Soft Tissue Segment to Bolster Dental Laser Treatment Market Growth During 2023–2031

According to our new research study on "Dental Laser Treatment Market Forecast to 2031 – Global Analysis – by Application, End User, and Clinical Indication," the market was valued at US$ 445.38 million in 2023 and is projected to reach US$ 864.58 million by 2031; it is anticipated to record a CAGR of 8.6% from 2023 to 2031. The dental laser treatment market report emphasizes the trends prevalent in the global market, along with drivers and deterrents affecting its growth.

The increasing cases of dental diseases, growing geriatric population, and increasing product launches and product developments are contributing to the dental laser treatment market growth. However, the high cost of dental laser treatment hampers market growth. Further, advancements in laser dentistry are expected to bring new dental laser treatment market trends in the coming years.

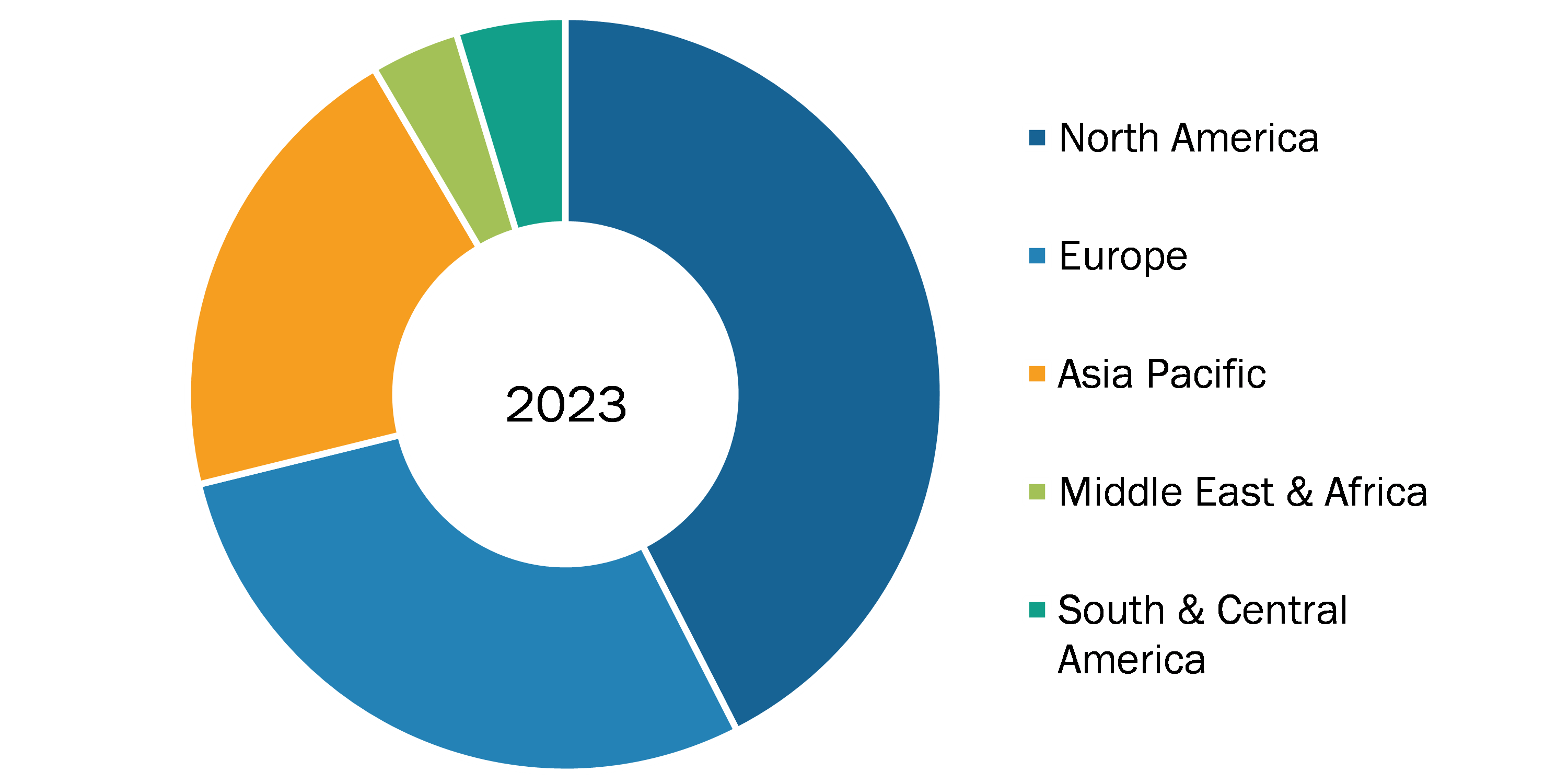

Dental Laser Treatment Market Share, by Region, 2023 (%)

Dental Laser Treatment Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Application (Hard Tissue, Soft Tissue, and Others), End User (Hospitals, Dental Clinics, Dental-Owned Practices, and Others), Clinical Indication [Conservative Dentistry, Root Canal (Endodontic Treatment), Oral Surgery, Implantology, Peri-Implantitis, Periodontics, and Others], and Geography

Dental Laser Treatment Market Trends and Top Players by 2031

Download Free Sample

Source: The Insight Partners Analysis

Increasing Product Launches and Product Developments Drive Dental Laser Treatment Market

The continuous research in medical device development has resulted in new innovative dental devices. Small and large companies operating in the dental laser treatment market are increasingly adopting various strategies, such as new product launches and technological advancements, to boost their revenues. A few recent developments in the dental laser treatment market are mentioned below:

- In February 2024, Biolase Inc launched an all-tissue laser system, Waterlase iPlus Premier Edition. The Waterlase iPlus Premier Edition is an updated version of Waterlase iPlus. A modular software design is included in the premier edition that provides an innovative approach, providing clinicians with customized packages of procedures, which ensures that practitioners invest in the capabilities they need while allowing easily added features as the clinician expands their practice.

