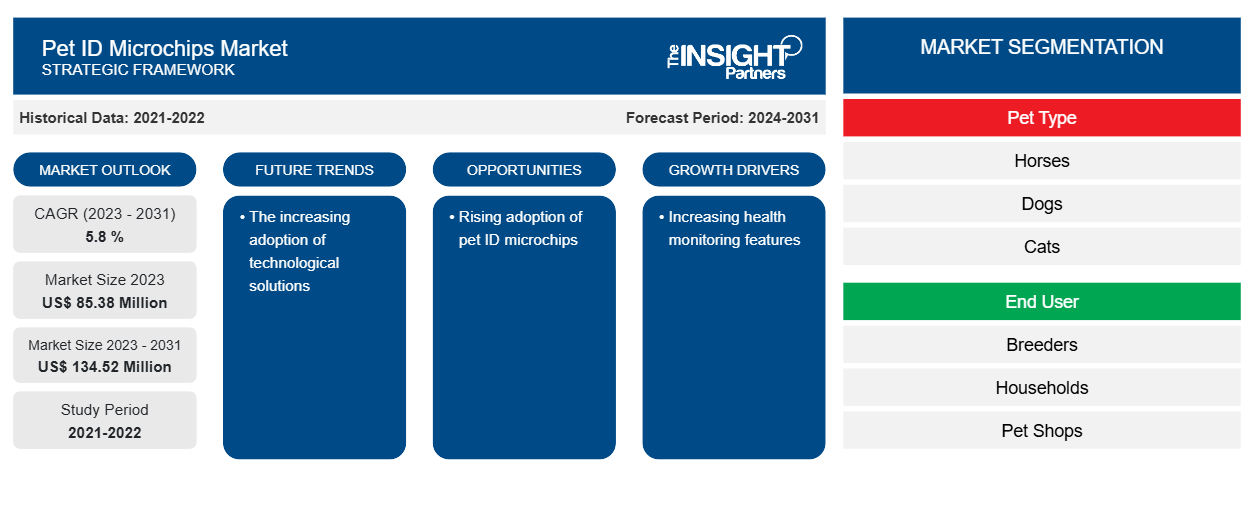

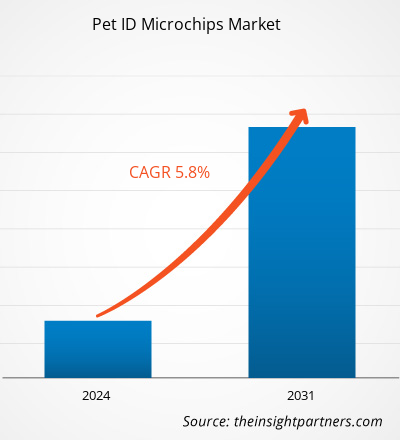

The pet ID microchips market size is projected to reach US$ 134.52 million by 2031 from US$ 85.38 million in 2023. The market is expected to register a CAGR of 5.8 % during 2023–2031. The increasing adoption of technological solutions is likely to remain a key trend in the market.

Pet ID Microchips Market Analysis

A single chip will remain functional for up to 25 years and last for the pet's lifetime. Most current-day chips operate at 134.2 kHz, while some 125 kHz microchips are still available in the US. In addition, the microchip has significantly reduced its size and enhanced the temperature reading of the pet when scanned with a microchip scanner. Microchips are an effective method of identifying pets since it is embedded inside the body and, therefore cannot be chewed off, removed, torn, or falsified. Veterinarians and animal welfare charities across the globe are embracing pet ID microchipping mandates imposed by regulations.

