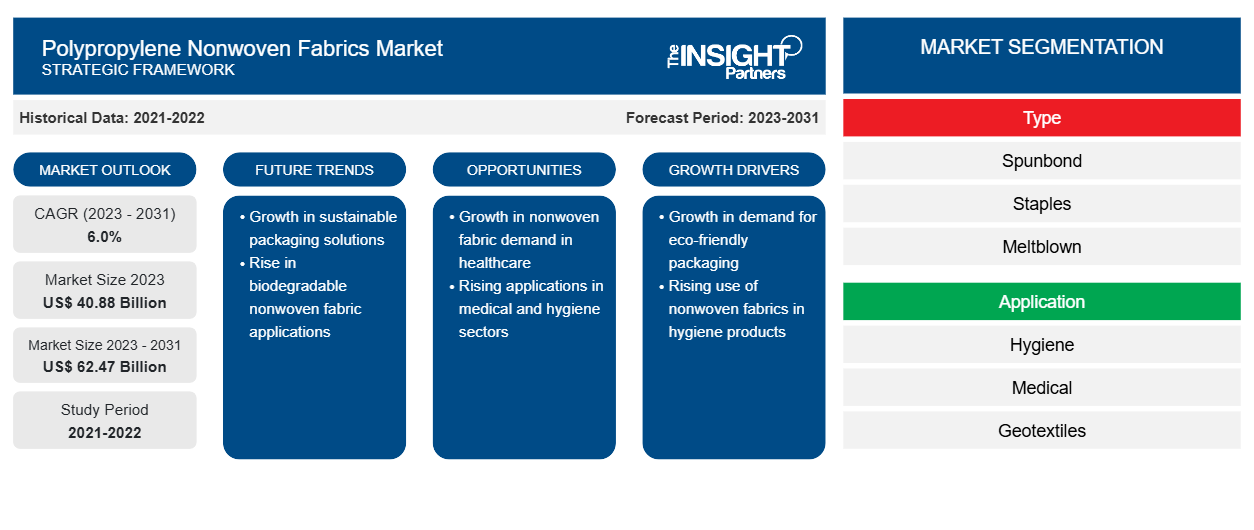

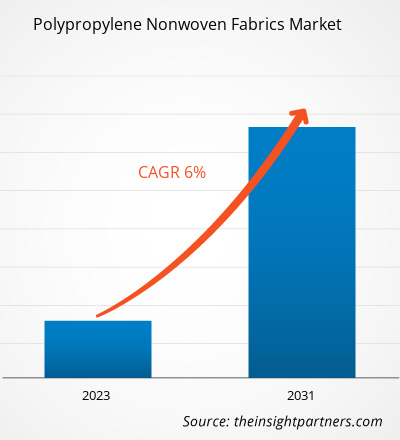

The polypropylene nonwoven fabrics market size is projected to reach US$ 62.47 billion by 2031 from US$ 40.88 billion in 2023. The market is expected to register a CAGR of 6.0% in 2023–2031. The growing demand from application sectors, including agriculture and construction, is likely to remain a key polypropylene nonwoven fabrics market trends.

Polypropylene Nonwoven Fabrics Market Analysis

The growing demand in the geotextile sector has significantly driven the polypropylene nonwoven fabric market growth. Geotextiles are crucial in civil engineering and construction projects, serving purposes such as erosion control, soil stabilization, and drainage. These fabrics ' essential properties, such as strength, permeability, and resistance to environmental factors, make them a preferred material for geotextile applications. With a rising number of infrastructure development projects, there is a growing need for reliable and durable materials to improve the longevity and stability of structures. Polypropylene nonwoven fabrics also provide efficient separation of soil layers, offer reinforcement in areas with unstable ground, and prevent erosion. These fabrics are also lightweight, which contributes to easier installation and handling in geotextile applications. This helps to reduce labor and transportation costs. In addition, these fabrics also show excellent resistance to chemicals and biological degradation. This ensures long-lasting performance in different environmental conditions.

