Increase in Elderly Population Drive Epilepsy Drugs Market Growth

According to our new research study on "Epilepsy Drugs Market Forecast to 2030 – Global Analysis – by Treatment, Distribution Channel, and Geography," the epilepsy drugs market size was valued at US$ 7,768.50 million in 2022 and is projected to reach US$ 10,705.48 million by 2030; it is estimated to register a CAGR of 4.1% from 2022 to 2030.

Epilepsy is one of the prevalent neurological disorders affecting the geriatric population. According to the National Center for Biotechnology Information, epilepsy is the third most common neurological disorder affecting the elderly after dementia and stroke. The incidence of epilepsy is increasing in older adults, partly because of the growing prevalence of stroke, brain tumors, and dementia. Considering that modern society is aging, the overall prevalence and incidence of epilepsy are expected to rise.

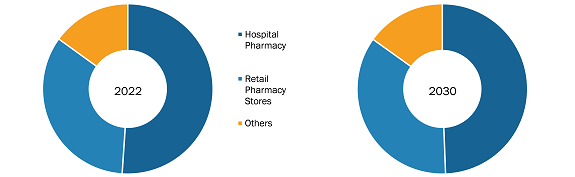

Epilepsy Drugs Market, by Distribution Channel – 2022 and 2030

Epilepsy Drugs Market Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Treatment (First-Generation Anti-Epileptics, Second Generation Anti-Epileptics, Third Generation Anti-Epileptics), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Others), and Geography

Epilepsy Drugs Market Strategic Insights by 2030

Download Free Sample

According to the 2020 population statistics by the US Census Bureau, the geriatric population reached 55.8 million, i.e., 16.8% of the national population; nearly 1 in 6 people in the country were aged 65 and above in 2020. As per the data published by the Fraser Institute, the share of Canada’s population aged 65 or older increased from 14% in 2010 to 19% in 2022 and is expected to reach 22.5% by 2030. In Brazil, the aging population is increasing rapidly. According to the data from the Pan American Health Organization (PAHO), Brazil has ~30 million people aged 60 and above (i.e., 13% of the country's population). The population of this age group is further expected to reach ~50 million (i.e., 24% of the total population) by 2030. The Eurostat statistics indicate that over one-fifth (21.1%) of the European population was aged 65 or more in 2022. According to an article published by UpToDate Inc. in August 2021, the incidence rate of epilepsy rises with age and is highest among patients aged 75 and above.

Therefore, due to the growing geriatric population, there is a notable surge in conditions such as epilepsy, owing to the epilepsy drugs market growth.

The epilepsy drugs market is segmented as follows:

The “Epilepsy Drugs Market” is segmented on the basis of treatment, distribution channel, and geography. The epilepsy drugs market, by product, is segmented into first generation anti-epileptics, second generation anti-epileptics, and third generation anti-epileptics. In 2022, the second generation anti-epileptics segment held the largest market share; the third generation anti-epileptics segment is estimated to register the fastest CAGR during 2022–2030. The second-generation AEDs include felbamate, gabapentin, lamotrigine, levetiracetam, oxcarbazepine, pregabalin, rufinamide, stiripentol, tiagabine, topirate, topiramate, vigabatrin, and zonisamide. In North America and Europe, ZNS is considered a second-generation drug. The higher cost of second-generation AEDs compared with first-generation drugs is a significant factor limiting their mention in formularies. The second-generation AEDs have a more favorable side-effect profile and a lower risk of teratogenesis compared with first-generation drugs. Many first-generation and several second-generation (AEDs) share a common feature of enzyme induction that can increase the metabolism of different substrates targeted by the cytochrome p450 enzyme, along with a decrease in the action of the inducer.

Based on distribution channel, the epilepsy drugs market is segmented into hospital pharmacy, retail pharmacy stores, and others. In 2022, the hospital pharmacies segment held the largest market share; the retail pharmacy is anticipated to register the fastest CAGR during 2022–2030. Hospital pharmacies purchase pharmaceuticals from different companies and supply them to hospitals for outpatient or inpatient treatments. Hospital pharmacies usually offer therapeutic and critical care drugs that have applications in cardiology, neurology, urology, pathology, hematology, and dermatology. Hospital pharmacies are among the essential parts of the healthcare system of any country. These pharmacies maintain stocks of epilepsy drugs to ensure their ready availability for patients. Thus, hospital pharmacies hold a considerable size of the epilepsy drugs market.

Region Analysis – Epilepsy Drugs Market

In terms of geography, the global epilepsy drugs market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

North America will hold the largest market share during 2022–2030. The market in this region is further divided into the US, Canada, and Mexico. The market growth in this region is attributed to increasing number of people affected with epilepsy, growing aging population, ongoing R&D in the field of epilepsy drugs in the region, growing regulatory approvals for new products, and rising number of accidents and brain injuries in epilepsy drugs.

The US is experiencing continued growth in the elderly population. According to the National Centre for Biotechnology Information, the total population of the US is expected to reach 252 million to 317 million, which is a 26% rise between 1987 and 2030, while the population aged 65 years and above is expected to rise by more than 100%, from 12% of the total population to nearly 21% by 2030. According to the Centers for Disease Control and Prevention (CDC), AD is the fifth leading cause of death in people aged 65 and above; also, the number of people living with AD doubles every five years. According to a study titled "2022 Alzheimer's disease facts and figures," published in March 2022, ~6.5 million Americans aged 65 and above were found to have AD in 2022, and the number is projected to rise to 13.8 million by 2060.

Growing cases of neurological diseases such as PD, increasing awareness about neurological disorders, positive research results, and growing investments in developing epilepsy drugs are among the main factors driving the overall market for epilepsy drugs in the US. According to the Parkinson's Foundation, 930,000 people in the US were suffering from PD in 2020, and the number is expected to increase to 1.2 million by 2030.

New product approvals and launches increased in the market. In March 2020, Neurelis, Inc., announced the commercial availability of VALTOCO (diazepam nasal spray) to treat stereotypic, intermittent episodes of frequent seizure activity (i.e., acute repetitive seizures and seizure clusters) that are different from a patient’s usual seizure pattern in pediatric and adult patients. Similarly, in March 2022, the FDA approved Ztalmy (ganaxolone) to treat seizures associated with cyclin-dependent kinase-like 5 (CDKL5) deficiency disorder (CDD) in patients aged 2 and older.

In August 2021, the Epilepsy Foundation announced it had been selected by the Centers for Disease Control and Prevention’s (CDC) Epilepsy Program as a funding recipient under a new cooperative agreement: Improving Systems of Care, Epilepsy Education, and Health Outcomes through National and Community Partnerships. The US$ 17.5 million in federal funds over the next five years will support the work of the Epilepsy Foundation and its partners in creating and maintaining a robust public health infrastructure for epilepsy, advancing health equity, improving quality of life, and achieving the best outcomes for all people living with epilepsy.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com