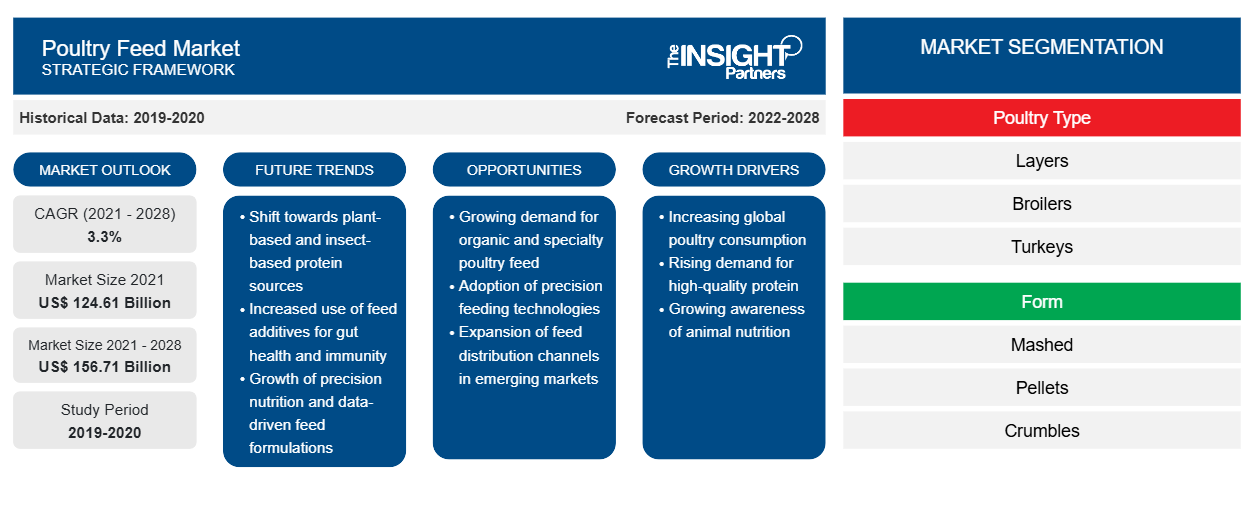

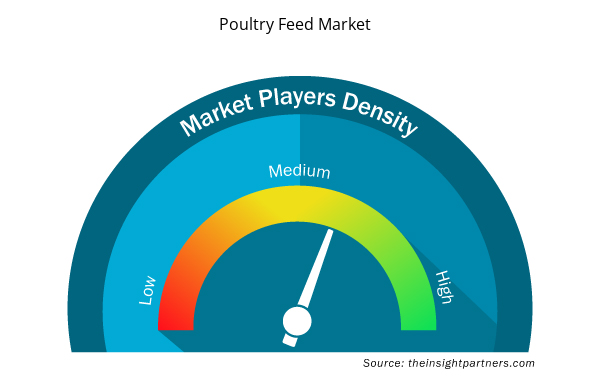

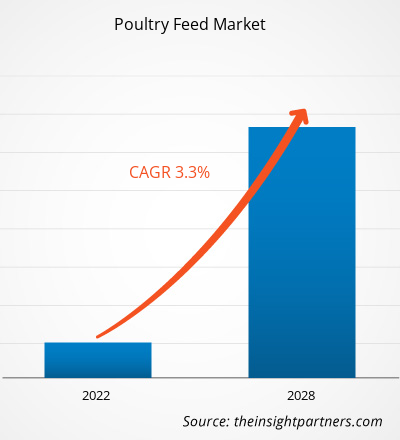

The poultry feed market was valued at US$ 124,611 million in 2021 and is projected to reach US$ 156,710 million by 2028; it is expected to grow at a CAGR of 3.3% from 2021 to 2028.

Poultry feed is produced from various raw materials, such as cereal and grains, cakes or oil meal, and feed additives. The nutritional requirements of the poultry feed depend on the weight and age of the poultry, their rate of growth, and the rate of egg production. The increase in the consumption of poultry products among consumers is boosting the poultry feed market.

