort of the administration of injections, which is likely to gain significant popularity among patients. In addition to this, the controlled release of the patient-controlled injectors helps the patient administer the drug by themselves and decide their dosage rate.

Besides this, it is crucial to ensure the safety of healthcare providers. According to an article published by NIH in 2023, In developing countries, 40-65% of hepatitis B infections in healthcare workers were attributable to percutaneous occupational exposure. Many manufacturers are now focusing on developing patient-controlled injectors to meet the unmet needs, which, in turn, is stimulating the growth of the market.

Adoption of Self-Administered Medication

Patients use self-administered medication to control blood pressure, blood glucose, and other chronic illnesses. Self-medication refers to the use of medicinal items by consumers to treat self-diagnosed disorders or symptoms, as well as the intermittent or continuous use of medication recommended by a physician for chronic or recurring diseases or symptoms. Chronic diseases require repeated dosing, therefore these indications represent large drug volume and revenue opportunities. According to a study published in the Lancet in June 2023, the number of individuals with diabetes globally is expected to reach 1.3 billion by 2050. Diabetes self-management is the technique of determining and giving insulin doses based on self-measured capillary glucose readings. self-administered medication foe diabetes is giving insulin doses based on self-measured capillary glucose readings.

Patient Controlled Injectors Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Patient Controlled Injectors Market analysis are product, application, and distribution channel.

- Based on product, the Patient Controlled Injectors Market is divided into electronic wearable injectors, mechanical wearable injectors, and infusion pumps. The electronic wearable injectors segment held a larger market share in 2023.

- By cause, the market is segmented into cancer treatment, auto-immune treatment, blood disorders treatment, and others. The cancer treatment segment held the largest share of the market in 2023.

- In terms of category, the market is segmented into hospital pharmacies, retail pharmacies, and mail order pharmacies. The hospital pharmacies segment dominated the market in 2023.

Patient Controlled Injectors Market Share Analysis by Geography

The geographic scope of the Patient Controlled Injectors Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the Patient Controlled Injectors Market. The growth of the North American market is characterized by the rising prevalence of chronic diseases like cancer, autoimmune disease, cardiovascular diseases and others, along with development of innovative products and presence of key market players in the region. In addition, technological advancements for the treatment of diseases is likely to be a major growth stimulator for the Patient Controlled Injectors Market market in the region.

Patient Controlled Injectors Market Regional Insights

The regional trends and factors influencing the Patient Controlled Injectors Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Patient Controlled Injectors Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Patient Controlled Injectors Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3.71 Billion |

| Market Size by 2031 | US$ 12.33 Billion |

| Global CAGR (2023 - 2031) | 12.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

Patient Controlled Injectors Market Players Density: Understanding Its Impact on Business Dynamics

The Patient Controlled Injectors Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Patient Controlled Injectors Market top key players overview

Patient Controlled Injectors Market News and Recent Developments

The Patient Controlled Injectors Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for Patient Controlled Injectors Market:

- Ypsomed (SIX: YPSN) has developed a new autoinjector platform for liquid medications with volumes ranging from 1.5 to 5.5 ml. The YpsoMate 5.5 is the latest addition to the growing YpsoMate family of devices and is based on the established technology of the YpsoMate 2.25 Pro. YpsoMate 5.5 enables the self-administration of larger volume medications for treating cancer, rare and autoimmune diseases. (Source: Ypsomed AG, Press Release, 2022)

- Gerresheimer acquired the IP of a new generation cartridge based autoinjector from Midas Pharma. This is the start of a strategic partnership. The joint project comprises the development and marketing of the new generation autoinjector. (Source: Gerresheimer AG, Press Release, 2021)

Patient Controlled Injectors Market Report Coverage and Deliverables

The “Patient Controlled Injectors Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For