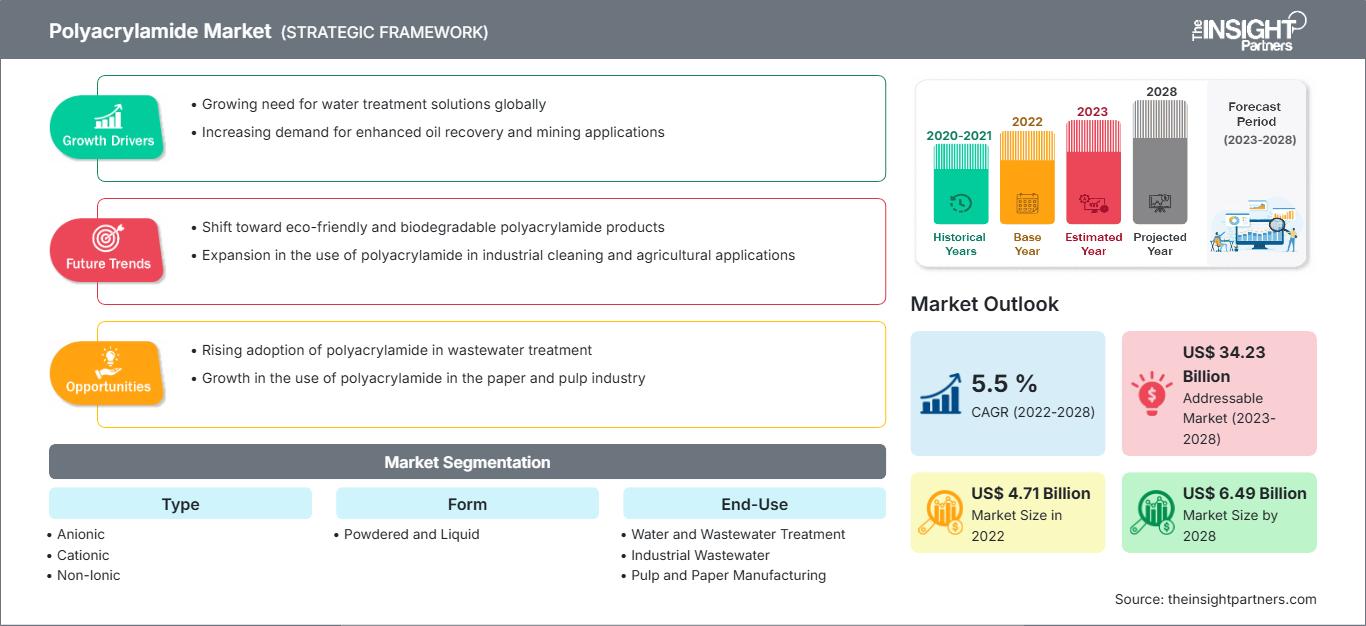

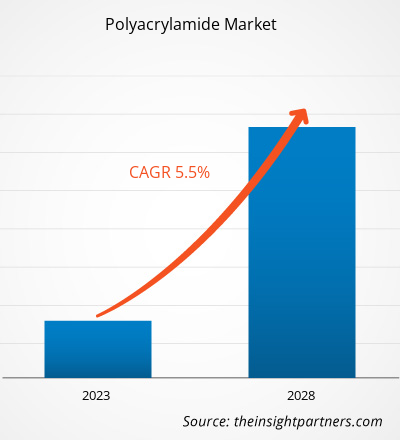

[Research Report] The polyacrylamide market was valued at US$ 4714.79 million in 2022 and is projected to reach US$ 6485.30 million by 2028; it is expected to register a CAGR of 5.5 % from 2022 to 2028.

Rapidly growing water treatment industries across the globe are projected to drive the growth of the polyacrylamide market. Polyacrylamide is a synthetic and long chain of homopolymers. It has high molecular weight and high solubility in water, making it suitable for the water treatment industry. It is widely used as a thickening agent, binder, and flocculating agent. Investment in energy projects owing to rising demand also increases the demand for polyacrylamide in petroleum applications. For instance, the US is investing in its shale oil and gas exploration projects to meet the increasing demand and cut the dependency on Middle Eastern countries for oil, petroleum, and petrochemical derivatives.

