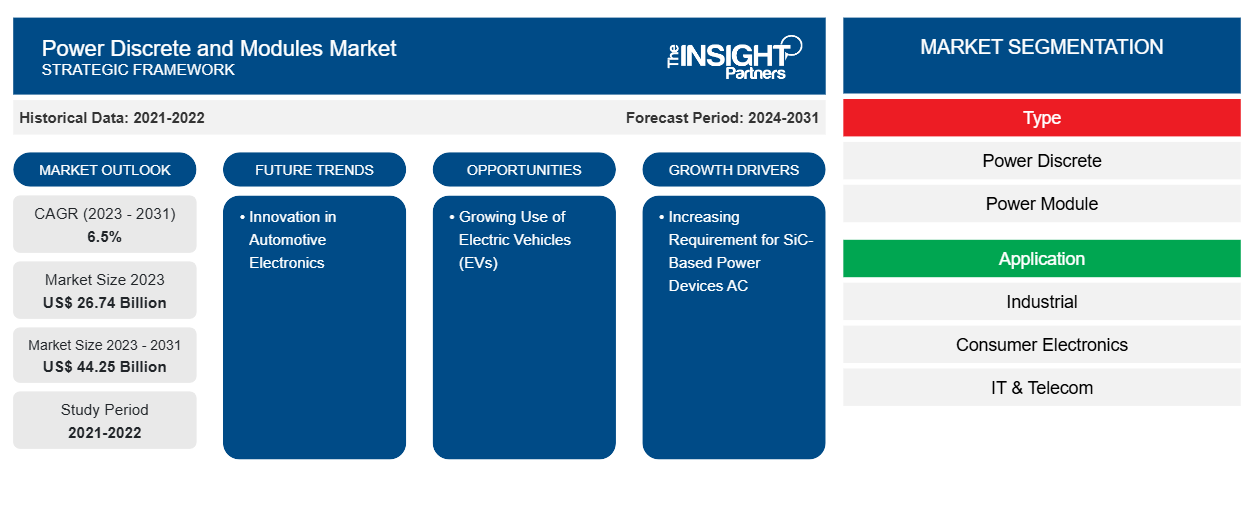

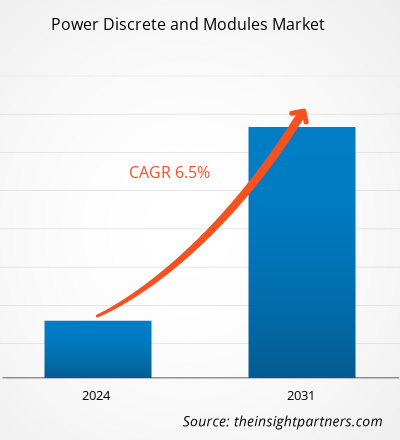

The power discrete and modules market size is projected to reach US$ 44.25 billion by 2031 from US$ 26.74 billion in 2023. The market is expected to register a CAGR of 6.5% during 2023–2031. Innovation in automotive electronics is likely to remain a key trend in the market.

Power Discrete and Modules Market Analysis

The rise in popularity of silicon carbide power devices is leading to a revolution in the power discrete and module market. There has been a rise in the need for power electronics modules in different industry sectors, especially in developed regions such as the US, Europe, and China. Due to the increasing demand for photovoltaic inverters, industrial motor drives, and electro-mobility, companies in this sector are introducing a range of products like silicon carbide Schottky barrier diodes and power MOSFETs.

The use of power devices in power electronics has risen because they can operate at higher voltages and temperatures than traditional silicon semiconductor devices. Using these SiC devices results in reduced power loss and smaller power circuit sizes. Power devices have been experiencing a robust growth rate due to the increasing use of electric vehicles and photovoltaic inverters. In addition, the governments of China, Japan, and the US make substantial investments in smart grid technology to enhance their electricity infrastructures. Therefore, it is anticipated that these factors will contribute to the expansion of the power discrete and module market.

