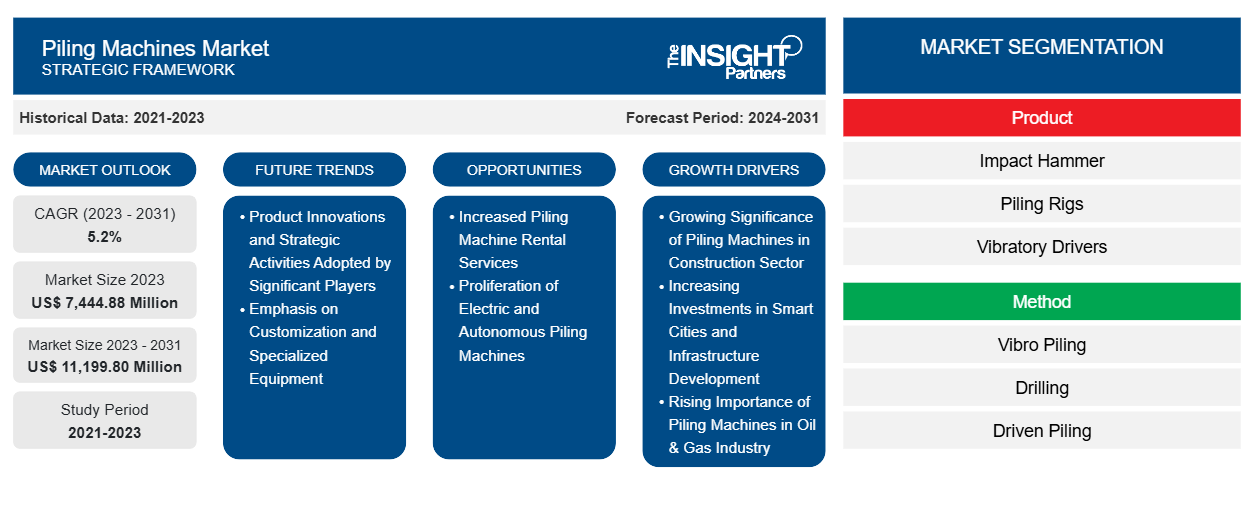

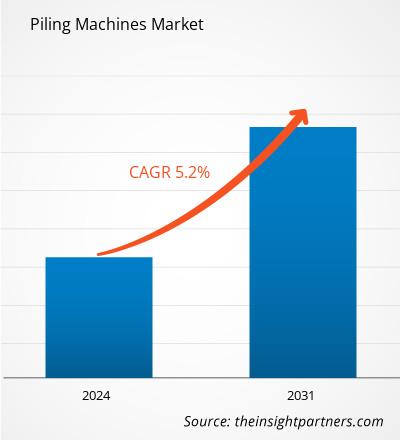

The global piling machines market is projected to reach US$ 11,199.80 million by 2031 from US$ 7,444.88 million in 2023. The market is expected to register a CAGR of 5.2% during 2023–2031. Key infrastructure developments, such as a growing number of railway stations, commercial spaces, buildings, residential housing, airports, and water treatment facilities, drive the Piling Machines market growth.

Global Piling Machines Market Analysis

The acceptance of drilling has intensified over the years. Gas distribution has been utilizing mid- and small-size drills over the years. Large drills are normally leveraged in the conventional oil & gas industry. The sewer & water industry is also driving the growth of the piling machines market

The construction industry is witnessing increased investment from governments and various private and public players. Canadatance, in May 2023, the executive government ministries of Saskatchewan, Canada, announced an investment worth US$ 1.26 million in infrastructure. As of 2023, it is the largest infrastructure investment in Saskatchewan's history. SaskBuilds and Procurement Minister announced that apart from this, the government of Saskatchewan is planning to invest nearly US$ 11.27 billion in infrastructure over the next four years. Similarly, in September 2021, the government of the UK announced US$ 709.61 billion of private and public investment projected to be implemented in infrastructure projects across the country till 2031. Such rising investments are projected to drive the piling machines market.

