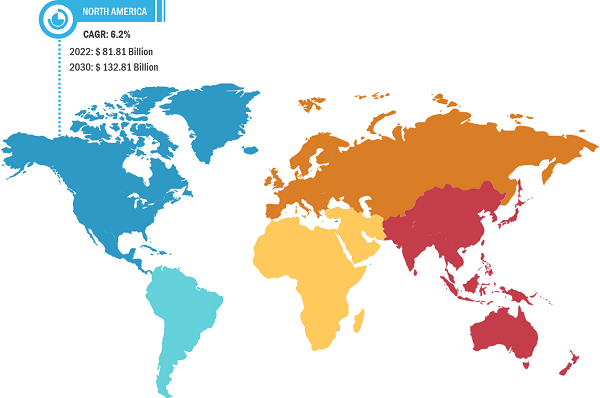

According to our latest study on “North America Testing, Inspection, and Certification Market Size and Forecast (2020–2030), Regional Share, Trends, and Growth Opportunity Analysis – by Sourcing Type, Service Type, and End-User,” the North America testing, inspection, and certification market was valued at US$ 81.81 billion in 2022 and is projected to reach US$ 132.81 billion by 2030; it is expected to grow at a CAGR of 6.2% from 2022 to 2030. The rising implementation of Industry 4.0 solutions and adoption of a circular economy drive the market. However, counterfeit products and certificates hinder the market growth.

The North America testing, inspection, and certification market comprises conformity assessment enterprises that offer services ranging from auditing and certification to testing, verification, quality assurance, and inspection. A product certificate attests that a product satisfies certain standards and safety-related requirements. The certificate outlines the fundamental criteria that were used to examine a product. Corresponding test results give clients tangible evidence of the product's quality, which they can use to make an informed selection. The testing, inspection, and certification market players provide compliance assessment services, including testing, declaration of conformity, and validation, either for regulatory reasons or good practice, in order to protect people and the environment. The most important testing and certification services involve quality and safety controls through conformity assessments, including industrial site inspections, supply chain certifications, product testing, management system auditing and certification, pre-shipment inspections, periodic car inspections, and consignment-based conformity assessments.

North America Testing, Inspection, and Certification Market Size and Forecasts (2020 - 2030), Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Sourcing Type (In-House Service and Outsourced Service), Service Type (Testing, Inspection, and Certification), End-User (Consumer Goods & Retail, Food & Beverage, Healthcare & Pharmaceutical, Energy & Power, Manufacturing & Construction, and Others)

North America Testing, Inspection, and Certification Market 2030

Download Free Sample

Rising EV Adoption Provides Lucrative Opportunities for North America Testing, Inspection, And Certification Market

Electric vehicle (EV) sales are increasing due to concerns regarding environmental protection and government policies favoring the adoption of low-emission or zero-emission vehicles, including EVs. For instance, in 2021, the government of Colorado offered a tax credit of US$ 4,000 on the purchase of a light-duty EV. Similarly, the government of Connecticut accepts a reduced biyearly vehicle registration fee of US$ 38 for EVs. As per the International Energy Agency (IEA), EV sales in the US grew from 0.3 billion units in 2019 to 1.0 billion in 2022 and are anticipated to reach 1.6 billion units by the end of 2023. Additionally, the Inflation Reduction Act (IRA) strongly promoted a rise in investments from global electromobility companies to expand manufacturing operations in the US. From August 2022 to March 2023, major EV manufacturers and EV battery makers announced cumulative post-IRA investments of ~US$ 52 billion in EV supply chains in North America. Approximately 50% of these investments were for battery manufacturing and ~20% each for EV manufacturing and battery components, respectively.

North America has a wide presence of most of the world’s largest automotive OEMs, who have established their manufacturing plants in the region. Most of these OEMs have undertaken various electrification initiatives. For instance, in July 2021, Stellantis announced its plan to invest ~US$ 35.5 billion in vehicle electrification and new software/technologies by 2025. Stellantis has also announced huge investments in EVs similar to General Motors, Volkswagen, and Ford Motor. For the purpose of boosting productivity, efficiency, and the production process to achieve the desired requirements—electric vehicle testing, inspection, and certification are required to validate offerings to automotive TIC providers. Several players across North America are collaborating for the safety and performance evaluation of EVs. Thus, the increasing EV adoption is likely to create an opportunity for the growth of the North America testing, inspection, and certification market during the forecast period.

North America Testing, Inspection, And Certification Market: Segmental Overview

The North America testing, inspection, and certification market is segmented on the basis of sourcing type, service type, and end-user. Based on sourcing type, the North America testing, inspection, and certification market is bifurcated into in-house service and outsourced service. In terms of service type, the North America testing, inspection, and certification market is segmented into testing, inspection, and certification. In terms of end-user, the North America testing, inspection, and certification market is segmented into consumer goods & retail, food & beverage, healthcare & pharmaceutical, energy & power, manufacturing & construction, and others. By country, the North America testing, inspection, and certification market is segmented into the US, Canada, and Mexico.

North America Testing, Inspection, And Certification Market Analysis: Competitive Landscape and Key Developments

ALS Limited, Applus Services SA, Bureau Veritas SA, DEKRA SE, DNV Group AS, Eurofins Scientific SE, Intertek Group Plc, SGS SA, TUV Rheinland AG, and TUV SUD AG are among the key North America testing, inspection, and certification market players profiled during this market study. In addition to these players, several other important North America testing, inspection, and certification market players were also studied and analyzed during this market research study to get a holistic view of both the North America testing, inspection, and certification market and it’s ecosystem. The leading North America testing, inspection, and certification market players focus on feature upgrades, expansion and diversification, collaboration, and acquisition strategies, which enable them to participate in new business opportunities. A few recent key North America testing, inspection, and certification market developments are listed below:

- In July 2023, TUV SUD America Inc, a leading TIC service provider, opened a new state-of-the-art environmental laboratory in Michigan, the US, through an investment of US$ 44 billion.

- In February 2023, UL Solutions, a leading applied safety science enterprise, and the Modular Energy System Architecture (MESA) Standards Alliance, a leader in standardizing communications between utility systems and distributed energy resources (DER), partnered to provide testing and certification of the MESA-DER profile. Utilities in the US commonly utilize Distributed Network Protocol (DNP3), a set of communications protocols used between components in process automation systems, for their supervisory control and data acquisition system (SCADA). The MESA-DER profile organizes DER data in a standard structure to allow many types of distributed energy installations to be easily integrated and understood by utility SCADA systems. Electric utilities or aggregators can utilize MESA-DER to significantly lower their integration and implementation costs for large energy storage systems, microgrids, solar inverter power plants, and other grid-scale DER.

- In May 2021, Atlas Technical Consultants, Inc., a prominent Infrastructure and environmental services provider, received a US$ 3 million contract to provide on-call special inspection and materials testing in various healthcare facilities for the Los Angeles County Department of Public Works.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com