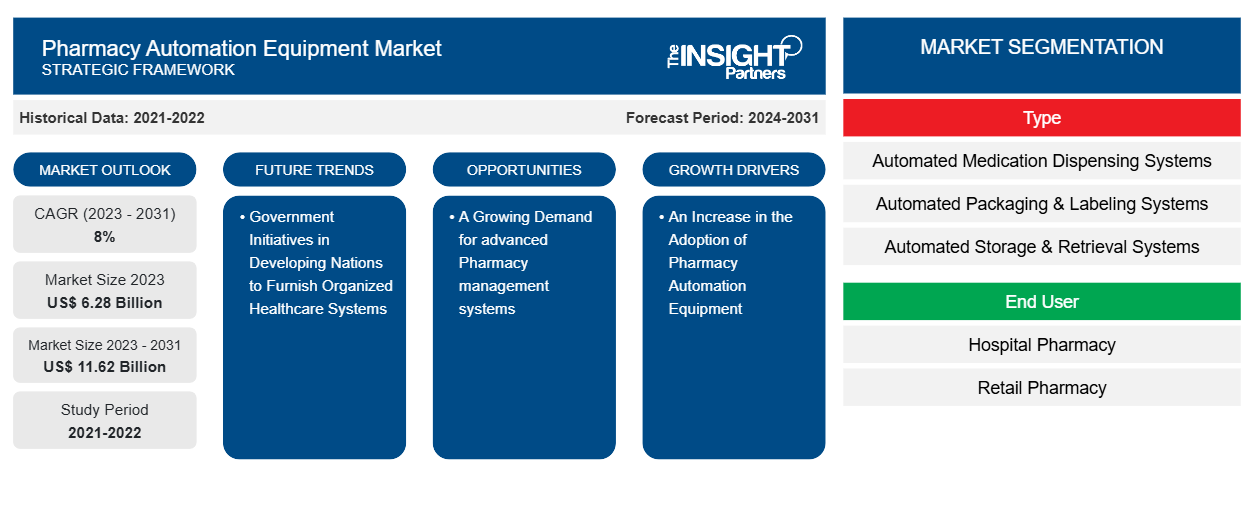

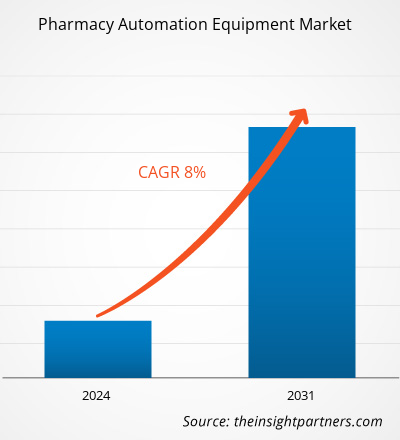

The pharmacy automation equipment market size is projected to reach US$ 11.62 billion by 2031 from US$ 6.28 billion in 2023. The market is expected to register a CAGR of 8.00% during 2023–2031. The emergence of medication dispensing systems, robotics, artificial intelligence (AI), telepharmacies, and automated inventory management systems are likely to remain a key trend in the market.

Pharmacy Automation Equipment Market Analysis

Due to new technologies, the healthcare sector is constantly changing and getting better, especially for pharmacies. To maintain timeliness, precision, and accuracy, pharmacies need to use a variety of systems, so those in this field must stay current on technological advancements. Leading the way in the technological revolution for the betterment of patients and healthcare providers has been pharmacy automation. Pharmacists can now handle patient prescriptions more efficiently and work more productively due to automation, which can handle anything from tedious chores to the smooth exchange of health information.