The construction industry is witnessing increased investment from governments and various private and public players. For instance, in May 2023, the executive government ministries of Saskatchewan, Canada, announced an investment worth US$ 1.26 million in infrastructure. As of 2023, it is the largest infrastructure investment in Saskatchewan's history. SaskBuilds and Procurement Minister announced that apart from this, the government of Saskatchewan is planning to invest nearly US$ 11.27 billion in infrastructure over the next four years. Similarly, in September 2021, the government of the UK announced US$ 709.61 billion of private and public investment projected to be implemented in infrastructure projects across the country till 2031. Such rising investments are projected to drive the piling machines market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Piling Machines Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Piling Machines Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Global Piling Machines Market Overview

The increase in residential and commercial construction activities worldwide is one of the factors driving the piling machines market. In addition, the increasing expenditure on renovation and retrofitting activities is positively affecting the growth of the piling machines market. For instance, in August 2023, T&T Construction Enterprises bagged a contract worth US$ 3.66 million for the renovation of The Hardin County Public Library, based in the US. Such projects are expected to increase the demand for piling machines during the forecast period. Further, the development of the drilling industry is driven by the growing application of various drilling techniques and equipment in oil & gas, utility, mining, telecommunication, and sewer & water facilities sectors.

The acceptance of drilling has intensified over the years. In the natural gas distribution space, telecommunication projects are two noteworthy application areas of drilling, specifically in urban environments. Telecommunication projects boost the application of small- and mid-size drilling rigs. Gas distribution has been utilizing mid- and small-size drills over the years. Large drills are normally leveraged in the conventional oil & gas industry. The sewer & water industry is also driving the growth of the piling machines market.

Global Piling Machines Market Drivers and Opportunities

Growing Significance of Piling Machines in Construction Sector

The construction industry is continuously growing due to an increase in low-to-medium-priced residential housing projects, commercial infrastructure, and government-backed infrastructure initiatives, including roads, bridges, and highways. As the construction industry develops and evolves, the requirement for construction equipment and machines becomes essential. There is an increase in various types of infrastructural development projects, such as residential buildings, commercial complexes, and industrial facilities. Each project needs various kinds of machines for construction, repair, maintenance, and renovation. Rapid urbanization and population outbursts drive the necessity for new housing, commercial spaces, and infrastructure. For instance, in March 2023, the Canadian Kelowna City Council stated authorization for funding of US$ 90 million for the expansion project of the Kelowna Airport terminal.

The increasing infrastructure development across the globe drives the Piling Machiness market growth. For instance, in September 2024, Santo Domingo Water Utility (CAASD) announced a bunch of projects to solve water shortages and the lack of sewers in the Dominican Republic's capital, promoting the number of construction and infrastructure development activities in the country. In January 2024, The European Climate, Environment, and Infrastructure Executive Agency received ∼400 applications requesting US$ 20 billion for transport infrastructure projects. The rising population is another factor increasing the demand for public infrastructure and the development of new transport networks and residential structures. As per the data published by the European Union in 2023, the EU's population increased from 446.7 million in January 2022 to 448.4 million in January 2023.

Increased Piling Machines Rental Services

The growing inclination toward renting construction equipment, including piling machines, is expected to offer an opportunity for rental companies to expand their services. Renting services allow construction companies to access high-end machines and equipment without the financial obligation of ownership. At present, piling machines are not restricted to conventional construction projects; they are gradually being utilized in various sectors, including renewable energy; for instance, wind turbine foundations and marine construction that involve docks and piers. This expansion opens new possibilities for growth and lets manufacturers choose different kinds of piling machines according to their requirements. The growing proliferation of rental services offers construction companies the liberty to rent various kinds of piling machines as per specific requirements.

