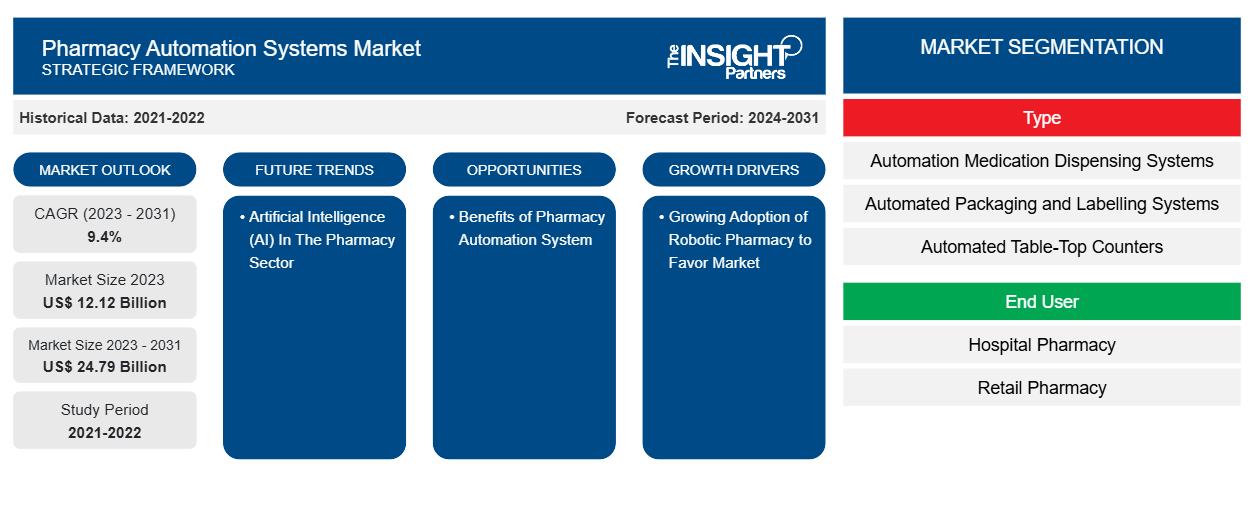

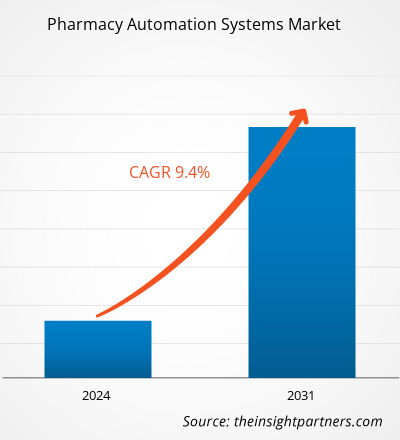

The pharmacy automation systems market size is projected to reach US$ 24.79 billion by 2031 from US$ 12.12 billion in 2023. The market is expected to register a CAGR of 9.4% during 2023–2031. Pharmacy automation for telepharmacy is likely to remain a key trend in the market.

Pharmacy Automation Systems Market Analysis

The presence of several market players and the increasing chronic diseases incidences are the key factors driving the market growth. In the UK, due to a lot of medication errors, the government suffers from a high cost. In a year, nearly 273 medication miscalculations are stated, which cost US$ 79.4 million (£98 million) to the healthcare systems. Therefore, the operating companies, along with the National Health Services (NHS) are taking strategic initiatives to curb the extent of errors. In June 2023, Omincell UK & Ireland collaborated with Alphatron Medical, the Netherlands-based company, to launch the AMiS-PRO Smart Cart in the country. Such instances are likely to transform the workflow of nurses for the medication.