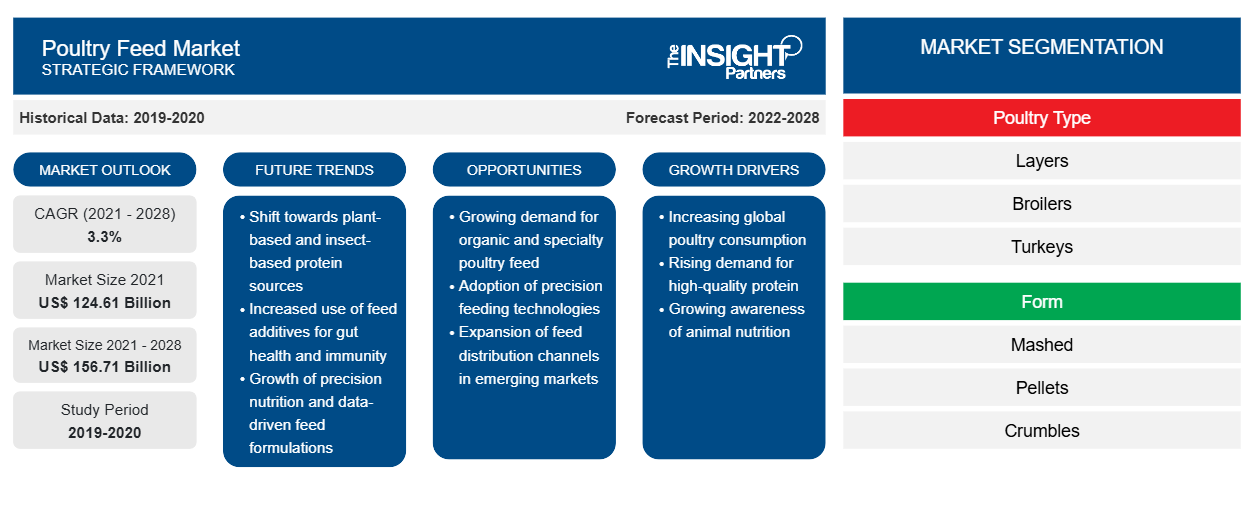

In 2020, Asia-Pacific held the largest revenue share of the global poultry feed market. With a large base of poultry meat consuming population, the Asia-Pacific poultry feed market is reporting a remarkable growth and is expected to continue to do so over the next few years. China and India are the two leading poultry feed producers in the world. In India, the poultry feed production industry is among the fastest-growing ones with the competition intensifying among feed manufacturers. Consumers in this region are looking for additional sources of protein-rich foods. An increase in demand for protein-rich food, coupled with enhanced purchasing power, has fueled poultry meat consumption extensively. All these factors are likely to fuel the growth of the Asia-Pacific poultry feed market during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Poultry Feed Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Poultry Feed Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Poultry Feed Market

The ongoing COVID-19 pandemic compelled the implementation of preventive measures that drastically altered the status of the animal feed industry and negatively impacted the growth of the poultry feed market. Governments across the globe have ordered the closure of their international ports, further causing disruptions in the poultry feed supply chain. The COVID-19 pandemic impacted the availability of raw materials to prepare poultry feed in almost all countries. Corn and soybeans are the main ingredients in poultry feeds. Many countries worldwide that depend on imports of these raw materials to prepare poultry feed have had substantial problems procuring the ingredients. The availability of poultry feed in most places was difficult due to the shutting down of the feed plants. The worldwide consumption of poultry meat declined drastically. The poultry feed industry has been badly affected by the closure of restaurants across the world. However, as the economies are planning to revive their operations, the demand for poultry feed is expected to rise globally. The expanding demand for poultry feed and significant investments by prominent manufacturers are expected to drive the growth of poultry feeds.

