Asia Pacific Dominated Electronic Thermal Management Materials Market in 2023

According to our latest market study on "Electronic Thermal Management Materials Market Forecast to 2031 – Global Analysis – by Product Type and End-Use Industry ," the market was valued at US$ 2.94 billion in 2023 and is projected to reach US$ 4.83 billion by 2031; it is anticipated to record a CAGR of 6.4% from 2023 to 2031. The report includes growth prospects owing to the current electronic thermal management materials market trends and their foreseeable impact during the forecast period.

In 2023, North America had a significant electronic thermal management materials market share. The North America electronic thermal management materials market growth is due to lucrative opportunities during the forecast period, owing to the growth of various industries, including electronics, telecommunication, aerospace, and automotive. With the expansion of high-performance computing, data centers, electric vehicles (EVs), 5G infrastructure, and consumer electronics industries, thermal management has become a critical factor in ensuring device longevity and reliability. The proliferation of 5G networks and the demand for high-speed internet connectivity in North America are further boosting the need for thermal management materials. The expansion of 5G infrastructure has introduced new electronic components, including antennas, base stations, and network equipment, that require efficient cooling to maintain connectivity and performance. According to the GSM Association, by 2030, 5G will account for 90% of connections in the region and contribute US$ 210 billion to the North American economy. As 5G becomes a foundational technology for smart cities and connected devices, maintaining optimal thermal conditions in equipment is critical to prevent signal disruption and manage increased data transmission.

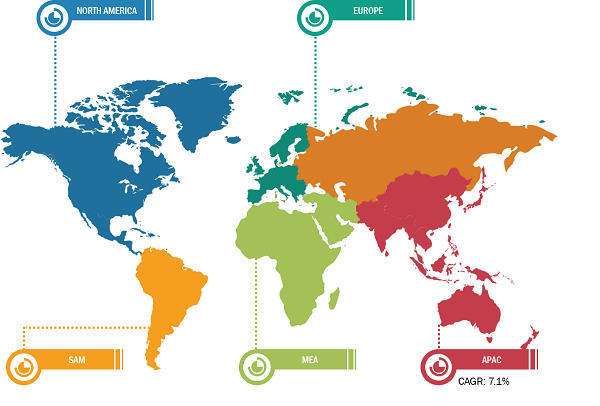

Global Electronic Thermal Management Materials Market Breakdown – by Region

Electronics Thermal Management Materials Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Conductive Adhesives, Thermal Management Films, Gap Fillers, Thermal Gels, Phase Change Materials, Thermal Greases, and Others), End-Use Industry (Consumer Electronics, Automotive, Aerospace, Telecommunication, and Others), and Geography

Electronics Thermal Management Materials Market Scope 2031

Download Free Sample

Countries in Europe are experiencing increasing advancements and expansions in various industries, including automotive, electronics, and aerospace. Data centers and high-performance computing (HPC) facilities are key sectors driving the demand for electronic thermal management materials in Europe. As data consumption grows across the continent due to the growing use of cloud computing, artificial intelligence (AI), and the Internet of Things (IoT), data centers are under pressure to manage larger computational loads and operate efficiently. Europe's data centers, particularly in tech hubs such as Germany, France, and the Netherlands, generate substantial heat, necessitating effective thermal management to maintain operational stability and prevent downtime.

In terms of revenue, in Asia Pacific, China accounted for the largest electronic thermal management materials market share. China is the global leader in the production of passenger cars, commercial vehicles, and electronic product assembly. The government of China has introduced the "Made in China 2025" initiative, which further drives the manufacturing sector. As the world's largest producer of electronic devices, including smartphones, tablets, computers, and home appliances, China relies heavily on efficient electronic thermal management solutions to enhance the performance, safety, and longevity of these products. The miniaturization of electronic components and the push for higher-performance devices result in greater heat generation within compact spaces, necessitating advanced thermal management materials to dissipate heat effectively. Furthermore, China's automotive industry, especially the EV sector, plays a significant role in boosting the demand for electronic thermal management materials. As the government encourages the adoption of EVs to address environmental concerns and reduce urban pollution, the market for electric and hybrid vehicles is experiencing rapid growth. EVs produce significant heat in batteries, power electronics, and motors, requiring efficient thermal regulation to maintain safety, efficiency, and battery lifespan. Electronic thermal management materials are essential to ensure that EV components operate within safe temperature ranges, which is critical as China aims to lead in global EV production and usage. All these properties of electronic thermal management materials play a major role in contributing to the electronic thermal management materials market growth in the country.

Global Electronic Thermal Management Materials Market: Trends

The rollout of 5G technology is expected to bring significant trends in the electronic thermal management materials market. 5G-enabled devices, including smartphones, base stations, and network infrastructure, handle larger data volumes and higher processing speeds, leading to substantially more heat generation than previous generations. To maintain optimal performance and prevent overheating, advanced thermal management materials are essential in dissipating heat effectively. This focus on 5G is spurring the demand for high-performance TIMs, heat spreaders, and phase-change materials that can manage elevated thermal loads. The telecommunication industry is evolving rapidly, particularly with the deployment of 5G technology. According to the GSM Association, 5G networks are likely to cover one-third (1.2 billion) of the world's population by 2025. In addition, there is a widespread rollout of 5G networks across the globe, which has led to an increased demand for smartphones and other consumer electronics. For instance, in October 2021, AIS and Samsung jointly launched a voice-over 5G radio service enabling voice calls on AIS's 5G standalone (SA) network in Thailand. Samsung Electronics and Viettel announced the launch of 5G commercial trials in Da Nang (Vietnam) in December 2021. In addition, according to Viavi Solutions Inc.'s report, in April 2023, over 92 countries across the world launched 5G networks. Further, 23 countries have pre-commercial 5G network trials underway, and 32 nations have announced their 5G rollout plans. The widespread rollout of 5G networks has led to an increased demand for smartphones and other consumer electronics products. This revolution is driving the development of high-frequency, high-performance devices and systems. 5G base stations, for instance, generate much more heat due to the increased power and data processing required for faster connectivity and low latency. They often operate continuously, particularly in urban areas, requiring robust thermal solutions to ensure uninterrupted performance and avoid component failure. High-performance materials such as synthetic graphite and advanced TIMs are in demand to meet these requirements, as they provide both high thermal conductivity and reliability in extreme conditions. Thus, the rising proliferation of 5G technology is likely to contribute to the electronic thermal management materials market size in the near future.

DuPont de Nemours Inc, Henkel AG & Co KGaA, Electrolube Ltd, Tecman Speciality Materials Ltd, Momentive Performance Materials Inc, 3M Co, European Thermodynamics Ltd, Honeywell International Inc, Parker Hannifin Corp, Wacker Chemie AG, Sur-Seal Corp, Graco Inc, Robnor ResinLab Ltd, Master Bond Inc, and Marian Inc are among the key players profiled in the electronic thermal management materials market report.

The electronic thermal management materials market analysis is based on product type, end-use industry, and geography. Based on product type, the electronic thermal management materials market is segmented into conductive adhesives, thermal management films, gap fillers, thermal gels, phase change materials, thermal greases, and others. In terms of end-use industry, the market is segmented into consumer electronics, automotive, aerospace, telecommunication, and others. The scope of the electronic thermal management materials market report focuses on North America (US, Canada, and Mexico), Europe (Germany, France, UK, Italy, Russia, and Rest of Europe), Asia Pacific (China, India, Japan, Australia, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com