Pharmacy Automation Systems Market Overview

Pharmacy automation system market driving factors include low cost, fewer medication-related errors, more significant pharmacy workflow, and good patient experience. There are vast benefits that are associated the pharmacy automation system brings to pharmacies. Furthermore, older people live with one or more chronic medical conditions, such as diabetes, arthritis, Alzheimer’s, or Parkinson’s; the treatments of these conditions require regular refilling of medicines. Therefore, with the growing aging population, the prescription demand will rise exponentially in the years to come. Currently, automation integrates automated dispensing, packaging, storing, labeling, etc, to reduce dispensing errors and increase pharmacy leaders’ productivity.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pharmacy Automation Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Pharmacy Automation Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Pharmacy Automation Systems Market Drivers and Opportunities

Growing Adoption of Robotic Pharmacy to Favor Market

Automation dismisses pharmacists from labour-intensive distributive functions and improves workflow efficiency in pharmacies. Moreover, robotics and automated systems are rising as the growing network of pharmacies can enhance patient safety, reduce costs, and improve the patient experience. Therefore, product launches are also increasing. In May 2023, ScriptPro received Retail Excellence Award–Technology and Automation from Drug Store News. The premier chain and retail industry publication, DSN, spotlights pharmacy technology companies that strive the best for their clients. Furthermore, in October 2022, McKesson Corporation opened a new state-of-the-art pharmaceutical distribution center in Jeffersonville, Ohio, between Cincinnati and Columbus. The new facility will distribute pharmaceutical, over-the-counter (OTC), and home healthcare (HHC) products as well as consumer packaged goods (CPG) to customers across Ohio, Indiana, Kentucky, Michigan, Pennsylvania, and West Virginia.

Artificial Intelligence (AI) In The Pharmacy Sector

These days AI technology has been incorporated by top pharmaceutical companies for healthcare system analysis, drug discovery, the accuracy of medicine, research and development, health support and medical assistance, treatment plan design, assisting in repetitive tasks, and others. AI provides opportunities for various other industries and fields. For instance, AI can also be implemented via telehealth partnerships, inventory management, and using chatbots to mimic patient-pharmacist interactions. In retail pharmacy and hospital pharmacy settings, AI is used to track the preparation of injectable medications, barcode scanning, and others. With such features, the adoption of automated pharmacy systems will grow in developing countries as well in the coming years.

Pharmacy Automation Systems Market Report Segmentation Analysis

Key segments that contributed to the derivation of the pharmacy automation systems market analysis are type and end-user.

- Based on type, the Pharmacy Automation Systems market is divided into automated packaging and labeling systems, automated medication dispensing systems, automated storage and retrieval systems, automated table-top counters, and other types. The pharmacy automation systems market for automated dispensing systems type is bifurcated into product and operation. The automated medication dispensing systems segment held a larger market share in 2023.

- Based on end user, the pharmacy automation systems market is divided into hospital pharmacy, retail pharmacy, and others. The hospital pharmacy segment held a larger market share in 2023.