Market Insights

Growing Poultry Production

Fuels Poultry Feed Market Growth

The poultry sector is registering a continual rise across the world. Poultry is regarded as one of the most cost-effective protein sources due to which the demand for poultry products, such as eggs and meat, continues to rise. There is a surge in chicken consumption among people who are more concerned about their health. The upswing in the poultry production is catering substantially to the bolstering need for the global population. According to the Food and Agriculture Organization (FAO) of the US, the world poultry meat production has increased from 9 to 132 million tons between 1961 and 2019, and egg production has grown from 15 to 90 million tons. The surging poultry production propels the use of quality poultry feed products.

Poultry Type Insights

Based on poultry type, the global poultry feed market is segmented into layers, broilers, turkeys, and others. The broilers segment held the largest share of the market in 2020. Broilers are chickens raised for meat and are fed a high-protein diet to help support rapid growth. Broiler chicken feed comes in different forms, such as mash, pellet, and crumble. India is one of the largest broiler producers with the growing demand for compound feed in the broiler industry. The increasing broiler production will continue to boost the demand for broiler poultry feed during the forecast period.

Form Insights

Based on form, the global poultry feed market is segmented into mashed, pellets, crumbles, and others. The pellets segment held the largest market share in 2020. Pellet feed is made by using steam and pressure to compress mash feed. Mash feed is compressed and molded into hard, dry pellets in a pellet mill. The pellet feed improves growth rate in broilers with an increased feed intake. This is due to increased digestibility, decreased ingredient segregation, and increased palatability. As the ingredients are well mixed in each pellet, pellet feed ensures a well-balanced diet, better feed conversion, and performance in poultry birds. The pellet feed advantages, such as easily digestible feed, a well-balanced diet, and less waste, usually contribute to its high demand.

A few key players in the global poultry feed market are ADM; Cargill, Incorporated.; Alltech.; Charoen Pokphand Foods PCL; For Farmers; Kent Corporation; SHV Holdings; Land O'Lakes, Inc.; AFGRI Animal Feeds; and DE HEUS ANIMAL NUTRITION. Players operating in the market are highly focused on the development of high quality and innovative product offerings to fulfil the customer’s requirements.

Poultry Feed Market Regional Insights

Poultry Feed Market Regional Insights

The regional trends and factors influencing the Poultry Feed Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Poultry Feed Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Poultry Feed Market

Poultry Feed Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 124.61 Billion |

| Market Size by 2028 | US$ 156.71 Billion |

| Global CAGR (2021 - 2028) | 3.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Poultry Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

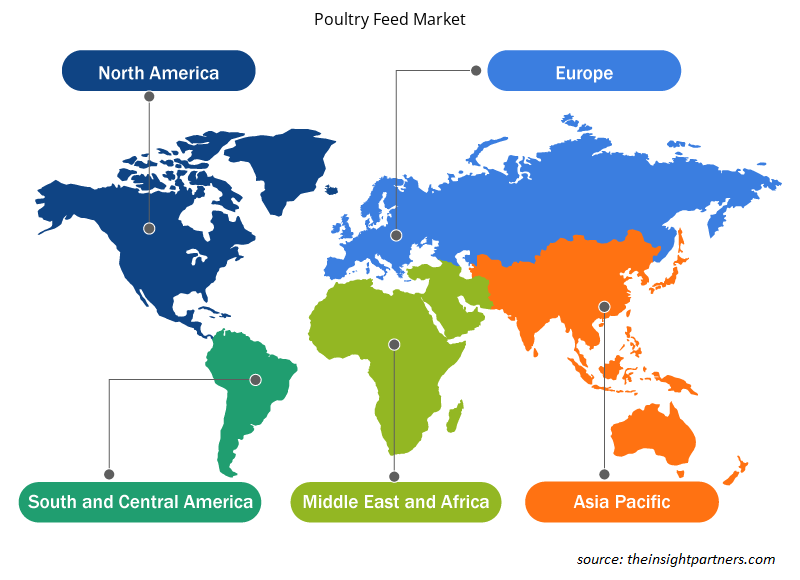

Poultry Feed Market Players Density: Understanding Its Impact on Business Dynamics

The Poultry Feed Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Poultry Feed Market are:

- ADM

- Cargill, Incorporated.

