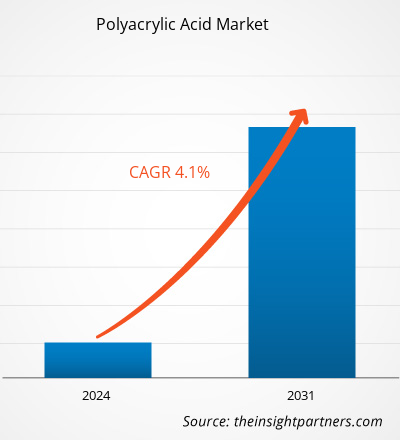

The polyacrylic acid market was valued at US$ 2.43 billion in 2023 and is expected to reach US$ 3.34 billion by 2031; it is estimated to register a CAGR of 4.1% from 2023 to 2031.

Market Insights and Analyst View:

Polyacrylic acid is a synthetic, high-molecular-weight, and water-soluble polyelectrolyte. Polyacrylic acid is made by polymerizing acrylic acid. The polymerization is carried out in a solvent, such as water or mixtures of water and isopropanol. Market players offer polyacrylic acid in powder and liquid forms. The global polyacrylic acid market is highly competitive. Polyacrylic acid is used in various end-use industries such as water treatment, personal care & cosmetics, detergents & cleaners, leather & textiles, pulp & paper, paints & coatings, and ceramics. It is a versatile synthetic polymer with various industrial applications, including water treatment, personal care products, textiles, adhesives, paints and coatings, and pulp and paper. Further, the adoption of polyacrylic acids in the detergents & cleaners industry is expected to offer lucrative opportunities for the polyacrylic acid market growth during the forecast period.

Growth Drivers and Challenges:

The rising focus on water and wastewater treatment activities and upsurging demand from the pulp & paper industry contribute to the growing polyacrylic acid market size. Many European countries are progressing toward wastewater treatment targets and the protection of sensitive water systems. Data published by the European Environment Agency (EEA) in 2021 shows that ~90% of urban wastewater is collected and treated in accordance with the EU Waste Water Treatment Directive across the EU. Country analysis based on the implementation of EU rules on wastewater treatment shows that the EU member states are significantly applying the rules, and the compliance rate slightly increased between 2016 and 2018. The global paper & pulp industry is growing due to factors such as the expanding e-commerce sector, increasing demand for paper packaging products, and rising demand for eco-friendly packaging products. Countries in Europe, Asia, and North America such as the US, China, Germany, Japan, Finland, and Canada are major pulp and paper producers across the world. In Europe, paper production is concentrated in the northern European countries, including Finland, Russia, and Sweden. The expansion of the water treatment and pulp & paper industries drives the polyacrylic acid market growth.

The volatility in raw material prices can act as a deterrent for the polyacrylic acid market. Supply and demand gaps, natural disasters, political instability, currency fluctuations, and other factors can fluctuate raw materials’ prices. The volatility in raw material prices makes it difficult for manufacturers to plan and budget for their operations. Polyacrylic acid is of fossil origin. Acrylic acid is a major raw material in the production of polyacrylic acid. One of the major reasons impacting propylene prices is the global economic landscape. The propylene market is closely tied to the oil & gas industry, as propylene is mainly derived from the refining of crude oil or the cracking of natural gas liquids. Price hikes in petroleum products and other raw materials can restrain the profit margins on the products, posing a challenge to the market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Polyacrylic Acid Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Polyacrylic Acid Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Global Polyacrylic Acid Market Analysis and Forecast to 2031" is a specialized and in-depth study with a significant focus on global market trends and growth opportunities. The report aims to provide an overview of the market with detailed market segmentation by form, application, and end-use industry. The market has witnessed high growth in the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the consumption of polyacrylic acids globally. In addition, the global polyacrylic acid market report provides a qualitative assessment of various factors affecting the market performance globally. The report also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Several analyses were conducted to identify the key driving factors, polyacrylic acid market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The polyacrylic acid market forecast is estimated on the basis of various secondary and primary research findings, such as key company publications, association data, and databases. Further, the ecosystem analysis and Porter's five forces analysis provide a 360-degree view of the market, which helps understand the entire supply chain and various factors affecting the market performance.

