Pharmaceutical Excipients Market Analysis, Size, and Share by 2028

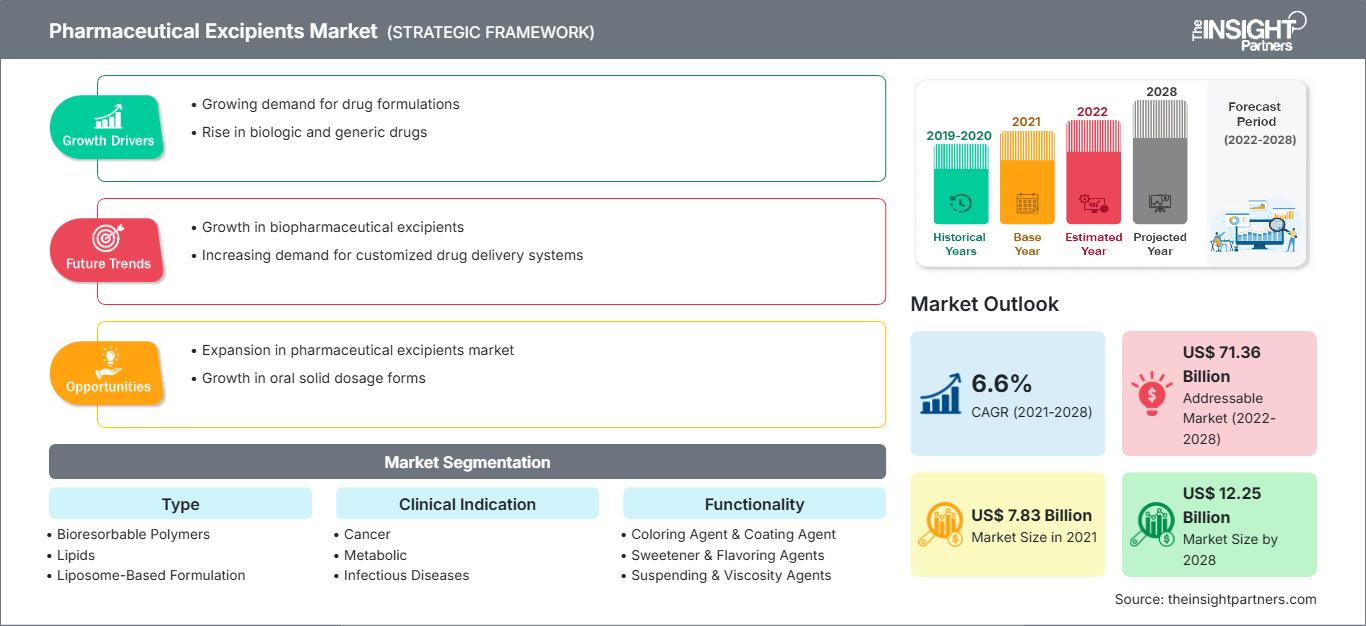

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028Pharmaceutical Excipients Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Type (Bioresorbable Polymers, Lipids, and Liposome-Based Formulation; Oleochemicals; Sugars; Cellulose; Starches; Petrochemicals; Plant Proteins, Polyols and Cyclodextrins; Inorganic Chemicals; and Others), Clinical Indication (Cancer, Metabolic, Infectious Diseases, Dental, Ophthalmic, Gene Therapies, and Others), Functionality (Coloring Agent & Coating Agent; Sweetener & Flavoring Agents; Suspending & Viscosity Agents; Preservative & Controlled-Release; Antioxidant & Oil; Tablet Filler & Diluents; Binders, Compression Aids, and Granulating Agents; and Others), Application (Parenteral, Oral Formulations & Tablets, Capsules, Liquid & Injectables, Physicochemical Excipient-Container Interactions in Prefilled Syringes, Nutraceuticals & OTC, Topical, and Others), End User (Biopharma Industries, Pharma Industries, Animal Health, and Others)

- Report Date : Nov 2022

- Report Code : TIPRE00003534

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 570

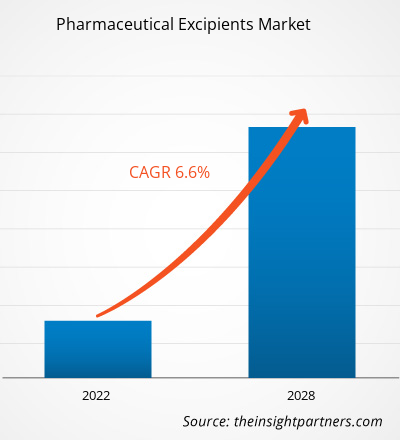

The global pharmaceutical excipients market is expected to reach US$ 12,245.04 million by 2028; it is estimated to grow at a CAGR of 6.6% from 2022 to 2028.

