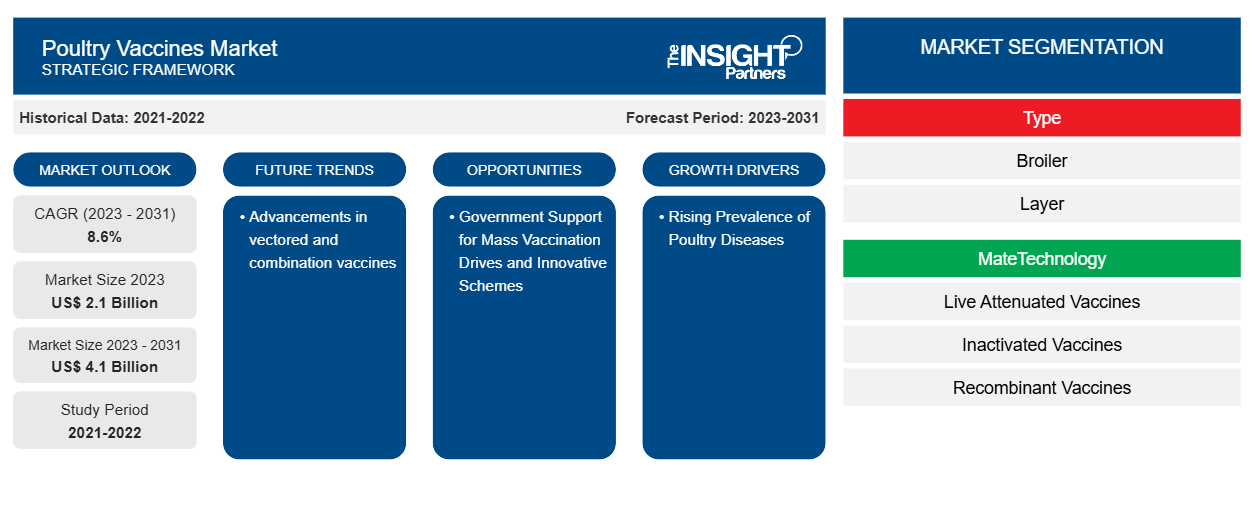

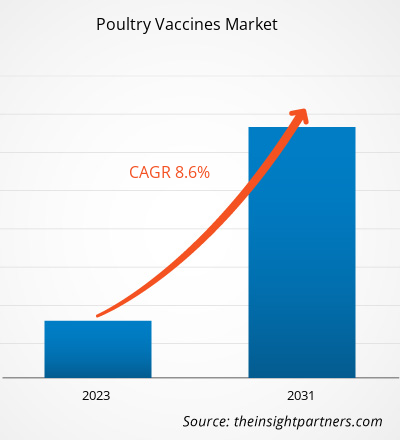

The poultry vaccines market size is projected to reach US$ 4.1 billion by 2031 from US$ 2.1 billion in 2023. The market is expected to register a CAGR of 8.6% in 2023–2031. The advancements in vectored and combination vaccines are likely to remain key poultry vaccines market trends.

Poultry Vaccines Market Analysis

Rising Prevalence of Poultry Diseases

Poultry production results in producing different types of animal proteins through eggs and meat. With rising poultry production, there are high chances of susceptibility to several zoonotic diseases such as “Fowl disease” that might result in huge economic losses, particularly in developing countries. For example, chickens are more prone to bacterial, viral, parasitic, and fungal infections. These viral outbreaks can cause Newcastle disease, avian influenza, infectious bursal disease, and other diseases to a wide range of poultry animals.

The table below provides disease outbreaks of avian influenza among mammals across several countries in 2022.