Power Discrete and Modules Market Overview

Power discrete and modules are widely used in different industries, including medical and aerospace & defense sectors. The modules provide a controlled power source to the flight controller as well as necessary details on battery current and voltage. Utilizing the current and voltage data to calculate consumed power assists in estimating the remaining battery capacity. This enables the flight controller to show failsafe warnings if there is low power. Drones play an important role in modern warfare scenarios. There is an increasing need for drones in the defense industry for tasks like aerial videography, mapping, and surveillance in every country. In 2021, India intends to finalize a $3 billion agreement for Predator B weaponized drones. Diodes are commonly used in rectifiers, clipper circuits, clamping circuits, voltage multipliers, logic gates, solar panels, and reverse current protection circuits. A few practical uses of diodes include emitting light, dissipating inductive load, and sensing and controlling. As industrial applications advance, the use of high-power diodes is becoming more popular in the market, anticipated to have a positive impact on market growth in the future.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Power Discrete and Modules Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Power Discrete and Modules Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Power Discrete and Modules Market Drivers and Opportunities

Increasing Requirement for SiC-Based Power Devices AC to Drive Growth of the Market

IGBT type power modules are specifically designed for managing high currents. The power modules utilize Si IGBT paired with fast recovery diodes (FRDs). Numerous manufacturers have begun offering innovative modules that combine SiC MOSFETs with SiC Schottky barrier diodes (SBDs). These modules reduce switching losses from IGBT tail current and FRD recovery loss. Sic models have enhanced power supply efficiency and basic cooling methods, as well as reduced peripheral components due to their high-frequency operation. SiC-MOSFET has a higher capability of switching at high speeds compared to Si-IGBT used in current power modules.

There is an increasing demand for SiC power modules in the aerospace industry. Thales Group has created specialized power modules to fulfill the requirements of Urban Air Mobility (UAM) and More Electric Aircraft (MEA). The COTS Aero power module from the company is a complete SiC leg power module specifically designed for DC/AC power conversion applications up to 260 kW at altitudes reaching 44,000 feet in non-pressurized zones. The demand for SiC MOSFET power modules is growing because of their high-frequency and highly efficient performance in 3-phase solar inverters, batteries, and UPS management.

Growing Use of Electric Vehicles (EVs)

The need for power electronics in EV systems, specifically power discrete and modules for inverters and converters, is increasing due to the growing number of people worldwide transitioning to electric vehicles. The surge in popularity is caused by the rising sales and rapid expansion of electric vehicles, which reached over ten million in 2022, with the proportion of electric vehicles in overall sales more than tripling in three years, from approximately 4% in 2020 to 14% in 2022. The rise in worldwide investment in electric vehicles has resulted in car manufacturers, both established and new players, earning greater profits due to the increasing popularity of EVs.

Power Discrete and Modules Market Report Segmentation Analysis

Key segments that contributed to the derivation of the power discrete and modules market analysis are type, application, material and wafer size.

- Based on type, the market is segmented into power discrete and power module. The power discrete segment held a significant market share in 2023.

- In terms of application, the market is divided into industrial, consumer electronics, IT & telecom, automotive, and others. The Industrial segment held a substantial share of the market in 2023.

- Based on material, the market is segmented into Si, SiC, and GaN. The Si segment held a significant market share in 2023.

- Based on wafer size, the market is segmented into Up to 200 mm and 300 mm. The Up to 200 mm segment held a significant market share in 2023.

