Rise in Infrastructure Development Investments by Government Bodies Fuels Global Ferroalloys Market Growth

According to the latest market study on “Ferroalloys Market Analysis and Forecast to 2031 – Global Analysis – by Type and Application," the market was valued at US$ 170.04 billion in 2023 and is expected to reach US$ 300.64 billion by 2031; it is estimated to register a CAGR of 7.4% from 2023 to 2031. The report highlights key factors fueling the market growth and prominent players along with their developments in the market.

Ferroalloys are alloys of iron with a high proportion of other elements such as manganese, aluminum, or silicon, primarily used in steel and alloy production. These alloys include ferrochrome, ferromanganese, ferrosilicon, silicon manganese, etc., each serving specific purposes in steel making. Their demand is surging due to the growth of the construction industry in emerging economies, particularly in Asia Pacific, driving the need for steel as well as ferroalloys. Additionally, the rising demand for stainless steel across various industries and the increasing requirements for steel variety and performance in modern science and technology contribute to the escalating demand for ferroalloys in the market. Ferrochrome, for instance, predominantly originates from South Africa, Kazakhstan, and India, catering to stainless steel demand. Also, there was a rise in the production of ferromanganese, essential for steel production, across China, South Africa, and Ukraine. Ferrosilicon, crucial for deoxidization and enhancing steel’s mechanical properties, finds major production hubs in China, Norway, and Russia. Moreover, the global ferroalloys market size is likely to surge by 2031 owing to the growth in the global aerospace & defense industry.

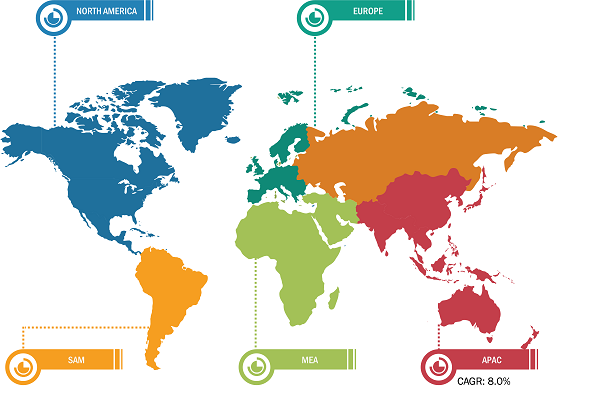

Global Ferroalloys Market Breakdown – by Region

Ferroalloys Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Ferrochrome, Ferromanganese, Ferro Silico Manganese, Special Alloys, and Others) and Application (Steel Making, Wire Manufacturing, Welding Electrodes, Superalloys, and Others)

Ferroalloys Market Size and Growth by 2031

Download Free Sample

The government-supported infrastructure projects involve building roads, dams, bridges, tunnels, ports, airport pavements, and highways. The growing investments from government organizations lead to a rise in infrastructure construction. In 2022, the Department for Transport of the UK announced the funding of US$ 34.83 million to develop net zero highways. In 2022, the Roads and Transport Authority of the UAE commenced phase 1 of the Sheikh Rashid bin Saeed Corridor Improvement Scheme, building four bridges and a four-lane road. The project aimed to improve traffic safety and flow and eliminate overlapping traffic spots. The Department of Water Resources, River Development, and Ganga Rejuvenation of India launched a scheme with a financial outlay of US$ 322.5 million for the rehabilitation of 223 dams in seven states in India. In November 2021, the US government approved a US$ 1.2 trillion infrastructure bill to aid federal investments in various infrastructure projects. Also, construction spending was estimated to increase by 5.5% by 2023. Such initiatives generate demand for construction services, chemicals, and materials. In 2023, the Colorado Department of Transportation in the US invested US$ 17.6 million in addressing road conditions and repairing 12 stretches of roadways. Thus, the rise in infrastructure development investments by government bodies is contributing to the growing ferroalloys market size.

