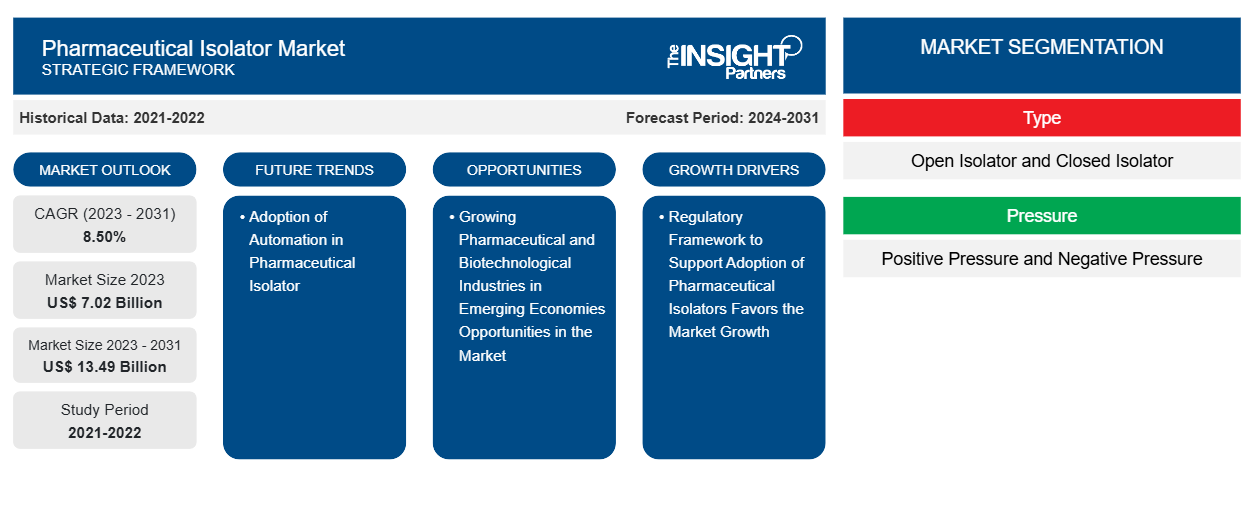

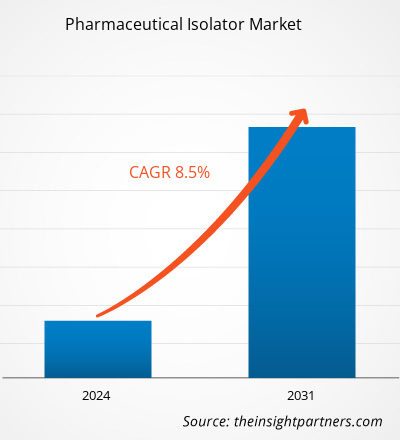

The pharmaceutical isolator market size is projected to reach US$ 13.49 billion by 2031 from US$ 7.02 billion in 2023. The market is expected to register a CAGR of 8.50% during 2023–2031. Adopting automation in pharmaceutical isolators will likely remain a key trend in the market.

Pharmaceutical Isolator Market Analysis

Factors such as an increase in Investments by the pharmaceutical and biotechnology industry and regulatory framework to support the adoption of pharmaceutical isolators are driving the market growth. Growth in the biotechnological and pharmaceutical sectors will ultimately result in a rise in the need for pharmaceutical isolators in the upcoming years. The market is anticipated to be driven by a growing trend of pharmaceutical companies approving more drugs to meet the demand for non-compliant drugs. Given the region's rapid growth in the generic drug industry, Asia Pacific is anticipated to experience significant growth over the projection period.

Pharmaceutical Isolator Market Overview

Numerous large and small pharmaceutical companies are working on creating novel and new molecules for conditions that threaten human life. Pharmaceutical isolator systems are considered an essential piece of equipment for searching for new drugs. As a result, more and more pharmaceutical isolators are being used to guarantee contamination-free product handling and manufacturing. The pharmaceutical isolator keeps an operator safe from potentially hazardous drug exposure, removes the chance of cross-contamination, and upholds drug quality standards. In the pharmaceutical sector, proceeding with extreme caution when producing new products is crucial. The pharmaceutical industry offers a variety of isolators that provide the highest level of sterility during the product manufacturing process—managing medications containing vital components, like hormones and antibiotics. Precautions are more critical when using biologic drugs. Pharmaceutical isolator techniques have seen significant investment from pharma and biotech companies during the last ten years. Merck KGaA, a well-known science and technology company, invested €35 million in 2017 to build a production line at its manufacturing site in Bari, Italy, for the aseptic filling of biotech medications under an isolator. At the Bari biotech manufacturing site, the company invested about €50 million in an automated warehouse and a fully automated production line operating under an isolator. Six additional containment isolators and a product development manufacturing laboratory were added to the UK-based inhalation contract development manufacturing company Vectura's expanded site in December 2020. The facility works with potent active pharmaceutical ingredients (HPAPIs) and develops new ones.

