Waking Aids Product Segment to Bolster Europe and Asia Pacific Wheelchairs and Mobility Aids Market Growth During 2023–2031

According to our new research study on "Europe and Asia Pacific Wheelchairs and Mobility Aids Market Forecast to 2031 –Europe and Asia Pacific Analysis – by Product, Application, End User, and Distribution Channel" the market is expected to grow from US$ 8.09 billion in 2023 to US$ 15.24 billion by 2031; it is anticipated to record a CAGR of 7.0% from 2023 to 2031. The Europe and Asia Pacific wheelchairs and mobility aids market report emphasizes the trends prevalent in the market, along with drivers and deterrents affecting its growth.

The increasing prevalence of disabilities due to accidents as well as increasing chronic illnesses, and conditions such as arthritis is contributing to higher demand for Europe and Asia Pacific wheelchairs and mobility aids market growth. However, initial purchase price of advanced wheelchairs and mobility aids may limit the market access in some of the countries and may hamper the market growth. Nevertheless, technological advancements in wheelchairs and mobility aids are expected to bring new Europe and Asia Pacific wheelchairs and mobility aids market trends in the coming years.

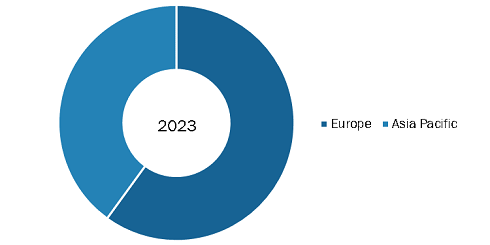

Europe and Asia Pacific Wheelchairs and Mobility Aids Market Share, by Region, 2023 (%)

Europe and Asia Pacific Wheelchairs and Mobility Aids Market Size and Forecast (2021–2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: Product (Manual Wheelchairs, Powered Wheelchairs, Mobility aids, Walking Aids, and Others); Application (Neurologically Impaired, Handicap Patients, and Other Applications); End Users (Homecare, Hospitals and Clinics, Rehabilitation Centers, and Ambulatory Surgical Centers); Distribution Channel (Online and Offline), and Geography (Europe and Asia Pacific)

Europe and Asia Pacific Wheelchairs and Mobility Aids Market 2031

Download Free Sample

Source: The Insight Partners Analysis

Increasing Geriatric Population Bolsters Europe and Asia Pacific Wheelchairs and Mobility Aids Market

Elderly people are more susceptible to mobility limitations, owing to which medical assistive aids are used for their movement. The proportion of the geriatric population in Europe and Asia Pacific is expected to increase significantly during the forecast period owing to a decline in the fertility rate and increased life expectancy. According to the World Economic Forum, more than 30% of the EU population will be above 65 and above by 2100. According to the WHO, the population size aged 60 and older in 2021 was 215 million and is projected to reach 247 million by 2030. Additionally, according to the Economic and Social Commission for Asia and the Pacific, the number of senior people is projected to almost double, from 630 million in 2020 to ~1.3 billion by 2050. Reduced muscle strength, joint problems, and balance issues are often observed in older adults, which makes it challenging to move freely. Mobility aids such as scooters, wheelchairs, and walkers are designed to provide support and assistance. These devices aid in preventing falls, reduce the risk of injuries, and enable older adults to remain engaged in their daily activities. Prominent manufacturers operating in the market are developing products for aged adults, with a greater focus on stability and comfort. Thus, the increasing elderly population is a significant driver for the growth of the Europe and Asia Pacific wheelchair and mobility aids market.

The Europe and Asia Pacific wheelchairs and mobility aids market analysis has been carried out by considering the following segments: product, application, end user, distributional channel, and geography. Based on product, the Europe and Asia Pacific wheelchairs and mobility aids market is bifurcated into manual wheelchairs, powered wheelchairs, mobility scooters, walking aids, and others. The walking aids segment held a larger share of the Europe and Asia Pacific wheelchairs and mobility aids market in 2023. Walking aids, also called ambulatory assistive devices or rehabilitation aids, are given to patients to improve their walking patterns, balance, and promote independent mobility. They can also be used to transfer weight from the upper to the lower extremities of the body to reduce the weight on the lower limb. Walking aids include walkers, crutches, rollators, walking sticks, or canes. Canes are identical to crutches as they carry the weight of an individual body and transfer load from the legs to the upper body. A walker is a type of walking aid with four contact points on the ground and typically has three edges, with the fourth and the closest side being accessible by patients. This type of walking aid offers larger support than a walking stick and is used more often to stabilize patients with poor balance and mobility.

