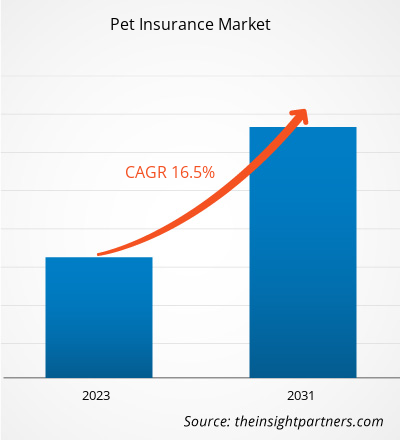

The pet insurance market size is expected to grow from US$ 11.2 billion in 2023 to US$ 38.0 billion by 2031; it is anticipated to expand at a CAGR of 16.5% from 2023 to 2031. The market growth in the pet industry is being driven by various factors, including the expanding pet population, the adoption of pet insurance in untapped markets, the rising costs of veterinary care, strategic initiatives by key companies, and the growing trend of humanizing pets.

Pet Insurance Market Analysis

The animal industry faced significant challenges during the COVID-19 pandemic, impacting various stakeholders such as pet owners, veterinarians, veterinary hospitals, and animal health companies. However, the industry swiftly adapted by implementing supportive measures to ensure uninterrupted access to veterinary care and related services. These challenges also led to an increased awareness among pet parents about the need for financial protection, resulting in a surge in the adoption of pet insurance policies. A survey conducted by Petplan, a prominent player in the UK market, indicated a rise in pet ownership in 2020, with dogs being the preferred choice, followed by cats.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pet Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pet Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Pet Insurance Industry Overview

- Pet insurance is a specialized form of insurance coverage that provides financial protection to pet owners against unexpected veterinary expenses. It operates on a similar principle to health insurance for humans, offering coverage for medical treatments, surgeries, medications, and other healthcare services for pets.

- Pet insurance policies typically involve a monthly or annual premium payment, and in return, the policyholder receives reimbursement for eligible veterinary expenses incurred during the policy period. The reimbursement amount is based on the coverage limits, deductibles, and co-pays specified in the policy.

- The primary purpose of pet insurance is to mitigate the financial burden associated with veterinary care, which can be substantial, especially in cases of accidents, injuries, or serious illnesses.

Pet Insurance Market Driver

Growing Pet Population to Pet Insurance to Drive the Pet Insurance Market

- Several key factors are driving the pet insurance market growth. First and foremost, the growing pet population is contributing to the expansion of the pet insurance market growth. As more individuals and families welcome pets into their homes, the demand for pet insurance as a means of protecting their furry companions and managing potential medical expenses is on the rise.

- For instance, as per Forbes, the pet ownership landscape in the United States has undergone significant growth over the past three decades. As of 2024, approximately 66% of U.S. households, equivalent to 86.9 million homes, own a pet. This represents a substantial increase from the 56% reported in 1988.

- Pet ownership statistics highlight the integral role that pets play in the lives of their owners, with 85% of dog owners and 76% of cat owners considering their pets as members of their families.

Pet Insurance Market Report Segmentation Analysis

- Based on animal type, the pet insurance market forecast is segmented into dogs, cats, and others. The dogs segment is expected to hold a substantial pet insurance market share in 2023. The increasing prevalence of pet adoption, the expanded range of services offered by insurance companies, and the rising disposable income in key markets are significant factors driving the market share in the pet insurance industry.

- Major players in this sector include Trupanion, Inc., Petplan, PetFirst Healthcare LLC, Nationwide Mutual Insurance Company, and Embrace Pet Insurance Agency, LLC. As per the findings of a study conducted by the American Pet Products Association (APPA) between 2023 and 2024, approximately 66% of households in the United States own at least one pet, resulting in a total of around 86.9 million households.

- Among the insured pet population, dogs account for approximately 80%, while cats represent the remaining 20%. The growth in the pet population throughout the region, coupled with the availability of diverse insurance policies catering to the varied needs of pets, is expected to bring new pet insurance market trends.