Rental services offer companies the elasticity to scale their operations to match the project needs. Construction projects vary in duration and scope, allowing companies to access a rental fleet for suitable equipment for each operation without being tied to a single machine. Furthermore, when renting Piling Machiness, the liability for maintenance normally falls on the rental company. This understanding allows construction companies to emphasize their fundamental activities without being concerned about the maintenance of heavy machinery

Global Piling Machines Market Report Segmentation Analysis

Key segments that contributed to the derivation of the global piling machines market analysis are product, method, and region.

- Based on product, the piling machines market is segmented into impact hammers, piling rigs, vibratory drivers, and others. In terms of method, the market is categorized into vibro piling, drilling, and driven piling. Geographically, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Global Piling Machines Market Share Analysis by Geography

The geographic scope of the global Piling Machines market report offers detailed regional analysis.

Asia Pacific's construction and infrastructure sector is experiencing robust expansion and development initiatives, boosted by the region's surging economic growth and increasing population. Key infrastructure developments include a growing number of railway stations, commercial spaces, buildings, residential housing, airports, and water treatment facilities. High-speed rail projects are at the foreground of transportation infrastructure. Japan's Chuo Shinkansen, China's high-speed rail network expansion, and Australia's Sydney to Melbourne link are a few of the major construction projects positively impacting the piling machine market.

The Government of New Zealand is emphasizing on developing infrastructure networks such as water and wastewater systems, road and rail networks, electricity transmission, and telecommunication infrastructure. Growing population and increasing urbanization are boosting the need to expand and upgrade important infrastructure facilities in the country. In 2023, The government offered ~US$ 47 billion for infrastructure development over the coming five years. The growing focus on infrastructure development is anticipated to propel the growth of construction activities and the application of piling machines across the country in the coming years.

Global Piling Machines Market Regional Insights

Piling Machines Market Regional Insights

The regional trends and factors influencing the Piling Machines Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Piling Machines Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Piling Machines Market

Piling Machines Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 7,444.88 Million |

| Market Size by 2031 | US$ 11,199.80 Million |

| Global CAGR (2023 - 2031) | 5.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Piling Machines Market Players Density: Understanding Its Impact on Business Dynamics

The Piling Machines Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Piling Machines Market are:

- Liebherr-Werk Nenzing GmbH

- Junttan Oy

- Bauer AG

- Soilmec SpA

- Casagrande SpA

- Comacchio SpA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Piling Machines Market top key players overview

Global Piling Machines Market News and Recent Developments

The global Piling Machines market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the global Piling Machines market are listed below:

- Conventional drilling and piling equipment cannot always be used in the railway sector without great effort, RTG Rammtechnik GmbH, which belongs to the BAUER Maschinen Group, together with the Leipzig company Techne and accompanied by Hering Bau GmbH & Co. KG, developed a track-bound drilling and piling rig. The overall system consists of the carrier device with a leader based on an RTG RG 18 S, a flat car for storing the leader and another flat car for transport and for upgrading the attachments. With the leader erected, the device reaches a height of approx. 23 m. The leader has a main winch with 170 kN, a feed winch with 200 kN and an auxiliary winch with 55 kN. A mast inclination of 5° in all directions is possible during operation to compensate for formation. In addition, the leader can be swiveled around the axis of the telescopic arm by 90° to each side, which means that it can always be brought into the desired working position in relation to the superstructure. The leader arm can be telescoped up to 2 m. The connection is bolted hydraulically.

- Bauma - the world's leading trade fair for construction machinery, building material machines, mining machines, construction vehicles, and construction equipment - opens its doors at the Munich Exhibition Center. Over 3,000 exhibitors from 58 countries will present themselves on around 200,000 m 2 of hall space and more than 400,000 m 2 of outdoor space until October 30th.

- BAUER Training Center GmbH, together with Usaneers GmbH, developed the "Next Level Operator" application. There are two training options for the construction trade. The only requirements are a stable internet connection and augmented reality glasses (AR glasses) with the appropriate software.