The availability of a range of products and the increasing use of these products among the disabled and elderly people favor the market growth for the walking aid segment. In addition, the rising prevalence of diseases such as osteoporosis and arthritis, and the increasing adoption of walking aids contribute to the segment growth.

Based on application, the Europe and Asia Pacific wheelchairs and mobility aids market is segmented into neurologically impaired, handicap patients, and other applications. The neurologically impaired segment held the largest share in the Europe and Asia Pacific wheelchairs and mobility aids market in 2023. Neurological impairment is a consistent process hampering intellectual function, mobility, communication, and others. It can be mild, with reduced muscle tone and coordination, or severe enough to disrupt a person's ability to stand or walk. Mobility aids help these individuals maintain their independence and improve their quality of life. In addition to overcoming physical limitations, these aids enhance their safety while moving. Mobility aids used by neurologically impaired patients include wheelchairs, walkers, canes, and scooters.

Multiple sclerosis damages neural and biological signal transmission pathways, causing disabilities such as impaired vision, difficulty in walking, weakness, imbalance, sensory loss, pain, and cognitive changes. People with multiple sclerosis experience impaired mobility to some degree within 10–15 years of their initial diagnosis. Loss of mobility in these people adversely affects independence, employment, and quality of life. In addition, traumatic brain injury (TBI) and stroke are other common neurological conditions. Brain injury is one of the significant causes of death and disability worldwide. This condition is mainly related to cognitive and motor functions. Different types of mobility aids are frequently used by patients having neurological conditions to move from one place to another with optimum balance, preventing falls and injuries. Canes and walkers help people with walking difficulty as they address mild balance or weakness issues. Moreover, the neurologically impaired patients use wheelchairs, crutches, and sticks. The selection of mobility aids depends on the individual's specific needs, abilities, and preferences, with the guidance of a healthcare professional.

Based on end user, the Europe and Asia Pacific wheelchairs and mobility aids market is segmented into homecare, hospitals and clinics, rehabilitation centers, and ambulatory surgical centers. The homecare segment held the largest share in the Europe and Asia Pacific wheelchairs and mobility aids market in 2023. Homecare holds a substantial market share in the mobility aids market. According to a study published by the World Health Organization in 2020, ~1 billion people across the globe are suffering from some kind of mobility challenge. According to the same study, low- and middle-income countries together account for a majority share of patients with challenged mobility. Homecare plays a crucial role in aiding mobility and ensuring the independence of patients who prefer to receive treatments at their homes. Most people, including elderly people and individuals with disabilities, prefer to remain at home while receiving healthcare services. As more individuals choose to receive healthcare services in their homes to cut down hospital costs, the need for mobility aids becomes more prevalent. The increasing prevalence of conditions such as muscle injuries, spinal cord injuries, and muscular dystrophy is likely to boost the growth of the market for the homecare segment. In addition, the burgeoning cases of age-related conditions such as orthopedic conditions support the growth of the market for the homecare segment.

Based on distribution channel, the Europe and Asia Pacific wheelchairs and mobility aids market is segmented into online and offline. The offline segment held a larger share of the Europe and Asia Pacific wheelchairs and mobility aids market in 2023. The market growth of this segment is attributed to the strong preference for offline purchases of mobility aids due to advantages such as in-person assistance provided by pharmacists (or other equivalent personnel) and immediate access to products. The offline channel provides patients with the opportunity to personally evaluate comfort, seating settings, and positioning feel, thereby aiding in the selection of the most suitable mobility aid devices, particularly for first-time users. The choice of a wheelchair is influenced by the patient's lifestyle, such as whether it will be used indoors or outdoors and the frequency of usage. Offline retailers often provide expert guidance and assistance, ensuring that patients make informed decisions regarding their mobility aids.

The geographic scope of the Europe and Asia Pacific wheelchairs and mobility aids market report includes the assessment of the market performance in Europe (Germany, The UK, France, Italy, Norway, Denmark, Sweden, Poland, Belgium, The Netherlands, and Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, New Zealand, and Rest of Asia Pacific). Europe dominated the Europe and Asia Pacific wheelchairs and mobility aids market in 2023. The Germany holds the largest Europe and Asia Pacific wheelchairs and mobility aids market size.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com