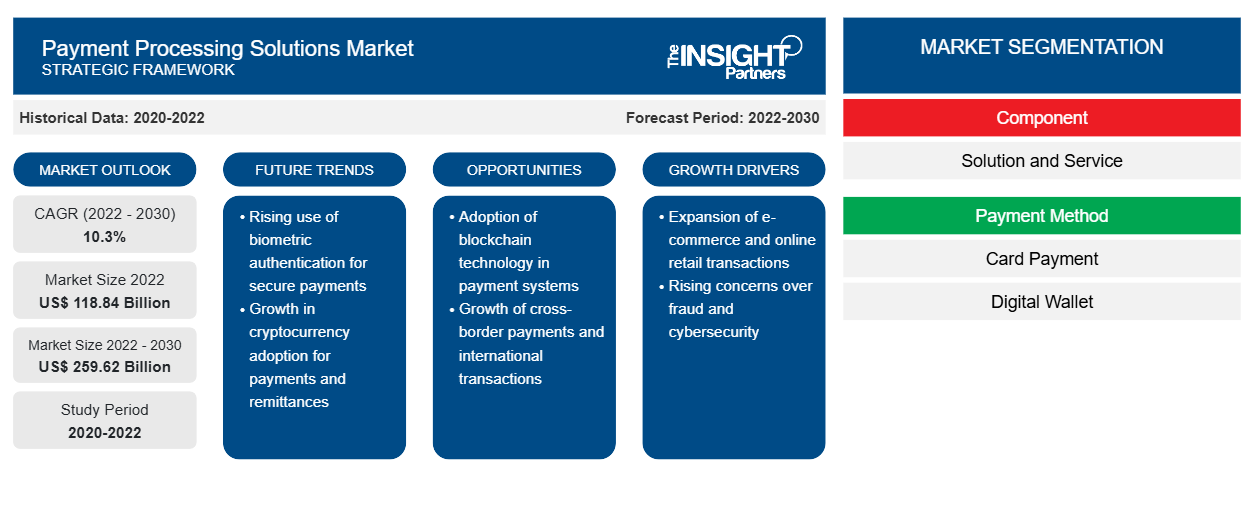

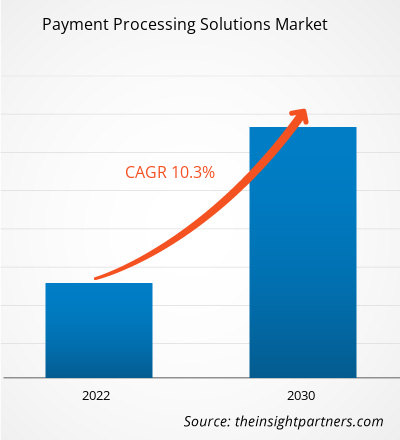

[Research Report] The payment processing solutions market is expected to grow from US$ 118.84 billion in 2022 to US$ 259.62 billion by 2030; it is estimated to record a CAGR of 10.3% from 2022 to 2030.

Analyst Perspective:

The growing implementation of robust security measures and fraud prevention techniques by the solution providers is driving the payment processing solutions market growth. Expansion of the e-commerce industry is also expected to boost the global payment processing market during the anticipated period. Moreover, the rising adoption of advanced technologies such as AI, ML, 5G, big data analytics, and cloud are creating growth opportunities for the payment processing solutions market share.

Market Overview:

Payment processing refers to authorizing, verifying, and completing a financial transaction between merchant and consumer. The process involves transferring funds and exchanging payment information from the buyer's account to the seller's account. It typically involves numerous parties such as seller, buyer, issuing bank, acquiring bank, and payment gateway.

Payment processing solutions are electronic systems and software that enable financial transactions funds between merchant and consumer. Various payment processing solutions are available in the market, including card payments, digital wallets, and automatic house cleaning. Card payments consist of debit cards, credit cards, stored-value cards, and forex cards. The digital wallets process the financial transaction through Google Pay, PhonePe, Amazon Pay, Square Cash, and others. Also, several other payment processing solutions, such as cheques and cheque payments, are available for customers. These solutions help users by ensuring security, facilitating payment, and streamlining the transaction process efficiently, increasing consumer demand. Thus, all these factors drive the payment processing solutions market share.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Payment Processing Solutions Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Payment Processing Solutions Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Increasing Customers' Focus on Fraud and Security Prevention is Driving the Payment Processing Solutions Market Growth