Pet Insurance Market Regional Analysis

The scope of the Pet Insurance market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant Pet Insurance market share. In 2022, the North American pet insurance market witnessed a significant increase, with approximately 5.36 million pets being insured, marking a growth of around 22% compared to the previous year. This data was reported by The North American Pet Health Insurance Association (NAPHIA), a trade association for the pet insurance industry in the United States and Canada. The rising number of pet owners opting for insurance coverage for their pets indicates a growing market demand.

Pet Insurance Market Regional Insights

The regional trends and factors influencing the Pet Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Pet Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Pet Insurance Market

Pet Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 11.2 Billion |

| Market Size by 2031 | US$ 38.0 Billion |

| Global CAGR (2023 - 2031) | 16.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Sales Channel

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Pet Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Pet Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Pet Insurance Market are:

- Trupanion, Inc.

- Direct Line

- Nationwide Mutual Insurance Company

- MetLife Services and Solutions, LLC.

- Deutsche Familienversicherung AG (DFV)

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Pet Insurance Market top key players overview

The "Pet Insurance Market Analysis" was carried out based on coverage type, animal type, sales channel, and geography. In terms of coverage type, the market is segmented into accident-only and accident & illness. Based on animal type, the market is segmented into dogs and cats. Based on sales channels, the market is segmented into agency, broker, and direct. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Pet Insurance Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the pet insurance market. A few recent key market developments are listed below:

- In January 2024, Five Sigma, a prominent provider of cloud-based claims management solutions, entered into a strategic alliance with Odie Pet Insurance, a company committed to enhancing the accessibility and affordability of pet insurance. This collaborative partnership seeks to transform the claims processes within the pet insurance sector and enhance overall industry operations.

(Source: Five Sigma, Company Website)

- In November 2023, Fetch, a leading company in the pet industry, established a strategic partnership with Best Friends Animal Society, a renowned national organization dedicated to eradicating the euthanasia of dogs and cats in American shelters by 2025. Under this partnership, Fetch will make significant contributions to support Best Friends' initiatives in finding loving homes for shelter pets and ultimately realizing their vision of creating a no-kill nation.

(Source: Fetch, Company Website)

- In September 2023, Independence Pet Group (IPG), a prominent pet insurance platform known for its comprehensive services, successfully acquired Felix, the exclusive pet insurance brand dedicated solely to cats in the United States. This strategic acquisition aligns with IPG's recognition of the growing demand for cat pet health insurance, which has emerged as the fastest-growing segment in the market. By integrating Felix into its portfolio, IPG aims to better serve cat owners and address the historically underrepresented cat insurance market. The completion of this acquisition further strengthens IPG's position as one of North America's largest pet insurance and services organizations, supporting the well-being and safety of over 800,000 pets in the U.S. and Canada.

(Source: Independence Pet Group (IPG), Company Website)

Pet Insurance Market Report Coverage & Deliverables

The market report on "Pet Insurance Market Size and Forecast (2021–2031)", provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Coverage Type, Animal Type, Sales Channel, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global pet insurance market is expected to reach US$ 38.0 billion by 2031.

Various factors, including the expanding pet population, the adoption of pet insurance in untapped markets, and the rising costs of veterinary care, are driving the market growth in the pet industry.

The pet insurance market size is expected to grow from US$ 11.2 billion in 2023 to US$ 38.0 billion by 2031; it is anticipated to expand at a CAGR of 16.5% from 2023 to 2031.

The key players holding majority shares in the global pet insurance market are Trupanion, Inc., Direct Line, MetLife Services and Solutions, LLC., Figo Pet Insurance, LLC, and Petplan (Allianz).

The growing trend of humanizing pets is anticipated to play a significant role in the global pet insurance market in the coming years.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Trupanion, Inc.

- Direct Line

- Nationwide Mutual Insurance Company

- MetLife Services and Solutions, LLC.

- Deutsche Familienversicherung AG (DFV)

- Petplan (Allianz)

- Animal Friends Insurance Services Limited

- Embrace Pet Insurance Agency, LLC

- PoilicyBazaar

- Figo Pet Insurance, LLC

Get Free Sample For

Get Free Sample For