Segmental Analysis:

The global polyacrylic acid market is segmented on the basis of form, application, and end-use industry. Based on form, the market is bifurcated into powder and liquid. The liquid segment accounted for a significant polyacrylic acid market share in 2023. Handling liquid PAA solutions reduces the risk of dust exposure compared to powdered counterparts. Liquid readily mixes with water and other solvents, allowing quick and efficient solution preparation with precise concentration. Liquid solution is less prone to agglomeration or clumping than powder form, ensuring consistent product performance. However, powder is easier to handle and transport compared to liquid solutions. It has a long shelf life and is less prone to spillage or leakage during storage and transportation. PAA powder can be easily dissolved in water to form solutions with desired concentrations, offering versatility in applications across various industries such as water treatment, personal care, and textiles.

Based on application, the market is segmented into dispersing agents, anti-scaling agents, thickeners, emulsifiers, ion-exchanger, and others. The anti-scaling agent segment held a substantial polyacrylic acid market share in 2023. PAA inhibits the deposition of insoluble mineral salts onto a surface, thereby making it a significant chemical in water treatment, preventing deposit formation in various oil and gas applications and industrial cleaning. PAA is widely used in water treatment to prevent scale formation in water cooling systems, boilers, and reverse osmosis membranes. It is a cost-effective, environment-friendly solution to prevent and mitigate mineral scale formation.

Based on end-use industry, the polyacrylic acid market is segmented into water treatment, personal care and cosmetics, detergents and cleaners, leather and textiles, pulp and paper, paints and coatings, ceramics, and others. The water treatment segment accounted for a significant market share in 2023. PAA finds application as a clarifying agent, dispersing agent, and anti-scaling agent in membrane-based water treatment processes such as reverse osmosis and ultra-filtration. It aids in preventing membrane fouling and scaling by inhibiting the precipitation of sparingly soluble salts on membrane surfaces. In the past few years, several efforts have been made to study the utilization of PAA to eliminate undesirable compounds from water.

Regional Analysis:

The report provides a detailed overview of the market with respect to five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. In terms of revenue, Asia Pacific dominated the polyacrylic acid market and was valued at more than US$ 850 million in 2023. The Asia Pacific market, by country, is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. The demand for polyacrylic acid has been steadily increasing in the region as it is one of the most rapidly growing markets driven by significant industrialization and urbanization trends. The rise in demand can be attributed to its versatile applications across various industries, including personal care, paints & coatings, textile processing, and water treatment. All these factors boost the polyacrylic acid market in Asia Pacific.

The Europe polyacrylic acid market is expected to reach ~US$ 750 million by 2031. According to a report published by the Confederation of European Paper Industries in February 2024, the total production of pulp generated a total output of ~33 million tons, of which chemical pulp accounted for 79% of total pulp production in 2023. Polyacrylic acid copolymers are used as additives for surface sizing of linerboard and paper boards. Further, acrylic acid polymers and copolymers are used as hydrosoluble agents for dispersing agents, thickeners, flocculating agents, and copolymer emulsions for paints and papers.

Polyacrylic Acid Market Regional Insights

Polyacrylic Acid Market Regional Insights

The regional trends and factors influencing the Polyacrylic Acid Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Polyacrylic Acid Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Polyacrylic Acid Market

Polyacrylic Acid Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.43 Billion |

| Market Size by 2031 | US$ 3.34 Billion |

| Global CAGR (2023 - 2031) | 4.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Form