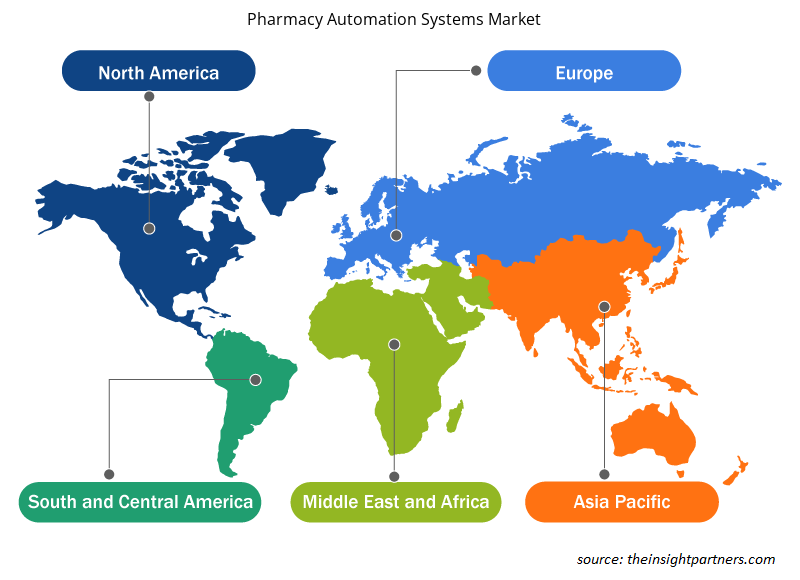

Pharmacy Automation Systems Market Share Analysis by Geography

The geographic scope of the pharmacy automation systems market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the market and Asia Pacific is anticipated to grow with the highest CAGR in the coming years. The growth of the Asia Pacific market is due to the rising use of artificial intelligence for medical device technology, international players entering the healthcare markets in the region, and the increasing geriatric population. Automation technologies are widely used in the healthcare industry, leveraging demand for automated pharmacy systems. China is the biggest exporter of active pharmaceutical ingredients to Western countries, requiring automation for the packaging and labeling of the products to be shipped. Also, production sites and warehouses have automated pharmacy systems installed in the manufacturing site. The above factors will propel the pharmacy automation systems market.

Pharmacy Automation Systems Market Regional Insights

The regional trends and factors influencing the Pharmacy Automation Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Pharmacy Automation Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Pharmacy Automation Systems Market

Pharmacy Automation Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 12.12 Billion |

| Market Size by 2031 | US$ 24.79 Billion |

| Global CAGR (2023 - 2031) | 9.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

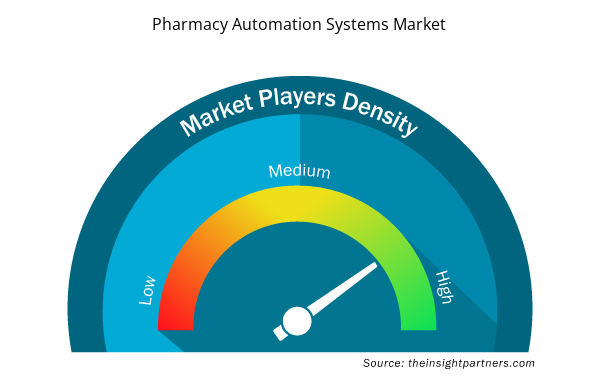

Pharmacy Automation Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Pharmacy Automation Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Pharmacy Automation Systems Market are:

- McKesson Corp

- Becton Dickinson and Company

- Capsa Solutions LLC

- Omnicell Inc

- Oracle Corp

- Deenova Srl

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Pharmacy Automation Systems Market top key players overview

Pharmacy Automation Systems Market News and Recent Developments

The pharmacy automation systems market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the pharmacy automation systems market are listed below:

- Successful Launch of JVM's Next-Generation Automated Drug Dispensing System, an affiliate of Hanmi Science, via High-End Robot Arm 'MENITH' in the European Market. (Source: Hanmi Science, Press Release, October 2023)

- Deenova announced the unveiling of three new innovative additions to its award-winning D3 product line of mechatronic solutions in conjunction with the 26th Congress of the European Association of Hospital Pharmacists, in Vienna. AIDE-Cut is one of three new Deenova’s latest modular mechatronic solutions for the repackaging of oral solid medications in unit doses. AIDE-Pack is Deenova’s new solution for the repackaging of all forms of medications (Oral and non Oral) in unit dose format, and AIDE-Pick solution is developed to fit the needs of the centralized therapy preparation in sub-acute and/or multi-site Healthcare Facilities. (Source: Deenova, Press Release, March 2022)

Pharmacy Automation Systems Market Report Coverage and Deliverables

The “Pharmacy Automation Systems Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Pharmacy automation systems market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Pharmacy automation systems market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Pharmacy automation systems market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments3

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the pharmacy automation systems market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Virtual Event Software Market

- Intraoperative Neuromonitoring Market

- Constipation Treatment Market

- Environmental Consulting Service Market

- Oxy-fuel Combustion Technology Market

- 3D Mapping and Modelling Market

- Biopharmaceutical Tubing Market

- Travel Vaccines Market

- Cosmetic Bioactive Ingredients Market

- Dropshipping Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

North America has dominated the pharmacy automation systems market.

Factors such as growing adoption of robotic pharmacy and its associated benefits will boost the market growth.

Pharmacy automation for telepharmacy is likely to remain a key trend in the market.

The pharmacy automation systems market size is projected to reach US$ 24.79 billion by 2031.

The market is expected to register a CAGR of 9.4% during 2023–2031.

Get Free Sample For

Get Free Sample For