Similarly, in September 2019, COMEDCO joined forces with Optima Pharma and Optima Life Science to provide a wide range of aseptic filling and sealing services, including freeze-drying and isolator technology. The alliance will be able to swiftly and strategically launch new oral dispersible films (ODF) and transdermal patch systems (TPS) by utilizing Optima's isolator technologies. Consequently, the main factors propelling the growth of the pharmaceutical isolator market are the rising investments made by biotechnology and pharmaceutical companies and the long drug pipelines being developed for the treatment of different chronic diseases like cancer, metabolic, cardiovascular, immune, and neurological disorders.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pharmaceutical Isolator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pharmaceutical Isolator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Pharmaceutical Isolator Market Drivers and Opportunities

Regulatory Framework to Support Adoption of Pharmaceutical Isolators Favors the Market Growth

Compared to traditional clean rooms, pharmaceutical isolators provide a more sterile atmosphere. The chamber's internal pressures, either positive or negative, guard against contamination from operator interference. Compliance with pharmaceutical regulations pertaining to the production of sterile pharmaceutical products guarantees persistent sterility. Furthermore, most experts concur that regulatory bodies are no longer preventing technological advancements like pharmaceutical isolators. Regarding isolators versus cleanrooms, the US Food and Drug Administration and the European Medicines Agency's guidelines play a significant role in their adoption. In its most recent guidance on manufacturing in an aseptic environment, the FDA refers to isolators 55 times. Compared to conventional aseptic processing, a well-designed positive pressure isolator with sufficient maintenance, monitoring, and control protocols offers several benefits, including a reduced risk of microbial contamination during processing.

Additionally, the FDA notes that operators in crucial pharmaceutical manufacturing areas have been removed, which is anticipated to accelerate the use of pharmaceutical isolators in the upcoming years. According to trend analysis, the number of US pharmaceutical facilities utilizing isolator technology is rising. Aseptic filling in isolators was only present in 84 facilities in 1998. In 2000, there were 174 facilities; in 2002, there were 201; and in 2004 there were 258. The rise in the manufacturing of high-potency medications is correlated with expanding facilities providing aseptic processing. Due to the high cost of breaking regulatory guidelines, isolators have become essential to the pharmaceutical industry. Pharmaceutical isolators are necessary for maintaining aseptic conditions and containment in various processes. Strict aseptic conditions are required to ensure quality control, comply with other regulatory requirements, and meet the FDA's current good manufacturing practice (cGMP) guidelines (21 C.F.R. Parts 210 and 211).

Similarly, pharmaceutical-sector isolators must adhere to the class A Standards specified in the EU GMP Clean Room Classification. A final version of the European Union's (EU) good manufacturing practice (GMP.) Annex 1 is anticipated in 2021. For example, an updated draft was released in February 2020. These GMP guidelines cover several important topics regarding the design and use of isolators, including aseptic equipment design, automation and digitization, sterility with isolators, and H202 surface decontamination. The use of isolator technology to reduce human interventions in processing areas is also mentioned in section 8 of Annex 6 of the WHO's good manufacturing practices guidelines for sterile pharmaceutical products. The market's adoption of pharmaceutical isolators is fueled by all of these regulatory guidelines.

Growing Pharmaceutical and Biotechnological Industries in Emerging Economies Opportunities in the Market

