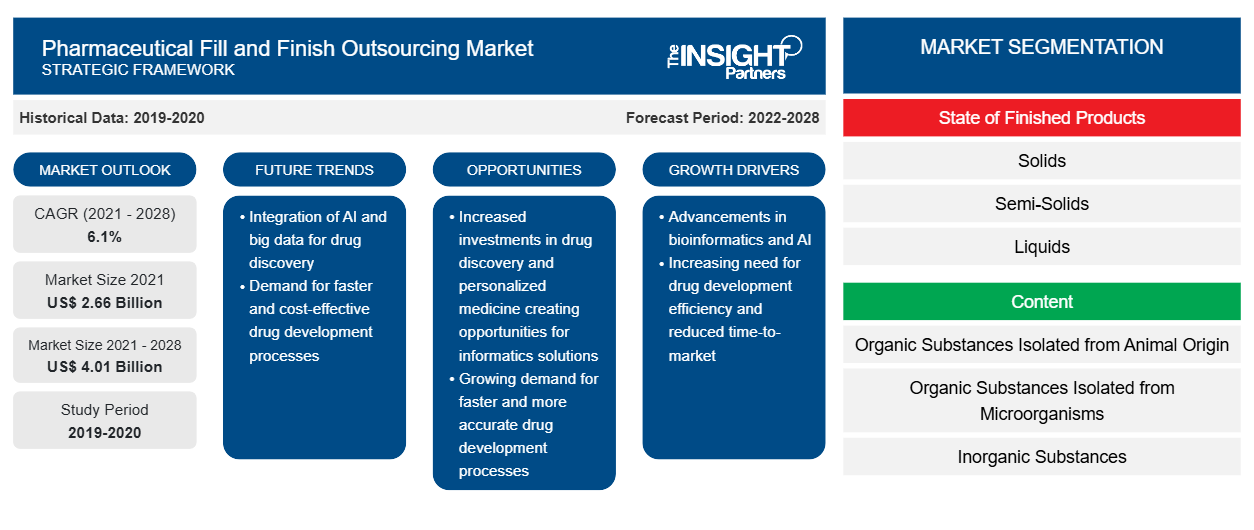

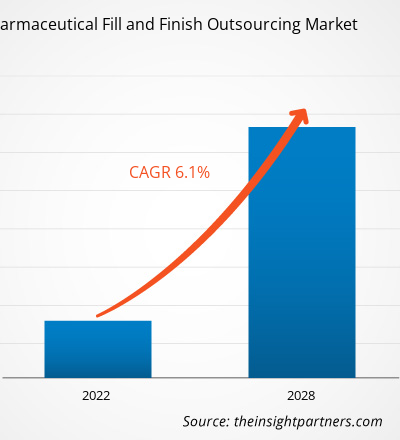

The pharmaceutical fill and finish outsourcing market is projected to reach US$ 4,010.51 million by 2028 from US$ 2,657.04 million in 2021; it is expected to register a CAGR of 6.1% from 2021 to 2028.

The rising demand from pharmaceutical and biopharmaceutical industries to meet the demand for fill/finish gap is expected to drive the market growth. According to the US Food and Drug Administration’s (FDA’s) Center for Drug Evaluation and Research (CDER), biologics have accounted for 20% to 29% of approvals of new molecular entities (NMEs) in 2020. In 2019, small molecules accounted for 79% of all NME approvals, representing 38 of the 48 NMEs approved by the FDA and biologics accounted for 10 of the 48 NMEs approved or 21% of all NME approvals. In 2018, small molecules accounted for 71% of NME approvals and biologics 29% of NME approvals. In-house capacities companies sometimes lack the ability to manufacture new products. This factor supports the growth of the market. Specialized capabilities, such as lyophilization, filling prefilled syringes and cartridges, or novel therapeutics, require unique manufacturing techniques that biotech technology companies find beneficial to outsource from contract manufacturing organizations, as they are cost-effective. Companies with in-house aseptic fill-and-finish capacity outsource on average 39% of their fill-and-finish needs.

