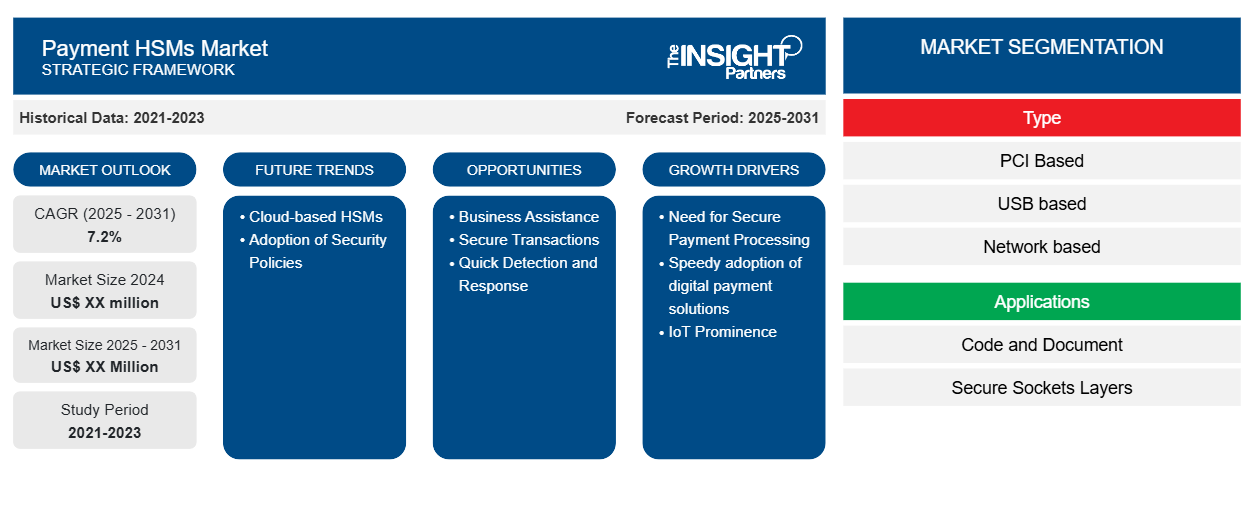

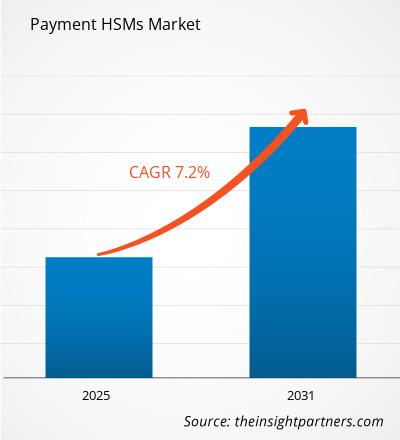

The Payment HSMs Market is expected to register a CAGR of 7.2% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The Payment Hardware Security Modules (HSMs) Market research report gives insight on the existing market and trends along with the future growth potential in the market, under key factors driving the industry. The market is divided into type, applications and end user.

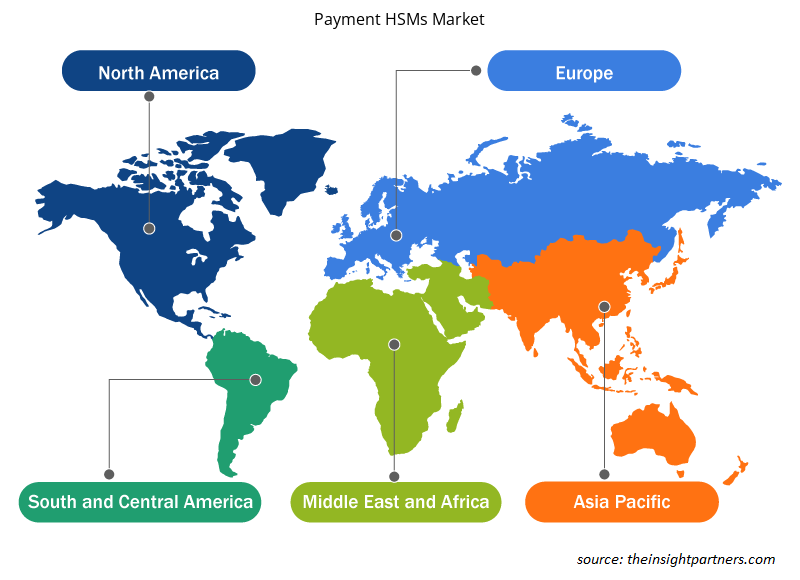

The global analysis is further divided to regional level, where key markets are developed about North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. This segmentation will enable the stakeholders to understand local trends, regulatory environments, and growth opportunities specific to each region. In this market evaluation, we would be presenting it in US dollars (US$) for the segmental analysis that has been discussed above.

Purpose of the Report

The report Payment HSMs Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Payment HSMs Market Segmentation

Type

- PCI Based

- USB based

- Network based

Applications

- Code and Document

- Secure Sockets Layers

End-user

- BFSI

- Government

- Technology and communication

- Manufacturing industry

- Retail and consumer products

- others

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Payment HSMs Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Payment HSMs Market Growth Drivers

- Need for Secure Payment Processing: The Payment Hardware Security Module (HSM) Market is growing due to various critical factors and reiterates the need for secure payment processing solutions in the contemporary digital environment. Data security is one of the most sensitive drivers in this regard, considering cyberattacks coupled with data breaches are becoming very frequent. Organizations are now very conscious of safeguarding sensitive payment information. HSMs are a critical security layer as they ensure the secure management of the cryptographic keys and keep the transaction data encrypted to prevent unauthorized access and fraud against payments.

