Resting ECG Segment to Lead ECG Devices Market Based on Product During 2024–2031

According to our new research study on “ECG Devices Market Forecast to 2031 – Global Analysis – by Product, Lead Type, Technology, and End User,” the market was valued at US$ 3,310.87 million in 2024 and is projected to reach US$ 4,509.53 million by 2031; it is expected to register a CAGR of 4.5% from 2024 to 2031. Major factors driving the market growth include the increasing prevalence of cardiovascular disorders and a surge in government initiatives and healthcare investment.

ECG devices are medical instruments used to measure the electrical activity of the heart. These devices are crucial for diagnosing heart conditions, including arrhythmia, heart attacks, and other cardiac abnormalities. They detect the electrical signals that trigger each heartbeat and can provide vital information about the heart's rhythm and overall health.

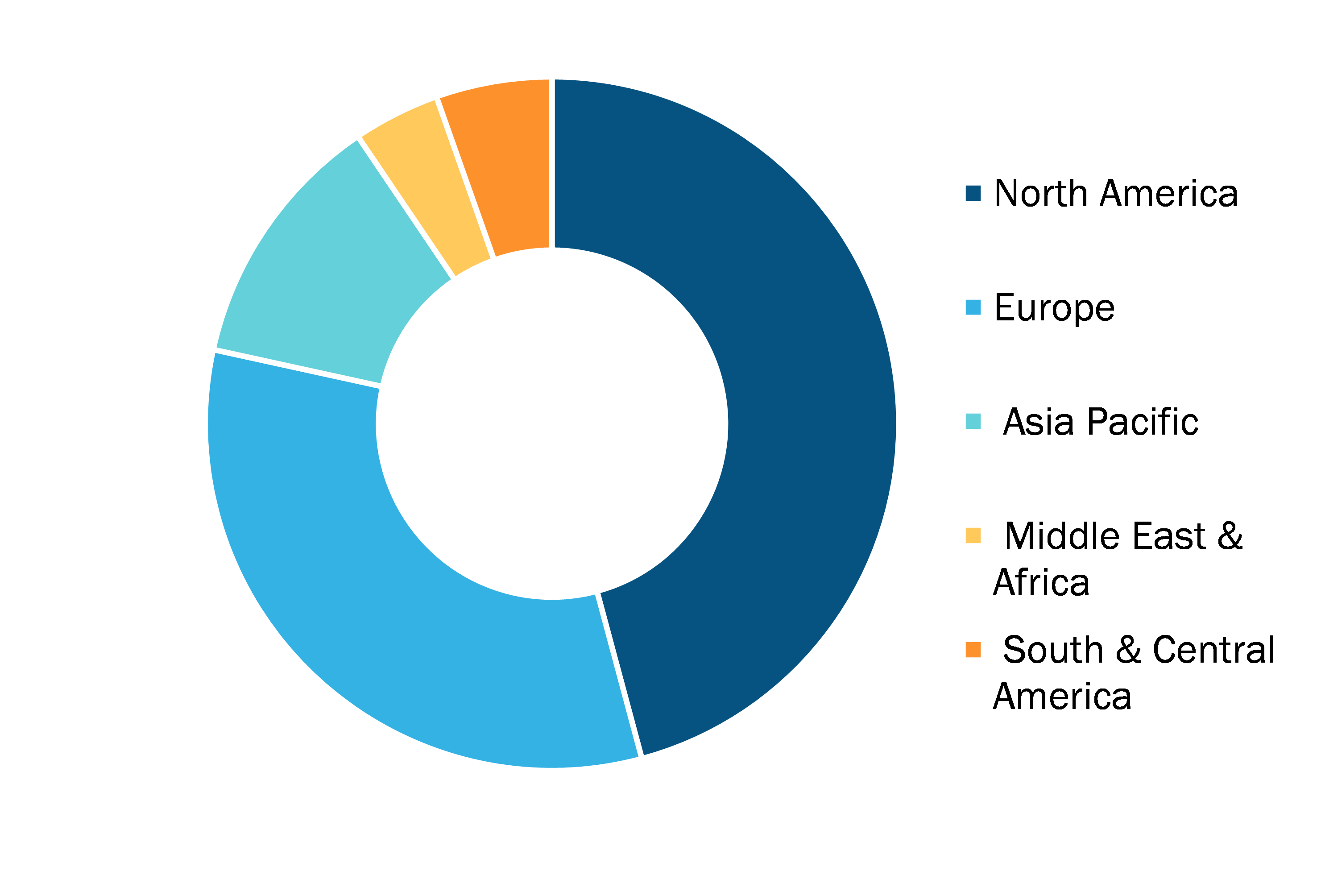

ECG Devices Market, by Region, 2024(%)

ECG Devices Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Resting ECG and Stress ECG), Lead Type (12-Lead ECG, 3–6 Lead ECG, and Single Lead), Technology [Portable (Wired) ECG System and Wireless ECG System], End User (Hospital and Clinics, Ambulatory Surgical Centers, Cardiac Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