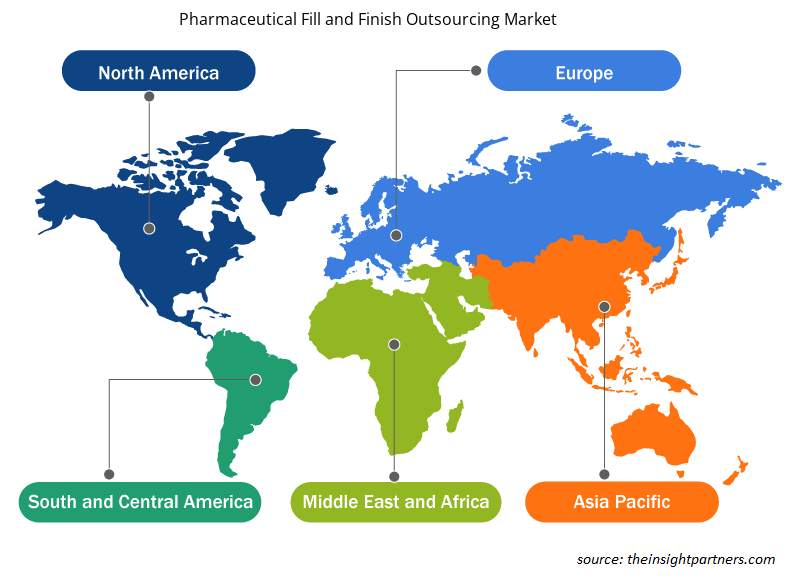

North America is likely to continue its dominance in the pharmaceutical fill and finish outsourcing market during 2021–2028. The US holds the largest share of the market in North America and is expected to continue this trend during the forecast period. Automation advancements such as robotics have been one of the areas of progress for the US fill/finish operations. This primarily reduces the contamination risk to a great extent, thus aiding the regional growth. The overall integration of the supply chain that reduces human interactions is driving the pharmaceutical fill and finish outsourcing market growth. For instance, ABL adopted automation in their fill/finish operations in 2017. The company completed an expansion of aseptic fill/finish operations at its GMP biomanufacturing facility in Rockville, MD. The company installed a fully automated vial filling system. Such factors are expected to aid the growth of the overall pharmaceutical fill and finish outsourcing market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pharmaceutical Fill and Finish Outsourcing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pharmaceutical Fill and Finish Outsourcing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Surge in Demand for Biological Products

The rising pipeline of biologic drugs and the increasing preference for such therapeutic interventions are expected to drive the demand for pharmaceutical fill and finish outsourcing during the forecast period. Approximately 60% of fill/finish services involve the clinical and commercial-scale packaging of anti-COVID-19 vaccines. Expansion of facilities is one of the critical factors that biopharma companies are considering during the pandemic. Biopharmaceutical companies are facing issues such as the aforementioned changes and budgetary constraints. Outsourcing is required to overcome these issues and meet the demands of biological products. The outsourcing of biopharmaceutical products from the contract manufacturing organizations is expected to drive the pharmaceutical fill and finish outsourcing industry over the next seven years. Approximately 90% of the installed fill/finish capacity belongs to market participants with commercial-scale production capabilities. Over 85% of the available fill and finish capacity belongs to large-scale companies.

State of Finished Products-Based Insights

Based on state of finished products, the pharmaceutical fill and finish outsourcing market is segmented into solids, semi-solids, and liquids. The liquid segment captured the largest share in 2021 and is expected to continue a similar trend over the forecast period. Growing demand for prefilled syringes and vials in the plastic syringe industries is expected to drive the demand for pharmaceutical fill and finish outsourcing. Application demand of vials in lyophilization is fuelling the growth of the fill and finish services market. Also, the rising number of new entrants in global biologics manufacturing results in the surge in outsourcing activities. Such a factor is anticipated to assist the global pharmaceutical fill and finish outsourcing market.

Based on content, the pharmaceutical fill and finish outsourcing market is segmented into organic substances isolated from microorganisms, organic substances isolated from animals, and inorganic substances. The organic substances isolated from microorganisms segment hold a considerable market share and is projected to continue a similar trend during the forecast period. Advances in pharmaceutical fill and finish outsourcing have enabled successful implementation of the reduction in contamination risks in the supply chain. Such an end-to-end integration has successfully aided the demand for organic substances isolated from microorganisms, thus aiding the demand for pharmaceutical fill and finish outsourcing.

Companies operating in the pharmaceutical fill and finish outsourcing market adopt the product innovation strategy to meet the evolving customer demands across the world, which also permits them to maintain their brand name in the global market.

