Cell Therapy Held Larger Share in Cell and Gene Therapy Market in 2023

According to our new research study on "Cell and Gene Therapy Market Forecast to 2031 – Global Analysis – by Type, Services, Scale, Service Provider and End User," the market is expected to grow from US$ 4,485.00 million in 2023 to US$ 28,050.39 million by 2031; it is anticipated to record a CAGR of 25.8% from 2023 to 2031. The market report emphasizes trends prevalent in the global market, along with drivers and deterrents affecting its growth. The increase in the number of approvals of cell and gene therapies and the rapid popularity of outsourcing cell and gene therapy manufacturing are among the prominent factors driving the cell and gene therapy market. However, the high cost of cell and gene therapy manufacturing is hampering the growth of the market. Automation of cell and gene therapy manufacturing services is expected to bring new cell and gene therapy market trends in the coming years.

Rapid Popularity of Outsourcing Cell and Gene Therapy Manufacturing Propels Cell and Gene Therapy Market Growth

Cell and gene therapy manufacturing is a complex process, which makes the proper execution and monitoring of the operation crucial. Cell and gene therapy manufacturers have a limited number of qualified personnel who know biological and process engineering. Moreover, for experienced teams, managing the attempts to reach the first clinical trial using a manual and open manufacturing method, as well as building a more commercially suitable process, can be challenging. Therefore, these manufacturers choose to work with contract development and manufacturing organizations (CDMOs) to accelerate their clinical studies and commercialization process. CDMOs support product development, manufacturing, clinical trials, and commercialization services to cell and gene therapy companies on a contract basis. Under the partnership with a CDMO, cell and gene therapy manufacturers support scalability, speed to market, access to technical expertise without overhead costs, and cost efficiencies.

Cell and Gene Therapy Market, by Region, 2023 (%)

Cell and Gene Therapy Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Cell Therapy (Allogeneic, Autologous, and Viral Vectors) and Gene Therapy (Non-Viral Vectors, and Viral Vectors)], Services (Process Development, cGMP Manufacturing, Regulatory Services, and Bioassay Services), Scale (Pre Commercial/R and D Manufacturing and Commercial Scale Manufacturing), Service Providers (CDMOs and CMOs), End User (Contract Research Organizations, Pharmaceutical and Biopharmaceutical Companies, and Academic and Research Institutes), and Geography

Cell and Gene Therapy Market Size, Share & Growth Report by 2031

Download Free Sample

Source: The Insight Partners Analysis

In January 2020, Deerfield Management Company and The Discovery Labs of MLP Ventures established the Center for Breakthrough Medicines in Pennsylvania, US. This new CDMO facility will occupy more than 40% of the campus created by The Discovery Labs. In that space, the CDMO will install 10 plasmid suites; 20 viral vector suites; 36 universal cell processing suites; and 20 current good manufacturing practice (cGMP) testing, process development, and cell banking suites. Deerfield Management Company and The Discovery Labs have invested US$ 1.1 billion to raise a technologically developed facility to support the manufacturing of cell and gene therapies. Further, in March 2020, Fujifilm Cellular Dynamics (FCDI) invested US$ 21 million in the cGMP-compliant production facility, which will be used for manufacturing FCDI’s pipeline of regenerative medicine therapies using induced pluripotent stem cells (iPSCs) and to provide CDMO services for the production of iPSCs and iPSC-derived differentiated cells. In April 2022, ThermoGenesis established a CDMO facility in California, US, to provide CDMO services to cell and gene therapy manufacturers, using its expertise in T-cell receptor (TCR), chimeric antigen receptor-T cell (CAR-T cell), tumor-infiltrating leukocyte (TIL), iPSC, natural killer cell (NK), and mesenchymal stem cell (MSC) manufacturing.

Outsourcing cell and gene therapy manufacturing to CDMOs proves to be cost-effective for manufacturers. They gain access to the technologically advanced infrastructure and expertise of CDMOs. CDMOs employ proper, mapped processes for manufacturing cell and gene therapies. Thus, the increasing preference for outsourcing growing cell and gene therapy manufacturing to CDMOs fuels the cell and gene therapy market growth.

The cell and gene therapy market analysis has been carried out by considering the following segments: type, services, scale, service provider, end user, and geography.

The cell and gene therapy market, by type, the cell and gene therapy market is segmented into bifurcated into cell therapy, gene therapy. The cell therapy segment held a larger cell and gene therapy market share in 2023.

The cell and gene therapy market, by services, the market is segmented into process development, cGMP manufacturing, regulatory services, bioassay services. The process development segment held a larger share of the market in 2023.

The cell and gene therapy market, by scale, the market is bifurcated into pre commercial/R and D manufacturing, commercial scale manufacturing. The pre commercial/R and D manufacturing segment held a larger share of the market in 2023.

The cell and gene therapy market, by service provider, the market is divided into CDMOs, CMOs. The CDMOs segment held a larger share of the market in 2023.

The cell and gene therapy market, by end user, the market is segmented into contract research organizations, pharmaceutical and biopharmaceutical companies, academic and research institutes. The pharmaceutical and biopharmaceutical companies segment dominated the market in 2023.

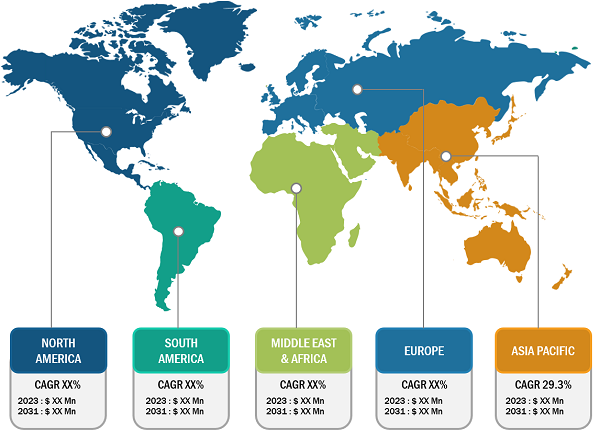

The geographic scope of cell and gene therapy market report entails North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America). In terms of revenue, North America accounted for the largest cell and gene therapy market share in 2023. On the other hand, Asia Pacific accounted for the fastest-growing global cell and gene therapy market in 2023. China is making progress in the field of gene and cell therapy. The country has a large patient population, making it an attractive market for companies developing these treatments. Several companies are working on innovative therapies for diseases such as cancer and genetic disorders in China, and the country has invested heavily in gene therapy research and development. China was the first country to approve gene therapy in 2003; since then, cell and gene therapy developments have advanced rapidly worldwide, and their therapeutic potential has soared. The Government of China has conducted several regulatory reforms to promote the normative development of cell and gene therapies. In addition, the presence of various market leaders operating in the segments is contributing to the market expansion, which contributes notably to the growing cell and gene therapy market size.

Competitive Landscape

Thermo Fisher Scientific, Inc.; Merck KGaA; Charles River Laboratories; Cell and Gene Therapy Catapult; Lonza; WuXi AppTec; Takara Bio Inc.; Bristol Myers Squibb; FUJIFILM Holdings Corporation; F. Hoffmann-La Roche Ltd.; and Catalent Biologics are among the leading companies profiled in the cell and gene therapy market report. The companies implement both organic (such as product launches, expansion, and product approvals) and inorganic (such as collaborations and partnerships) strategies to stay competitive in the market.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com