The rising number of financial frauds has increased customer focus on fraud and security prevention activities, driving the global payment processing solutions market. For instance, according to National Police Agency data, Japan observed a financial loss of US$ 65.13 million, reaching 35% in 2022, from 21.2% in 2021, increasing concern among consumers about using appropriate payment processing solutions. Consumers are highly concerned about protecting their financial transactions against fraud and cybercrimes. This encourages companies to implement robust fraud prevention techniques and security measures to help consumers protect sensitive payment information. Moreover, the growing need for building consumer trust increases the demand for encrypted techniques for secure transmission of payment data between customers, payment processors, and merchants. This encryption technique includes the credit card name and expiration date to safeguard the payment information from unauthorized access or interruption. The technique works by encrypting payment data into an unreadable code. However, increasing focus by service providers to offer security and fraud prevention solutions for building consumer trust drives the payment processing solutions market.

Report Segmentation and Scope:

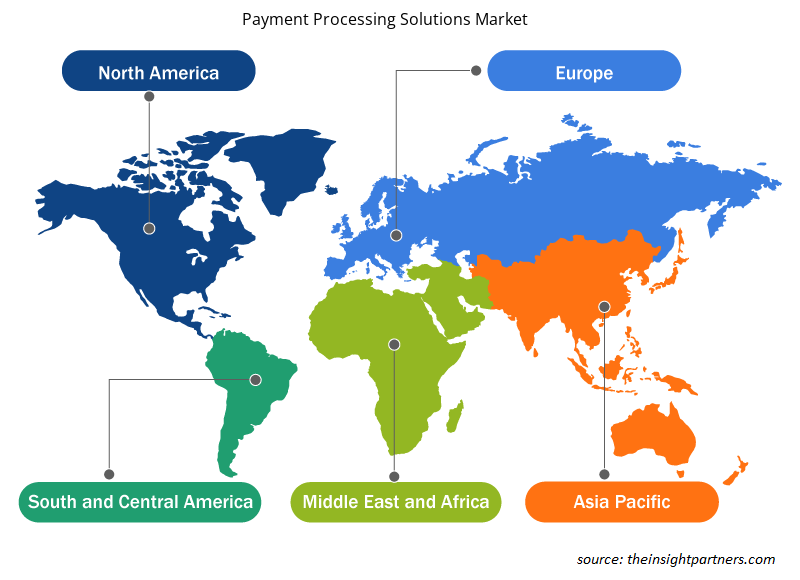

The payment processing solutions market is segmented on the basis of components, payment methods, and industry verticals. Based on component, the payment processing solutions market is segmented into solution and services. In terms of payment method, the payment processing solutions market is categorized into card payment, digital wallet, and others. Based on industry vertical, the payment processing solutions are divided into BFSI, retail & e-commerce, government & utilities, travel & hospitality, IT & telecom, and others. By region, the payment processing solutions market is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

Segmental Analysis:

Based on payment method, the payment processing solutions market is segmented into card payment, digital wallet, and others. The digital wallet segment is anticipated to expand at the highest CAGR during the forecast period due to high adoption from consumers across the globe. Digital wallets are now becoming essential for safe and easy mobile payment processing. Digital wallets offer sophisticated security features to users, including encryption and tokenization. They boost customer confidence and promote digital payment methods, which drives the market for the segment. The expansion of the payment processing solutions market is associated with the surging contactless payments, and the incorporation of QR codes and NFC technology is fueling the market. The availability of digital wallets for making cross-border transactions is driving the payment processing solutions market. Digital wallets offer users various schemes, such as rewards and e-wallet loyalty schemes, encouraging users to adopt these online payment methods. However, digital wallets allow users to transact through their smartphones or other mobile devices, which is projected to fuel the market during the forecast period.

Regional Analysis:

North America is projected to expand at a significant rate during the forecast period. The North America payment processing solutions market is segmented into the US, Canada, and Mexico. The region contributes a noteworthy share to the global payment processing solutions market owing to the high adoption and investments in payment processing solutions in the region. The presence of solution providers, including Cisco Systems, Fiserv, Mastercard, Alphabet, Visa, Stripe, FIS Global, Square, PayU, and ACI Worldwide, is boosting the market. These players are continuously developing AI-based payment processing solutions to support customers across the globe, which is expected to create opportunities in the market during the forecast period. For instance, in October 2022, Pelican/ACE Software Solutions Inc. extended its partnership agreement to provide Payments as a Service (PaaS) solution to Santander Consumer Bank Austria. The rising use of AI-based payment processing solutions in several industries is driving the market in the region. However, rising awareness regarding the benefits of payment processing solutions and increasing investment in R&D activities are driving the market in the region.

