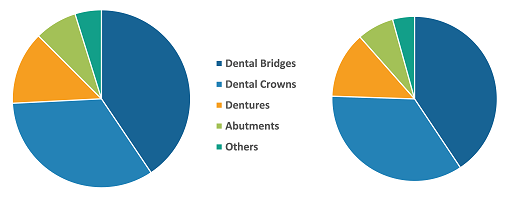

Dental Bridges Held Largest Share in Romania Dental Implants Market in 2023

According to our new research study on "Romania Dental Implants Market Forecast to 2031 – Country Analysis – by Product, Material, and End User," the market size is projected to reach US$ 25.36 million by 2031 from US$ 12.21 million in 2023. The market is expected to register a CAGR of 9.7% during 2023–2031.The market report emphasizes trends prevalent in the market, along with drivers and deterrents affecting its growth. The increasing incidences of dental diseases across Romania and technological advancements in dental implants are among the prominent factors driving the Romania dental implants market growth. However, the high cost of dental implants is hampering the growth of the market. Apart from growth drivers, the report covers the Romania dental implants market trends and their foreseeable impact during the forecast period.

Increasing Technological Advancements in Dental Implants Propel Romania Dental Implants Market Growth

The field of dental implants has experienced several advancements due to groundbreaking innovations and technologies. 3D printing, nanotechnology, smart implants, regenerative dentistry, immediate loading, and laser-guided procedures have made implants more effective, efficient, and patient-friendly. These advancements promise greater comfort, reliability, and longevity, making dental implants the preferred solution for restoring smiles and improving overall oral health. 3D printing technology has revolutionized the customization of dental implants. This advancement allows for tailoring implants as per the unique anatomy of each patient's jawbone. Eastern European dental clinics are increasingly adopting this technology, recognizing its potential to improve surgical outcomes and patient satisfaction. The precision of 3D-printed implants ensures a better fit and reduces the risk of complications.

Romania Dental Implants Market

Romania Dental Implants Market Size and Forecast (2021 - 2031), Country Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Dental Bridges, Dental Crowns, Dentures, Abutments, and Others), Material (Titanium Implants, Zirconium Implants, and Others), End User (Hospitals and Clinics, Dental Laboratories, and Others), and Country

Romania Dental Implants Market Report, Opportunities by 2031

Download Free Sample

Further, the development of dental implants using biocompatible materials is one of the most significant technological advancements witnessed in dentistry. Traditionally, titanium has been the material of choice due to its strength and compatibility with human bone. However, recent innovations have introduced materials such as zirconia, which offer enhanced aesthetic results due to their tooth-like color. Moreover, these new materials have been found to reduce inflammation and promote faster healing.

Similarly, the integration of artificial intelligence (AI) and machine learning into dental implantology marks a significant shift. These technologies aid in planning and executing implant procedures with unprecedented accuracy. They provide predictive analytics to evaluate the success of dental implants, improving decision-making for dental professionals.

The Romania dental implants market analysis has been carried out by considering the following segments: product, material, and end user.

The product segment of the Romania dental implants market is subsegmented into dental bridges, dental crowns, dentures, abutments, and others. The dental bridges segment held the largest Romania dental implants market share in 2023. Furthermore, the same segment is expected to account for the highest CAGR in 2031. Dental bridges are prosthetic devices that strengthen damaged teeth and improve appearance, shape, alignment, and dental occlusion. They also prevent remaining teeth from shifting into the gaps left by missing teeth, which can result in a bad bite. There are four types of dental bridges: traditional, Maryland, cantilever, and implant-supported. Traditional bridges consist of dontics supported by dental crowns, while dental implants support implant-supported bridges. The bridges can be made of various materials, including gold, alloys, or porcelain.

Based on material, the market is segmented into titanium implants, zirconium implants, and others. The titanium implants segment held the largest share of the market in 2023. Furthermore, the same segment is expected to account for the highest CAGR in 2031. Titanium dental implant is a valuable investment in oral health and is known for its strength and biocompatibility. Its durability and long-term effectiveness make it a preferred option for many patients, even though the cost may vary. The process of implantation often involves placing a titanium screw in the jawbone, which acts as an artificial root for the tooth. Unlike other materials that trigger rejection, titanium has exceptional biocompatibility, making it readily accepted by the body. This allows osseointegration, a process where the implant fuses with the jawbone, to occur smoothly.

By end users, the market is categorized into hospitals & clinics, dental laboratories, and others. The hospitals and clinics segment held the largest of the Romania dental implants market share in 2023. Furthermore, the same segment is expected to account for the highest CAGR in 2031. Dental hospitals in many Eastern European countries embrace international visitors through the Global Clinic Rating (GCR). The T-PLUS is a leading implant company’s database that helps users choose the best options in this region. The T-PLUS focused on 13 Eastern European nations to streamline the data and used data from the first 15 dental institutions listed on the GCR. T-PLUS excluded hospitals from sorting if they did not provide information on their yearly average implant volume.

The dental implants market growth in Romania is attributed to adoption of organic and inorganic growth strategies by private and government organizations. For instance, in October 2023, Koite Health Oy (a Finnish health technology company) signed a distribution agreement with Swed Green Group SRL (a Romanian–Swedish company). This company also owns Swed Clinic SRL, which operates dental clinics. The cooperation agreement will make the Lumoral oral self-care technology available in the Romanian market through Swed Clinic dental clinics and family doctors.

Furthermore, the growing cases of lip and oral cavity cancer and growing medical tourism in the country contribute to the increasing Romania dental implants market size.

Competitive Landscape

Dentsply Sirona Inc, BioHorizons Inc, Adin Dental Implant Systems Ltd., 3M Co, MEGA'GEN IMPLANT CO., LTD, ZimVie Inc, Institut Straumann AG, Alpha Dent Implants GmbH are among the leading companies profiled in the Romania dental implants market report. The companies implement both organic (such as product launches, expansion, and product approvals) and inorganic (such as collaborations and partnerships) strategies to stay competitive in the market.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com