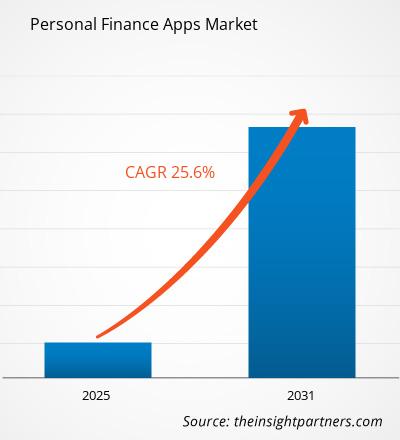

The Personal Finance Apps market is expected to register a CAGR of 25.6% in 2023–2031. Multi-platform support and focus on privacy and security are likely to remain key Personal Finance Apps market trends.

Personal Finance Apps Market Analysis

COVID-19 has contributed to a rise in the number of personal finance apps. An entirely understandable pattern in an era of economic uncertainty, with many people concerned about the future and looking to improve their financial conditions. According to a 2022 report by SLA Digital, finance apps were used more than "1 trillion times on Android devices" in 2021 and were downloaded about 1.3 billion times by 2021. The average weekly usage of banking apps increased between December 2019 and March 2021.

Personal Finance Apps Market Overview

Given that the expense of living has increased, many people around the world intend to cut back, invest, or earn more wherever possible. According to a Google study, smartphone users download approximately three personal finance apps to their mobile devices, with 4 in 10 using their devices for managing finances, checking account history, tracking investments, and paying bills, among other financial activities. Technology has attracted a new wave of clients: millennials and even younger customers are embracing a new era of financing powered by mobile technology and offering far more products and services than ever before.

Personal Finance Apps Market Drivers and Opportunities

Rise in Digital Banking to Favor Market

The emergence of digital banking has transformed the traditional banking business, creating new opportunities for individuals to save, invest, and grow their wealth. Online banking has grown in popularity due to its simplicity and accessibility, particularly for savings accounts. Digital banking includes a variety of financial tools and trends. Most Americans have used digital banking services in the last year, and more banks are introducing new, innovative digital solutions, such as AI-powered budgeting and new methods to buy common products. Millions of bank customers now prefer to handle their finances through mobile apps. With increased expectations, digital banking teams understand the importance of regularly iterating their mobile apps to guarantee that their mobile banking experiences are tailored to the demands of their customers.

Integration of AI and advanced analytics – An Opportunity in Personal Finance Apps

Artificial intelligence and machine learning are two of the most important trends in personal finance app development today. AI's ability to evaluate trends, generate forecasts, gather insights, and provide solutions to issues has proven useful in a variety of business domains. Aside from the benefits AI and ML provide to FinTech companies, there is another significant advantage to employing advanced technology: increased interest from venture funds. Investors today see significant promise in the evolution of Artificial Intelligence and are eager to support companies that provide upgraded solutions using new technologies.

Personal Finance Apps Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Personal Finance Apps market analysis are operating system and application.

- Based on the operating system, the Personal Finance Apps market is divided into Android, iOS, and web-based. The Android segment held a larger market share in 2023.

- By application, the market is segmented into mobile phones, tablets, computers, and others. The mobile phones segment held the largest share of the market in 2023.

Personal Finance Apps Market Share Analysis by Geography

The geographic scope of the Personal Finance Apps Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

North America has dominated the personal finance apps market. Rapid developments in payment technology in North America countries are driving the demand for banking and personal finance apps in the region. The personal finance apps market is undergoing substantial development in North America, which can be attributed to the rapid digital transformation in the BFSI sector's large customer base.

PERSONAL FINANCE APPS Market Report Scope

Personal Finance Apps Market News and Recent Developments

The Personal Finance Apps market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for embedded finance and strategies:

- Doxo, an all-in-one bill payment platform, raised $18.5 million in Series C financing. This helped the company to develop its platform, which allowed consumers to better their financial health by automating recurring bill payments. This allowed the company to hire more people, develop its bill pay provider list, and expedite its doxoDIRECT platform, which allows billers to receive direct electronic payments. (Source: Doxo, Press Release, 2022)

Personal Finance Apps Market Report Coverage and Deliverables

The “Personal Finance Apps Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Personal Finance Apps Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 25.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Operating System

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies

1. Intuit, Inc.

2. Personal Capital Corporation

3. Lampo Licensing, LLC.

4. You Need a Budget

5. Wally Yachts S.A.

6. Acorns Grow, Inc.

7. Robinhood Financial, LLC

8. Capital One Financial Corporation

9. Wealthfront Inc

10. Credit Karma, Inc.

Get Free Sample For

Get Free Sample For