Polypropylene Nonwoven Fabrics Market Overview

Polypropylene nonwoven fabrics strongly resist liquids and contaminants, making them ideal for applications in medical textiles and hygiene products. These fabrics are also extensively used for manufacturing surgical gowns, masks, and drapes in the medical sector. The strength of polypropylene ensures the durability of nonwoven fabrics. This provides protection to healthcare professionals and patients during medical applications. Furthermore, the breathability of polypropylene nonwoven fabrics is important in ensuring comfort, which allows air moisture to pass through while maintaining a protective barrier against microorganisms. The unique characteristics of polypropylene nonwoven fabric benefit various hygiene products such as diapers and sanitary napkins. The polypropylene nonwoven fabric's softness, moisture resistance, and comfort make it a perfect choice for these applications. The material's versatility allows the creation of highly absorbent and comfortable products for extended use.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Polypropylene Nonwoven Fabrics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Polypropylene Nonwoven Fabrics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Polypropylene Nonwoven Fabrics Market Drivers and Opportunities

Surging Demand for Automotive Industry Bolsters Polypropylene Nonwoven Fabrics Market Growth

The flexibility of these fabrics makes them compatible with numerous automotive applications. Polypropylene nonwoven fabrics are widely used in components such as carpeting, upholstery, and insulation materials in the interior of vehicles. The moldability of these fabrics allows them to create complex designs and customized interior features, providing automotive manufacturers with a flexible and cost-effective solution. Additionally, the growing emphasis of the automotive industry on sustainability aligns with the eco-friendly characteristics of polypropylene nonwoven fabrics. These fabrics also offer recyclability and energy-efficient alternatives to traditional materials. The increasing adoption of environmentally conscious practices has propelled the demand for these fabrics. Moreover, the growing adoption of electric vehicles (EVs) also bolstered the growth of the market. The rising need for lightweighting to improve fuel and energy efficiency has also bolstered the demand for these fabrics due to their lightweight properties.

Increasing Adoption from Construction and Agriculture Industries

The unique properties of polypropylene nonwoven fabrics that address specific needs in the construction and agriculture industries are the significant growth drivers of the market. These fabrics are widely used in geotextile applications in the construction sector. They are widely used in erosion control, soil stabilization, and drainage systems. Their ability to provide reinforcement, filtration, and separation in various construction projects contributes to the growing popularity of polypropylene nonwoven fabrics. These fabrics help to improve the structural integrity of roads, dams, and other civil engineering projects, making them an essential component in modern construction practices.

Further, these fabrics play a significant role in crop protection and management in agriculture. Polypropylene nonwoven fabrics are extensively used as crop covers to shield plants from pests, adverse weather conditions, and UV radiation. The porous nature of these fabrics allows air, sunlight, and moisture to reach the plants and provides a protective barrier against external elements such as pests. Moreover, the demand for polypropylene nonwoven fabrics has significantly increased with the growing popularity of sustainable alternatives to chemical-based herbicides in weed control applications.

Polypropylene Nonwoven Fabrics Market Report Segmentation Analysis

Key segments that contributed to the derivation of the polypropylene nonwoven fabrics market analysis are material and application.

- Based on the type, the market is segmented into spunbond, staples, meltblown, and composite. The spunbond segment held a larger market share in 2023.

- In terms of application, the market is segmented into hygiene, medical, geotextiles, automotive, construction, agriculture, and others. The hygiene segment held the largest share of the market in 2023.

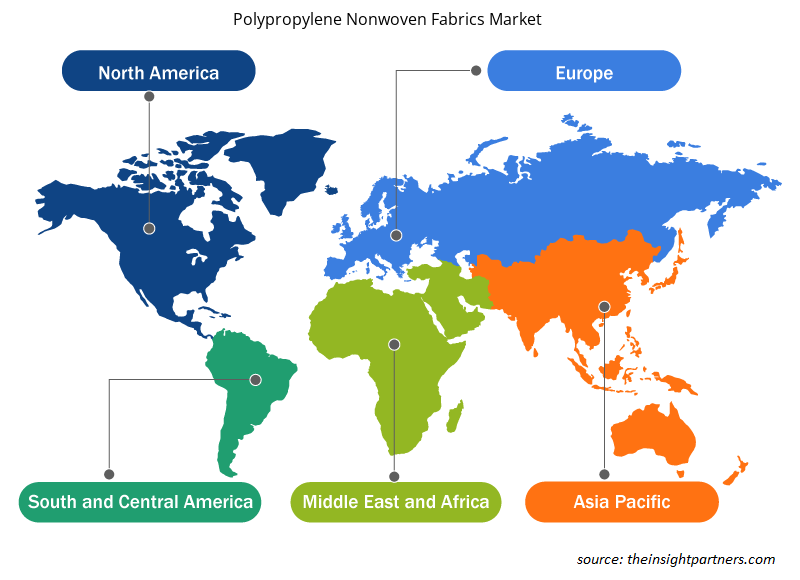

Polypropylene Nonwoven Fabrics Market Share Analysis by Geography

The geographic scope of the Polypropylene Nonwoven Fabrics Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

