Increasing Organic Farmland Area Bolster Organic Fertilizers Market Growth

According to our latest study on “Organic Fertilizers Market Size and Forecast (2021–2031), Global and Regional Growth Opportunity Analysis – by Source, Form, and Crop Type,” the market size is expected to grow from US$ 11.95 billion in 2024 to US$ 19.40 billion by 2031; the market is estimated to register a CAGR of 7.2% from 2024 to 2031. The report highlights key factors driving market growth and prominent players along with their developments in the market. Apart from the growth drivers, the report covers the organic fertilizers market trends and their foreseeable impact during the forecast period.

Organic farmland areas are increasing worldwide with a significant shift toward sustainable farming practices, driven by consumer demand for healthier and cleaner foodstuff. Europe, North America, and Asia have seen the most significant growth in organic farmlands. Emerging markets in Africa and South America are also expanding their organic agricultural base. Moreover, countries such as India, the US, and Australia capitalize on organic farmlands to reap the benefits of rising consumer demand, export opportunities, and government incentives. Organic farming has proven beneficial for the environment owing to its potential role in improving soil health, increasing biodiversity, reducing water contamination, and lowering greenhouse gas emissions compared to conventional farming.

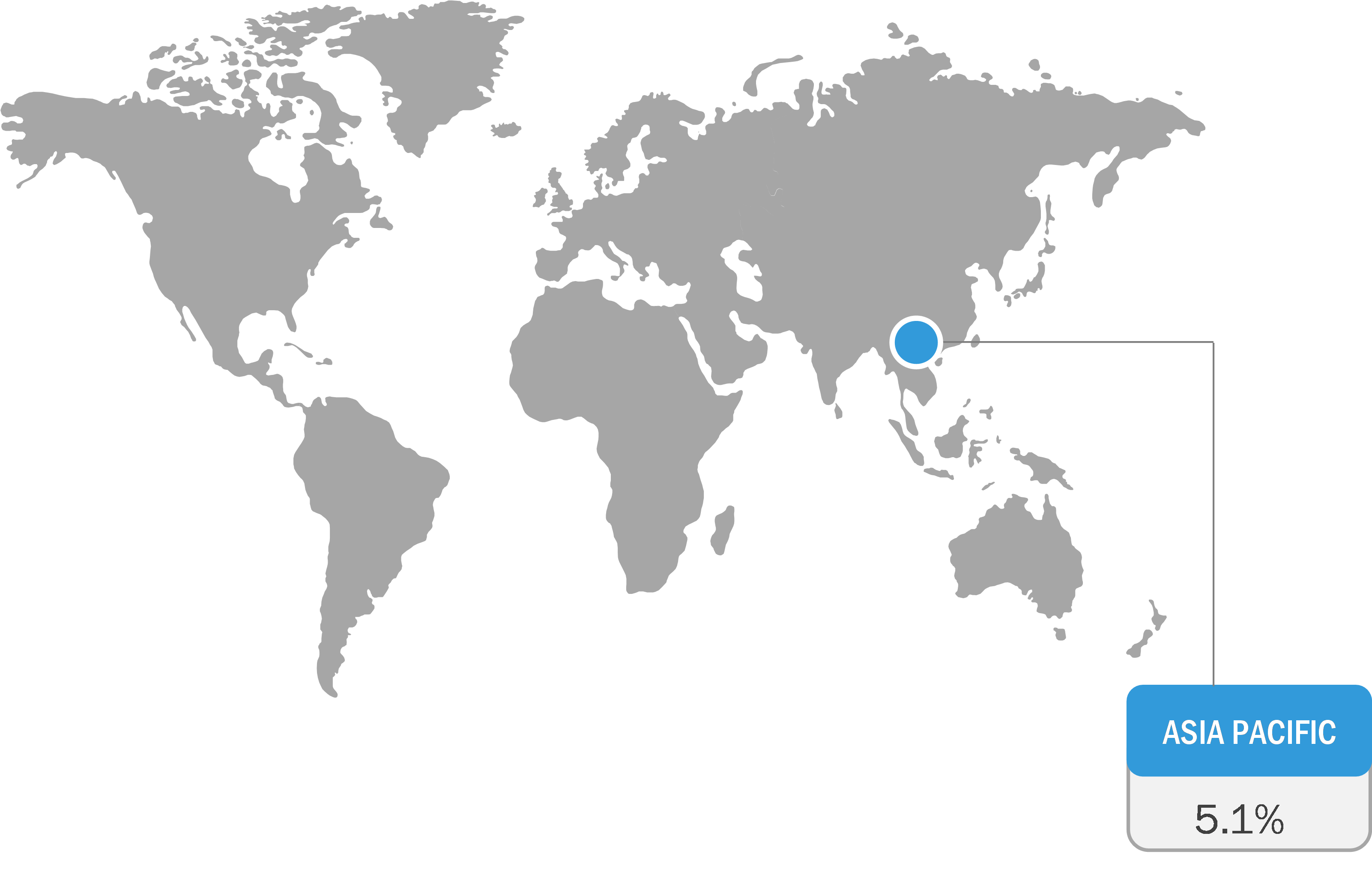

Organic Fertilizers Market Breakdown – by Region

Organic Fertilizers Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Source (Plant, Animal, and Mineral), Form (Dry and Liquid), Crop Type (Fruit and Vegetables, Cereals and Grains, Turf and Ornamental, Flowers and Nursery, Tree Crop, Legumes, Herbs and Spices, Oilseeds, Tubers and Root Crops, and Others), and Geography