Key Player Analysis:

Cisco Systems, Fiserv, Mastercard International Incorporated, Alphabet, Visa, Stripe, FIS Global, Square, PayU, and ACI Worldwide are among the key payment processing solutions market players profiled in the report.

Payment Processing Solutions Market Regional Insights

Payment Processing Solutions Market Regional Insights

The regional trends and factors influencing the Payment Processing Solutions Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Payment Processing Solutions Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Payment Processing Solutions Market

Payment Processing Solutions Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 118.84 Billion |

| Market Size by 2030 | US$ 259.62 Billion |

| Global CAGR (2022 - 2030) | 10.3% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

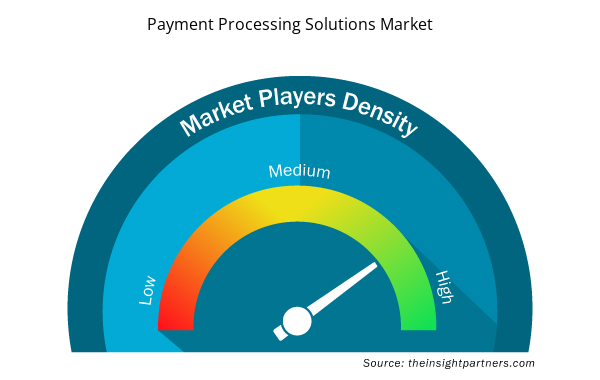

Payment Processing Solutions Market Players Density: Understanding Its Impact on Business Dynamics

The Payment Processing Solutions Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Payment Processing Solutions Market are:

- Cisco Systems

- Fiserv

- Mastercard International Incorporated

- Alphabet

- Visa

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Payment Processing Solutions Market top key players overview

Recent Developments:

The payment processing solutions market players highly adopt inorganic and organic strategies. A few recent key market developments are listed below:

- In November 2023, Al Ansari Exchange received approval from the Central Bank of the UAE for a Store Value Facilities and Retail Payment Service Provider license. This innovative platform aims to redefine digital transactions by providing businesses and consumers with a secure and user-friendly atmosphere to facilitate fast, secure, and convenient digital transactions.

- In June 2023, Visa acquired Pismo to provide core banking and issuer processing capabilities across debit, credit, prepaid, and commercial cards for clients through cloud-native APIs. The company also provides connectivity and support for emerging payment rails, including Pix in Brazil.

- In June 2023, Adyen launched Payout services for faster payment processing. The service allows customers to payout funds faster as per their convenient method.

- In May 2022, Square's company Afterpay partnered with Rite Aid to support online shoppers in paying for everyday items in four installments at no additional cost.

- In February 2022, Apple Inc. introduced Tap to Pay on iPhone to empower retailers and merchants to accept the Apple Pay solution securely and seamlessly. Tap to Pay on iPhone allows businesses to use the convenience and security of the iPhone to accept contactless payments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Rare Neurological Disease Treatment Market

- Online Recruitment Market

- Health Economics and Outcome Research (HEOR) Services Market

- Europe Industrial Chillers Market

- Hydrocephalus Shunts Market

- Compounding Pharmacies Market

- Space Situational Awareness (SSA) Market

- Aircraft Wire and Cable Market

- Pharmacovigilance and Drug Safety Software Market

- Sleep Apnea Diagnostics Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Payment Method, and Industry Vertical

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The estimated global market size for the payment processing solutions market in 2022 is expected to be around US$ 118.84 billion

1. Increasing Customers' Focus on Fraud and Security Prevention

2. Growing Digitalization and Expansion of the E-commerce Industry

Cisco Systems, Inc., Fiserv, Inc., Mastercard International Incorporated, Alphabet Inc, Visa Inc, Stripe, Inc., FIS Global, Square, PayU, and ACI Worldwide Inc are the key market players expected to hold a major market share of payment processing solutions market in 2022

Asia Pacific is expected to register highest CAGR in the payment processing solutions market during the forecast period (2022-2030)

Rising Adoption of Value-added Services by Fintech, Banks, and Other Financial Institutions

US, Germany, and China are expected to register high growth rate during the forecast period

Solution segment is expected to hold a major market share of payment processing solutions market in 2022

The US is expected to hold a major market share of payment processing solutions market in 2022

The global market size of payment processing solutions market by 2030 will be around US$ 259.62 billion

The payment processing solutions market is expected to register an incremental growth value of US$ 140.78 billion during the forecast period

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies - Payment Processing Solutions Market

- Cisco Systems

- Fiserv

- Mastercard International Incorporated

- Alphabet

- Visa

- Stripe

- FIS Global

- Square

- PayU

- ACI Worldwide

Get Free Sample For

Get Free Sample For