Rising Healthcare Investments in Emerging Economies Driving Market Growth

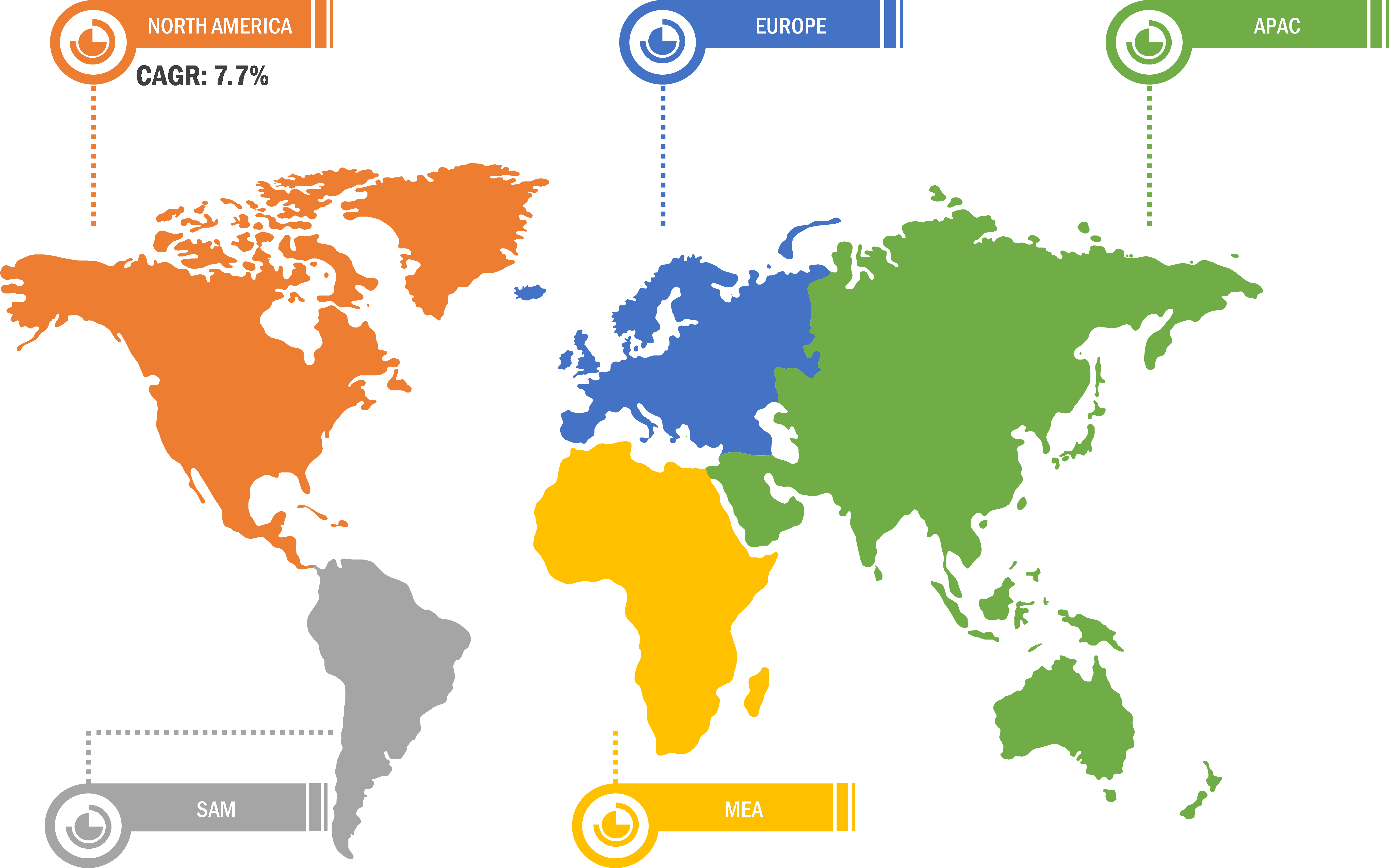

According to our latest market study on “Medical Plastics Market Forecast to 2027 – COVID-19 Impact and Analysis – by Type (Standard Plastic, Engineering Plastic, High Performance Plastic (HPP), Silicone, and Others) and Application (Medical Disposables, Prosthetics, Medical Instruments and Tools, Drug Delivery, and Others),” the global medical plastics market was valued at US$ 24,671.82 million in 2019 and is projected to reach US$ 44,669.63 million by 2027; it is expected to grow at a CAGR of 7.7% from 2020 to 2027. The report highlights key factors driving the market growth and prominent players along with their developments in the market.

