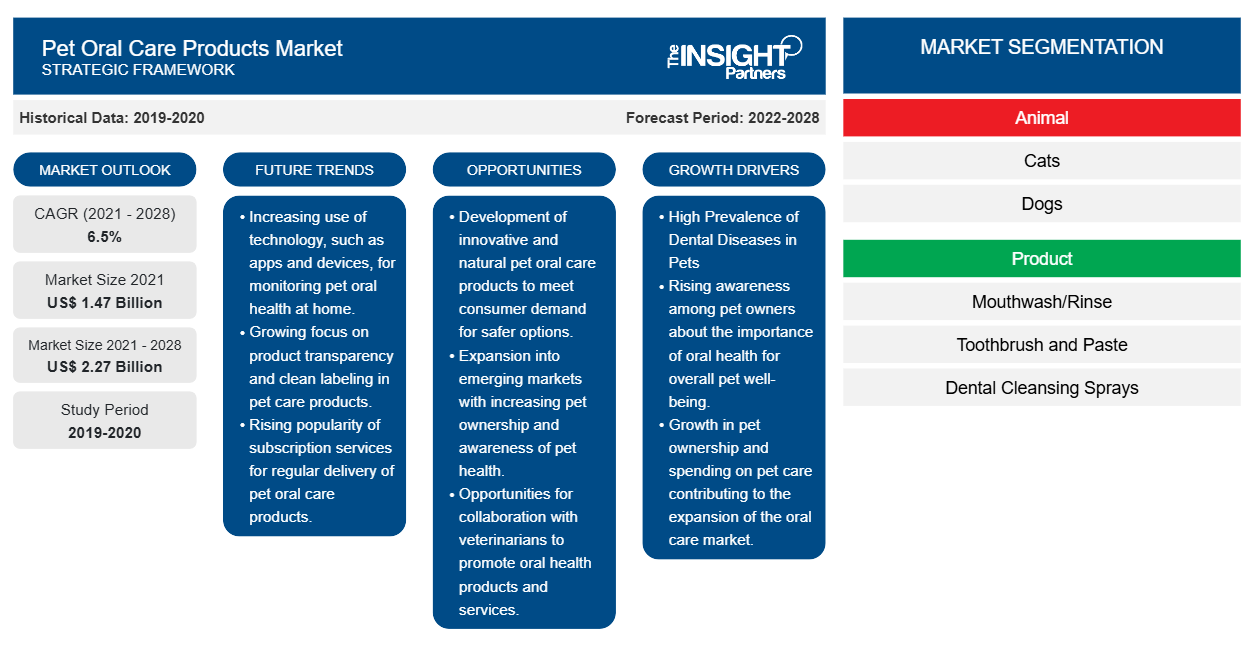

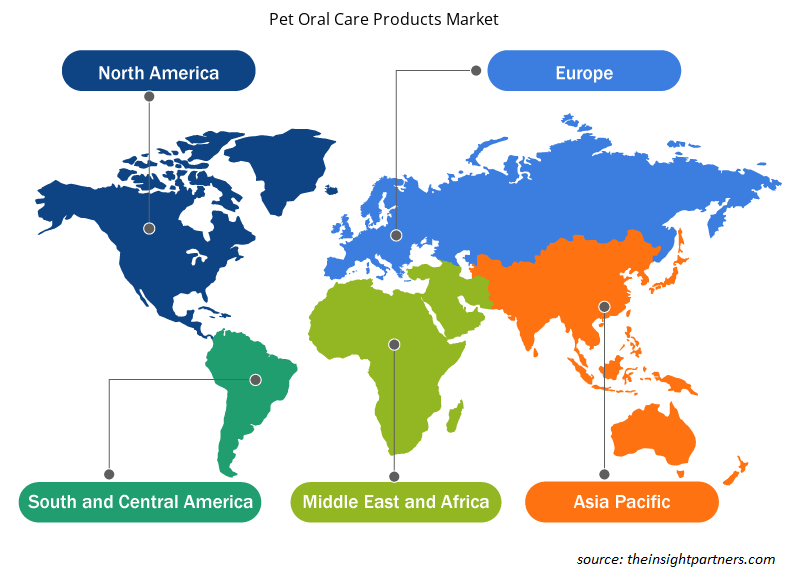

The pet oral care products market was valued at US$ 1,465.07 million in 2021 and is projected to reach US$ 2,270.33 million by 2028; it is expected to grow at a CAGR of 6.5% from 2021 to 2028.

