Infusion Pumps Segment to Lead North America Infusion Devices Market Based on Product Type During 2023–2031

According to our new research study on “North America Infusion Devices Market Forecast to 2031 –Regional Analysis – by Product Type, Application, End User, and Geography,” the market was valued at US$ 5,494.15 million in 2023 and is projected to reach US$ 9,116.47 million by 2031; it is expected to register a CAGR of 6.5% from 2023 to 2031. Key factors driving the market growth include the increasing prevalence of cancer and the growing geriatric population. However, frequent product recalls hinder market growth. Moreover, growing technological advancements are projected to bring new North America infusion devices market trends in the coming years.

Infusion devices are widely used in all clinical areas and are essential for perioperative care, critical care, and pain management. The treatment of diabetes requires infusion pumps such as insulin pumps to regulate and monitor the essential amount of glucose in the bloodstream of the patient. An insulin pump is a small device that continuously delivers insulin to manage carbohydrate intake. Moreover, in chemotherapy, drugs are used to eliminate cancer cells. It is usually administered with an infusion device directly into a vein, allowing the drugs to move through the bloodstream and target the cancer cells. Infusion pumps are also used to infuse fluids in babies with weak renal, cardiac, or pulmonary functions to prevent fluid overload. Infusion pumps have been preferred over manual flow control systems as they ensure precise and accurate delivery of suggested fluid volumes over a specified time and help in better nursing management. Additionally, the increasing prevalence of chronic diseases and the growing cost of hospital-based infusion therapies have resulted in a growing research and development effort to develop home-based infusion products, thereby contributing to the growing North America infusion devices market size.

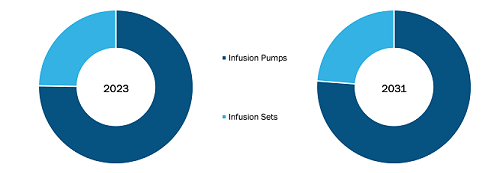

North America Infusion Devices Market, by Product Type, 2023(%)

North America Infusion Devices Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Infusion Pumps and Infusion Sets), Application (Diabetes, Oncology, Pain Management, Hematology, Pediatrics, Gastroenterology, and Others), End User (Hospitals and Specialty Clinics, Homecare Settings, Ambulatory Surgical Centers, and Others), and Country

North America Infusion Devices Market Trends and Scope - 2031

Download Free Sample

Source: The Insight Partners Analysis

North America Infusion Devices Market Analysis Based on Segmental Evaluation:

The North America infusion devices market is segmented on the basis of product type, application, and end user. Based on product type, the market is bifurcated into infusion pumps and infusion sets. By application, the North America infusion devices market is segmented into diabetes, oncology, pain management, hematology, pediatrics, gastroenterology, and others. Based on end user, the market is divided into hospitals and specialty clinics, homecare settings, ambulatory surgical centers, and others. In terms of country, the North America infusion devices market is segmented into the US, Canada, and Mexico.

- In 2023, the infusion pumps segment held a significant North America infusion devices market share, and it is expected to register a higher CAGR in the market during 2023–2031. Volumetric pumps, syringe pumps, elastomeric pumps, insulin pumps, enteral pumps, and patient control analgesia pumps are a few types of infusion pumps. Growing cases of chronic diseases such as cancer, diabetes, and others propel the requirement for the treatment of these diseases, which enhances the demand for different types of infusion pumps as per the disease application. Moreover, market players are launching products with advanced technologies for various disease applications.

- In April 2024, Baxter International Inc. announced the clearance of its Novum IQ large volume infusion pump (LVP) incorporated with Dose IQ Safety Software. This addition of LVP modality to the Novum IQ Infusion Platform—which includes Baxter’s syringe infusion pump (SYR) with Dose IQ Safety Software, powered by the IQ Enterprise Connectivity Suite—allows clinicians to use a single, integrated system across various patient care settings. The introduction of Novum IQ LVP in the US demonstrates Baxter’s dedication to ongoing innovation and the advancement of infusion therapy.

- In July 2023, BD announced that the updated BD Alaris Infusion System received 510(k) clearance, which enables remediation and a return to full commercial operations for the most comprehensive infusion system available in the US. BD Alaris Infusion System is the only modular and most comprehensive infusion system on the US market. It includes large-volume pumps, patient-controlled analgesia (PCA) pumps, syringe pumps, respiratory monitoring, autoidentification, dose error reduction software, and EMR interoperability.

- In May 2023, Medtronic Canada announced the approval of Medtronic Extended infusion set by Health Canada for its use with the MiniMedTM 780G system. This infusion set is the first of its kind and can be worn for up to 7 days. The MiniMedTM 780G system is the first insulin pump in Canada that can automatically adjust and correct blood sugar levels every 5 minutes. The Medtronic Extended infusion set, developed in partnership with Convatec Group, is licensed for subcutaneous infusion of insulin to manage diabetes mellitus. It is also compatible with the Medtronic MiniMed 630G, 670G, 770G, and 780G insulin pumps.

Chronic diseases typically require long-term treatment, and infusion pumps are a necessary tool for delivering medication to patients for long periods. The increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular diseases bolsters the demand for infusion pumps, which favor the North America infusion devices market growth.

The scope of the North America infusion devices market report includes the assessment of the market performance in the US, Canada, and Mexico. In terms of revenue, the US held the largest North America infusion devices market share in 2023, and it is estimated to dominate the market during the forecast period. The rising prevalence of chronic disease and the increasing geriatric population in the US are the key factors driving the North America infusion devices market. The unprecedented rate of an aging population and extended periods of physical inactivity boost the prevalence of lifestyle disorders such as cardiovascular disease (CVDs), diabetes, and obesity. According to the Diabetes Research Institute, the number of people affected by diabetes in the US was ~37.3 million (i.e., 11.3% of the population) in 2022. Nearly 28.7 million people in the country were diagnosed with diabetes, and ~8.6 million people have undiagnosed diabetes. According to Yale researchers, approximately 7 million people require insulin daily. An insulin pump is a small device that can continuously deliver insulin to manage carbohydrate intake. The pump contains a reservoir connected to a small plastic tube, i.e., cannula, through which insulin is infused into fatty tissue. The cannula along with a needle, i.e., an infusion set, is inserted under the skin for insulin delivery.

In May 2024, Moog Inc. received 510(k) clearance for the Industrial segment’s CURLIN 8000 Ambulatory Infusion System. The premium infusion platform was specifically developed for use in home infusion settings. In August 2023, ICU Medical, Inc. announced that the company received FDA 510(k) regulatory clearance for the Plum Duo infusion pump with LifeShield infusion safety software. The Plum Duo pump and LifeShield software will be available to customers in the US in early 2024. Thus, the rising prevalence of diabetes and the growing number of FDA approvals drive the use of infusion devices in the US, thereby supporting North America infusion devices market growth.

Becton Dickinson and Co, Fresenius Kabi AG, B Braun SE, CODAN US Corp, Baxter International Inc., Elimedical Inc., ICU Medical Inc., BPL Medical Technologies Pvt Ltd, Nipro Corp., KD Scientific Inc., Medtronic Plc, Zimed Healthcare Ltd, Terumo Corp., Eitan Medical Ltd, Polymedicure, and Moog Inc. are among the leading companies profiled in the North America infusion devices market report.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com