The global ferroalloys market trends include the growing adoption of superalloys. Superalloys are high-performance materials engineered to withstand extreme temperatures, corrosion, and mechanical stress, making them ideal for applications in harsh operating conditions. In the aerospace industry, superalloys play a critical role in the production of aircraft engines, gas turbines, and components subjected to high temperatures and mechanical loads. These alloys offer exceptional strength and oxidation resistance, allowing the efficient and reliable operation of jet engines and other propulsion systems. In the energy industry, superalloys are used in gas and steam turbines, and oil and gas exploration equipment. The infrastructure development of renewable energy sources, such as wind and solar, also boosts the utilization of superalloys in the manufacturing of turbine blades, generator components, and heat exchangers—supporting the transition to clean and sustainable energy sources. The adoption of superalloys is driven by the ongoing research and development efforts aimed at improving the material properties, manufacturing processes, and cost-effectiveness. Advances in alloy design and processing techniques enable the development of a new generation of superalloys with superior performance characteristics.

Glencore Plc, Samancor Chrome, Jindal Stainless Ltd, Ferro Alloys Corporation Limited (FACOR), Erdos Group, Pertama Ferroalloys Sdn Bhd, Brahm Group, Tata Steel Ltd, Nikopol Ferroalloy Plant, and Nava Limited are among the prominent players profiled in the ferroalloys market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. The market report also includes company positioning and concentration to evaluate the performance of competitors/players in the market.

The ferroalloys market report aims to provide an overview of the market with detailed market segmentation. The market is bifurcated on the basis of type and application. Based on type, the market is segmented into ferrochrome, ferromanganese, ferro silico manganese, special alloys, and others. The ferrochrome segment accounts for the significant ferroalloys market share. Ferrochrome, a chromium and iron alloy, plays a crucial role in various industrial applications, particularly in stainless steel production. With its high strength, excellent corrosion resistance, and durability, ferrochrome enhances the properties of steel, making it suitable for use in diverse sectors such as automotive, construction, aerospace, and electronics. The process of producing ferrochrome involves smelting chromite ore, typically extracted from chromite deposits found in countries such as South Africa, Kazakhstan, India, and Turkey. The ore is processed in electric arc furnaces at temperatures exceeding 1,700°C, where it undergoes reduction with carbon to form ferrochrome alloy. The carbon source, often in the form of coke or coal, reacts with the oxygen in the chromite to produce carbon dioxide and molten ferrochrome. The composition of ferrochrome can vary depending on the requirements of its end-use applications. Generally, it contains ~50–70% chromium and 10–20% iron, with small amounts of other elements, including carbon, silicon, and sulfur. These elements contribute to the alloy's mechanical and chemical properties, including corrosion resistance, hardness, and thermal conductivity. Ferrochrome is also utilized in the manufacturing of specialty steels, superalloys, and refractory materials. Additionally, it finds applications in the chemical industry for the production of chromium compounds used in pigments, catalysts, and corrosion inhibitors.

Based on application, the ferroalloys market is segmented into steel making, wire manufacturing, welding electrodes, superalloys, and others. The superalloys segment accounts for the significant ferroalloys market share. Ferroalloys are essential in the manufacturing of superalloys. Superalloys are high-performance materials designed to withstand extreme temperatures, corrosion, and mechanical stress in demanding applications such as aerospace, power generation, and industrial processing. The alloys typically contain a base metal such as nickel, cobalt, or iron, along with a combination of alloying elements, including chromium, molybdenum, tungsten, titanium, and niobium, many of which are derived from ferroalloys. Chromium is a key component in superalloys as it can form stable oxides that provide oxidation and corrosion resistance at high temperatures. Molybdenum and tungsten contribute to the strength and creep resistance of superalloys, enabling them to maintain their mechanical properties under prolonged exposure to elevated temperatures. Titanium and niobium are added to improve the thermal stability and precipitation hardening of superalloys, enhancing their performance in extreme environments. Moreover, rare earth elements such as yttrium and lanthanum, often sourced from ferroalloys, are incorporated into superalloys to refine their microstructure and enhance their high-temperature properties, including creep resistance and thermal fatigue resistance. Thus, the growing benefits of using superalloys boost the global ferroalloys market growth.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com