Cases of Avian Influenza in Mammals | ||

Country | Poultry Diseases | Disease Outbreak (2022) |

Argentina | H5 | 18 |

Chile | 34 | |

Norway | 2 | |

Uruguay | 3 | |

Peru | 12 | |

Brazil | H5N1 | 5 |

Canada | 40 | |

China | 1 | |

Estonia | 1 | |

Finland | 76 | |

France | 2 | |

Ireland | 2 | |

Italy | 3 | |

Japan | 4 | |

Russia | 1 | |

Canada | H5N5 | 2 |

Denmark | H5N8 | 1 |

Source: World Organization for Animal Health 2023

Poultry diseases are a major cause of death of chicks and also lead to reduced livestock. Farmers are facing huge economic losses worldwide as they spread zoonotic diseases, posing a serious health risk to mammals. For example, poultry coccidiosis is one of the most common diseases across the globe; it leads to huge losses associated with mortality, reduced body weight, and extra expenses related to preventive and therapeutic control. As per the DSM company website, farmers face an economic loss of US$ 3 billion annually owing to coccidiosis in chickens and avian species worldwide. Newcastle disease is also considered an economically expensive disease causing huge production losses to the farmers of developing countries that export poultry products. The International Journal of Current Microbiology and Applied Sciences (IJCMAS) report published in October 2021 reveals that total losses due to Newcastle disease mortality and total expenditure on live birds in all the 25 commercial broiler farms ranged between INR 17,864 (US$ 214.0) to INR 2,66,080 (US$ 3,188.89) and INR 2,78,393 (US$ 3,336.46) to INR 17,86,745 (US$ 21,413.6), respectively. Also, the selling income of live birds from individual farms ranged from INR 1,60,255 (US$ 1,920.61) to INR 12,46,314 (US$ 14,936.7) due to infection.

Therefore, the rising prevalence of poultry diseases resulting in huge economic losses boosts the demand for poultry vaccinations, which drives the market.

Poultry Vaccines Market Overview

India accounts for the second largest market share in Asia Pacific. India holds a considerable position in the global poultry vaccines market. The economic importance of the poultry industry can be estimated on the basis of the fact that the Indian poultry industry forms ~0.7% of the national GDP and 10% of the livestock GDP. In the recent past, the Indian poultry sector has faced a frequent onslaught of newer poultry diseases, such as bird flu (Avian Influenza or AI), leading to enormous losses to the poultry sector in India and globally. Avian influenza has emerged as an unpredictable threat to the country's poultry industry, causing more than 176 outbreaks in the last ten years, impacting substantial economic loss to the poultry industry. Every reported case of an outbreak of AI leads to distortions in domestic demand and, consequently, in prices and global trade. Scientific interventions are urgently needed to curb the menace of such emerging poultry diseases in the country. However, current practice does not incorporate avian influenza vaccine into routine vaccination programs. Thus, there is a need for a predictive analytics approach to forecast the outbreak and, more importantly, to have a safe and productive vaccine for avian influenza.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Poultry Vaccines Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Poultry Vaccines Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Poultry Vaccines Market Drivers and Opportunities

Advancements in Vectored and Combination Vaccines

Vectored vaccines work differently from conventional vaccines and offer several advantages. These advantages include no adverse effects/reactions, overcoming maternal antibody interference, and meeting evolving disease challenges, among others. The "Vaxxitek HVT+IBD+ND" is an example of a vector vaccine manufactured by Boehringer Ingelheim and was launched in the US market in 2019. It is a trivalent vaccine and is effective against three diseases: Marek's Disease (MD), Infectious Bursal Disease (IBD), and Newcastle disease (ND). Additionally, in 2020, a second trivalent form, "Vaxxitek HVT+IBD+ILT," received marketing authorization in the US to protect against MD, IBD, and Infectious Laryngotracheitis (ILT). These are all highly infectious and commercially disruptive diseases that affect the poultry industry worldwide, and Vaxxitek proves beneficial in overcoming such diseases in one shot. Other manufacturers except Boehringer Ingelheim producing such bivalent and trivalent vaccines will enhance global demand. Also, major manufacturers plan to procure pentavalent vaccines that will prove beneficial to overcome poultry diseases and help them stand out in the global market. Thus, the advancements in vectored and combination vaccines production acts as a new trend that is likely to boost the poultry vaccines market growth in the coming years.

Government Support for Mass Vaccination Drives and Innovative Schemes

Government worldwide is supportive against poultry vaccination with rising Global Burden of Disease (GBD). The support involves launching of mass vaccination schemes and several vaccination programs at vaccination centers or through door-step immunization services.

