Adoption of Additive Manufacturing in Remanufacturing Industry to Drive North America Mining Remanufacturing Components Market Growth

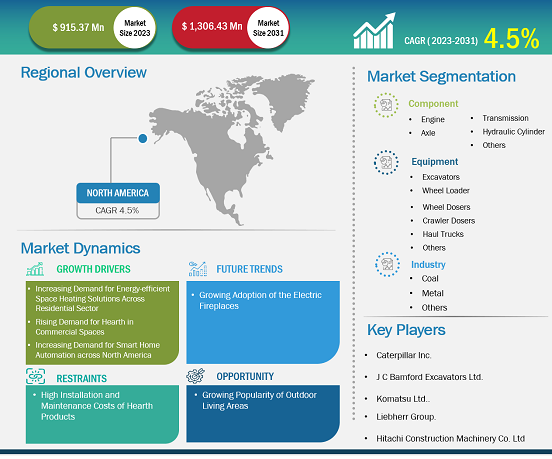

According to our latest market study on "North America Mining Remanufacturing Components Market Forecast to 2031 – Regional Analysis – by Component, Equipment, and Industry," the market was valued at US$ 915.37 million in 2023 and is expected to reach US$ 1,306.43 million by 2031; it is anticipated to record a CAGR of 4.50% from 2023 to 2031. The report includes growth prospects owing to the current North America mining remanufacturing components market trends and their foreseeable impact during the forecast period.

As one of the major technologies of remanufacturing engineering, additive remanufacturing technology can repair the structure and function of high-value-added key metal parts of large and complex equipment, significantly reducing its use and maintenance costs, along with saving time and labor costs. Additive remanufacturing is a subset of additive manufacturing technology that might restore the size accuracy of damaged parts, increase surface performance, and introduce new surface functions as needed. In the remanufacturing process, additive manufacturing technologies such as laser sintering and thermal spraying are utilized to restore worn parts or cores to their original proportions, and 3D printing is also employed in various ways by remanufacturers. Additive manufacturing is viewed as advantageous in remanufacturing. A few additive manufacturing technologies create standalone parts and can also be used to repair damage or add functionality to an existing item to convert a core to the newest specification. However, additive manufacturing or 3D printing is in the nascent stages. In the coming years, additive manufacturing can be integrated with the remanufacturing process. Many 3D printing and mining vehicle manufacturing companies are taking steps toward using this technology as a mainstream process. In April 2022, Boliden, a Swedish mining business, collaborated with Sandvik Mining and Rock Solutions to test 3D printing technology for machine parts. In addition, Caterpillar, one of the key mining vehicle manufacturers, is focusing on additive manufacturing for component manufacturing. Thus, the rising adoption of additive manufacturing in the remanufacturing industry is expected to fuel the North America mining remanufacturing components market growth in the coming years.

North America Mining Remanufacturing Components Market Share – by Region, 2023

North America Mining Remanufacturing Components Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Engine, Axle, Transmission, Hydraulic Cylinder, and Others), Equipment (Excavators, Wheel Loader, Wheel Dozer, Crawler Dozer, Haul Trucks, and Others), and Industry (Coal, Metal, and Others), and Region

North America Mining Remanufacturing Components Market Share by 2031

Download Free Sample

Source: The Insight Partners Analysis

Based on component, the North America mining remanufacturing components market is segmented into engine, axle, transmission, hydraulic cylinder, and others. The engine, transmission, and hydraulic cylinder segments are likely to account for significant shares of the North America mining remanufacturing components market. The state of a mining vehicle is highly influenced by the way it is handled and the environment around it, necessitating continuous replacements. If any equipment breaks down in case of engine, axle, transmission, or hydraulic cylinder failure, the profitability of mining companies is affected. Thus, most mining companies prefer to replace equipment components with remanufactured components owing to their cost-effectiveness and reliability.

The engine segment held the largest North America mining remanufacturing components market share in 2023. Engines in the mining sector serve a variety of purposes. However, these engines must be properly designed to resist extreme circumstances and comply with safety regulations. This is due to the extreme conditions in deep mining, where explosions are a genuine threat. As mining operations progress deeper into the earth, the strain on the equipment engines increases. Continuous wear and tear under unfavorable conditions increases the need for maintenance, repair, and overhaul. A remanufactured engine has been rebuilt to near-new condition. The engine is thoroughly inspected, and any broken or worn parts are replaced with new or re-machined parts that satisfy the original equipment manufacturers' (OEM) specifications. The head and block castings, camshaft, rods, and crankshaft are all measured to ensure they are accurately machined and meet OEM tolerances. Thus, the demand for remanufactured engines in the mining sectors increased due to the continuous need for higher efficiency under tense conditions and the availability of new engines at lower costs.

The scope of the North America mining remanufacturing components market report focuses on the US, Canada, and Mexico. The US mining industry has demonstrated resilience in the face of challenges, adapting to changing circumstances and economic downturns. Despite the impact of the pandemic, the industry has continued to play a crucial role in providing essential raw materials for manufacturing. The products extracted through mining serve as the building blocks for various industries and are integral to the production of countless goods and materials. According to American Mine Services, as of 2019, there were ~13,000 active mines in the US, contributing significantly to the country's economy. The value of these active mines was estimated to be US$ 61 billion, indicating the importance of the mining sector in terms of revenue generation and employment opportunities. By continuously adapting to changing market conditions, technological advancements, and environmental considerations, the US mining industry has solidified its position as a crucial pillar of the country's economy. Owing to the well-established mining industry of the US, the industry is creating a constant demand for mining remanufacturing components, which is anticipated to contribute to the growing North America mining remanufacturing components market size.

In 2021, the majority of brown coal (~92%) was utilized for power generation. This indicates a consistent need for mining equipment and components to support the extraction and processing of brown coal for electricity generation. As the demand for brown coal remains steady, the North America mining remanufacturing components market can expect a continuous demand for products and services. Thus, the substantial consumption of brown coal and hard coal, particularly for power production and steel manufacturing, contributes to the growing North America mining remanufacturing components market size. The demand for mining equipment and components is expected to remain strong, providing opportunities for businesses operating in this sector to thrive and expand their operations.

Canada's mineral production and mining industries play a significant role in the country's economy, making it a global leader in the production of several essential minerals and metals. According to the data published by the Canadian government, Canada ranks among the top producers of various precious metals, including diamonds, gemstones, and gold. Gold was the top-ranked commodity by production value in 2021, with a value of US$ 13.7 billion. Canada is a major producer of various base metals, including indium, niobium, platinum group metals, and uranium, contributing to both domestic and international markets. Canada produces a wide range of minerals and metals, with almost 200 active mines and 6,500 sand, gravel, and stone quarries, highlighting the diversity of the country's mineral resources. The value of Canada's mineral production reached US$ 55.5 billion in 2021, making mining a significant contributor to the Canadian economy. Overall, the growth of the mining industry in Canada creates a favorable market for mining remanufacturing components, driven by the industry's increasing demand for efficient, reliable, and adaptable material handling solutions to support its ongoing operations and expansion.

AB Volvo; Atlas Copco AB; Caterpillar, Inc.; Epiroc AB; J C Bamford Excavators Ltd.; Liebherr Group; Komatsu Ltd; SRC Holding Corporation; Hitachi Construction Machinery Co. Ltd.; and Swanson Industries are among the key players profiled in the North America mining remanufacturing components market report. Companies operating in the market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com