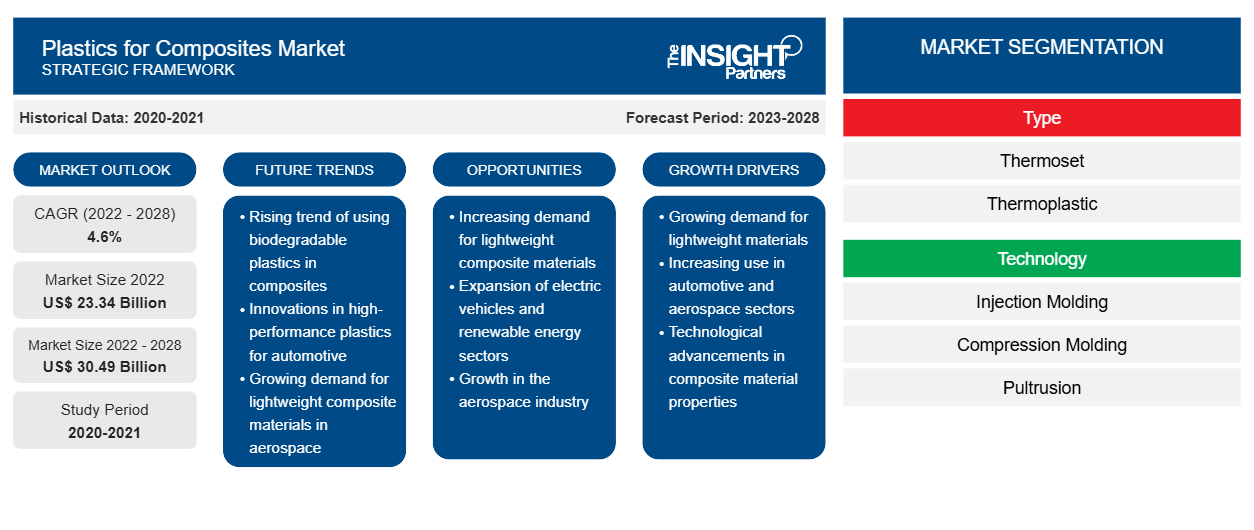

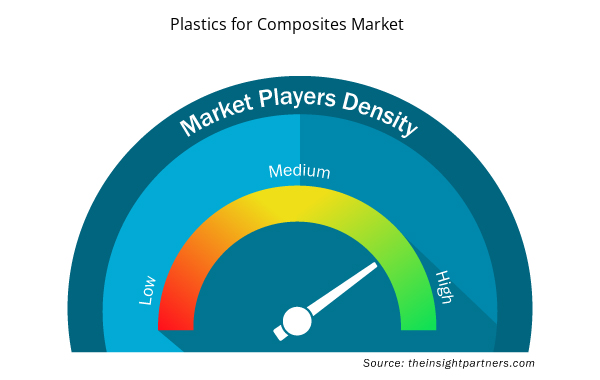

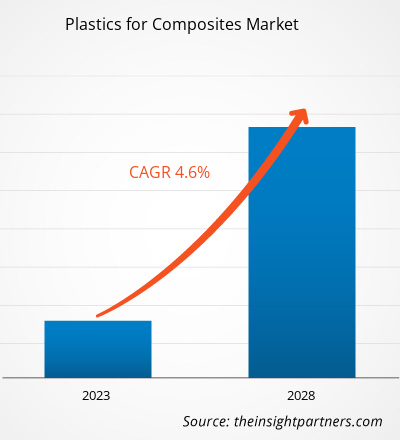

The plastics for composites market is expected to grow from US$ 23,337.24 million in 2022 to US$ 30,490.85 million by 2028; it is estimated to record a CAGR of 4.6% from 2022 to 2028.

Composites are materials that consist of two or more chemically and physically different phases separated by a distinct interface. Most commercially produced composites use a polymer matrix material, often called a resin solution. Commonly used polymer matrices include polyester, vinyl ester, epoxy, phenolic, polyimide, polyamide, polypropylene, and polyether ether ketone (PEEK). Low cost, easy processability, good chemical resistance, and low specific gravity are among the major advantages associated with polymer matrices.