Global Piling Machines Market Report Coverage and Deliverables

The "Global Piling Machines Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Global Piling Machines market size and forecast at regional and country levels for all the key market segments covered under the scope

- Global Piling Machines market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Global Piling Machines market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the global Piling Machines market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Nuclear Waste Management System Market

- Battery Testing Equipment Market

- Thermal Energy Storage Market

- Cut Flowers Market

- Molecular Diagnostics Market

- Sleep Apnea Diagnostics Market

- Public Key Infrastructure Market

- Airport Runway FOD Detection Systems Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- EMC Testing Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Method

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Belgium, Brazil, Canada, China, Denmark, Finland, France, Germany, India, Italy, Japan, Mexico, Netherlands, Norway, Russian Federation, Saudi Arabia, South Africa, South Korea, Sweden, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Proliferation of Electric and Autonomous Piling Machines: The adoption of automation technologies is growing rapidly across industries such as manufacturing, automotive, and IT. Many manufacturers are focusing on developing autonomous piling machines. In March 2023, Built Robotics introduced an autonomous pile-driving robot that is helping to build utility-scale solar farms faster, safer, and more cost-effectively, making solar viable even in the most remote regions.

Liebherr-Werk Nenzing GmbH, Junttan Oy, Bauer AG, Soilmec SpA, Casagrande SpA, Comacchio SpA, Mait SpA, ABI Equipment Ltd, Enteco Srl, IMT Srl, Sany Heavy Industry Co Ltd, CONSTRUCCIONES MECANICAS LLAMADA SL, BSP TEX Ltd, BRUCE Piling Equipment Co Ltd, American Piledriving Equipment Inc, Terra Infrastructure GmbH, International Construction Equipment Inc, FAYAT GROUP, XCMG Construction Machinery Co Ltd, and TWF Baumaschinentechnik GmbH are among the key companies operating in the piling machines market.

The Asia Pacific piling machines market is expected to dominate the market owing to increasing construction activities at a rapid pace during the forecast period.

One of the most noteworthy trends in the piling machines market is the growing demand for customization and specific equipment altered to explicit applications. As construction projects become more diverse and complex, contractors are seeking piling machines that can fulfill single-project requirements. This trend is driven by the need for effectiveness and efficiency in numerous environments, such as urban sites where space is limited or in challenging geological circumstances.

The construction industry is continuously growing due to an increase in low-to-medium-priced residential housing projects, commercial infrastructure, and government-backed infrastructure initiatives, including roads, bridges, and highways. As the construction industry develops and evolves, the requirement for construction equipment and machines becomes essential. There is an increase in various types of infrastructural development projects, such as residential buildings, commercial complexes, and industrial facilities. Each project needs various kinds of machines for construction, repair, maintenance, and renovation. Rapid urbanization and population outbursts drive the necessity for new housing, commercial spaces, and infrastructure. For instance, in March 2023, the Canadian Kelowna City Council stated authorization for funding of US$ 90 million for the expansion project of the Kelowna Airport terminal.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Piling Machines Market

- Liebherr-Werk Nenzing GmbH

- Junttan Oy

- Bauer AG

- Soilmec SpA

- Casagrande SpA

- Comacchio SpA

- Mait SpA

- ABI Equipment Ltd.

- Enteco Srl

- IMT Srl

- Sany Heavy Industry Co Ltd.

- CONSTRUCCIONES MECANICAS LLAMADA SL

- BSP TEX Ltd.

- BRUCE Piling Equipment Co Ltd.

- American Piledriving Equipment Inc.

- Terra Infrastructure GmbH

- International Construction Equipment Inc

- FAYAT GROUP

- XCMG Construction Machinery Co Ltd.

- TWF Baumaschinentechnik GmbH

Get Free Sample For

Get Free Sample For