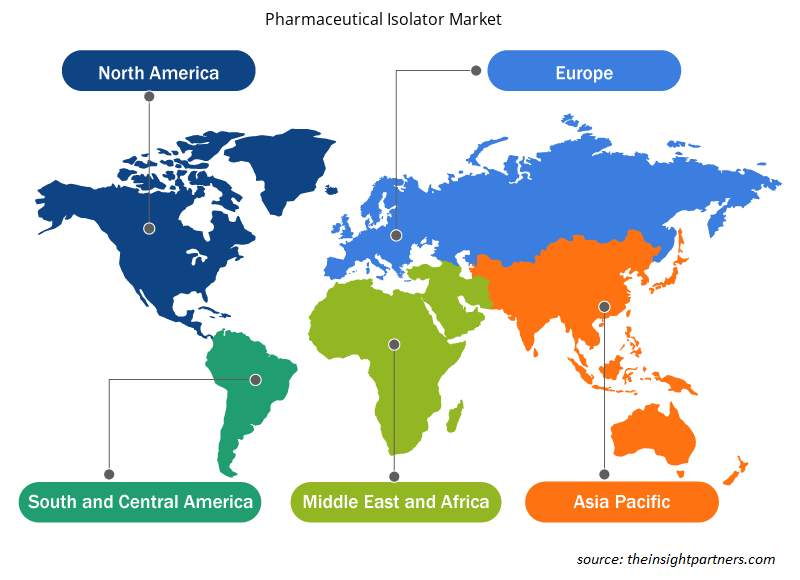

Most of the companies in the pharmaceutical isolator market are based in North America and Europe. Several nations from regions with significant growth potential, like Asia Pacific, the Middle East, and Latin America, have been marginalized by leading vendors in the market. Nonetheless, funding for pharmaceutical research is increasing in nations like China and India. Furthermore, several countries in the regions above can implement cutting-edge technologies like aseptic isolators. They also work to become the world's most advanced drug developers by creating high-performing and reasonably priced systems. For the creation of hormone products, Shanghai Marya Pharmaceutical, for example, provides an Aseptic Negative Isolator. Weighing, packing, sampling, and other high-activity production processes can be performed with this isolator. The pharmaceutical isolators market is expected to significantly expand in emerging nations like China, India, and Brazil because of their diverse healthcare markets, affordable labor and raw material costs, increased life science research, government backing, booming CRO and pharmaceutical industries, and technological advancements and integration.

The governments of these developing nations have also made significant investments to support pharmaceutical industry research. Aseptic isolators are becoming increasingly in demand in emerging markets due to pharmaceutical companies' growing interest in outsourcing drug discovery in response to the growing need for better drugs, constrained drug pipelines, and rising R&D expenses. Numerous CROs in Brazil, China, and India provide drug discovery services to pharmaceutical and biotechnology companies. Moreover, biopharmaceutical producers worldwide are finding Asian nations to be appealing outsourcing destinations. One of the main reasons propelling the growth of pharmaceutical isolators in Asia is the low cost of manufacturing and operating in nations like China and India.

Furthermore, there appears to be substantial market potential based on the latest advancements in the biopharmaceutical sector in China and India. Further opening up new opportunities for contract manufacturers in APAC are the expanding pipelines of biologics and biosimilars. According to the International Society for Pharmaceutical Engineering, approximately 200 new biological pharmaceuticals were registered with the China Food and Drug Administration (CFDA) 2016 for clinical trials. In the upcoming years, contract manufacturing is anticipated to support the expansion of the nation's biopharmaceuticals sector as a whole. Additionally, because it has lower operating costs, it primarily helps early-stage drug innovators. To fulfill the rising demand, many CMOs are increasing the scope of their manufacturing operations. For example, Optima Korea and Aprogen, a South Korean biosimilar manufacturer, started a unique isolator project in 2020. One of the first two businesses in South Korea to apply isolator technology to a high-speed syringe system is Aprogen. During the projected period, the pharmaceutical isolator market in emerging economies would present profitable opportunities due to the factors above.

Pharmaceutical Isolator Market Report Segmentation Analysis

Key segments that contributed to the derivation of the pharmaceutical isolator market analysis are type, pressure, configuration, application, and end user.

- Based on type, the pharmaceutical isolator market is segmented into open isolators and closed isolators. The open isolator segment held the most significant market share in 2023.

- By pressure indication, the market is categorized into positive pressure and negative pressure. The positive pressure segment held the largest share of the market in 2023.

- By configuration, the market is segmented into floor standing, modular, mobile, compact, tabletop, and portable. The floor-standing segment held a significant share of the market in 2023.

- Based on application, the pharmaceutical isolator market is segmented into aseptic isolators, containment isolators, sampling and weighing isolators, fluid dispensing isolators, and others. The aseptic isolators segment held the most significant market share in 2023.

- By end user, the market is segmented into hospitals, pharmaceutical and biotechnology companies, research and academic laboratories, and others. The pharmaceutical and biotechnology companies segment held a significant share of the market in 2023.

Pharmaceutical Isolator Market Share Analysis by Geography

The geographic scope of the pharmaceutical isolator market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North America pharmaceutical isolator market is segmented into the US, Canada, and Mexico. The US held the largest North American Pharmaceutical Isolator market share in 2021. The market's growth is driven by factors such as the rising adoption of pharmaceutical isolators in the US, rising public health awareness, increasing strategic activities by the government, and the presence of leading players. Growing usage of sterilized methods, cost of noncompliance, rising research laboratories, and advancements in isolator efficiency are stimulating the growth of the global pharmaceutical isolators market. Additionally, pharmaceutical isolators can handle hazardous materials effectively coupled with launch of new products contributing to the increase. Several manufacturers are adopting innovative business strategies to diversify their product portfolio and extend their presence on a global scale. Product development via research and development activities is one of the critical strategies aiding the market players in leveling up their market shares. For instance, in April 2017, Perle Systems, a leading provider of serial device networking hardware, announced the launch of its new product, RS232 Serial Interface Isolator, which can be used in factories, laboratories, and industrial and retail sectors. Another critical trend popular among market players is the customization and personalization of isolators to avoid contamination risks, protect personnel, and provide seamless products.