The increasing uptake of composite resins in building & construction activities, and aerospace and military applications is contributing to the plastics for composites market growth. In addition, the demand for lightweight materials in vehicle manufacturing, to improve fuel efficiency, is another factor propelling the expansion of the market. Further, the rising demand for thermoplastic resins is contributing significantly to the overall plastic for composites market growth. Rigid fibers and more heat resistance, crack resistance, high strike resistance, and tough polymer matrix are the major characteristics of polymer composites that drive their popularity. Increasing investments in renewable energy generation are likely to trigger the demand for polymer composites over the coming years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Plastics for Composites Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Plastics for Composites Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Increasing Demand from Automotive and Aerospace Industries Drives Plastics for Composites Market Growth

The composite resin is utilized in various applications, including construction and infrastructure, transportation, electrical & electronics, wind energy, pipelines and tanks, marine, and aerospace & military. Advanced materials are crucial for boosting the fuel economy of modern automobiles while ensuring safety and performance. Since it takes less energy to accelerate lighter objects than heavier ones, lightweight materials offer excellent potential for increasing vehicle efficiency. Therefore, high demand for composites from the automotive industry for the manufacturing of fuel-efficient, lightweight vehicles drives the plastics for composites market growth. End-use industries in emerging economies, such as China and India, are the major contributors to the rising demand for plastics for composites. The increasing need for lighter-weight materials to construct aviation components and parts has been another significant factor contributing to the growth of the plastics for composites market. Aircraft manufacturers are making efforts to enlarge primary thermoplastic structures in business jets and commercial aircraft. They have been the early adopters of long fiber-reinforced thermoplastics.

Type Insights

Based on type, the plastics for composites market is segmented into thermoset (polyester, vinyl ester, epoxy, polyurethane, and others) and thermoplastic (polypropylene, polyethylene, polyvinyl chloride, polystyrene, polyethylene terephthalate, polycarbonate, and others). The thermoset segment held a larger share of the market in 2021. Thermoset is a popular polymer matrix material for fiber-reinforced composites. Common examples of thermosets include epoxies and polyesters. They are among the major types of matrix systems, specifically used in the aerospace industry. Thermoset matrix composites are more extensively used than thermoplastic matrix composites due to their lower viscosity at relatively low temperatures (less than 100°C), which better facilitates the resin/fiber wetting process. These factors are expected to drive the growth of the market for thermoset matrix components.

Lanxess AG, Covestro AG, Celanese Corp, INEOS Group Holdings SA, Daicel Corp, BASF SE, Evonik Industries AG, Solvay SA, Saudi Basic Industries Corp, and Arkema SA are among the key players operating in the plastics for composites market. The leading players adopt strategies such as mergers and acquisitions, and product launches to expand their geographic presence and consumer base. For instance, in June 2022, Lanxess AG launched a composite with polyamide 6 matrix based on “green” cyclohexane.

Plastics for Composites Market Regional Insights

Plastics for Composites Market Regional Insights

The regional trends and factors influencing the Plastics for Composites Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Plastics for Composites Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Plastics for Composites Market

Plastics for Composites Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 23.34 Billion |

| Market Size by 2028 | US$ 30.49 Billion |

| Global CAGR (2022 - 2028) | 4.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Plastics for Composites Market Players Density: Understanding Its Impact on Business Dynamics

The Plastics for Composites Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Plastics for Composites Market are:

- Lanxess AG

- Covestro AG

- Celanese Corp

- INEOS Group Holdings SA

- Daicel Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Plastics for Composites Market top key players overview

Report Spotlights

- Progressive trends in the plastics for composites industry to help players develop effective long-term strategies

- Business growth strategies adopted by companies to secure growth in developed and developing markets

- Quantitative analysis of the global plastics for composites market from 2020 to 2028