The rising number of product approvals and launches drives the pharmaceutical excipients market growth. Formulation scientists have recognized that single-component excipients do not always provide the requisite performance to allow certain APIs to be manufactured adequately. These scientists focus on the production of co-processed and multifunctional excipients with enhanced performance. Co-processed excipients are a mixture of two or more existing excipients at the sub-particle level, offering substantial benefits of the incorporated excipients and minimizing their drawbacks. These multipurpose excipients have dramatically reduced the number of incorporating excipients in the tablet. The co-processed excipients are used to improve the drug's flow, disintegration, lubrication, and compressibility. The excipients also simplify the formulation process and make it cost-effective. They are increasingly used to convert complicated and labor-intensive formulation processes, such as wet granulation, to quick direct-compression processes, without affecting the final product quality or performance. Co-processed excipients play a crucial role in the creation of a stable, result-oriented drug delivery system with enhanced chemical, physical, and mechanical properties.

The companies are focusing on developing co-processed excipients for drug formulations. For instance, in July 2021, DFE Pharma launched a co-processed excipient, Pharmacel sMCC 90, silicified microcrystalline cellulose (MCC). It has been developed as the synergistic solution for challenging oral solid dosage formulations. A co-processed excipient is a promising tool in the production of pharmaceutical products. Existing co-processed adjuvants cannot fulfill all the needs for the preparation of various novel formulations. There is also enough space for the production of new co-processed excipients to satisfy the demand of the pharmaceutical industries, which is expected to act as an opportunity for the growth of the pharmaceutical excipients market during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pharmaceutical Excipients Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The pharmaceutical excipients market comprises major competitive players who adopt various strategies such as product launches, geographic expansion, and technological advancements. A few recent developments in the market are listed below:

- In July 2022, Roquette announced addition of a new grade to its PEARLITOL SD mannitol range for direct compression – PEARLITOL 150 SD. Developed specifically for active pharmaceutical ingredients (APIs) that are highly sensitive to reducing sugars, PEARLITOL 150 SD supports opportunities to unlock advanced tablet dosage forms, even when using challenging active ingredients.

- In October 2019, Ashland announced the launch of three new pharmaceutical solutions—Plasdone S630 Ultra, Benecel XR and XRF, and Viatel bioresorbable polymers. Ashland stated that it is expanding its portfolio to meet growing needs by formulators and will introduce them at the upcoming tradeshows AAPS and CPhI.

- In January 2021, ADM won the 2021 BIG Innovation Awards presented by the Business Intelligence Group. ADM Biopolis’ groundbreaking probiotic strain, Bifidobacterium lactis (BPL1), was featured among the 2021 winning products.

The active participation of market players in product innovation and development, coupled with an increase in approvals of products, fuels the growth of the pharmaceutical excipients market. Also, with the advanced technologies, the market would grow exponentially during the forecast period.

Regional Overview

Asia Pacific was the fastest-growing pharmaceutical excipients market in 2021 owing to the rising interest of major players in developing countries and increasing number of global key players willing to outsource their excipients manufacturing activities from Asia Pacific countries due to availability of low manufacturing and labor costs. The growing population in countries such as China and India is likely to increase the demand for pharmaceutical excipients in the region. China has launched over 500 types of pharmaceutical excipients. According to the World Health Organization (WHO), ~400 pharmaceutical excipient manufacturers are in China, ~23% of which specialize in producing pharmaceutical excipients, while the remaining ones focus on chemical and food processing. Currently, Colorcon (US), Meggle (Germany), Degussa (Germany), Roquette (France), and other leading foreign pharmaceutical excipient companies have established joint ventures, wholly owned companies, or offices in China. Colorcon provides film-coated products, Roquette pharmaceutical provides starch, while Meggle primarily provides pharmaceutical lactose and polyols. A few pharmaceutical excipient giants of China are Sunhere Pharmaceutical Excipients, Er-Kang Pharmaceuticals, Dongbao Bio-Tech, Zhanwang Pharmaceutical, Qinghai Gelatin, Shandong Liaocheng A Hua Pharmaceutical, and Qufu Tianli. Still, their market concentration rate is relatively low.

Ranking among the most extensive Chinese pharmaceutical excipient producers with complete types, Er-Kang Pharmaceutical holds 116 pharmaceutical excipients and a capacity of 45,000 tons (40,823.313 Metric Tons) or more. The company has continued to pursue an epitaxial expansion strategy in the last two years and enhance the market layout. Similarly, Sunhere Pharmaceutical Excipients is a Chinese member of the International Pharmaceutical Excipient Confederation (IPEC), mainly producing microcrystalline cellulose, hypromellose, hydroxypropyl cellulose, and 18 other types of new-type pharmaceutical excipients with the capacity of 10,000 tons (9,071.847 Metric Tons).

Zhanwang Pharmaceutical supplies 28 pharmaceutical excipient products, including pre-gelatinized starch, hypromellose, carboxymethyl starch sodium, and microcrystalline cellulose, with a capacity of more than 10,000 tons (9,071.847 Metric Tons). The US FDA and the European COS have certified some of the company's production bases. Exports have now contributed 25% to the company's revenue. Additionally, in July 2019, JRS Pharma announced that many of its excipient products are being registered with the National Medical Products Administration (NMPA, former CFDA). The NMPA is the Chinese agency tasked to draft regulations and laws for medical devices and drugs in China. These Commercial Data Masking Facility (CDMF) filings permit pharmaceutical companies worldwide to manufacture and sell pharmaceutical products in China, utilizing JRS Pharma's excipients.