In addition, technological advancements and the introduction of innovative equipment by leaders in the global laboratory isolators market will likely stimulate market growth over the coming years. For instance, Geneva Scientific LLC in the United States currently offers Hospital Pharmacy Isolators for negative and positive recirculation pressure. This device provides superior sterility of products compared to open-front clean air systems such as biological safety cabinets and laminar flow clean benches. Class Biologically Clean, Ltd. offers Breeder Isolators featured with a polypropylene holding box. This device is used to breed selective colonies of germ-free rodents with the company’s flexible film materials. Similar introductions will positively work in the favor of the global laboratory isolators market by providing a healthy competitive platform for the development of newer products

Pharmaceutical Isolator Pharmaceutical Isolator Market Regional Insights

The regional trends and factors influencing the Pharmaceutical Isolator Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Pharmaceutical Isolator Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Pharmaceutical Isolator Market

Pharmaceutical Isolator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 7.02 Billion |

| Market Size by 2031 | US$ 13.49 Billion |

| Global CAGR (2023 - 2031) | 8.50% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

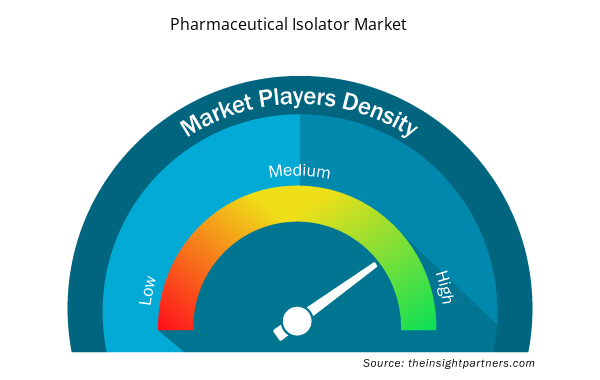

Pharmaceutical Isolator Market Players Density: Understanding Its Impact on Business Dynamics

The Pharmaceutical Isolator Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Pharmaceutical Isolator Market are:

- ITECO S.R.L.

- Schematic Engineering Industries

- Nuaire Inc.

- Comecer

- Getinge AB

- Hosokawa Micron Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Pharmaceutical Isolator Market top key players overview

Pharmaceutical Isolator Market News and Recent Developments

The pharmaceutical isolator market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the pharmaceutical isolator market are listed below:

- Getinge launches ISOPRIME; an isolator with comprehensive connectivity and traceability features. It is the ideal solution for customers looking for a rigid wall isolator that combines high quality, versatility, and continuous operations at a competitive price. (Source: Getinge, Press Release, June 2023)

- Comecer partners with G-CON to speed up the implementation of the Cell & Gene Therapy cGMP manufacturing facility. G-CON’s new Aseptic facility integrates Comecer’s upstream processing & downstream filling technologies for turnkey aseptic facility solutions, including isolation technologies. (Source: Comecer, Press Release, June 2021)

Pharmaceutical Isolator Market Report Coverage and Deliverables

The “Pharmaceutical Isolator Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Pharmaceutical isolator market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Pharmaceutical isolator market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Pharmaceutical isolator market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the pharmaceutical isolator market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Small Internal Combustion Engine Market

- Analog-to-Digital Converter Market

- Blood Collection Devices Market

- Portable Power Station Market

- Cut Flowers Market

- Arterial Blood Gas Kits Market

- Authentication and Brand Protection Market

- Long Read Sequencing Market

- Compounding Pharmacies Market

- Clear Aligners Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type , Pressure , Configuration , Application , and End User ; and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, RoAPAC, RoE, RoMEA, RoSCAM, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The market is expected to register a CAGR of 8.50% during 2023–2031.

ITECO SRL, Schematic Engineering Industries, Nuaire Inc., Comecer, Getinge AB, Hosokawa Micron Group, Fedegari Autoclavi S.p.A., Azbil Telstar, Gelman Singapore

Adopting automation in pharmaceutical isolators will likely remain a key trend in the market.

Key factors driving the market are an Increase in pharmaceutical and biotechnology industry investments and a regulatory framework to support the adoption of pharmaceutical isolators.

North America dominated the pharmaceutical isolator market in 2023

Get Free Sample For

Get Free Sample For