China Dominated Asia Pacific Industrial PPE Market During 2023–2031

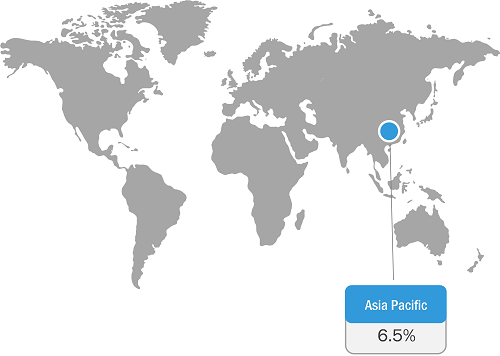

According to our new research study on "Asia Pacific Industrial PPE Market Forecast to 2031 – by Product Type, Flavor, and Distribution Channel," the market was valued at US$ 19.56 billion in 2023 and is projected to reach US$ 32.33 billion by 2031; it is expected to register a CAGR of 6.5% from 2023 to 2031. The report highlights key factors propelling the market growth and prominent players along with their developments in the market. Apart from growth drivers, the report covers the Asia Pacific industrial PPE market trends and their foreseeable impact during the forecast period.

The scope of the Asia Pacific industrial PPE market report focuses on China, Japan, Australia, India, South Korea, Singapore, Malaysia, Indonesia, Thailand, Vietnam, and the Rest of Asia Pacific. The China segment accounted for a larger share in 2023. China is the primary producer of textiles and spandex. The rising adoption of protective equipment by manufacturers in the country drives the demand for industrial PPE. Moreover, China is scaling up the production of PPE and other industrial personal protective equipment (PPE) accessories to prevent occupational accidents and fatalities. The country's personal protective clothing and equipment companies, such as Anbu Safety and Zhengzhou Chengxiao Textile Co. LTD, have stepped up to help mitigate the acute shortage of protective outfits. Therefore, the Asia Pacific industrial PPE market size is likely to surge by 2030 owing to the rising production of protective clothing.

Asia Pacific Industrial PPE Market Growth: CAGR (2023-2031)

Asia Pacific Industrial PPE Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Hand and Arm Protection, Body Protection, Respiratory Protection, Head and Face Protection, and Others), Material (Natural Rubber, Vinyl, Polyethylene, Nitrile, and Others), End-Use Industry (Manufacturing, Construction, Oil & Gas, Pharmaceuticals, and Others), Distribution Channel (Wholesalers, National Retailers, Regional Retailers, and Online Platforms), and Country

Asia Pacific Industrial PPE Market Share and Dynamics by 2031

Download Free Sample

Over the past few years, China has witnessed significant growth in copper ore mining and the building & construction industry owing to the superior infrastructure and emerging economy of China. According to the IBISWorld 2022 data, the copper ore mining and building & construction industry contributed the highest revenue in China's economy—US$ 13,626 billion and US$ 2,475 billion, respectively, in 2021. Several hazardous toxins, including methylmercury, arsenic, asbestos, and lead, are released during mining, making the use of safety equipment in the mining industry necessary. In addition, chronic copper dust poses a serious risk of diabetes and respiratory discomfort to the miners. Therefore, the increasing need to protect workers from infections and diseases encourages the adoption of industrial PPE, which fuels the Asia Pacific industrial PPE market growth.

Asia Pacific Industrial PPE Market: Trends

Smart PPE is one of the trending innovations in the global personal protective equipment (PPE) industry. It refers to innovative wearable equipment that connects to smart devices and technologies such as smartphones and Bluetooth and remotely delivers real-time safety information to workers in the field as well as managers. These smart wearables can track movements, send voice messages, monitor body temperature, provide issue alerts, and record audio and video. They are often paired with a cloud-based analytics platform or a smartphone app. Such innovative technologies are becoming popular among end-use industries as they ensure workers' safety at the workplace. Compared to traditional PPE, smart PPE's advanced features heighten usability and propel its efficiency. Smart PPE reduces errors, thereby decreasing the number and severity of workplace accidents and injury cases; improving productivity, performance, and efficiency; and providing long-term cost savings. It also saves time; increases compliance; and improves worker safety, comfort, and health. Global manufacturers are increasingly launching smart gear such as helmets, earmuffs, glasses, and face masks that aid communication in loud or low-visibility environments.