Pharmacy Automation Equipment Market Overview

The market for pharmacy automation systems is being driven by the numerous advantages that they offer to pharmacies. Automation enhances accuracy, pharmacy workflow, and patient experience while lowering expenses and medication-related errors. Future predictions for the global automation market point to an exponential growth in prescription demand, technical equipment, and broadening technological knowledge. The field of digital healthcare is rapidly growing and dominating. The number of prescriptions written will increase in tandem with the aging population, meaning that automation will have a significant impact on pharmacy practice in the future. Automation currently combines automated labeling, packaging, storing, and dispensing to lower errors in dispensing and boost productivity for pharmacy leaders. From this point on, the company will only use electronics and technology to grow.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pharmacy Automation Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pharmacy Automation Equipment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Pharmacy Automation Equipment Market Drivers and Opportunities

Increase in Adoption of Pharmacy Automation Equipment Favors the Market Growth

Pharmacy automation is now being done with robotics and AI. Mechanical devices known as pharmacy robotics can replicate human behavior once they are programmed to do so without constant operator assistance. For instance, a lot of automated workflow systems, pharmacy barcoding, and medication dispensing systems are all categorized as robotic. Artificial Intelligence (AI) is a rapidly developing field in pharmacy technology that can be applied to various tasks like polypharmacology, dosage form design, drug discovery, computer programs, and hospital pharmacy. Since AI is typically used to mimic human cognitive tasks, the pharmaceutical industry may see a significant increase in its use of this technology. It can be used to carry out human-like tasks on digital computers or computer-controlled robots (such as automated dispensing cabinets). Leading pharmaceutical companies are beginning to use artificial intelligence (AI) in research and development, drug discovery, healthcare system analysis, medication accuracy, medical support, and assistance, helping with repetitive tasks, treatment plan design, and health record maintenance. AI can be used in hospital pharmacies for a variety of purposes, including barcode scanning, automated medication preparation, automated tracking, and dispensing. Thus, an increase in use coupled with emerging applications of pharmacy automation systems is likely to drive the growth of the market.

Government Initiatives in Developing Nations

Because healthcare costs are rising and there is increasing pressure to improve access to services, pharmaceutical management plays a critical role in developing countries. For instance, the role of the pharmacist has expanded to include ensuring appropriate counseling, monitoring, and medication adherence, as well as preventing the development of HIV drug resistance in many resource-constrained settings burdened by the virus. This generates the need for cutting-edge technological solutions. The governments of developing nations are implementing several measures to make these medications easier to obtain. For example, to improve the delivery of HIV treatment, the Ministry of Health and Social Services in Namibia has implemented multi-month dispensing to enable the scaling-up of antiretroviral therapy. In Namibia's healthcare facilities, this is currently widely used, which aids in achieving the country's HIV treatment objectives. In India, the hospital sector makes up 80% of the whole healthcare market. There is a significant demand for it from both domestic and international investors. Consequently, during the projected period, these factors are probably going to generate significant growth opportunities for the pharmacy automation equipment market.

Pharmacy Automation Equipment Market Report Segmentation Analysis

Key segments that contributed to the derivation of the pharmacy automation equipment market analysis are type and end user.

- Based on type, the pharmacy automation equipment market is divided into automated medication dispensing systems, automated packaging & labeling systems, automated storage & retrieval systems, automated compounding devices, and tabletop tablet counters. The automated medication dispensing systems segment held the most significant market share in 2023.

- By end user, the market is segmented into hospital pharmacy, retail pharmacy, and others. The hospital pharmacy segment held the largest share of the market in 2023.