Pet oral care is one of the most effective measures taken by pet owners to maintain the overall health of their animals and prevent health problems. Pet oral care products aid in the prevention of infectious disease transmission from other pets and play an important role in the maintenance of hygiene and comfort for the animals. With the use of these products, it is recommended that the pets' oral care be checked once a year. Pet oral care products comprise a variety of appliances, medicines, and other chemicals used to keep pets' teeth clean and prevent dental disease.

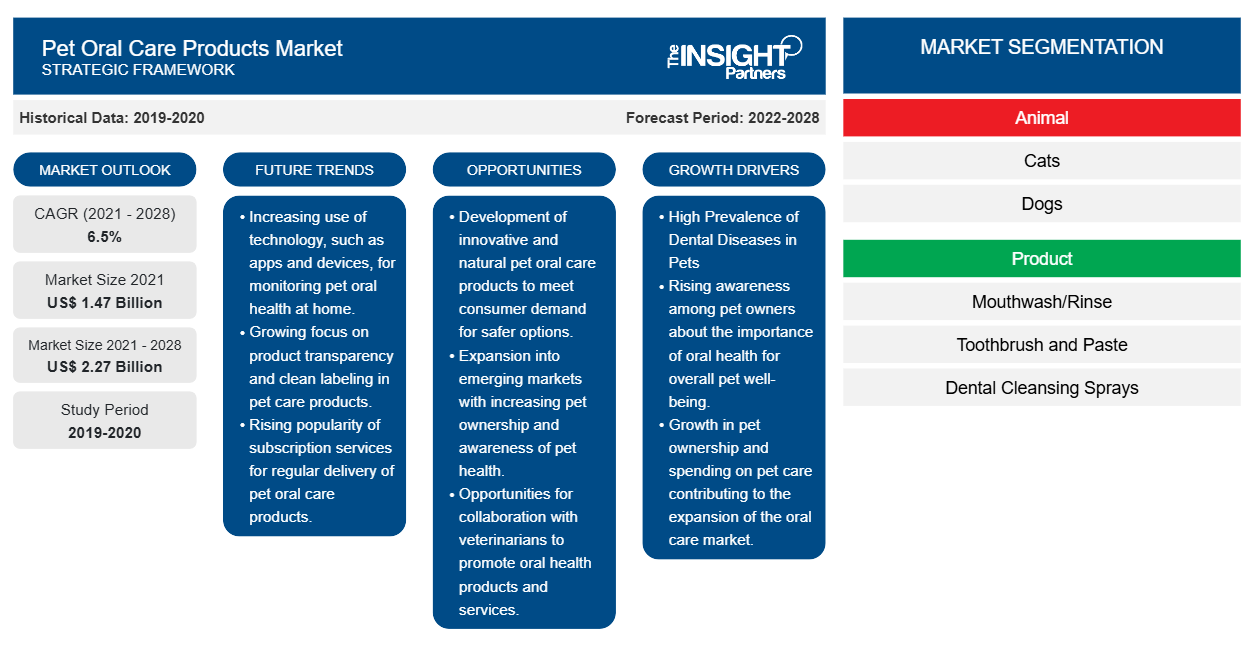

The pet oral care products market is segmented on the bases of animal, product, end user, distribution channel, and geography. By geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South and Central America. The report offers insights and in-depth analysis of the market, emphasizing on parameters such as market trends, technological advancements, and market dynamics along with the analysis of competitive landscape of world’s leading market players.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pet Oral Care Products Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pet Oral Care Products Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Pets are considered the best companion for humans as they create a positive effect on their owner’s life. They promote active lifestyle with companionship and have also been able to detect oncoming epileptic seizures. Also, pets help bring social, emotional, and cognitive development in children, as well as relieve stress and anxiety in adults. Research studies have shown that the dog owners have 36% lower risk of dying from cardiovascular disease and an 11% lower risk of getting heart attack. As per the National Pet Owners Survey 2019–2020, conducted by the American Pet Products Association (APPA), 67% of the US households, i.e., ~85 million families, own a pet. This indicates 56% rise since 1988, the first year when the survey was conducted.