- Speedy adoption of digital payment solutions: Rapidly people have started shifting from cash to cashless transactions at an even faster pace due to the growth of e-commerce and the proliferation of mobile payment platforms. According to the Federal Trade Commission's (FTC) report of 2020, consumers experienced about US$3.3 billion in losses due to fraud, which highlights the urgent need for strong security strategies. Indeed, HSMs provide one vital function: robust key management and transaction encryption.

- IoT Prominence: The growing number of IoT devices, therefore, means payment HSMs usage is also on the rise. With increasing IoT prominence in the payment ecosystem, cybercriminals have greater attack surfaces. Payment HSMs ensure safe communication and protection of data within connected objects and thus safeguard the integrity of payment transactions. This has been important because industries increasingly integrate IoT solutions into their operations.

Payment HSMs Market Future Trends

- Cloud-based HSMs: The Payment Hardware Security Module (HSM) Market is seeing changing trends, which are a reflection of the shifting horizon of payment security. For example, organizations are inclined toward choosing cloud-based HSM solutions, which help them bring about higher scalability and lower the cost of operations.

- Adoption of Security Policies: As a result of mobile payments reaching the projected figure of $6.6 trillion in 2022, secure transaction processing is being seen as the main business focus on the protection of consumer data. Other regulatory requirements, like PCI DSS, also dictate the spending by organizations on HSMs, which satisfies the requirements based on the severe security policies adopted.

Payment HSMs Market Opportunities

- Business Assistance: HSMs will play a vital role in assisting businesses in meeting some of those demands. Companies with HSM solutions that make regulatory compliance easier will benefit the most from this developing environment.

- Secure Transactions: With the increasing penetration of IoT devices, there is a uniqueness in security, and HSMs are well-prepared to address this. Secure communication and data protection are now critical once IoT has been integrated into the payment. Here lies the opportunity for the HSM providers to create specific solutions in line with the special security needs of the IoT application, ensuring secure transactions in a connected world.

- Quick Detection and Response: Rising demand for the advanced security features HSMs utilizing increasing threat levels from the cyber world will make it useful for them to offer enhanced services for securing information. With leading technologies like artificial intelligence (AI) and machine learning (ML), the HSM can enhance the quick detection and response to such advanced threats, thus helping organizations defend themselves.

Payment HSMs Market Regional Insights

The regional trends and factors influencing the Payment HSMs Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Payment HSMs Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Payment HSMs Market

Payment HSMs Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 7.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

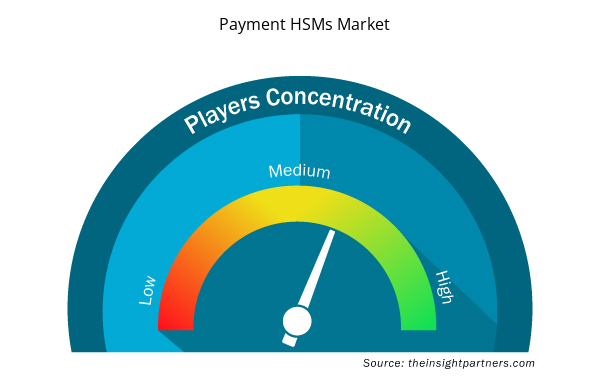

Payment HSMs Market Players Density: Understanding Its Impact on Business Dynamics

The Payment HSMs Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Payment HSMs Market are:

- Gemalto NV

- Thales e-Security, Inc.

- Utimaco GmbH

- IBM Corporation

- FutureX

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Payment HSMs Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Payment HSMs Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Payment HSMs Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Space Situational Awareness (SSA) Market

- Dry Eye Products Market

- Data Annotation Tools Market

- Single Pair Ethernet Market

- Aircraft Landing Gear Market

- Emergency Department Information System (EDIS) Market

- Artificial Intelligence in Defense Market

- Rugged Servers Market

- GNSS Chip Market

- Dairy Flavors Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

Some of the customization options available based on request are additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

Trends like the move to cloud-based solutions, the incorporation of blockchain technology, the emphasis on compliance and regulatory standards, the need for mobile payment solutions, the expansion of e-commerce, and the integration of payment gateways are what define the Payment HSM Market. These developments are changing the payment security scene, spurring innovation, and expanding the use of HSM solutions in a variety of industries.

Key players in this market- Gemalto NV, Thales e Security Inc, Utimaco GmbH, IBM Corporation, FutureX, Hewlett Packard Enterprise Development LP, SWIFT, Atos SE, Ultra Electronics

The market is expected to register a CAGR of 7.2% during 2023-2031

Growing worries about data security, the quick uptake of digital payments, an increase in payment fraud incidents, the expansion of IoT devices, and regulatory compliance requirements are driving the Payment Hardware Security Module (HSM) Market and calling for strong security solutions to safeguard sensitive payment data.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies

1.Gemalto NV

2.Thales e-Security, Inc.

3.Utimaco GmbH

4.IBM Corporation

5.FutureX

6.Hewlett-Packard Enterprise Development LP

7.SWIFT

8.Atos SE

9.Ultra-Electronics

10.Yubico

Get Free Sample For

Get Free Sample For