The market is dominated by multinationals such as SNF Group, BASF SE, and Kemira, which account for more than 50% of the total market share. These multinational companies have systems to distribute their products directly or indirectly to domestic and international markets. In addition, companies are expected to increase production to meet rising global demand, which has also anticipated the demand for polyacrylamide in manufacturing various products for end-use industries. Key manufacturers such as SNF and BASF SE have brand values and strategic partnerships, which enables easy marketing of their polyacrylamide products in the market. The manufacturers focus on improving their product quality and investing more in R&D to reduce the polyacrylamide cost and tap the consumer base.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Polyacrylamide Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

In 2021, Asia Pacific held the largest share of the polyacrylamide markets. Asia Pacific is the largest market for polyacrylamide due to the increasing industrialization and population in the region, which increased the demand for water purification for industrial applications. The region's strong pharmaceutical and chemical industry sector generated large amounts of wastewater, which is expected to drive the demand for polyacrylamide as a water treatment chemical during the forecast period. The region is also one of the world's leading pulp and paper markets and is home to several major pulp and paper industries, including Shandong Pulp and Paper Co., Ltd. Demand for polyacrylamide from the oil & gas industry in China, India, and the other Asia Pacific regions is expected to drive the market demand in this region. Due to extensive coal mining and washing operations, China has become one of the largest markets for polyacrylamides. India is expected to become one of the fastest growing markets for polyacrylamides for wastewater treatment businesses due to the growth of water treatment and oil and gas businesses in the region.

Impact of COVID-19 Pandemic on polyacrylamide market

The COVID-19 pandemic severely impacted the global market in 2020 due to disrupted supply chains of raw materials used in producing polyacrylamide for various end-use industries such as wastewater treatment, pulp and paper manufacturing, and others. Further, the ease of lockdown measures in several countries and resumption of operational activities in many industries helped revive the polyacrylamide market from 2021. In addition, the rapid pace of COVID-19 vaccination programs supported the polyacrylamide market's growth over the last few quarters.

Market Insights

Development Across Mining and Textile Industry Favors Polyacrylamide Market

In the textile industry, polyacrylamide is used as a finish for the post-treatment of fibers. It can create a soft protective layer in textiles. This range of chemical fibers can reduce yarn breakage rates through strong moisture absorption. Polyacrylamide makes the material resistant to fire and static electricity. As a textile chemical, it provides excellent adhesion and high elasticity. It can also act as a silicone-free polymer stabilizer.

In the mining industry, polyacrylamide is used for the flocculation separation of mineral solids from water or aqueous solution. In the mining industry, it is also used for the treatment of wastewater as the mining industry uses tons of water for coal washing.

Application Insights

Based on type, the polyacrylamide market is segmented into cationic, anionic, and non-ionic. Cationic holds the largest market share. Cationic polyacrylamide is used as a sludge conditioner for its low dosage requirement and higher efficiency. Demand for polyacrylamide polymers is anticipated to increase as coal washing activity increases in many European countries such as the UK and the development of a wide range of mobile and modular coal washing units for the preparation and separation of various grades of coal and the recovery and processing of coal fines is a key driver of the growth of the UK polyacrylamide market.

A few of the key market players in the polyacrylamide market are SNF; Kemria Oyj; BASF SE; China National Petroleum Corporation; Anhui Jucheng Fine Chemicals; Mitsui Chemicals, Inc.; Ashalnd Inc.; Black Rose Industries Ltd.; Xitao Polymer Co., Ltd.; and Dongying Kechuang Biochemical Industrial Co. Ltd. These companies provide a wide range of polyacrylamide portfolios for various end-use industries. They also have a presence in developing countries. These market players are highly focused on developing high-quality, innovative products to fulfill customer requirements.

Polyacrylamide Market Regional InsightsThe regional trends and factors influencing the Polyacrylamide Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Polyacrylamide Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Polyacrylamide Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4.71 Billion |

| Market Size by 2028 | US$ 6.49 Billion |

| Global CAGR (2022 - 2028) | 5.5 % |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Polyacrylamide Market Players Density: Understanding Its Impact on Business Dynamics

The Polyacrylamide Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Polyacrylamide Market top key players overview

Report Spotlights

- Progressive industry trends in the polyacrylamide market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the polyacrylamide market from 2020 to 2028

- Estimation of demand for polyacrylamide global market.

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers in the polyacrylamide market

- Recent developments to understand the competitive market scenario

- Market trends and outlook as well as factors driving and restraining the growth of the polyacrylamide market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest

- The size of the polyacrylamide market at various nodes

- Detailed overview and segmentation of the market, as well as the polyacrylamide industry dynamics

- Size of the polyacrylamide market with promising growth opportunities

Frequently Asked Questions

Which region held the fastest CAGR in the global polyacrylamide market?

Based on end-use, which segment is among the leading segment in the global polyacrylamide market during the forecast period?

Based on form, which segment is leading the global polyacrylamide market during the forecast period?

Based on type, which segment is leading the global polyacrylamide market during the forecast period?

Can you list some of the major players operating in the global polyacrylamide market?

Which region held the largest share of the global polyacrylamide market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For