- Alltech.

- Charoen Pokphand Foods PCL

- ForFarmers

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Poultry Feed Market top key players overview

Report Spotlights

- Progressive industry trends in the poultry feed market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the poultry feed market from 2019 to 2028

- Estimation of global demand for poultry feed

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook as well as factors driving and restraining the growth of the poultry feed market

- Assistance in decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- The size of the poultry feed market size at various nodes

- Detailed overview and segmentation of the market, as well as the poultry feed industry dynamics

- Size of the poultry feed market in various regions with promising growth opportunities

Global Poultry Feed Market

By Poultry Type

- Layers

- Broilers

- Turkeys

- Others

By Form

- Mashed

- Pellets

- Crumbles

- Others

By Category

- Organic

- Conventional

Company Profiles

- ADM

- Cargill, Incorporated.

- Alltech.

- Charoen Pokphand Foods PCL

- ForFarmers

- Kent Corporation

- SHV Holdings

- Land O'Lakes, Inc.

- AFGRI Animal Feeds

- DE HEUS ANIMAL NUTRITION

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Mobile Phone Insurance Market

- Semiconductor Metrology and Inspection Market

- Cosmetic Bioactive Ingredients Market

- Foot Orthotic Insoles Market

- Portable Power Station Market

- Enteral Nutrition Market

- Real-Time Location Systems Market

- Online Exam Proctoring Market

- Mice Model Market

- Health Economics and Outcome Research (HEOR) Services Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Poultry Type, Form, and Category

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The major players operating in the global poultry feed market are Adm Animal Nutrition, Alltech, Inc., Cargill Inc., Charoen Popkhand Foods, Forfarmers, Hi-Pro Feeds, Inc, Kent Nutrition Group, Inc., Land O’lakes, Inc., Perdue Farms Inc., Southern States Cooperative and many others.

In 2020, the poultry feed market was predominant by Asia Pacific at the global level. With a large base of poultry meat consuming population, the Asia-Pacific poultry feed market is reporting a remarkable growth and is expected to continue to do so over the next few years. China and India are the two leading poultry feed producers in the world. In India, the poultry feed production industry is among the fastest-growing ones with the competition intensifying among feed manufacturers. Consumers in this region are looking for additional sources of protein-rich foods. An increase in demand for protein-rich food, coupled with enhanced purchasing power, has fueled poultry meat consumption extensively. All these factors are likely to fuel the growth of the Asia-Pacific poultry feed market during the forecast period.

Based on form, the global poultry feed market is segmented into pellets, crumbles, mashed, and others. The pellets segment dominated the market during the research period. The pellet feed improves growth rate in broilers with an increased feed intake. This is due to increased digestibility, decreased ingredient segregation, and increased palatability.

The global poultry feed market growth is majorly influenced by determinants such as growing poultry production, rising demand for compound feed in poultry, increasing demand for fortified poultry feed products, and volatility in raw material prices.

By category, the global poultry feed market is bifurcated into organic and conventional. The conventional segment held a larger share in the global poultry feed market in 2020. However, organic segment is expected to register a higher CAGR during the forecast period.

Among the segments of poultry type, broilers segment has led the market in 2020. Broilers are chickens raised for meat and are fed a high-protein diet to help support rapid growth. Broiler chicken feed comes in different forms, such as mash, pellet, and crumble. India is one of the largest broiler producers with the growing demand for compound feed in the broiler industry. The increasing broiler production will continue to boost the demand for broiler poultry feed during the forecast period.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The list of Companies - Poultry Feed Market

- ADM

- Cargill, Incorporated.

- Alltech.

- Charoen Pokphand Foods PCL

- ForFarmers

- Kent Corporation

- SHV Holdings

- Land O'Lakes, Inc.

- AFGRI Animal Feeds.

- De Heus Animal Nutrition.

Get Free Sample For

Get Free Sample For