- In December 2023, Zolar Technologies and Oral Science launched the New Photon EXE Soft-Tissue Diode Laser. The Photon EXE has a compact footprint and weighs less than 2 kg. It has a wavelength of 810 nm and can produce up to 3W in continuous or pulse modes. This new diode system is used for various procedures such as exposure of gingival troughing, implant recovery, soft tissue crown lengthening, and fibroma removal.

- In November 2023, Convergent Dental launched Solea Protect, a laser used for dental caries prevention using CO2 lasers. The treatment utilizes the Solea laser's new 9.3-micron wavelength to gently heat the surface of tooth enamel and remove the impurities that can weaken teeth.

- In August 2023, Shofu launched DentaLaze, a wireless diode laser used for soft tissue procedures. It is a lightweight, compact diode laser optimal for clinicians. The laser provides 5 single-use fiber optic tips, a slide-on shield, 2 goggles, and 50 barrier sleeves.

- In January 2022, Biolase Inc and EdgeEndo received the FDA 510(k) clearance for the EdgePRO Laser-Assisted Microfluidic Irrigation Device. The new laser-assisted microfluidic irrigation device offers an advanced solution to current cleaning and disinfection techniques without disrupting procedure workflow or adding substantial cost on a per-procedure basis.

Thus, an increase in product launches and product developments is expected to contribute to the growing dental laser treatment market size in the coming years.

The dental laser treatment market analysis has been carried out by considering the following segments: application, end user, clinical indication, and geography. Based on application, the dental laser treatment market is segmented into hard tissue, soft tissue, and others. The soft tissue segment held the largest share of the market in 2023. Soft tissue applications use soft tissue lasers, which are primarily used for procedures involving the gums. The Biolase Epic X Dental Laser, a top-notch product in this category, enhances this precision and flexibility. The product is designed for a broad range of soft tissue applications, allowing dentists to make precise incisions with minimal bleeding and faster recovery times for patients. Soft tissue laser applications include treatment of periodontal disease in children, enhancement of tooth eruption, elimination of abnormal gingival lesions due to improper tooth movements, exposure of unerupted teeth for orthodontic purposes, treatment of drug-induced gingival hyperplasia, disinfection and decontamination, resection of fibroma, aphthous lesions, preservation of pulp vitality, herpes labialis, mucocele and pyogenic granuloma, and esthetic procedures. Hence, wide applications of soft tissue lasers and an increase in dental treatments requiring soft tissue lasers are mainly fueling the market growth for the segment.

By end user, the market is segmented into hospitals, dental clinics, dental-owned practices, and others. The dental clinics segment dominated the market in 2023. The dental laser treatment market is experiencing significant growth, driven by advancements in technology and a rise in demand for minimally invasive procedures. Dental lasers are employed in various applications, including periodontal treatment, cavity preparation, teeth whitening, and soft tissue surgeries, providing benefits such as reduced pain, quicker recovery times, and enhanced precision. Clinics adopting dental laser technology experience improved patient satisfaction due to less discomfort and more efficient treatments. Furthermore, the rising trend of aesthetic dentistry bolsters the demand for lasers, as they are integral to cosmetic procedures that enhance smile appearance. Additionally, educational programs and training seminars are being organized to equip dental professionals with the necessary skills to utilize these technologies effectively. As awareness of the benefits of dental lasers increases, dental clinics that invest in this technology can differentiate themselves in a competitive landscape, ultimately leading to improved practice profitability and better patient outcomes.

Based on clinical indication, the dental laser treatment market is segmented into conservative dentistry, root canal (endodontic treatment), oral surgery, implantology, peri-implantitis, periodontics, and others. The conservative dentistry segment held the largest dental laser treatment market share in 2023. Conservative dentistry involves minimally invasive procedures that primarily focus on the preservation of teeth and their supporting structures. Conservative dentistry helps in providing dental care on a broader scale and has longer success rates, which improves the retention rate of patients. Dental lasers such as CO2 laser and Er:YAG laser are used in conservative dentistry for restoring dental health. CO2 lasers are used to prevent dental caries by reducing carbonate from minerals and fusing hydroxyapatite crystals. Er:YAG lasers are used for treating dental caries by replacing acid etching with a similar effect on enamel and without any adverse influence of phosphoric acid. Diode laser irradiation increases the microtensile bond strength of adhesive systems in Dentin. Increasing dental caries, especially in pediatric patients, and preference for minimally invasive solutions such as dental lasers in these patients are fueling the market growth for this segment. For instance, according to the World Health Organization, ~514 million children suffer from caries of primary teeth. According to the article "Prevalence of Dental Caries and Its Associated Factors among Primary School Children in Ethiopia," in 2021, ~60–90% of school children had dental caries globally. Thus, the increasing prevalence of dental caries and the consequent rise in the use of dental lasers for the treatment of dental caries boost the use of dental lasers in conservative dentistry.

The geographic scope of the dental laser treatment market report includes the assessment of the market performance in North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), South & Central America (Brazil, Argentina, and Rest of South & Central America), and the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and Rest of the Middle East & Africa).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com