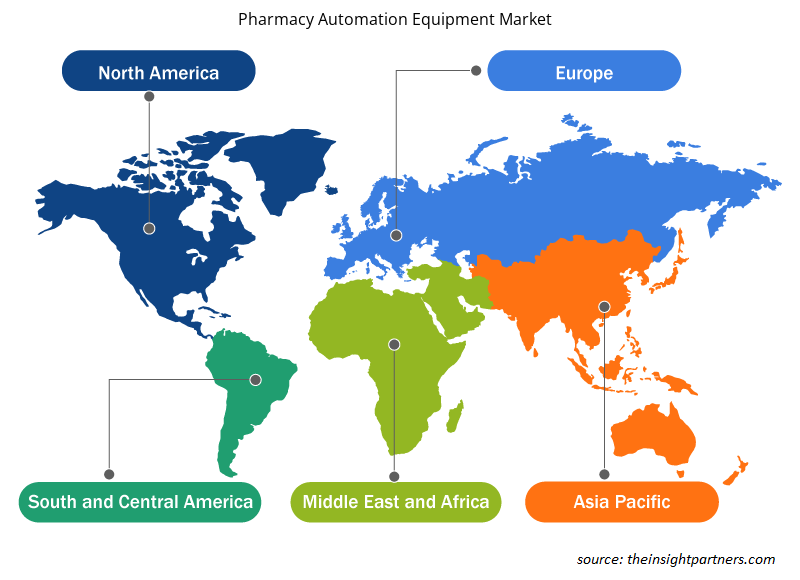

Pharmacy Automation Equipment Market Share Analysis by Geography

The geographic scope of the pharmacy automation equipment market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has captured the largest share of the global market, with growth being driven by factors such as the increasing adoption of pharmacy automation equipment in the US, growing public health awareness, increasing government initiatives, and the presence of leading players. A key driver of market growth is the increase in medication errors and the increasing demand for pharmaceutical products. The growing patient population in the U.S. indicates an increase in the number of patients taking multiple medications daily. Research shows that in the U.S., over 50% of patients have at least one prescription, with many taking multiple medications daily, putting them at increased risk of medication errors and potential health risks. The rising demand for pharmaceutical products, advancing technology, and the need for precise robotic equipment and tools to efficiently perform tasks are expected to be key factors for market growth.

Pharmacy Automation Equipment Market Regional Insights

The regional trends and factors influencing the Pharmacy Automation Equipment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Pharmacy Automation Equipment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Pharmacy Automation Equipment Market

Pharmacy Automation Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.28 Billion |

| Market Size by 2031 | US$ 11.62 Billion |

| Global CAGR (2023 - 2031) | 8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

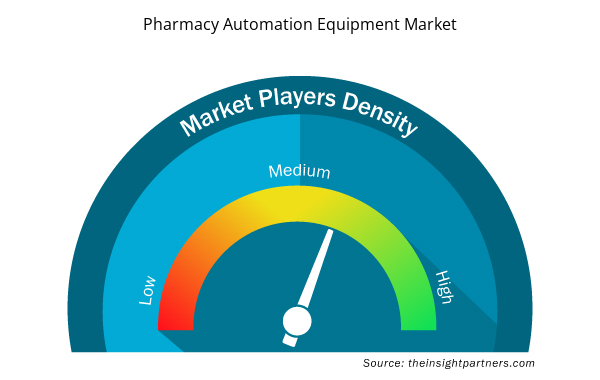

Pharmacy Automation Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The Pharmacy Automation Equipment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Pharmacy Automation Equipment Market are:

- Cerner Corporation

- AmerisourceBergen

- Baxter International Inc

- Talyst LLC (Swisslog Healthcare)

- Capsa Healthcare

- BD

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Pharmacy Automation Equipment Market top key players overview

Pharmacy Automation Equipment Market News and Recent Developments

The pharmacy automation equipment market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the pharmacy automation equipment market are listed below:

- BD (Becton, Dickinson, and Company) a leading global medical technology company, and Frazier Healthcare Partners, a leading private equity firm focused exclusively on the healthcare sector, announced a definitive agreement for BD to acquire Parata Systems, an innovative provider of pharmacy automation solutions, for $1.525 billion. (Source: BD, Press Release, June 2022)

- Canadian pharmacies serving the hospital, retail, and long-term care markets now have access to next-generation pharmacy automation technology to increase the reliability, efficiency, and safety of medication management. This includes adherence pouch packaging and inspection systems and front-loading semi-automated vial filling machines. (Source: News Letter, April 2024)

Pharmacy Automation Equipment Market Report Coverage and Deliverables

The “Pharmacy Automation Equipment Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Pharmacy automation equipment market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Pharmacy automation equipment market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Pharmacy automation equipment market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the pharmacy automation equipment market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America dominated the pharmacy automation equipment market in 2023

Key factors driving the market are an increase in the adoption of pharmacy automation equipment and a growing demand for pharmacy automation equipment.

The emergence of medication dispensing systems, robotics, artificial intelligence (AI), telepharmacies, and automated inventory management systems are likely to remain a key trend in the market.

Cerner Corporation, AmerisourceBergen, Baxter International Inc, Talyst LLC (Swisslog Healthcare), Capsa Healthcare, BD, OMNICELL INC, MCKESSON CORPORATION, ScriptPro LLC, YUYAMA Co., Ltd

The market is expected to register a CAGR of 8.0% during 2023–2031.

Get Free Sample For

Get Free Sample For