- In December 2022, the Indian Government announced launching of schemes such as the "Livestock Health & Disease Control Scheme" improve the animal health sector by implementing prophylactic vaccination programs against several diseases. This scheme is Central or State-driven and funded with a sharing pattern of 60:40. Also, the scheme covers "research & innovation, publicity & awareness, training & allied activities" that are 100% Center-funded.

- In April 2023, the government of France announced passing a tender for ordering 80 million doses of avian influenza vaccines as the country was preparing for a mass vaccination program. The "ANES" Ministry in France was the first country in the European Union (EU) to start such a mass vaccination scheme. For conducting such a mass vaccination drive, France mandated 2 companies, France's Ceva Animal Health and Germany's Boehringer Ingelheim, to develop avian influenza vaccines. Both vaccines by the two companies effectively protect birds against the virus.

Therefore, such government support for mass vaccination drives and designing innovative schemes is anticipated to provide lucrative opportunities for the poultry market growth in the coming years.

Poultry Vaccines Market Report Segmentation Analysis

Key segments that contributed to the derivation of the poultry vaccines market analysis are type, technology, dosage form, disease, route of administration, and end user.

- Based on type, the poultry vaccines market is divided into broiler and layer. The broiler segment held a larger market share in 2023.

- By technology, the market is segmented into live attenuated vaccines, inactivated vaccines, and recombinant vaccines. The live attenuated vaccines segment held the largest share of the market in 2023.

- In terms of dosage form, the market is categorized into liquid vaccines, freeze-dried vaccines, and dust/powder form vaccines. The liquid vaccines segment dominated the market in 2023.

- In terms of disease, the market is segmented into avian influenza, avian salmonellosis, Marek's disease, infectious bronchitis, infectious bursal disease (IBD), Newcastle disease, and others. The avian influenza segment dominated the market in 2023.

- In terms of route of administration, the market is categorized into drinking water (D/W), intramuscular (I/M), subcutaneous (I/S), and others. The drinking water (D/W) segment dominated the market in 2023.

- In terms of end user, the market is segmented into poultry farms, veterinary hospitals, and poultry vaccination centers & clinics. The poultry farms segment dominated the market in 2023.

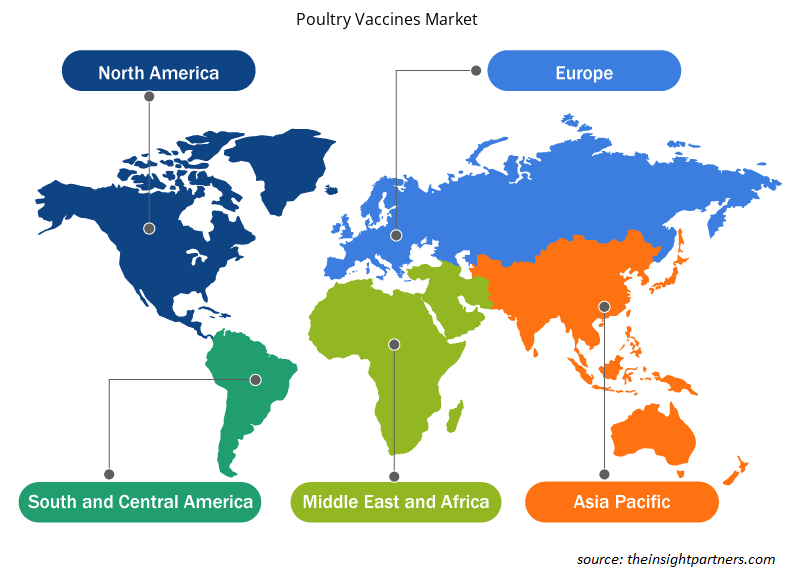

Poultry Vaccines Market Share Analysis by Geography

The geographic scope of the poultry vaccines market report is mainly segmented into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific has dominated the poultry vaccines market and is anticipated to grow with the highest CAGR in the coming years. In Asia Pacific, China accounted for the largest share of the poultry vaccines market in 2022. China is witnessing rapid economic growth and urbanization. China has one of the major healthcare systems in the region. The market growth in the country can be accredited to the growing demand for poultry meat, the increasing consumption of animal-derived food products, the growing livestock population, increasing awareness about animal health, and the rising frequency of poultry disease outbreaks in China. Therefore, favorable government initiatives to promote vaccination among the population of China are the key factor influencing the poultry vaccines market growth.