Medical plastics are made from a huge number of macromolecules. These plastics are utilized to produce consistent and safe instruments in the healthcare industry. They are remarkably long-lasting, supple, and economical. The performance, sterility, and quality of the tools made from medical plastics are a major factor for market expansion. Medical plastics find a broad range of applications in diagnostic instruments, implants, disposables, drug delivery devices, surgical instruments, syringes, and catheters. The global population is projected to increase in the coming years. With the increasing population, diseases and infections are rampantly overspreading through several mediums. Rising geriatric population further boosts the development of the healthcare sector. Moreover, medical plastics are also exploited in prosthetics. Prosthetics offers a life-changing solution for physically disabled people. According to a report by the US Department of Health and Human Services, nearly 8.7 million sports and recreation injuries were reported in the US in 2018. Out of these, 72% were injuries associated with upper and lower extremities. The injuries are growing at a rapid rate which demands more prosthetic products, further enhancing the growth of the medical plastics market.

Factors such as increase in disposable income and rapid urbanization are fueling the demand for advanced healthcare services and treatments in emerging economies. Also, public investments in healthcare sector in developing countries are increasing significantly owing to rising geriatric population coupled with growing demand for modern healthcare services from urban middle-class population. According to the United Nations, it is reported that the percentage of population comprising people aged 65 years and above in emerging countries would rise from 10% to 15% of the overall population by 2030. The escalating healthcare needs of senior citizens and expensive treatment costs for non-communicable disease in these economies are paving the way for numerous healthcare investments. Furthermore, factors such as increasing GDP, expanding middle class, rising life expectancy, and growing disposable income are fueling the demand for medical devices across South America, especially in Brazil. Moreover, increasing purchasing power and rising willingness of the populace to pay for better health services and government initiatives are catalyzing the investments in Brazil.

Key players operating in the global medical plastics market include Celanese Corporation, Eastman Chemical Company, GW Plastics, Orthoplastics Ltd, ARAN BIOMEDICAL TEORANTA, Rochling, SABIC, Saint-Gobain Performance Plastics, SOLVAY, and DOW.

COVID-19 first began in Wuhan, China, during December 2019, and since then, it has spread at a fast pace across the globe. The US, Brazil, India, Russia, Spain, and the UK are some of the worst affected countries in terms of confirmed cases and reported deaths. The COVID-19 outbreak has affected economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. However, it is estimated that COVID-19 has positively influenced the growth of the medical plastics market. Rising demand for medical plastics, such as PE, PP, and PC, from medical disposables, OEMs, and medical device/equipment manufacturers owing to COVID-19 pandemic propels the market growth. These medical plastics are used to produce critical care systems and disposables, such as thermal scanners, ventilators, respirators, masks, and gloves, which, in turn, is driving the market. Besides, increasing awareness about maintaining proper health and hygiene is further fueling the medical plastics consumption. Various key players are increasing their production to combat the spread of COVID-19. For instance, Celanese Corporation is expanding its production of materials used for the manufacturing of respirators, ventilators, and other critical medical equipment and supplies. The company is also expanding its supply chain base to serve the increased demand for medical plastics from the healthcare sector.

Global Medical Plastics Market Breakdown - by Region, 2019

Medical Plastics Market Strategic Insights by 2027

Download Free Sample

Medical Plastics Market Forecast to 2027 - COVID-19 Impact and Global Analysis by Type (Standard Plastics, Engineering Plastics, High Performance Plastics (HPP), Silicone, and Others), Application (Medical Disposables, Prosthetics, Medical Instruments and Tools, Drug Delivery, and Others), and Geography

Medical Plastics Market Strategic Insights by 2027

Download Free SampleMedical Plastics Market Forecast to 2027 - COVID-19 Impact and Global Analysis by Type (Standard Plastics, Engineering Plastics, High Performance Plastics (HPP), Silicone, and Others), Application (Medical Disposables, Prosthetics, Medical Instruments and Tools, Drug Delivery, and Others), and Geography

The report segments the global medical plastics market as follows:

By Type

- Standard Plastic

- Engineering Plastic

- High Performance Plastic (HPP)

- Silicone

- Others

- Medical Disposables

- Prosthetics

- Medical Instruments and Tools

- Drug Delivery

- Others

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- Italy

- U.K

- Russia

- Rest of Europe

- Asia Pacific (APAC)

- Australia

- China

- India

- Japan

- South Korea

- Rest of APAC

- Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

- SAM

- Brazil

- Argentina

- Rest of South America