As industries expand, there is an increased demand for these fabrics in applications ranging from hygiene products and medical textiles to geotextiles and automotive components. The region's thriving manufacturing sector and growing population further propel the need for these versatile materials. Cost competitiveness is another crucial factor. The Asia Pacific region is known for its cost-effective manufacturing capabilities, driven by factors such as lower labor costs and efficient production processes. This cost advantage positions manufacturers in the region to produce polypropylene nonwoven fabrics at competitive prices, meeting the demands of both domestic and international markets. These factors are driving the growth of the Asia Pacific polypropylene nonwoven fabrics market.

Polypropylene Nonwoven Fabrics Market Regional Insights

The regional trends and factors influencing the Polypropylene Nonwoven Fabrics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Polypropylene Nonwoven Fabrics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Polypropylene Nonwoven Fabrics Market

Polypropylene Nonwoven Fabrics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 40.88 Billion |

| Market Size by 2031 | US$ 62.47 Billion |

| Global CAGR (2023 - 2031) | 6.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

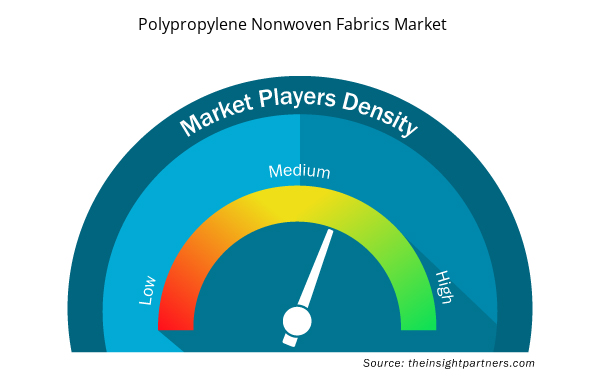

Polypropylene Nonwoven Fabrics Market Players Density: Understanding Its Impact on Business Dynamics

The Polypropylene Nonwoven Fabrics Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Polypropylene Nonwoven Fabrics Market are:

- Kimberly-Clark Corporation

- Berry Global, Inc.

- Fitesa S.A.

- Freudenberg Group

- Suominen Corporation

- TWE GmbH and Co. KG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Polypropylene Nonwoven Fabrics Market top key players overview

Polypropylene Nonwoven Fabrics Market News and Recent Developments

The polypropylene nonwoven fabrics market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for polypropylene nonwoven fabrics and strategies:

- Toray Industries, Inc., announced today that it has created a spunbond nonwoven fabric that is persistently hydrophilic (see glossary note 1) and is gentle on the skin. This fabric is suitable for disposable diapers, masks, feminine hygiene products, and other sanitary applications. The company plans to start full-scale production when the production technology is well established. (Source: Toray Industries, Inc., Press Release, 2022)

Polypropylene Nonwoven Fabrics Market Report Coverage and Deliverables

The "Polypropylene Nonwoven Fabrics Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter's Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Europe Surety Market

- Data Annotation Tools Market

- Aircraft Landing Gear Market

- Constipation Treatment Market

- Adaptive Traffic Control System Market

- Real-Time Location Systems Market

- Vision Care Market

- Cut Flowers Market

- Single-Use Negative Pressure Wound Therapy Devices Market

- Enzymatic DNA Synthesis Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies

1. Ahlstrom-Munksjo Oyj

2. Asahi Kasei Corporation

3. Avgol Industries 1953 Ltd

4. Berry Global Inc.

5. Fitesa

6. Johns Manville Corporation

7. Low and Bonar PLC

8. Suominen Corporation

9. The Freudenberg Group

10. Toray Industries, Inc.

Get Free Sample For

Get Free Sample For