Poultry Vaccines Market Regional Insights

The regional trends and factors influencing the Poultry Vaccines Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Poultry Vaccines Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Poultry Vaccines Market

Poultry Vaccines Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.1 Billion |

| Market Size by 2031 | US$ 4.1 Billion |

| Global CAGR (2023 - 2031) | 8.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

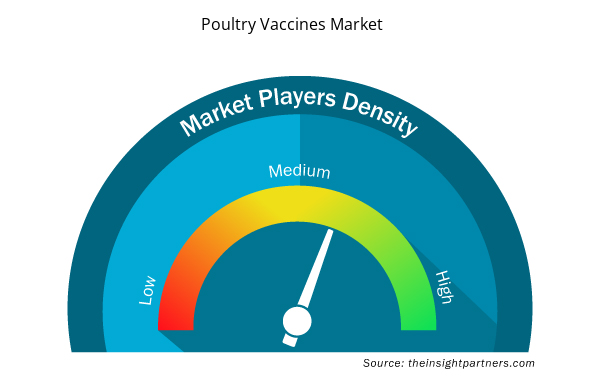

Poultry Vaccines Market Players Density: Understanding Its Impact on Business Dynamics

The Poultry Vaccines Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Poultry Vaccines Market are:

- Boehringer Ingelheim International GmbH,

- Zoetis Inc,

- BIOVAC,

- Phibro Animal Health,

- Hester Biosciences Ltd.,

- Venky's (India) Ltd.,

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Poultry Vaccines Market top key players overview

Poultry Vaccines Market News and Recent Developments

The poultry vaccines market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for poultry vaccines and strategies:

- In April 2021, Boehringer Ingelheim, a global leader in animal health, announced the launch of Prevexxion RN and Prevexxion RN+HVT+IBD, the next generation of Marek’s disease vaccines, in the European Union countries and the UK. (Source: Boehringer Ingelheim, Press Release, 2021)

Poultry Vaccines Market Report Coverage and Deliverables

The “Poultry Vaccines Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Technology, Dosage Form, Disease, Route of Administration, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, RoE, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The poultry vaccines market majorly consists of the players such Boehringer Ingelheim International GmbH, Zoetis, Inc., Biovac, Phibro Animal Health Corp, Hester Biosciences Ltd, Venky's India Ltd., Dechra Pharmaceuticals Plc, Elanco Animal Health Inc, Merck KgaA, Ceva, Nisseiken Co Ltd, and Vaccinova AB, and amongst others.

The Drinking Water (D/W) segment dominated the global poultry vaccines market and held the largest market share in 2023.

The CAGR value of the poultry vaccines market during the forecasted period of 2023-2031 is 8.6%.

The Avian Influenza segment held the largest share of the market in the global poultry vaccines market and held the largest market share in 2023.

The poultry industry constitutes a significant sector of world agriculture. In the US, more than 8 billion birds are produced annually with a value exceeding US$ 20 billion. Therefore, with rising poultry industry, demand for vaccination is an integral part of flock health management protocols. Therefore, disease prevention is an integral part of flock health management protocols.

Key factors that are driving the growth of this market are rising prevalence of poultry diseases and growing poultry industry are expected to boost the market growth for the poultry vaccines over the years.

Global poultry vaccines market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa and South & Central America. Asia Pacific held the largest market share of the poultry vaccines market in 2023.

Zoetis Inc. and Boehringer Ingelheim are the top two companies that hold huge market shares in the poultry vaccines market.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Report Companies - Poultry Vaccines Market

- Boehringer Ingelheim International GmbH

- Zoetis, Inc.

- Biovac

- Phibro Animal Health Corp

- Hester Biosciences Ltd

- Venky's India Ltd.

- Dechra Pharmaceuticals Plc

- Elanco Animal Health Inc

- Merck KgaA

- Ceva

- Nisseiken Co Ltd

- Vaccinova AB

Get Free Sample For

Get Free Sample For