ECG Devices Market Analysis and Top Players 2021-2031

Download Free Sample

ECG Devices Market Analysis Based on Segmental Evaluation:

Based on product, the ECG devices market is categorized into resting ECG and stress ECG. In 2023, the resting ECG segment held a significant ECG devices market share. Resting ECG systems play an important role in the diagnosis of heart issues such as irregular heartbeats, heart attacks, and other heart problems. These devices record the heart's electrical signals while a person is at resting state, providing vital data to check heart health. The increasing prevalence of cardiovascular disorders globally mainly drives the growth of the ECG devices market. As per World Health Organization (WHO) 2021 report, CVDs are the leading cause of death, killing over 17 million people globally every year. The growing need for ECG has led to the integration of new features such as wireless connections, compatibility with mobile devices, and better accuracy in finding heart problems. For instance, in February 2024, SCHILLER launched CARDIOVIT FT-2, a resting ECG designed for the hospital environment. This system consists of a hygienic 15" multi-touch display, advanced cybersecurity, and extensive connectivity features, along with an optional thermal printer.

The scope of the ECG devices market report includes an assessment of the market performance in North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the ECG devices market share in 2023. The increasing incidence of cardiovascular disease and an increased focus on preventive healthcare are among the key factors surging the demand for ECG devices. Additionally, government support, an aging population, and growing awareness of heart-related diseases are further propelling the expansion of the ECG devices market in the region.

In North America, the US holds a significant share of the ECG devices market. The growth of the market in the country is primarily driven by the rising geriatric population, growing prevalence and awareness of cardiovascular diseases, increasing focus on preventive healthcare, technological advancements in monitoring vital cardiac indicators, and the push for remote monitoring. According to the Centers for Disease Control and Prevention (CDC), ~805,000 people experience a heart attack in the country every year, of which ~605,000 individuals are first-time heart attacks. As per the Million Hearts 2021 data, ~1.5 million myocardial infarctions and strokes occur in the US annually. The most common type of heart disease in the nation is coronary artery disease (CAD). Per the CDC 2022 estimates, 20.1 million US adults report CAD. ECG devices, which are critical in diagnosing and monitoring various heart conditions such as arrhythmia, heart attack, and heart failure, play a vital role in early detection, treatment planning, and long-term management of CVD.

According to the American Heart Association, nearly half of adults in the US have some type of CVD, and it is estimated that the number of adults suffering from heart failure is projected to surge a substantial 40% by 2035. By 2035, over 130 million adults, i.e., 45.1% of the US population, are expected to report some form of CVD. These devices are noninvasive and provide quick clues to guide further management, such as the need for more advanced imaging or medical interventions.

Public health initiatives and awareness campaigns promoting early detection of CVDs have played a pivotal role in increasing the adoption of ECG devices and improving overall public health outcomes. For instance, to prevent, manage, and reduce the risk factors associated with heart disease and stroke, the CDC’s Division for Heart Disease and Stroke Prevention (DHDSP) supports state, local, and tribal populations in managing the condition. Along with DHDSP, the Division of Diabetes Translation also supports all 50 states and the District of Columbia to address health problems such as heart disease and stroke. Market players are also adopting organic and inorganic strategies for market development. For instance, in December 2024, HeartBeam, Inc., a pioneering medical technology company dedicated to revolutionizing cardiac care through advanced insights, announced that the US Food and Drug Administration (FDA) has granted 510(k) clearance for the HeartBeam system, specifically for comprehensive arrhythmia assessment. This device, distinguished by its patented design, is the first of its kind to achieve FDA approval. As a high-fidelity ECG system featuring a compact, credit card-sized form and a cable-free design, it effectively captures heart signals from three different angles, providing crucial information for actionable heart health management. Such advancements in ECG devices are promoting its market in the US, which, in turn, drive the growth of ECG devices market.

GE Healthcare; Spacelabs Healthcare (OSI Systems, Inc.); Nihon Kohden Corporation; SCHILLER AG; Hill-Rom Holdings, Inc.; BPL Medical Technologies; Koninklijke Philips N.V.; AliveCor Inc; Fukuda Denshi Co., Ltd; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; CompuMed, Inc.; Norav Medical; and custo med GmbH are among the leading companies profiled in the ECG devices market report.

Based on product, the ECG devices market is bifurcated into resting ECG and stress ECG. By lead type, the ECG devices market is segmented into 12-lead ECG, 3-6 lead ECG, and single lead ECG. In terms of technology, the ECG devices market is bifurcated into portable (wired) ECG system and wireless ECG systems. Based on end user, the ECG devices market is segmented into hospitals and clinics, ambulatory surgical centers, cardiac centers, and others. Geographically, the market is categorized into North America (the US, Canada, and Mexico), Europe (France, Germany, the UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), the Middle East & Africa (Saudi Arabia, South Africa, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com