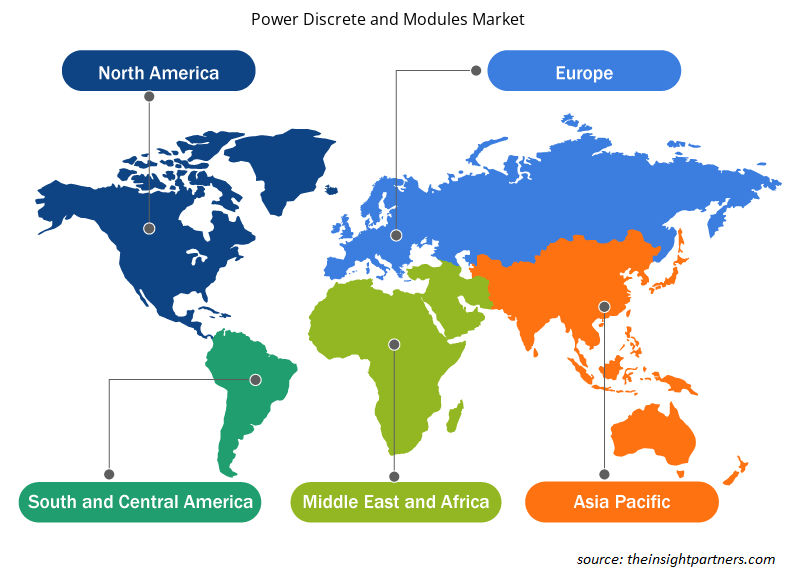

Power Discrete and Modules Market Share Analysis by Geography

The geographic scope of the power discrete and modules market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Companies are engaging in joint ventures to establish their strong presence in the Asia Pacific region. For instance, in October 2021, (Zhenghai Group) and ROHM Co., Ltd. are collaborating. (ROHM) and Semiconductor Manufacturing Co. have entered into a collaboration to create a new company focused on the power module business. The upcoming establishment of "HAIMOSIC (SHANGHAI) CO., LTD." in China is set for December 2021, with Shanghai Zhenghai Semiconductor Technology Co., Ltd. holding an 80% ownership stake. (Zhenghai Semiconductor) is owned by Zhenghai Group to the tune of 80%, with the remaining 20% belonging to ROHM. The new firm will participate in a joint venture focusing on creating, designing, producing, and selling power modules utilizing silicon carbide (SiC) power devices. The goal is to establish a power module enterprise suitable for traction inverters and other new energy vehicle applications. The agreement allows for the creation of highly effective power modules by integrating the inverter technology from Zhenghai Group companies, module technology from both companies and ROHM's advanced SiC chips. Development such as this is expected to boost the market in Asia Pacific.

Power Discrete and Modules Market Regional Insights

The regional trends and factors influencing the Power Discrete and Modules Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Power Discrete and Modules Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Power Discrete and Modules Market

Power Discrete and Modules Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 26.74 Billion |

| Market Size by 2031 | US$ 44.25 Billion |

| Global CAGR (2023 - 2031) | 6.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Power Discrete and Modules Market Players Density: Understanding Its Impact on Business Dynamics

The Power Discrete and Modules Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Power Discrete and Modules Market are:

- INFINEON TECHNOLOGIES AG

- Mitsubishi Electric Corporation

- Toshiba Corporation

- ON Semiconductor Corporation

- STMicroelectronics

- NXP Semiconductors

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Power Discrete and Modules Market top key players overview

Power Discrete and Modules Market News and Recent Developments

The power discrete and modules market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the power discrete and modules market are listed below:

- onsemi announced the availability of its 1200V SPM31 Intelligent Power Modules (IPMs) featuring the latest generation Field Stop 7 (FS7) Insulated Gate Bipolar Transistor (IGBT) technology. The SPM31 IPMs deliver higher efficiency, smaller footprint and higher power density, resulting in lower total system cost than other leading solutions on the market. Given the greater efficiency realized using optimized IGBTs, these IPMs are ideal for three-phase inverter drive applications such as heat pumps, commercial HVAC systems, servo motors, and industrial pumps and fans.

(Source: onsemi, Press Release, February 2024)

- STMicroelectronics (NYSE: STM), a global semiconductor leader serving customers across the spectrum of electronics applications, will supply BorgWarner Inc. (NYSE: BWA), a global leader in delivering innovative and sustainable mobility solutions, with the latest third-generation 750V silicon carbide (SiC) power MOSFETs dice for their proprietary Viper-based power module. This power module is used in BorgWarner’s traction inverter platforms for several current and future Volvo Cars electric vehicles.

(Source: STMicroelectronics, Press Release, August 2023)

Power Discrete and Modules Market Report Coverage and Deliverables

The “Power Discrete and Modules Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Power discrete and modules market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Power discrete and modules market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Power discrete and modules market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the power discrete and modules market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, Material, and Wafer Size

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Increasing requirements for SiC-Based power devices AC and extension of telecommunications infrastructure are driving the market.

Innovation in automotive electronics is a key trend in the market.

INFINEON TECHNOLOGIES AG, Mitsubishi Electric Corporation, Toshiba Corporation, ON Semiconductor Corporation, STMicroelectronics, NXP Semiconductors, Renesas Electronics Corporation, Texas Instruments Incorporated, ROHM CO., LTD., and Semtech Corporation are major players in the market.

The market is expected to reach a value of US$ 44.25 billion by 2031.

The market is anticipated to record a CAGR of 6.5% during 2023–2031.

Get Free Sample For

Get Free Sample For