Biologics Segment to Lead Gastrointestinal Drugs Market Based on Drug Class During 2023–2031

According to our new research study on “Gastrointestinal Drugs Market Forecast to 2031 – Global Analysis – by Drug Class, Application, Route of Administration, and Distribution Channel,” the market was valued at US$ 59,713.68 million in 2023 and is projected to reach US$ 1,06,304.81 million by 2031; it is expected to register a CAGR of 7.5% from 2023 to 2031. Major factors driving the market growth include the rising prevalence of cases of gastrointestinal diseases and the increasing development of biologics. However, the high cost of biologics hinders the market growth.

Gastrointestinal drugs are a category of medications used to address disorders and illnesses linked to the digestive system. This system encompasses the organs involved in the digestion, absorption, and elimination of food and waste. There are several causes for gastrointestinal problems, including infections, inflammation, imbalances in stomach acid secretion, ulcers, and other structural abnormalities. Certain digestive disorders involve abnormal mobility, which affects the movement of food through the digestive tract. Medications that either enhance or regulate motility, such as prokinetic agents, can be used to manage conditions such as gastroparesis or irritable bowel syndrome (IBS). The surge in research and development efforts by pharmaceutical companies to develop novel gastrointestinal medications and increasing product approvals are contributing to the growing gastrointestinal drugs market size.

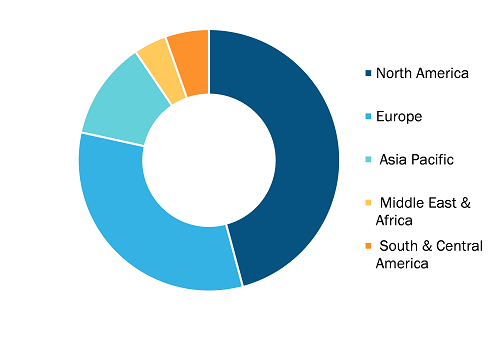

Gastrointestinal Drugs Market, by Region, 2023(%)

Gastrointestinal Drugs Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Drug Class (Biologics, Antidiarrheal and Laxatives, Acid Neutralizers, Anti-inflammatory Drugs, Antiemetic and Antinauseants, and Others), Application (Irritable Bowel Syndrome, Inflammatory Ulcerative Colitis, Crohn’s Disease, Gastroenteritis, Celiac Disease, and Others), Route Of Administration (Oral and Parenteral), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and Geography

Gastrointestinal Drugs Market Dynamics and Analysis by 2031

Download Free Sample

Source: The Insight Partners Analysis

Gastrointestinal Drugs Market Analysis Based on Segmental Evaluation:

Based on drug class, the gastrointestinal drugs market is categorized into biologics, antidiarrheal and laxatives, acid neutralizers, anti-inflammatory drugs, antiemetic and antinauseants, and others. In 2023, the biologics segment held a significant gastrointestinal drugs market share. Biologics is a new category of therapy involved with neutralizing proteins in the body that cause inflammation. The development of biologics has greatly impacted the management and treatment of inflammatory bowel disease (IBD). Biologics can be administered via intravenous infusions or injections. A few examples of biologics include adalimumab (Humira), infliximab (Remicade), certolizumab (Cimzia), golimumab (Simponi), vedolizumab (Entyvio), ustekinumab (Stelara), and risankizumab (Skyrizi). Treatment with biologics has led to a higher quality of life for patients suffering from Crohn's disease and ulcerative colitis, along with fewer hospitalizations and minimal corticosteroid side effects. Also, biologics are indicated for those diagnosed with moderate to severe gastrointestinal diseases and other active diseases who have not responded well to traditional therapy. Patients with gastrointestinal diseases who are not responding well to conventional treatment can benefit from biologics. For example, infliximab, which is derived from monoclonal antibodies to tumor necrosis factor, is a modifier of the immune system's actions. It is administered as a series of infusions by vein. This medication can be used to treat patients with fistulas and moderate-to-severe Crohn's disease that has not responded to other treatments. Two biologics—vedolizumab and natalizumab—are used for the treatment of patients suffering from mild to severe Crohn's disease who have not responded well to TNF inhibitors or other immunomodulating medications. Further, Takeda Pharmaceutical Company Ltd. is evaluating five candidates for various gastrointestinal indications in different phases. Thus, the segment is anticipated to grow rapidly during the forecast period due to the growing number of biologics in the pipeline, thereby positively influencing the overall growth of the gastrointestinal drugs market.