Pet ID Microchips Market Overview

A microchip is a tiny electronic device that contains all pertinent information. In this chip, there is a number that can accurately identify the pet. To get a chip, owners must visit a vet who will inject it slightly below their pet's skin. The procedure is painful, so it does not require the use of anesthesia. Within the microchip, there is a registration number of its registry. When the need arises, a scanner can retrieve the registry information about the pet. Microchips are ideal for permanent, tamper-proof identification but no replacement for a collar with up-to-date identification labels.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pet ID Microchips Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pet ID Microchips Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Pet ID Microchips Market Drivers and Opportunities

Rising adoption of pet ID microchips

Various pet ID specialists are offering pet ID microchip customers from all animal welfare sectors, including rescue, veterinary, groomer, local authority, breeder, pet services, and zoos. In addition, Pet-ID providers offer wildlife conservation projects in various regions, such as the UK and others. For instance, in October 2022, MSD Animal Health launched HomeAgain Thermochip, a new identification microchip that incorporates a temperature biosensor that measures the cat or dog's subcutaneous temperature. Therefore, the rising adoption of pet ID microchips is driving the pet ID microchips market.

Increasing health monitoring features

Wearable accessories are essential elements of smart health monitoring systems for pets. They collect various health information using sensors embedded in collars or harnesses, providing valuable information for your pet's health. Devices, such as FitBark or Whistle, attach to the pet's collar and monitor physical activity levels, sleep patterns, and calorie consumption. They provide information about the pet's fitness and energy levels. The Tractive and Link AKC brands offer GPS-enabled collars, allowing you to track your pet's location at any time. This is particularly useful for outdoor pets or those who are prone to wandering. Thus, the increasing health monitoring features are creating more opportunities for the market.

Pet ID Microchips Market Report Segmentation Analysis

Key segments that contributed to the derivation of the pet ID microchips market analysis are pet type and end user.

- Based on the component, the pet ID microchips market is divided into horses, dogs, cats, and others. The horses segment held a larger market share in 2023.

- By end user, the market is segmented into breeders, households, pet shops, and others.

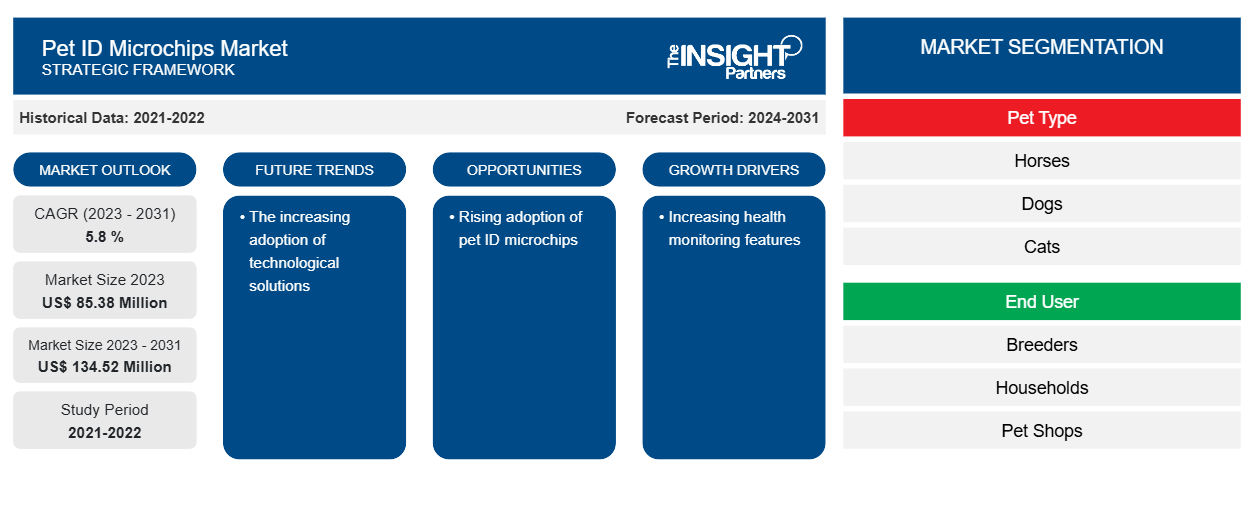

Pet ID Microchips Market Share Analysis by Geography

The geographic scope of the pet ID microchips market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America dominates the pet ID microchips market. According to the American Pet Products Association (APPA), people in the US will spend approximately US$ 109.6 billion on their pets in 2022. Furthermore, pet accessories are becoming more advanced, and there are a growing number of inventions and developments in the pet industry. Thus, the demand for pet microchips is increasing in the region.