Organic Fertilizers Market Dynamics and Analysis by 2031

Download Free Sample

According to the Research Institute of Organic Agriculture (FiBL), the organic farmland area in Asia increased from 6.1 million hectares in 2020 to 8.8 million hectares in 2022. In Europe, it rose from 17.1 million hectares to 18.7 million hectares during the same period. The statistical yearbook "The World of Organic Agriculture" published by FiBL (Research Institute of Organic Agriculture) and IFOAM – Organics International in 2023 revealed that the global organic farming area increased by over 20 million hectares, reaching 96 million hectares in 2022 compared to 2021. The number of organic producers also significantly rose, surpassing 4.5 million in the same year. Australia also witnessed a major growth in the organic farmland area; it continued to be the country with the largest organic agricultural land area of 53 million hectares, followed by India with 4.7 million hectares of organic agricultural land.

Organic farming prohibits the utilization of synthetic fertilizers and pesticides, and genetically modified organisms. Organic fertilizers, typically free of chemicals, are sourced from natural sources, including organic compost, poultry droppings, and cattle manures. Thus, a surge in organic farmland boosts the growth of organic fertilizers market.

The organic fertilizers market analysis has been performed by considering the following segments: source, form, and crop type. In terms of source, the market is segmented into plant, animal, and mineral. The pants segment held the largest organic fertilizers market share in 2024. Plant-based fertilizers break down quicker than other organic fertilizers, and they offer more than just nutrients for contributing to soil conditioning. Green manure, involving the incorporation of fresh plant materials, especially those obtained from fast-growing cover crops, offers a sustainable approach to enhancing soil quality/health. Cottonseed meal used in organic fertilizers serves as a source of nitrogen (6–7%), phosphorus (1–3%), and potassium (1.5%). Kelp meals are derived from kelp or brown algae seaweed; it aids in a nutrient-rich fertilizer containing N, P, K, and various trace elements.

Based on form, the organic fertilizers market is bifurcated into dry and liquid. The liquid segment is expected to register a higher CAGR during the forecast period. Liquid organic fertilizers aid fast nutrient availability and easy application, and they are highly compatible with precision agriculture. Fertilizers in the liquid form facilitate quick absorption and exhibit compatibility with hydroponics, greenhouse farming, and foliar applications. For example, seaweed extracts, fish emulsion, and compost tea can be applied in combination with drip irrigation.

Asia Pacific dominated the organic fertilizers market share in terms of revenue in 2024. The agricultural sector in the region is flourishing with the rising demand for organic produce owing to the awareness of the environmental impacts of chemical fertilizers. China and India are the largest producers of organic rice and other crops. The organic product industry in China is growing vigorously, and it recorded sales worth US$ 14 billion in 2023. The government promotes sustainable development goals through supportive regulations and initiatives. As per the Research Institute of Organic Agriculture, China is a leading producer of organic temperate fruits such as apples and organic oilseeds. In 2022, organic practices were implemented in ~126,000 ha of orchards and ~506,000 ha of organic oilseed farmlands.

In August 2024, the Union Cabinet (India) approved the progressive expansion of the Agriculture Infrastructure Fund (AIF) to strengthen the agricultural infrastructure and support the farming community in the country. It aims to expand the scope of eligible projects and integrate additional supportive measures to foster a robust agricultural infrastructure. In 2023, the Government of Japan announced a new economic stimulus package of US$ 113 billion to boost agriculture, forestry, and fishery exports. Such supportive agriculture policies and growing sustainable agriculture practices fuel the organic fertilizers market growth.

The organic fertilizers market forecast can help stakeholders plan their growth strategies. AgroCare Canada, Inc ; Coromandel International Ltd; Hello Nature International Srl; Midwestern BioAg; Krishak Bharati Cooperative Limited (KRIBHCO); The Scotts Miracle-Gro Co; Indian Farmers Fertiliser Cooperative Ltd (IFFCO); Shriansh Dharti Fertilizer (SDF) India Private Limited.; Ferticell; Espoma ; Down To Earth; Yara International ASA; Suståne Natural Fertilizer, Inc; Darling Ingredients Inc; and The Andersons Inc are among the prominent players profiled in the organic fertilizers market report. These market players are focusing on providing high-quality products to fulfill customer demand. They are also adopting strategies such as new product launches, capacity expansions, partnerships, and collaborations to stay competitive in the market.

The organic fertilizers market is segmented on the basis of source, form, crop type, and geography. Based on source, the market is segmented into plants, animals, and minerals. Based on form, the market is bifurcated into dry and liquid. Based on crop type, the market is divided into fruit and vegetables, cereals and grains, turf and ornamental, flowers and nursery, tree crops, legumes, herbs and spices, oilseeds, tubers and root crops, and others.

The geographic scope of the organic fertilizers market report focuses on North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in North America is further segmented into the US, Canada, and Mexico. The market in Europe is subsegmented into Germany, France, the UK, Italy, Spain, and the Rest of Europe. The Asia Pacific market is further segmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. The organic fertilizers market in the Middle East & Africa is subsegmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The market in South & Central America is further subsegmented into Brazil, Argentina, and the Rest of South & Central America.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com