The antiemetic and antinauseants segment is expected to register the highest CAGR in the market during 2023–2031. Antiemetic and antinauseant medications are a diverse group of drugs that are used to treat nausea or vomiting. Different antiemetic medicines can help when nausea and vomiting arise due to various causes, such as motion sickness, viral or bacterial infections, the effects of surgery, and other medications. Antiemetics include antihistamines, anticholinergic agents, phenothiazines, centrally acting benzamides, serotonin type 3 receptor blockers, cannabinoid receptor agonists, and others. Two types of over-the-counter antiemetics—bismuth subsalicylate (Kaopectate, Pepto-Bismol) and antihistamines—are available in the market. Antihistamines are medicines that help prevent nausea and vomiting triggered by motion sickness. For instance, Meclizine hydrochloride (Bonine) is an antihistamine that is efficient in the treatment of nausea, vomiting, and dizziness related to motion sickness. Antiemetic medications are often prescribed to treat vomiting in children with acute gastroenteritis. Ondansetron is an antiemetic agent with a consistent, proven effectiveness in reducing vomiting caused by gastroenteritis. Antiemetic medications work on the neural paths involved with vomiting by blocking specific receptors that respond to neurotransmitter molecules, such as dopamine, serotonin, and histamine. These drugs inhibit the stimulation of the gastrointestinal tract, diaphragm, and abdominal muscles and produce a calming effect on the brain, leading to slight drowsiness.

The scope of the gastrointestinal drugs market report includes the assessment of the market performance in North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the gastrointestinal drugs market share in 2023. The increasing incidence of gastrointestinal diseases due to changes in lifestyle, government organizations' support for prevention and treatment of gastrointestinal diseases, the presence of well-developed healthcare infrastructure, the growing pharmaceutical industry, and industry giants are a few of the key factors propelling the gastrointestinal drugs market growth in North America. Crohn's disease and ulcerative colitis are two of the most common types of IBD. As per the Crohn’s & Colitis Foundation of America report, “Facts about IBD,” ~70,000 new cases of IBD are diagnosed yearly in the US. The overall prevalence of IBD increased significantly from 2011 to 2020. The study estimates that nearly 1 in 100 Americans have IBD, and ~2.4 million Americans have some form of IBD.

Increasing initiatives to prevent and treat gastrointestinal diseases in Canada are likely to favor the market growth. The Canadian Digestive Health Foundation (CDHF) launched a scientific program to define the incidence, prevalence, mortality, and economic impact of digestive disorders in the country. CDFH has also launched my IBS app, a smart app that tracks digestive health and assists people in managing their bowels. The app is designed to help improve communication with the doctor by tracking the day-to-day bowel experiences of a person. Such apps help patients track their bowels and guide them to take treatment for constipation as per requirements, favoring the gastrointestinal drugs market growth.

Newer drug options offer healthcare providers more treatment choices and better patient outcomes. There has been an advancement in medical awareness and diagnostic techniques for gastrointestinal disorders, leading to earlier and more accurate diagnoses, prompting healthcare providers to prescribe appropriate medications for treatment. Thus, increasing research investment for novel drug development and artificial intelligence-based techniques are projected to bring new gastrointestinal drugs market trends in the coming years.

Sanofi SA, GSK Plc, Johnson & Johnson, Bausch Health Companies Inc, AstraZeneca Plc, Takeda Pharmaceutical Co Ltd, AbbVie Inc, Bayer AG, Pfizer Inc, and Celltrion Inc. are among the leading companies profiled in the gastrointestinal drugs market report.

Based on drug class, the gastrointestinal drugs market is categorized into biologics, antidiarrheal and laxatives, acid neutralizers, anti-inflammatory drugs, antiemetic and antinauseants, and others. By application, the market is segmented into irritable bowel syndrome, inflammatory ulcerative colitis, Crohns disease, gastroenteritis, celiac disease, and others. Based on route of administration, the market is bifurcated into oral and parenteral. In terms of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. Geographically, the market is categorized into North America (US, Canada and Mexico), Europe (France, Germany, UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia Pacific), the Middle East & Africa (Saudi Arabia, South Africa, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com