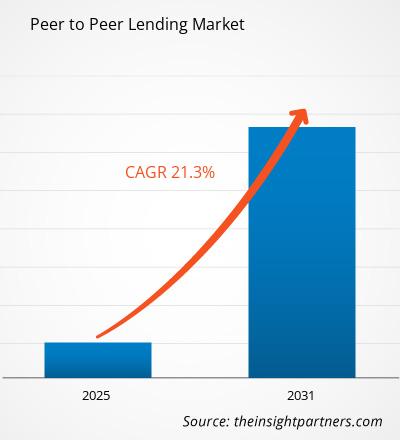

The peer-to-peer lending market size is expected to grow at a CAGR of 21.3% from 2025 to 2031. Advances in technology and data analysis are supporting the peer-to-peer lending business. These platforms can utilize advanced algorithms to evaluate borrowers' creditworthiness, lowering the probability of default. Furthermore, blockchain technology is being examined to improve transparency and security in peer-to-peer lending transactions. These technology advancements make peer-to-peer lending more appealing to both borrowers and lenders, creating opportunities for expansion in the business.

Peer-to-Peer Lending Market Analysis

The demand for alternative financing solutions is one of the key drivers of the peer-to-peer lending business. Traditional financing methods, such as banks, may not always be convenient or appealing to people and small enterprises. P2P lending platforms provide borrowers with a quick and streamlined loan application process, even if they have a short credit history or are considered high-risk by traditional lenders.

Peer-to-Peer Lending Market Overview

- In recent years, the worldwide peer-to-peer lending business has grown and transformed dramatically, disrupting the traditional lending landscape. Peer-to-peer lending, often known as P2P lending or marketplace lending, is the practice of individuals or organizations lending money directly to borrowers using internet platforms, bypassing traditional financial middlemen. This market has grown dramatically owing to technical developments, greater internet penetration, a rising need for rapid and easy access to credit, and a growing investor appetite for alternative investment opportunities.

Peer-to-Peer Lending Market Driver and Opportunities

Lesser Operating Cost to Drive the Peer-to-Peer Lending Market

- In contrast to traditional banks, a peer-to-peer lending solution does not require infrastructure or a huge workforce. P2P lending platforms use internet-based services. The data is public, and internet providers enable access to their websites, providing consumers with a clearer image of loans and their accessible types. These lending platforms generate revenue by charging fees to borrowers and deducting fees from loan repayments to investors, which fuels the growth of the peer-to-peer lending market.

Technological Innovations and Surge in Demand for Alternative Lending Options to Create Lucrative Market Opportunities

- The requirement for alternate lending choices is increasing. Many individuals and small businesses are looking for loans outside of traditional banks, and peer-to-peer lending platforms provide a more convenient and efficient way to obtain funds. This increase in demand for alternative lending options creates a lucrative opportunity for P2P lending platforms to expand their user base and loan offerings.

Peer-to-Peer Lending Market Report Segmentation Analysis

The key segment that contributed to the derivation of the peer-to-peer lending market analysis is type.

- In 2023, the non-business loans sector led the market in terms of revenue. Personal loans are designed to meet a variety of individual financial demands, including debt consolidation, home improvement, medical bills, education, and other personal expenses. This broad application attracts a huge number of borrowers, adding to the domination of the non-business lending segment.

- In 2023, the unsecured category led the market. Unsecured loans do not need borrowers to provide collateral, making the application process easier and more accessible to a wider range of borrowers.

Peer-to-Peer Lending Market Share Analysis By Geography

- The scope of the peer-to-peer lending market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- The Asia Pacific region includes a sizable population, including many unbanked or underbanked people who have little access to typical financial services. P2P lending platforms offer these individuals an alternate source of finance, increasing demand for P2P lending in the region.

- Furthermore, Asia Pacific is witnessing significant economic expansion, which is encouraging more entrepreneurial activity and the creation of small businesses. P2P lending platforms provide a key supply of finance for small enterprises, hence fuelling regional growth.

Peer-to-Peer Lending Market Report Scope

Peer-to-Peer Lending Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the peer-to-peer lending market. Some of the recent key market developments are listed below:

- In 2022, LendingClub, a prominent peer-to-peer lending platform headquartered in the US, finalized the acquisition of Radius Bank. This acquisition was a crucial step toward building a digital marketplace bank. It allowed LendingClub to broaden its product offerings beyond P2P lending and provide consumers with a wider range of financial services. [Source: LendingClub, Company Website]

Peer-to-Peer Lending Market Report Coverage & Deliverables

The peer-to-peer lending market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Peer to Peer Lending Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Peer to Peer Lending Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 21.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Asia Pacific is anticipated to grow with a high growth rate during the forecast period.

The major players holding majority shares are LendingClub Bank, Lendermarket, Prosper Funding LLC, Proplend, and PeerBerry

Technological innovations and surge in demand for alternative lending options in the global peer-to-peer lending market in the coming years.

Less operating costs and a growing focus on serving underbanked individuals are the major factors that propel the global peer-to-peer lending market.

The global peer to peer lending market was estimated to grow at a CAGR of 21.3% during 2023 - 2031.

Get Free Sample For

Get Free Sample For