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

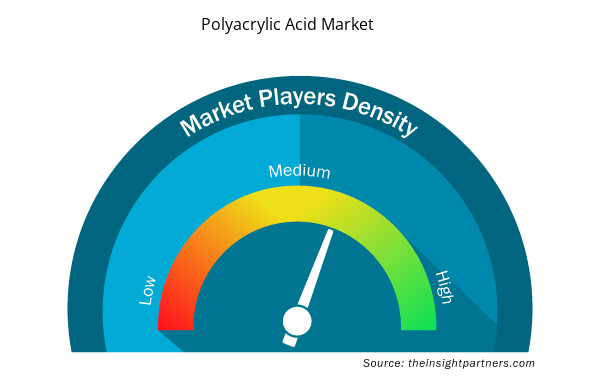

Polyacrylic Acid Market Players Density: Understanding Its Impact on Business Dynamics

The Polyacrylic Acid Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Polyacrylic Acid Market are:

- Arkema

- Ashland Inc

- BASF SE

- Evonik Industries AG

- Glentham Life Sciences Limited

- Nippon Shokubai Co Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Polyacrylic Acid Market top key players overview

Industry Developments and Future Opportunities:

Following are a few recent developments by major companies in the polyacrylic acid market, as per company press releases:

- In 2023, BASF SE announced the opening of the production complex at its Verbund site in Zhanjiang, China. The complex includes the production facility for butyl acrylate (BA), glacial acrylic acid (GAA), and 2-ethylhexyl acrylate (2-EHA). The company revealed its plan to stream by 2025, and the complex will have an annual production capacity of ∼400,000 metric tons of BA and 100,000 metric tons of 2-EHA.

In 2023, Nippon Shokubai Co Ltd inaugurated the acrylic acid facility with a production capacity of 100,000 MT/year in Cilegon, Banten, Indonesia. The total investment of the project is reported to be ∼US$ 200 million.

Competitive Landscape and Key Companies:

Arkema SA, Ashland Inc, BASF SE, Evonik Industries AG, Nippon Shokubai Co Ltd, Sumitomo Seika Chemicals Co Ltd, The Dow Chemical Co, The Lubrizol Corp, Shandong ThFine Chemical Co Ltd, and Glentham Life Sciences Limited are among the key players profiled in the polyacrylic acid market report. The global market players focus on providing high-quality products to fulfill customer demand.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Arkema SA, Ashland Inc, BASF SE, Evonik Industries AG, Nippon Shokubai Co Ltd, Sumitomo Seika Chemicals Co Ltd, The Dow Chemical Co, The Lubrizol Corp, Shandong ThFine Chemical Co Ltd, and Glentham Life Sciences Limited are among the key players profiled in the polyacrylic acid market report.

In 2023, Asia Pacific held the largest share of the global polyacrylic acid market. The demand for polyacrylic acid has been steadily increasing in Asia Pacific as it is one of the most rapidly growing markets driven by significant industrialization and urbanization trends.

The liquid segment held the largest share in the global polyacrylic acid market in 2023. Liquid PAA solutions are homogeneous, ensuring consistent performance and application across different batches and conditions.

The polyacrylic acid market growth is attributed to the rising focus on water and wastewater treatment activities and the rising demand from the paper & pulp industry.

Asia Pacific is estimated to register the fastest CAGR in the global polyacrylic acid market over the forecast period. The increasing emphasis on environmental protection and stringent regulations concerning wastewater treatment has led to a rise in demand for polyacrylic acid-based flocculants and coagulants in the water treatment sector in Asia Pacific.

The anti-scaling agent segment held the largest share of the global polyacrylic acid market in 2023. PAA is widely used in water treatment to prevent scale formation in water cooling systems, boilers, and reverse osmosis membranes.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Polyacrylic Acid Market

- Arkema SA

- Ashland Inc

- BASF SE

- Evonik Industries AG

- Nippon Shokubai Co Ltd

- Sumitomo Seika Chemicals Co Ltd

- The Dow Chemical Co

- The Lubrizol Corp

- Shandong ThFine Chemical Co Ltd

- Glentham Life Sciences Limited

Get Free Sample For

Get Free Sample For