Pet ID Microchips Market Regional Insights

The regional trends and factors influencing the Pet ID Microchips Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Pet ID Microchips Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Pet ID Microchips Market

Pet ID Microchips Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 85.38 Million |

| Market Size by 2031 | US$ 134.52 Million |

| Global CAGR (2023 - 2031) | 5.8 % |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Pet Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

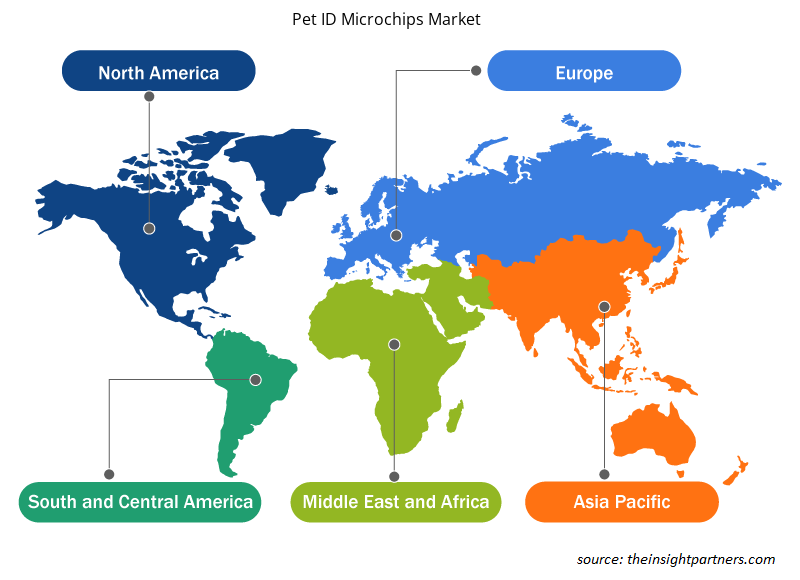

Pet ID Microchips Market Players Density: Understanding Its Impact on Business Dynamics

The Pet ID Microchips Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Pet ID Microchips Market are:

- Pethealth Inc

- Merck & Co. Inc

- Elanco Animal Health Inc

- Avid Identification Systems Inc

- Datamars SA

- Trovan Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Pet ID Microchips Market top key players overview

Pet ID Microchips Market News and Recent Developments

The pet ID microchips market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the pet ID microchips market are listed below:

- PetPace ™, a leader in advanced pet health monitoring, announcedhealh the launch of PetPace 2.0, an AI-powered, life-saving smart dog collar delivering continuous, near real-time medical insights for early detection, treatment, monitoring, and GPS tracking for canine health. PetPace improves the health and quality of life of pets through remote monitoring to bring peace of mind to pet owners. (Source: PetPace, Press Release, May 2024.)

- International Alliance Technologies motions to launch its marquee product, a QR code pet ID tag, on April 26. The tag is connected to an information database that is free to utilize upon activation. The database includes protected personal information, such as the owner's address and phone number, medical records, veterinarian contact information, and more, while also granting access to 24/7 customer service. (Source: International Alliance Technologies, Press Release, April 2021)

Pet ID Microchips Market Report Coverage and Deliverables

The “Pet ID Microchips Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Pet ID microchips market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Pet ID microchips market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- pet ID microchips market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the pet ID microchips market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Pet Type, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The expected CAGR of the global pet ID microchips market is 5.8 %.

The global pet ID microchips market is expected to reach US$ 134.52 million by 2031.

The increasing adoption of technological solutions is anticipated to play a significant role in the global pet ID microchips market in the coming years.

The key players holding majority shares in the global pet ID microchips market are Pethealth, Inc., Merck & Co., Inc., Elanco Animal Health, Inc., Avid Identification Systems, Inc, Datamars SA, Trovan Ltd, Virbac SA, Animalcare Group Plc, Microchip4solutions Inc, and PeddyMark Ltd.

The rising adoption of pet ID microchips and the increasing health monitoring features are the major factors that propel the global pet ID microchips market.

APAC dominates the pet ID microchips market.

Get Free Sample For

Get Free Sample For