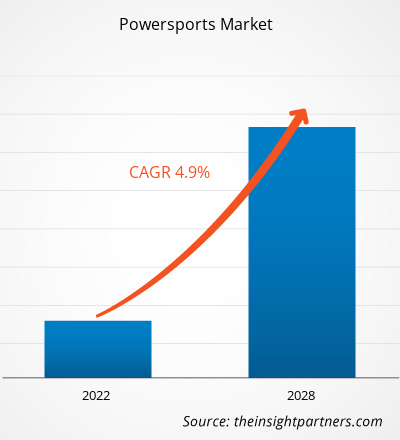

[Research Report] The powersports market is expected to grow from US$ 93,703.64 million in 2021 to US$ 131,083.20 million by 2028; it is estimated to grow at a CAGR of 4.9% during 2021–2028.

Adventure tourism involves traveling to new locations for gaining new experiences, with controlled risk components and personal challenges in wild and exotic environments. An increase in the number of visitors interested in off-road driving is contributing to the economic growth of the respective country.

Powersports generates over US$ 1.15 billion in revenue in Malaysia each year through housing, logistics, and tourism expenditures. Racing events hosted by Malaysia include the Motorcycle Grand Prix (MotoGP), the Asia Road Racing Championship (ARRC), and the Malaysian Cub Prix. These events bring significant societal and economic benefits. The widespread awareness among sports tourists regarding such racing events is the heart of motorsport tourism. The long duration of the events, visibility and coverage by print and electronic media, sponsorship from domestic and global firms, and excessive economic opportunities for locals are all advantages of motorsports tourism destinations. Factors such as high energy levels, drive, and travel desire among people are the major factors pushing the travel motive. For many, the desire to meet new and like-minded people with similar sociability interests is a driving force for off-roading. These features lead to the growth of the powersports market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Powersports Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Global Powersports Market

Prior to the COVID-19 pandemic, the powersports market was growing due to the increase in all-terrain vehicle (ATV) trader traffic. For instance, consumer interest in ATVs, utility terrain vehicles (UTVs), and specialty powersports units soared 35% in the first seven months of 2019, based on year-over-year searches on Trader Interactive's ATV Trader marketplace. ATV trader traffic is consistently growing faster monthly, reflecting a market shift that can help powersport dealers offset flattening motorcycle sales. The ATV trader traffic jumps supported the growth of the powersports market in 2019.

In 2020, the COVID-19 pandemic negatively impacted the powersports market due to the decline in the global automotive industry. The outbreak created significant disruptions in the manufacturing of products, including cars. A sharp decline in manufacturing automobiles impacted the growth of the global powersports market. Further, the data collected from the Organisation Internationale des Constructeurs d'Automobiles (OICA) showed a 16% decline in 2020 total number of vehicle production to less than 78 million vehicles. Moreover, to combat and contain the outbreak, factory shutdowns, travel bans, trade bans, and border lockdowns were imposed; these restrictions negatively impacted the manufacturing, supply, and sales of various automobile components required to manufacture cars. Therefore, the overall COVID-19 impact on the powersports market was negative in 2020.

In 2021 and 2022, the relaxation of lockdown measures and increase in production of powersport vehicles are supporting the market growth. As per an article published by Babcox Media Inc. in July 2021, new-model sales of leading brands increased more than 37.2% in the first quarter of 2021.

Before the COVID-19 pandemic, in 2019, the powersports market size was US$ 95,728.13 million. The market size during the pandemic was US$ 91,324.63 million in 2020. Furthermore, in 2021, the powersports market size was US$ 93,703.64 million. Therefore, the overall impact of the COVID-19 pandemic on the powersports market was negative in 2020.

Powersports Market Insights

Increase in All-Terrain Vehicle Popularity and Experience Zones

Due to their greater performance on difficult and uneven terrains, four-wheel all-terrain vehicles (ATVs) are in high demand among consumers. This is pushing ATV manufacturers to include a four-wheel-drive system as an optional feature or as a full-time option. Microfiber couplings recognize the requirement of a four-wheel-drive system in real time. The popularity of such new four-wheel ATVs is increasing in different countries. For instance, the Canadian Council of Snowmobile Organization holds sporting competitions every year. In addition, several major ATV and UTV manufacturers are hosting racing championships, which is expected to boost demand for these utility vehicles. The US has been experiencing an increase in recreational parks for ATV rides. Recreational options have been created on public lands in the country by adding miles to over 19 national recreational routes. ATVs are also widely used in the armed services, including the military and police agencies, where they are heavily used for transportation in isolated places. As a result, the rising demand for ATVs in recreational, sporting, and military applications is one of the primary factors driving the powersports market growth.

In developed regions such as North America and Europe, ATV experience zones are common. Moreover, there is a rising focus on propelling the number of these zones in emerging markets, such as India and Southeast Asian countries, to raise awareness and demand for utility vehicles. Customers can ride ATVs on artificial off-road fields at these sites. For instance, Polaris built an experience zone in Bengaluru, India, in 2018 to boost its client base.

Type - Based Market Insights

Based on type, the powersports market is segmented into all-terrain vehicles, side-by-side, and motorcycles. The motorcycles segment led the market with the largest share in 2020.

The players operating in the powersports market adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key players are listed below:

- In March 2022, BRP launched electric 2 wheel motorcycles amid the 50th anniversary of the Can-Am brand. The Can-Am brand is back to its motorcycles roots with complete electric-based product line. With electric motorcycles, there comes a great opportunity to flourish in the motorcycles market.

- In March 2021, American Landmaster launched lithium-powered side-by-side called the Landmaster EV. American Landmaster partnered with industry's two best leaders in lithium technology and AC motors.

The regional trends and factors influencing the Powersports Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Powersports Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Powersports Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 93.7 Billion |

| Market Size by 2028 | US$ 131.08 Billion |

| Global CAGR (2021 - 2028) | 4.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Powersports Market Players Density: Understanding Its Impact on Business Dynamics

The Powersports Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Powersports Market top key players overview

Company Profiles

- American Landmaster

- ARCTIC CAT

- BRP

- Hisun Motors Corp., USA

- Kawasaki Motors Corp

- Polaris Inc.

- Yamaha Motor Corporation

- Suzuki Motor USA

- Volcon ePowersports

- American Honda Motor Company, Inc.

Frequently Asked Questions

Which motorcycles segment is expected to dominate the market in terms of 2020 market share?

Which are the major five companies in the powersports market?

Which region has dominated the powersports market?

Which type mode segment is expected to dominate the market in terms of 2020 market share?

What are the reasons behind powersports market growth?

What are market opportunities for powersports market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For