Number of US Households Owning Pet, by Animal, 2019–2020 (Millions)

Pets | Number |

Birds | 5.7 |

Cats | 42.7 |

Dogs | 63.4 |

Horses | 1.6 |

Reptiles | 4.5 |

Other Small Animals | 5.4 |

Source: 2019–2020 National Pet Owners Survey of American Pet Products Association

As per the American Society for the Prevention of Cruelty to Animals, ~6.5 million companion animals enter the countrywide animal shelters every year; however, the number has declined from ~7.2 million in 2011, which indicates an increase in animal adoption. Moreover, as per the European Pet Food Industry Federation (FEDIAF), cats remain the most popular pet in European households, with a population of 74.4 million. The popularity of dogs is growing as there were 66.4 million pet dogs in the EU (84.9 million in Europe and Russia) in 2017, compared to 63.7 million (82.2 million) in 2016. According to the People's Dispensary for Sick Animals (PDSA) Animal Wellbeing (PAW) Report 2019, 50% of the UK population owns a pet. Also, 24% of the UK adults have a cat with an estimated population of 10.9 million pet cats and 26% of them own a dog with an estimated population of 9.9 million pet dogs. Hence, the growing adoption of pets for companionship is fueling the growth of the pet oral care products market.

High Prevalence of Dental Diseases in Pets Contributes Significantly to Market Growth

Periodontal disease is the most common condition in cats and dogs. It is a progressive, cyclical inflammatory disease of the supporting structures of the teeth, which leads to dental disease and early tooth loss in dogs and cats. Further, these diseases can lead to serious health concerns such as organ failure. As per the AVMA, nearly 70% of cats and 80% of dogs develop some form of periodontal disease by the time they are three years old. The rise in the prevalence of various oral health-related diseases has been identified as the major driving factor for market growth.

Additionally, calculus, gingivitis, gum disease, and tooth fractures are among the common oral issues in pets. As per the DSM pet owner survey, only 16% of dog owners clean their pets’ teeth every day. This has led to the need for pet products that provide a complete approach to oral care such as dental treats, water additives, dental wipes, and breath fresheners. Also, regular vet check-ups and preventative home care can improve pet’s oral health.

Animal Insights

Based on animal, the global pet oral care products market is bifurcated into cats and dogs. In 2020, the dogs segment held a larger share in the market. Moreover, the market for the cats segment is expected to grow at a higher rate by 2028. Periodontal disease is the most frequent infectious disease in dogs. It's a cyclical, progressive inflammatory illness of the teeth' supporting components that's the primary reason for dental issues and early tooth loss in dogs. It affects 90% of cats over three years of age. This factor is likely to boost the demand for pet oral care products across the world during the forecast period

Product Insights

Based on product, the global pet oral care products market is segmented into mouthwash/rinse, toothbrush and paste, dental cleansing sprays, anti-plaque pens, and other products. The toothbrush and paste segment held the largest market share in 2020, and the dental cleansing sprays segment is expected to dominate the market by 2028. Brushing a pet’s teeth using a soft-bristle toothbrush and paste and a toothpaste designed for pets is the most effective form of dental preventative care. Routine brushing of the teeth is the most important component of home dental care.

End User Insights

Based on end user, the global pet oral care products market is segmented into veterinary hospitals, private clinics, and home care. The home care segment held the largest market share in 2020. However, the same segment is expected to dominate the market by 2028. Early in a pet's life, home dental care is important for sustainable oral health and tooth preservation. Brushing pet's teeth every day is the greatest way to take care of their teeth at home. Home care is ideally a daily part of tooth maintenance, but even brushing just twice a week can remove most plaque before it can mineralize into tartar.

Distribution Channel Insights

Based on distribution channel, the global pet oral care products market is segmented into supermarkets/hypermarkets, online channel, specialized pet shops, and other distribution channels. The specialized pet shops segment held the largest market share in 2020. However, the online channel segment is expected to dominate the market by 2028. The pet store industry is expected to increase significantly in the forecast period, owing to an increasing number of pet owners who love their pets like family members, as well as big-spending millennials. Pet shops focus on pet owners' need to pamper their pets by offering a broader range of innovative, specialized, and luxury items and services.

