Rising Demand from Industrial Machinery, Building & Construction, and Automotive Industries Drive Iron Casting Market Growth

According to our latest market study on “Iron Casting Market Forecast to 2031 – Global Analysis – by Type, Process, and End Use,” the market was valued at US$ 143.67 billion in 2023 and is projected to reach US$ 222.84 billion by 2031; it is anticipated to record a CAGR of 5.6% from 2023 to 2031. The report highlights key factors contributing to the iron casting market size and prominent players, along with their developments in the market.

In 2023, Asia Pacific dominated the global iron casting market share. The Asia Pacific iron casting market encompasses a wide range of products, including gray iron, ductile iron, and malleable iron castings, each with distinct properties and applications. The demand for iron castings in Asia Pacific is driven by robust industrial activities and infrastructural development, alongside the steady advancements in casting technologies that enhance product quality and manufacturing efficiency. In recent years, the market has witnessed significant transformation due to the integration of advanced manufacturing processes, such as automation, and the use of innovative materials to improve durability and performance. The rising adoption of 3D printing and other digital technologies in casting has also contributed to reducing lead time and costs, thereby increasing competitiveness.

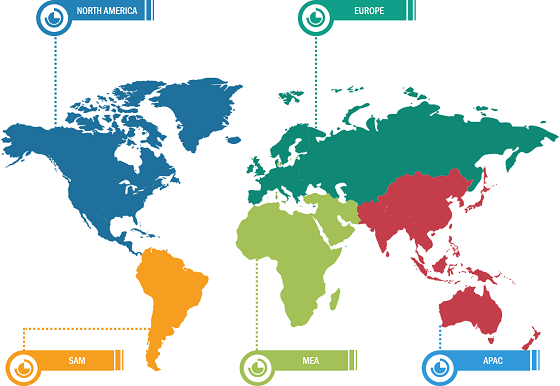

Global Iron Casting Market Breakdown – by Region

Iron Casting Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Grey Iron, Ductile Iron, and Others), Process (Die Casting, Centrifugal Casting, Sand Casting, Investment Casting, and Others), End Use (Automotive, Industrial Machinery, Aerospace, Building & Construction, Energy, Marine, and Others), and Geography

Iron Casting market Report Size & Share Analysis By 2031

Download Free Sample

Iron castings are widely used in various automotive applications due to their durability, strength, and cost-effectiveness. From engine blocks and cylinder heads to brake components and suspension parts, iron casting is integral for the construction of automobiles. The automotive industry has recently witnessed a surge in demand for lightweight materials to improve fuel efficiency and reduce emissions. While materials such as aluminum and composites have gained popularity for a few applications, iron casting remains indispensable for many critical components due to their superior mechanical properties and affordability. Manufacturers continue to invest in research and development to enhance the performance of iron casting while reducing their weight through advanced design and engineering techniques.

The automotive industry’s shift toward electric and hybrid vehicles has also presented new challenges and opportunities for the iron casting market. While these vehicles require fewer traditional components, such as engine blocks, they still rely on iron casting for essential parts—such as electric motor housings, battery casings, and structural components. As the demand for electric vehicles continues to grow, the iron casting market instantly adapts to meet the evolving needs of the automotive industry, exploring innovative solutions to support the production of electric and hybrid vehicles.

In industrial machinery, iron casting finds extensive use in the production of industrial pumps, valves, and compressors. These critical components are essential for fluid handling, control, and compression in various industrial processes. Iron castings provide the structural integrity and dimensional stability required for these components to operate efficiently under demanding conditions, including high pressure, corrosive environments, and extreme temperatures. In addition, iron casting is integral to manufacturing industrial tools and equipment used in metalworking, machining, and fabrication processes. From lathe beds and milling machine bases to gearboxes and tooling components, iron casting serves as the foundation for precision machinery and equipment essential for shaping, cutting, and forming metal materials with accuracy and efficiency.

In the building & construction sector, iron casting is a foundational element in producing various structural and decorative components essential for construction projects. Iron castings are valued for their strength, durability, and versatility, making them a preferred choice for a wide range of applications in the fabrication of structural components such as columns, beams, and connectors. These components provide essential support and stability to buildings, bridges, and other structures, with iron casting offering the structural integrity and load-bearing capacity necessary for ensuring the safety and longevity of construction projects. Additionally, iron casting is utilized in the production of decorative and architectural elements that enhance the aesthetic appeal of buildings and public spaces. Ornamental ironwork, including railings, gates, and balusters, often incorporates intricately designed iron casting to add visual interest and character to architectural designs. The versatility of iron casting allows for the creation of custom designs and intricate details, making it a popular choice for architects and designers seeking to incorporate unique and decorative elements into their projects. Moreover, iron casting finds use in the construction of infrastructure projects such as highways, railways, and utilities. Manhole covers, drainage grates, and utility covers are commonly manufactured using iron casting due to their durability and resistance to wear and tear. These components provide essential access points and protection for underground infrastructure, ensuring the efficient operation and maintenance of utility networks.

Global Iron Casting Market: Trends

The iron casting market trends include a rising emphasis on recycling cast iron. Governments and organizations in North America are focusing on establishing policies and legislation to promote and support the circular economy and recycling of metals. With several initiatives, the government aims to promote sustainable economic practices and recycling/reusing materials to achieve the carbon neutrality goal by 2050. The adoption of recycled iron casting has expanded among customers in response to rising environmental concerns. Iron casting can be recycled several times without compromising the material's quality.

Recycling cast iron provides environmental and economic advantages. Recycling cast iron reduces the amount of material that ends up in landfills. Recycling also conserves energy and reduces the demand for natural resources used in the production of new metal products. The Institute of Scrap and Recycling Industries revealed that more than 70% of the steel manufactured in the US is green steel, which is made from recycled material. In 2022, the US steel mills consumed ~57 million metric tons of recycled iron and steel in order to produce 82 million metric tons of steel. Moreover, recycled iron and steel exports (excluding stainless and alloy steel) declined 3.9% by quantity to 16 million metric tons. Thus, rising recycling initiatives are expected to fuel the iron casting market growth.

Aarrowcast Inc, Cadillac Casting Inc, Calmet Inc, Fusium Inc, Decatur Foundry Inc, Grupo Industrial Saltillo SAB de CV, Willman Industries Inc, OSCO Industries Inc, Mesa Castings Inc, and Waupaca Foundry Inc are among the key players profiled in the iron casting market report.

The iron casting market segmentation is as follows:

The iron casting market analysis is based on type, process, end use, and geography. Based on type, the market is segmented into gray iron, ductile iron, and others. Based on process, the market is categorized into die casting, centrifugal casting, sand casting, investment casting, and others. In terms of end use, the iron casting market is divided into automotive, industrial machinery, aerospace, building & construction, energy, marine, and others. The scope of the iron casting market report focuses on North America (the US, Canada, and Mexico), Europe (Germany, France, the UK, Italy, Russia, and the Rest of Europe), Asia Pacific (China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). In terms of revenue, the Asia Pacific dominated the iron casting market share in 2023.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com