Application Insights

Based on application, the global pharmaceutical excipients market is segmented into parenteral, orals formulations & tablets, capsules, liquid & injectable, physicochemical excipient container interactions in prefilled syringes, nutraceuticals & OTC, topical, and others. The oral formulation & tablets segment held the largest share of the market in 2021. Tablets are the most widely used dosage form. Tablet excipients include diluents, binders, lubricants, glidants, anti-adherents, and super disintegrants. Lactose, spray-dried lactose, microcrystalline cellulose, and sorbitol are a few examples of diluents. Examples of binders include gelatin, glucose, Lactose, and cellulose derivatives (methylcellulose). Lubricants include insoluble stearic acid, magnesium stearate, calcium stearate, talc, and paraffin. On the other hand, soluble excipients include sodium lauryl sulfate; sodium benzoate; and PEG 400, 600, and 800. Further, super disintegrant excipients used in tablets include croscarmellose sodium (Ac-di-sol), crospovidone (polyplasdone), and sodium starch and glycollate Starch. Excipients intended for oral formulations involve bulking or stabilizing agents, solubility enhancers, and therapeutic agents. Excipients also aid in the identification of a product along with improving the overall safety or functioning of the product during storage.

However, the global pharmaceutical excipients market in the physicochemical excipient-container interactions in prefilled syringes segment is expected to grow during the forecasted period. According to a report published in the Parenteral Drug Association (PDA) Journal of Pharmaceutical Science and Technology in 2022, chemical studies suggest that parenteral formulation excipients may interact with silicone oil in prefilled syringes, thereby causing variations in glide force and affecting the performance of autoinjectors. Therefore, it is crucial to control the glide force of the prefilled syringes to mitigate dose inaccuracies. The chemical stability analysis of surfactants suggested that the degradation of excipients also impacts syringe functionality. Various studies have been conducted to study the impact of different surfactants and their functionality on prefilled syringes. For example, upon storing syringes filled with different surfactant solutions at various temperatures, a rise in syringe glide force was noted. Such research results reveal that the use of surfactants in prefilled syringes has to be limited to avoid pharmaceutical-excipient container interactions.

Companies operating in the pharmaceutical excipients market adopt product innovation strategy to meet the evolving customer demands across the world, which also permits them to maintain their brand name in the market.

Pharmaceutical Excipients Market Regional InsightsThe regional trends and factors influencing the Pharmaceutical Excipients Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Pharmaceutical Excipients Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Pharmaceutical Excipients Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 7.83 Billion |

| Market Size by 2028 | US$ 12.25 Billion |

| Global CAGR (2021 - 2028) | 6.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Pharmaceutical Excipients Market Players Density: Understanding Its Impact on Business Dynamics

The Pharmaceutical Excipients Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Pharmaceutical Excipients Market top key players overview

Global Pharmaceutical Excipients Market – Segmentation

The pharmaceutical excipients market is segmented on the basis of type, clinical indication, functionality, application, end user, and geography. Based on type, the market is segmented into bioresorbable polymers, lipids, and liposome-based formulation; oleochemicals; sugars; cellulose; starches; petrochemicals; plant proteins, polyols and cyclodextrins; inorganic chemicals; and others. Based on clinical indication, the pharmaceutical excipients market is segmented into cancer, metabolic, infectious diseases, dental, ophthalmic, gene therapies, and others. Based on functionality, the market is segmented into coloring agent & coating agent; sweetener & flavoring agents; suspending & viscosity agents; preservative & controlled-release; antioxidant & oil; tablet filler & diluents; binders, compression aids, and granulating agents; and others. By application, the pharmaceutical excipients market is segmented into parenteral, oral formulations & tablets, capsules, liquid & injectables, physicochemical excipient-container interactions in prefilled syringes, nutraceuticals & OTC, topical, and others. Based on end user, the pharmaceutical excipients market is segmented into biopharma industries, pharma industries, animal health, and others. By geography, the market is segmented into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (the UAE, Saudi Arabia, South Africa, and the Rest of the Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Company Profiles

- JRS PHARMA GmbH & Co KG

- Roquette Freres SA

- BASF SE

- Evonik Industries AG

- AshLand Inc

- Archer-Daniels-Midland Co

- The Dow Chemical Co

- The Lubrizol Corp

- Avantor Inc

- MEGGLE GmbH & Co KG.

- Univar Solutions Inc.

Frequently Asked Questions

What is the regional market scenario of the pharmaceutical excipients market?

Which type segment held the largest market share in the pharmaceutical excipients market?

Who are the key players in the pharmaceutical excipients market?

What are the driving factors for the pharmaceutical excipients market across the globe?

Which application segment led the pharmaceutical excipients market?

Which end user segment held the largest market share in the pharmaceutical excipients market?

What is meant by the pharmaceutical excipients market?

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For