Product launches, and mergers and acquisitions are the highly adopted strategies by the players operating in the global pet oral care products market. A few of the recent key product developments are listed below:

- In June 2021, Mars Petcare announced its plans to invest $145 million to expand the production capabilities of its wet pet food manufacturing plant in Fort Smith, AR, by adding 200,000 square feet of space and installing two new production lines.

- In February 2020, Vetoquinol SA announced the acquisition of Profender and Drontal product families from Elanco Animal Health. It will also acquire intellectual property, registrations, and other rights currently owned by Bayer AG’s animal health business.

The COVID-19 pandemic is having the mixed impact on the pet oral care products market. Sales have spiked for pet oral care products at home, do-it-yourself, driven by the closure of veterinary clinics and professional salons. Some online retailers also reported strong sales in the lockdown period. For instance, Chewy.com has been witnessing an acceleration in sales since February 2020. Chewy.com generates around 70% of its sales through subscribed customers. All these developments suggest increased penetration of online business due to the pandemic.

Pet Oral Care Products Market Regional Insights

The regional trends and factors influencing the Pet Oral Care Products Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Pet Oral Care Products Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Pet Oral Care Products Market

Pet Oral Care Products Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1.47 Billion |

| Market Size by 2028 | US$ 2.27 Billion |

| Global CAGR (2021 - 2028) | 6.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Animal

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Pet Oral Care Products Market Players Density: Understanding Its Impact on Business Dynamics

The Pet Oral Care Products Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Pet Oral Care Products Market are:

- Vetoquinol SA

- Dechra Veterinary Products, LLC

- AllAccem, Inc.

- Imrex, Inc.

- Virbac

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Pet Oral Care Products Market top key players overview

Pet Oral Care Products – Market Segmentation

By Animal

- Cats

- Dogs

By Product

By End User

- Veterinary Hospitals

- Private Clinics

- Home Care

By Distribution Channel

- Supermarkets/ Hypermarkets

- Online Channels

- Specialized Pet Shops

- Other Distribution Channels

By Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- Italy

- Spain

- Rest of Europe

- Asia Pacific (APAC)

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

- South and Central America (SCAM)

- Brazil

- Argentina

- Rest of South and Central America

Company Profiles

- Vetoquinol SA

- Dechra Veterinary Products, LLC

- AllAccem, Inc.

- imrex, Inc.

- Virbac

- CEVA

- Hills Pet Nutrition, Inc.

- Nestle

- Mars, Incorporated

- TropiClean Pet Products

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Joint Pain Injection Market

- Nitrogenous Fertilizer Market

- Clinical Trial Supplies Market

- Artificial Intelligence in Defense Market

- Saudi Arabia Drywall Panels Market

- Microcatheters Market

- Thermal Energy Storage Market

- Photo Editing Software Market

- Vertical Farming Crops Market

- Aesthetic Medical Devices Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Animal ; Product ; End User ; Distribution Channel , and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, South Korea, Spain, United Kingdom, United States

Frequently Asked Questions

The pet oral care products market majorly consists of the players such Vetoquinol SA, Dechra Veterinary Products, LLC, AllAccem, Inc., Imrex, Inc., Virbac, CEVA, Hills Pet Nutrition, Inc., Nestle, Mars, Incorporated, and TropiClean Pet Products among others.

The factors such as increasing adoption of pets for companionship and high prevalence of dental diseases in pets drive the market growth. However, the lack of adoption of pet care products in developing countries hinders the market growth.

Pet oral care is one of the most effective measures taken by pet owners to maintain the overall health of their animals and prevent health problems. They aid in the prevention of infectious disease transmission from other pets and play an important role in the maintenance of hygiene and comfort for the animals. With the use of these pet oral care products, it is recommended that these pets' oral care be checked once a year. Pet oral care products include a variety of appliances, medicines, and other chemicals used to keep pets' teeth clean and prevent dental disease.

Trends and growth analysis reports related to Consumer Goods : READ MORE..

The List of Companies - Pet Oral Care Products Market

- Vetoquinol SA

- Dechra Veterinary Products, LLC

- AllAccem, Inc.

- Imrex, Inc.

- Virbac

- CEVA

- Hills Pet Nutrition, Inc.

- Nestle

- Mars, Incorporated

- TropiClean Pet Products

Get Free Sample For

Get Free Sample For