Government Initiatives Toward Vehicle Electrification Boosting the Electric Vehicle Heat Pump Systems Market Growth

According to our latest study on "Electric Vehicle Heat Pump Systems Market Analysis and Forecast to 2031 – by Propulsion Type, Component and Vehicle Type," the market was valued at US$ 437.94 million in 2023 and is projected to reach US$ 1,924.69 million by 2031; it is anticipated to record a CAGR of 20.3% from 2023 to 2031. The report includes growth prospects owing to the current electric vehicle heat pump systems market trends and their foreseeable impact during the forecast period.

The transportation industry is one of the main contributors to air pollution. Governments of different economies are focusing on reducing carbon emissions to protect the environment from pollution. Among many initiatives to protect the environment, many countries are experiencing a surge in the adoption of electric vehicles, which do not emit harmful gases. To reduce the toxic impact of greenhouse gas emissions from fossil fuel-based vehicles, the Government of India has implemented several measures at the state and national levels. The government is encouraging the installation of electric vehicle charging stations by offering capital grants under Phase II of the FAME India program and government policies.

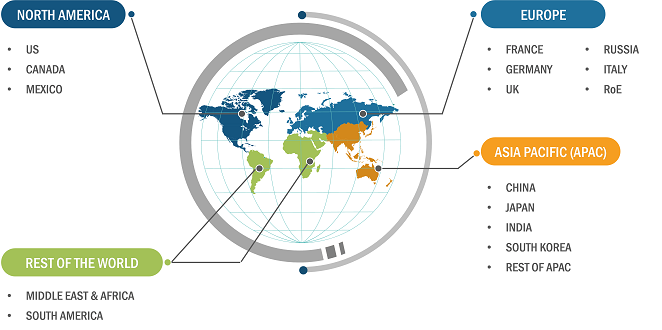

Electric Vehicle Heat Pump Systems Market Share — by Region, 2023

Electric Vehicle Heat Pump Systems Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Propulsion Type (BEV, HEV, PHEV), Component (Evaporator, Condenser, Compressors, Others), Vehicle Type (Passenger Vehicle, Commercial Vehicle), and Geography

Electric Vehicle Heat Pump Systems Market Outlook by 2031

Download Free Sample

Source: The Insight Partners Analysis

The Government of India has introduced several incentives, including PLI SCHEME, FAME-II, battery replacement policy, tax concessions for electric vehicles, and special zones for electric mobility. China has extended its tax exemption policy for new energy vehicles until 2027 to promote the electric vehicle industry. In the UK, the government provided grants for electric vehicles, such as grants for electric vehicle charging stations and grants for infrastructure. In 2023, the US government launched the Electric Vehicle Charger Reliability & Accessibility Accelerator program, providing up to US$ 100 million in federal funding to replace and repair existing but inoperable electric vehicle charging infrastructure. Therefore, increasing government focus and support toward vehicle electrification drives the electric vehicle heat pump systems market.

Based on component, the electric vehicle heat pump systems market is segmented into outside heat exchangers, inside condensers, evaporators, compressors, and others. The growing government focus on vehicle electrification and rising demand for energy-efficient technologies for the automotive sector boost the growth of the market. In terms of propulsion type, the market is segmented into battery electric vehicles, hybrid electric vehicles, and plug-in hybrid cars. The mounting concern about environmental pollution and the increasing number of policies toward mitigating carbon emissions bolster the electric vehicles market worldwide. Based on vehicle type, the electric vehicle heat pump systems market is bifurcated into passenger vehicles and commercial vehicles.

Based on propulsion type, the electric vehicle heat pump systems market is segmented into battery electric vehicles, hybrid electric vehicles, and plug-in hybrid cars. The growing concern about environmental pollution and an increasing number of policies toward mitigating carbon emissions are boosting the sales of electric vehicles. The growing number of electric vehicle battery charging infrastructure and the development of battery swapping stations also boost the market growth. In addition, road infrastructure improvement and a rising number of electric vehicle service centers propel the electric vehicle heat pump systems market. The BEV segment held the largest electric vehicle heat pump systems market share in 2023.

The scope of the electric vehicle heat pump systems market report focuses on North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

North America is one of the primary adopters of electric vehicles (EVs), owing to the adoption of technological advancements and the presence of key electric vehicle market players such as Ford Motor Company, Tesla Inc., The General Motors Company, and Lucid Group Inc. These players drive the automotive industry's development through various strategic initiatives such as new product introduction, partnerships, and advancing features of existing products through research and development and collaborations. The automotive market in North America is growing with the rise in automotive production. In 2023, sales of new electric light-duty vehicles in the US reached ~1.4 million, which increased from nearly 1 million in 2022, resulting in a sales share of about 9%. As the automotive industry is witnessing a rapid transition toward electrification, such data shows that North America is one of the lucrative markets for electric vehicle heat pump systems.

The mounting awareness of environmental protection among consumers is one of the leading considerations steering EV adoption in North America. Owing to government incentives and tax benefits, the prices of EVs have dropped slightly in recent years. Thus, the rising affordability of EVs is contributing to the growing electric vehicle heat pump systems market size.

Companies performing in the automotive sector are focusing on strengthening their vehicle electrification agenda by expanding production facilities across North America. In 2023, Toyota announced for assembly of an all-new, three-row, battery electric SUV at Toyota Kentucky starting in 2025. The BEV is projected to be powered by batteries fabricated by Toyota North Carolina. The new battery plant in North Carolina is under construction and is anticipated to secure an additional US$ 2.1 billion investment to support the company's initiative toward carbon neutrality. Thus, the advancements in EV production propel the electric vehicle heat pump systems market size.

Encouraging government policies are among the major factors driving the purchase of EVs in the US. The US government is taking significant steps to phase out gasoline-powered vehicles by accelerating domestic production of EVs. The Environmental Protection Agency of the US is planning to ensure that ~67% of the new light-duty, and ~25% of heavy-duty vehicles sold by 2032 are EVs. Furthermore, the Inflation Reduction Act (IRA) triggered various global market players to grow their manufacturing facilities in the country. The expanding demand for EVs is anticipated to drive the application of electric vehicle heat pump systems in the US. As per the International Energy Agency (IEA), owing to the IRA, the US, along with other North American countries, witnessed US$ 52 billion of investment, of which half of the investment is for battery manufacturing and one-fifth of the investment is for battery component manufacturing.

Consumer in the US is more concerned about the growing carbon emissions, which, in turn, is growing their preference toward EVs. As an outcome, the sales of EVs witnessed an upsurge in recent years. As per the International Energy Agency (IEA), in the US, new electric car registrations accounted for ~1.4 million in 2023, upsurging by more than ~40% compared to 2022. The modified and updated qualifications for the Clean Vehicle Tax Credit, together with electric car price reductions, direct that some prevalent EV models became eligible for credit in 2023. For example, sales of the Tesla Model Y increased by ~50% compared to 2022 after it became eligible for the full US$ 7,500 tax credit. All such factors increase EV sales in the US and simultaneously boost the electric vehicle heat pump systems market growth in the country.

Denso Corporation, Titanx Engine Cooling, Modine Manufacturing Company, Sanden Corporation, Highly Marelli, Hanon Systems, MAHLE GmbH, and Valeo are among the key players profiled in the electric vehicle heat pump systems market report. Companies operating in the market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com