Pharmaceutical Fill and Finish Outsourcing Market Regional Insights

Pharmaceutical Fill and Finish Outsourcing Market Regional Insights

The regional trends and factors influencing the Pharmaceutical Fill and Finish Outsourcing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Pharmaceutical Fill and Finish Outsourcing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Pharmaceutical Fill and Finish Outsourcing Market

Pharmaceutical Fill and Finish Outsourcing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2.66 Billion |

| Market Size by 2028 | US$ 4.01 Billion |

| Global CAGR (2021 - 2028) | 6.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By State of Finished Products

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

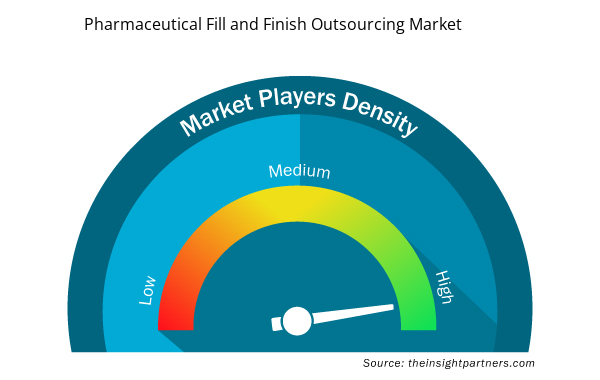

Pharmaceutical Fill and Finish Outsourcing Market Players Density: Understanding Its Impact on Business Dynamics

The Pharmaceutical Fill and Finish Outsourcing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Pharmaceutical Fill and Finish Outsourcing Market are:

- Abbott

- Teva Pharmaceutical Industries Ltd

- Dr. Reddy's Laboratories

- Sun Pharmaceutical Industries Ltd

- Piramal Enterprises Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Pharmaceutical Fill and Finish Outsourcing Market top key players overview

Pharmaceutical Fill and Finish Outsourcing Market

The global pharmaceutical fill and finish outsourcing market is segmented based on the state of finished products, and content. Based on state of finished products, the market is categorized into liquids, solids, and semi-solids. By content, the market is segmented into organic substances isolated from microorganisms, organic substances isolated from animals, and inorganic substances. Based on regions, the global pharmaceutical fill and finish outsourcing market is segmented into North America, Europe, Asia Pacific, South and Central America and Middle East and Africa. The North America market is segmented into United States, Canada and Mexico. Europe market is segmented into France, Germany, Italy, Spain, United Kingdom and Rest of Europe. Asia Pacific is segmented into China, Japan, South Korea, India, Australia and Rest of Asia Pacific. Middle East and Africa is segmented into South Africa, Saudi Arabia, UAE and Rest of Middle East and Africa. South and Central America is bifurcated into Brazil, Argentina and Rest of South and Central America.

Companies operating in the market are Abbott, TEVA PHARMACEUTICAL INDUSTRIES LTD, Dr. Reddy's Laboratories, Sun Pharmaceutical Industries Ltd, Piramal Enterprises Ltd., MabPlex International Ltd, WOCKHARDT, Cytovance Biologics, Thermo Fisher Scientific Inc. (Patheon N.V), Boehringer Ingelheim International GmbH amongst others.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

State of Finished Products, and Content

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Global pharmaceutical fill and finish outsourcing market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. North America is likely to continue its dominance in the pharmaceutical fill and finish outsourcing market during 2021–2028. The US holds the largest share of the market in North America and is expected to continue this trend during the forecast period. Automation advancements such as robotics have been one of the areas of progress for the US fill/finish operations. This primarily reduces the contamination risk to a great extent, thus aiding the regional growth. The overall integration of the supply chain that reduces human interactions is driving the pharmaceutical fill and finish outsourcing market growth.

The liquid segment accounted for the largest share in 2021 and is expected to continue during the forecast period.

Companies operating in the market are Abbott, TEVA PHARMACEUTICAL INDUSTRIES LTD, Dr. Reddy's Laboratories, Sun Pharmaceutical Industries Ltd, Piramal Enterprises Ltd., MabPlex International Ltd, WOCKHARDT, Cytovance Biologics, Thermo Fisher Scientific Inc. (Patheon N.V), Boehringer Ingelheim International GmbH amongst others.

Biopharmaceutical companies and pharmaceutical companies outsource a portion of the products from the contract outsourcing companies to meet the unmet demand of the companies. This process is termed as the pharmaceutical fill and finish outsourcing.

Rising investment in biopharmaceutical sectors and growing demand for biologics is expected to drive the market

Based on content, organic substances isolated from microorganisms took the forefront lead in the worldwide market by accounting largest share in 2020 and is expected to continue a similar trend over the forecast period.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Pharmaceutical Fill and Finish Outsourcing Market

- Abbott

- Teva Pharmaceutical Industries Ltd

- Dr. Reddy's Laboratories

- Sun Pharmaceutical Industries Ltd

- Piramal Enterprises Ltd

- MabPlex International Ltd

- Wockhardt

- Cytovance Biologics

- Thermo Fisher Scientific Inc. (Patheon N.V.)

- Boehringer Ingelheim International GmbH

Get Free Sample For

Get Free Sample For