Large Molecule Injectables Segment to Hold Larger Share of Generic Injectables Market During 2021–2028

According to our new research study on Generic Injectables Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by product type, container type, application, and route of administration,” the generic injectables market size is expected to grow from US$ 74.74 billion in 2021 to US$ 150.65 billion by 2028; it is estimated to grow at a CAGR of 10.5% during 2021–2028. The generic injectables market growth is attributed to low R&D, marketing, and manufacturing costs, and the rising prevalence of chronic illness cases are expected to drive the growth of the market.

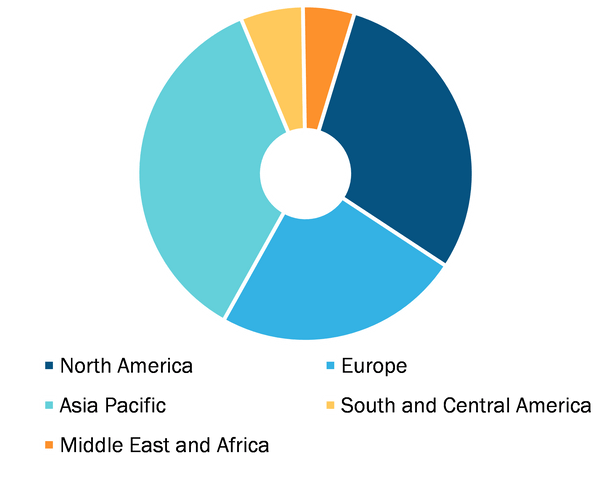

North America held the significant market share in generic injectables market. The growth of the market in countries such as the US and Canada is driven by the factors such as increasing demand for generic injectables to lower the treatment cost and growing support through an initiative to enhance generic pharmaceutical production.

High Demand for Affordable Drugs Fuelling Generic Injectables Market Growth:

Generic injectables are affordable and provide greater access to healthcare. For instance, as published by the Association for Accessible Medicines (AAM), the average primary copay (the amount set by the insurance plans) of a generic drug is US$ 6.06 and US$ 40.30 for branded drugs. This fact indicates the falling prices of generic medicines by at least ~7%. Additionally, according to the American Association of Retired Person (AARP), branded drug prices continue to increase at a pace that is 100-times greater than inflation. The high acceptance of generic injectables by patients due to low prices and easy accessibility, pushing physicians to prescribe generic version of medicines. For instance, as mentioned by the USFDA, 9/10 prescriptions filled in the US are for generic drugs.

Further, low prices of generic injectables contribute to greater and effective chronic illness treatments. As per the World Health Organization (WHO), ~422 million people worldwide were diabetic in 2021. Generic injectables such as insulin injections offer immediate solutions for such ailments, alongside ensuring affordable treatments in developing countries. The facts mentioned above boost the demand and availability of generic injectables, thus driving the entry of more players into the generic injectables market.

Impact of COVID-19 Pandemic on Generic Injectables Market:

Before COVID-19, the significance and acceptance of generic injectables were not much considerable. But the pandemic led to the shortage of several injectables, such as remdesivir, which flashed the light on other generic injectables as well. During the peak of the COVID-19 pandemic and amid the second wave, there had been a tremendous surge in demand for remdesivir, an antiviral medication. Due to a shortage in the supply of several other generic injectables for COVID-19 treatment, companies in the generic injectables market joined hands to fulfill the country-level demands. For instance, Novartis collaborated with Civica Rx to address the issue of chronic shortages of needed injectables. As part of this deal with Civica, Novartis' Sandoz boosted the supply of six generic injectables that are high in demand at hospitals to tackle the scarcity faced by acute care settings. Additionally, Sandoz began shipments of a group of antibiotics, acid reducers, blood thinners, and injectables required in the operating rooms to 1,200-member hospitals of Civica. In addition to drug launches and price cuts, stakeholders in the generic injectables market conducted webinars to understand how manufacturers were combating COVID-19, alongside ensuring flexibility and simplicity during drug containment and delivery.

AstraZeneca; Baxter International Inc.; Biocon; Fresenius SE & Co. KGaA; GlaxoSmithKline plc; Hikma Pharmaceuticals PLC; Johnson and Johnson Services, Inc.; Lupin; Merck & Co., Inc.; Viatris Inc.; Pfizer Inc. are among the leading companies operating in generic injectables market.

Generic Injectables Market, by Region, 2021 (%)

Generic Injectables Market Trends and Scope by 2028

Download Free Sample

Generic Injectables Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Product Type (Large Molecule Injectables and Small Molecule Injectables), Container Type (Vials, Premix, Prefilled Syringes, Ampoules, and Others), Application (Oncology, Infectious Diseases, Cardiology, Diabetes, Immunology, and Others), and Route of Administration (Intravenous, Intramuscular, Subcutaneous, and Others), and Geography

Based on product type, generic injectables market is bifurcated into large molecule injectables and small molecule injectables. The generic injectables market, by container type, is segmented into vials, premix, prefilled syringes, ampoules, and others. Based on application, the market is segmented into oncology, infectious diseases, cardiology, diabetes, immunology, and others. By the route of administration, the generic injectables market is segmented into intravenous, intramuscular, subcutaneous, and others. Based on geography, the market is segmented into North America (the US, Canada, and Mexico), Europe (France, Germany, the UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, India, Japan, Australia, South Korea, and the Rest of APAC), the Middle East & Africa (Saudi Arabia, the UAE, South Africa, and the Rest of MEA), and South & Central America (Brazil, Argentina, and the Rest of SCAM). Generic Injectables Market Trends and Scope by 2028

Download Free SampleGeneric Injectables Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Product Type (Large Molecule Injectables and Small Molecule Injectables), Container Type (Vials, Premix, Prefilled Syringes, Ampoules, and Others), Application (Oncology, Infectious Diseases, Cardiology, Diabetes, Immunology, and Others), and Route of Administration (Intravenous, Intramuscular, Subcutaneous, and Others), and Geography

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com