- Estimation of the demand for plastics for composites across various industries

- Porter's Five Forces analysis to illustrate the efficacy of buyers and suppliers operating in the plastics for the composites industry

- Recent developments to understand the competitive market scenario and demand for plastics for composites

- Market trends and outlook, and factors governing the growth of the plastics for composites market

- Enlightening strategies that underpin commercial interest concerning the market growth, aiding in the decision-making process

- Plastics for composites market size at various nodes of market

- Detailed overview and segmentation of the market, as well as its industry dynamics

- Plastics for composites market size in various regions with promising growth opportunities

The "Plastics for Composites Market Analysis to 2028" is a specialized and in-depth study of the chemicals and materials industry, focusing on the plastics for composites market trend analysis. The report aims to provide an overview of the market with detailed segmentation. The plastics for composites market is segmented on the basis of type, technology, and geography. Based on the type, the market is segmented into thermoset (polyester, vinyl ester, epoxy, polyurethane, and others) and thermoplastic (polypropylene, polyethylene, polyvinyl chloride, polystyrene, polyethylene terephthalate, polycarbonate, and others). Based on technology, the market is segmented into injection molding, compression molding, pultrusion, resin infusion, and others. In terms of geography, the market is segmented into five main regions—North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. In 2021, Asia Pacific dominated the plastics for composites market. The region is expected to register the highest CAGR in the market during the forecast period. The automotive and construction industries in Asia Pacific are growing at a rapid pace. It is the most populated region in the world, and the region hosts one of the world's most rapidly developing construction industries. These factors contribute to a high demand for plastics for composites in Asia Pacific.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Electronic Data Interchange Market

- Small Internal Combustion Engine Market

- Saudi Arabia Drywall Panels Market

- Foot Orthotic Insoles Market

- Pharmacovigilance and Drug Safety Software Market

- Vaginal Specula Market

- Sterilization Services Market

- Smart Grid Sensors Market

- Data Annotation Tools Market

- Queue Management System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Technology

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The increasing utilization of plastics for composites in building & construction activity, aerospace, and military applications are some of the key factors that contribute to the growth of the market. In addition, the demand for lightweight materials from transportation, which in response improves the efficiency of fuel, is another factor propelling the expansion of the market. These factors are driving the plastics for composites market growth.

During the forecast period, thermoplastic is expected to be the fastest-growing segment. The growing adoption of thermoplastic within the automotive industry, rising demand for recyclable and fast-curing materials, increasing demand for automobiles, and growing penetration of composite materials by replacing metals are significant factors boosting the growth of the thermoplastic segment in plastics for composites market demand during the forecast period.

During the forecast period, the compression molding segment is expected to be the fastest-growing segment. The manufacture of various parts of electronic and automotive products has increased due to the increased demand for automotive and electrical products, particularly vehicles, mobile phones and tablets. The compression molding process is primarily used in the fabrication of these parts. These factors are expected to accelerate the growth of the compression molding segment of the plastics for composites market.

In 2021, the thermoset segment held the largest market share. Increased use of thermoset plastic in the aerospace and automobile industry due to their lower viscosity at relatively low temperatures (less than 100°C), which better facilitates the resin/fiber wetting process led to the dominance of the thermoset segment in the plastics for composites market.

The major players operating in the plastics for composites market are Lanxess AG, Covestro AG, Celanese Corp, INEOS Group Holdings SA, Daicel Corp, BASF SE, Evonik Industries AG, Solvay SA, Saudi Basic Industries Corp, and Arkema SA.

In 2021, Asia-Pacific accounted for the largest share of the global plastics for composites market. Growing demand from construction, wind power, electronics, and automotive industries led to the dominance of the Asia Pacific region in 2021.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Plastics for Composites Market

- Lanxess AG

- Covestro AG

- Celanese Corp

- INEOS Group Holdings SA

- Daicel Corp

- BASF SE

- Evonik Industries AG

- Solvay SA

- Saudi Basic Industries Corp

- Arkema SA

Get Free Sample For

Get Free Sample For