In September 2019, Vuzix Corporation launched Vuzix Blade Smart Glasses, which provides the necessary protection for various industry and worksite applications. In August 2021, Gales introduced a smart PPE footwear collection to offer protection and comfort to healthcare industry experts. In August 2022, Canaria Technologies launched the Canaria-V—a noninvasive, wearable smart PPE device that estimates modifications in the wearer's physiology via transmissive photoplethysmography (PPG) technology and extracts metrics related to cognitive fatigue and heat stress. It also offers an all-in-one smart wearable technology that provides work instructions or expert remote support to workers in the enterprise. Thus, owing to the high efficiency of smart PPE for workplace safety, various end-use industries have started adopting such technologies, which is expected to be a significant trend in the Asia Pacific industrial PPE market during the forecast period.

Asia Pacific Industrial PPE Market: Segmental Overview

The Asia Pacific industrial PPE market analysis has been performed by considering the following segments: type, material, end-use industry, and distribution channel. By type, the market is segmented into hand and arm protection, body protection, respiratory protection, head and face protection, and others. The hand and arm protection segment accounted for the largest market share in 2023. Hands and arm protection equipment include gloves, finger guards, and arm coverings. Protective equipment for hands and arms is resistant to cuts, burns, and punctures. In food and pharmaceutical industries, rubber or latex gloves are widely used to ensure food and drug safety, thereby preventing contamination. In manufacturing and construction industries, hand gloves and arm guards protect workers from abrasions, bruises, and fractures while handling heavy machinery and tools. In the electrical industry, insulated rubber gloves protect against electrical shocks. In the chemicals industry, gloves and guards provide protection against hazardous and toxic chemicals. In the healthcare industry, disposable rubber gloves are used by health workers to ensure safety and prevent any microbial or fungal infections. The rising importance of personal safety in industrial settings and the increasing number of industrial hazards and mishaps drive the demand for hands and arm protection equipment in the region.

In terms of material, the market is segmented into natural rubber, vinyl, polyethylene, nitrile, and others. The natural rubber segment held the largest Asia Pacific industrial PPE market share in 2023. Natural rubber or latex is used for designing hand protection equipment such as gloves and guards as a barrier material for protection against heat, cuts, and flames. Natural rubber has high elasticity, and it improves the grip of gloves. Natural rubber PPE is used in construction, automotive, lumber & millwork, and metalworking & foundry, among other industries. Natural rubber can also withstand extreme temperatures, making it suitable for gloves used in oil & gas and chemicals industries.

By end-use industry, the market is segmented into manufacturing, construction, oil & gas, pharmaceuticals, and others. The manufacturing segment dominated the market in 2023. In the manufacturing sector, companies are involved in the production of consumer goods, electrical appliances, machinery and tools, pulp and paper, polymers and plastic products, rubber and wood products, and furniture. Workers in the manufacturing industry are constantly exposed to hazardous situations, which can cause irreparable damage. Therefore, in the manufacturing sector, protective gear, such as gloves, coveralls, hard hats, bump caps, protective boots, safety jackets, face masks, and shields, are used to safeguard workers from hazards associated with heavy machinery and equipment. Also, the increasing number of injuries and hazards at workplaces is driving the demand for PPE in the manufacturing industry.

In terms of distribution channel, the market is segmented into wholesalers, national retailers, regional retailers, and online platforms. The wholesalers segment held the largest Asia Pacific industrial PPE market share in 2023. Wholesalers usually sell bulk quantities of products at low costs. Manufacturers of industrial personal protective equipment (PPE) and original equipment manufacturers (OEMs) also sell their products directly in bulk quantities to end-use industries such as oil & gas, construction, manufacturing, and mining at low cost. Both wholesalers and PPE manufacturers have robust distribution capabilities. Industries usually have agreements with wholesalers or industrial PPE manufacturers to purchase personal protective equipment (PPE), such as gloves, masks, jackets, gowns and coveralls, helmets, and boots, in bulk and at affordable prices. This helps them save costs, unlike purchasing PPE from retailers. Thus, wholesalers are the preferred distribution channels for personal protective equipment by industries.

Honeywell International Inc, Lakeland Industries Inc, DuPont de Nemours Inc, 3M Co, Ansell Ltd, VF Corp, Aramark, Kimberly-Clark Corp, and W. L. Gore and Associates Inc are among the leading companies profiled in the Asia Pacific industrial PPE market report.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com